Published on May 24, 2019 by Raghavendran Vijendran

“The advantage of a dual class share structure is that it protects entrepreneurial management from the demands of shareholders. The disadvantage of a dual class share structure is that it protects entrepreneurial management from the demands of shareholders.”

Andrew Hill - Financial Times*

The background

Differential Voting Rights (DVR) or Dual Voting Class (DVC) have been in existence since the late nineteenth century. However, they have been at the center of much debate lately, after a number of large companies started using them to tackle investment decisions. DVCs allow share classes with different voting rights, giving a certain class higher voting power and, hence, greater control over a company, implying that control is unequal to the equity owned.

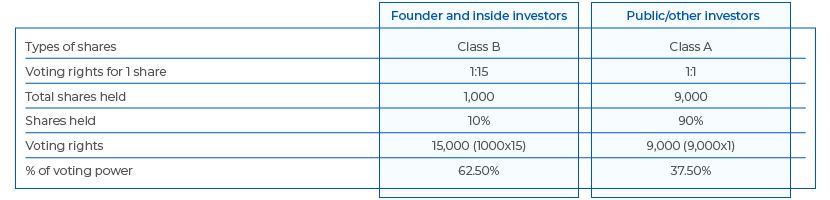

DVCs are most commonly seen in founder-led companies, where founders are influential in the decision making and success of the company. Founders find DVCs attractive because they offer the option of raising funds without giving up voting rights or control while allowing investors to participate in the company’s growth. To explain DVCs better, let us assume a company’s founder and other small investors hold nearly 10% of the company’s shares (Class B shares – 1:15 voting rights) but have over 62% of the voting rights. With only 10% ownership, these insiders have higher voting rights, while the remaining shareholders hold 90% of the company’s shares (Class A shares – 1:1 voting rights), but only 38% voting rights.

* Hill, A. 2011. “Enrolment open for an MBA in Murdoch.” Financial Times

Some of the major DVCs in the market today:

-

Google's parent company, Alphabet Inc., which is listed on the NASDAQ, has issued three classes of shares – Class A shares (1 vote each), Class B shares (10 votes each ), and Class C shares (with no votes).

-

Alibaba chose to list its shares on the NYSE instead of the Hong Kong Stock Exchange (HKEX), as the latter was not in favor of DVCs. As a result, the HKEX missed out on listing the e-commerce giant.

-

Facebook acquired WhatsApp for USD19bn by going against the majority of its shareholders, as they were not in favor of the deal. The founder was able to proceed with the deal due to his higher voting rights.

-

Snap Inc. went a step further and launched a no-voting-rights IPO.

What is the impact?

For investors

Dual voting classes of shares are a major concern for passive investors, such as institutional investors, who commonly have lower ownership rights in dual-class companies, ideally in a long run they do not have much of a control on many decision taken by the founder and other investors. For an active investor, it is less of a concern, as these investors sell or short sell their holdings when growth prospects see a downtrend, and do not engage in long-term investment. On the other hand, the power to vote is largely important for passive investors who concentrate on longer-term investment decisions and growth.

While institutions such as BlackRock, CalSTRS, the Vanguard Group, T. Rowe Price, and State Street Global Advisors have shown their disapproval of dual voting shares, they have also raised concerns about the way certain index players have excluded companies with dual share structures.

For exchanges

Exchanges are employing multiple methods to tackle the dual voting structure trend. US stock exchanges, such as the NYSE and NASDAQ have listed many companies with DVC shares, and this has forced other conservative exchanges to rethink their “one share one vote” policy. With visible growth in the DVC-listing trend, excluding some of these giants may impact exchanges. For example, due to the HKEX ’s “one share one vote policy” it missed out on the USD25bn IPO of Alibaba Group, China’s e-commerce mammoth, in 2014, thus creating an opportunity for the NYSE. Given the growing prevalence of and demand for DVCs, the HKEX has recently welcomed DVR listings, and Chinese smartphone-maker Xiaomi was the first company to be listed under HSE’s new framework for DVCs. Similarly, the Singapore Exchange (SGX) has recently opened its doors to DVCs.

