Published on July 31, 2018 by Anandita Ray

The role of remittances in economic development, especially in developing nations, cannot be undermined. Inflows form an integral part of overall capital inflows and in case of certain countries make a notable contribution to the overall GDP (up to ca. 50% of the GDP for Tajikistan and ca. 25% for Nepal). Technology evolution and positive migration trends are further likely to spur growth.

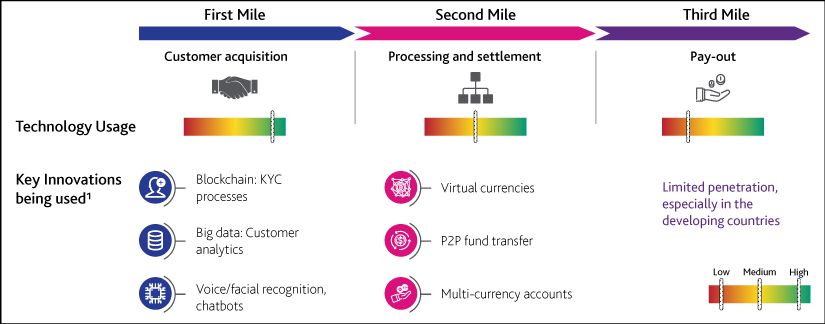

Over the years, the remittance industry has witnessed several break-through innovations, including the use of blockchain, artificial intelligence, and machine learning; however, most of them concentrate in the first two legs of transfer, namely customer acquisition and transaction processing. Despite global attempts to improve financial inclusion, the third mile, i.e. pay-out phase, often remains a major challenge, mainly in regions with high financial exclusion and low infrastructure development.

Note: 1) Use cases are indicative and not exhaustive

A classic example is Sub-Saharan Africa, which faces higher cost of transfers than the global average, owing to structural inefficiencies at the ground level.

The country has a financial exclusion rate of 66%. Furthermore, the cost of transferring $200 stood at ca. 9.3% as of 2017, nearly double compared with the World Bank target of 5%.

Although high penetration of mobile money and emergence of digital-only innovators are helping improve overall financial inclusion and reach, low infrastructure development across a large part of the globe still remains a major roadblock, outside the purview of technology.

The need of the hour is to leverage digital innovation in tandem with physical channels. Key strategies that may assist money transfer operators (MTOs) in the third mile include the following:

Collaboration with telcos: Partnership between MTOs and telcos may drive cheap and convenient transfers and help reach developing countries. Penetration of mobile money in developing regions remains high due to inaccessibility of other formal channels – M-Pesa in Kenya reached 80% penetration within four years of its launch.

Usage of post-offices: Most of these offices have strong presence and familiarity in rural areas; however, they lack the pay-out infrastructure. Developing technology infrastructure and training employees in these facilities will likely boost overall reach.

Increased role of micro-finance institutions (MFI): As financial intermediaries, MFIs can contribute to integrating remittances into the formal financial system. Most MFIs with a current large base of under-served customers can participate in