For index players

Index providers, such as FTSE Russell, S&P, and MSCI have conducted public consultations on their methodology of treating DVCs.

-

MSCI has found that of the 2,493 constituents of the MSCI ACWI Index (as of September 1, 2017), 253 securities had unequal voting structures. MSCI has been working on a proposal to adjust constituents’ weights according to the voting power of the issuer’s listed shares. The portion of total share capital that offers voting rights is considered eligible for inclusion, somewhat similar to the existing free-float calculation.

-

FTSE Russell has restructured its methodology to ensure a steady 5% minimum-voting-rights threshold is implemented for inclusion in FTSE Russell indexes for potential constituents, as well as a five-year grandfathering period for the exiting shares to be moved out.

-

S&P Dow Jones bars the addition of multi-class constituents to the S&P Composite 1500 index and its components, such as the S&P 500, MidCap 400, and SmallCap 600 indexes.

Implications for portfolio and index constructions

Researching each and every structural parameter, such as free-float shares, share structures, industry/sector classifications, IPOs, etc., is vital for portfolio, index and fund constructions. When the voting rights of a company is adjusted with the free float factor, it shows the true investable factor for the institutional investors. This research gives an understanding of the true investable weight, given the company’s voting rights, and helps to ascertain the decision-making power held by investors versus managements

Acuity Knowledge Partners has a highly dedicated team of data specialists supporting clients extensively in determining the actual free-float shares of the company, which is a very vital factor in deciding on a company’s inclusion in the index/portfolio/fund. Our support also extends to deep-dive research of industry classifications, IPO additions, country assignments, FOL, market capitalization, voting rights, and other major attributes. Our index team has researched and issued conclusions on voting-rights**appendix 2 patterns for over 10,000 global companies spanning over 70 countries, including non-English speaking countries, such as China, Korea, Vietnam, Taiwan, etc. Acuity Knowledge Partners support has helped clients achieve quick turnarounds and accurate decisions.

What’s next?

Given the growing demand for dual structures, exchanges, investors, and index players are trying to adapt to and accommodate such structures. This adoption is also making regulators relook at some of the current requirements.

A recent recommendation aimed at curtailing DVC listings is to have a sunset-based approach for the dual structure. Shares with DVC voting rights will automatically get converted to common stock with one vote per share, and the ideal recommended sunset period is seven years. The other option is to have a non-periodic sunset that is based on an event, such as disability, death, or transfer of shares, etc.

Dual voting structures seem to have mixed acceptance – they are friends for some and foes for the rest. With lots of changes in the industry, perspectives are definitely changing rapidly. Institutions, exchanges, and index players have all been forced by dual voting structures to redefine legacy policies. Whether these organizations will resist or adopt these structures remains to be seen.

Sources:

https://www.cnbc.com/2018/03/20/shareholders-wont-force-zuckerbergs-hand-in-facebook-management.html

https://corpgov.law.harvard.edu/2017/05/26/snap-and-the-rise-of-no-vote-common-shares/

https://igopp.org/wp-content/uploads/2018/09/CFAI-Dual-Class-Shares-2018-august.pdf

https://repository.law.umich.edu/mbelr/vol5/iss1/4/

https://www.sec.gov/Archives/edgar/data/1326801/000132680118000022/facebook2018definitiveprox.htm

https://www.ftse.com/products/downloads/Minimum_Voting_Rights_Hurdle_FAQ.pdf

https://www.cfainstitute.org/-/media/documents/survey/apac-dual-class-shares-survey-report.ashx

What's your view?

About the Author

An MBA graduate with 14 years of experience in Index Operations, Data management, Client Servicing, and Portfolio Analytics. Has been with MA Knowledge Services for the past 9 years, supporting a global benchmark index provider in portfolio analytical and client service group engagements. Previously, worked with Fidelity and Reuters.

Like the way we think?

Next time we post something new, we'll send it to your inbox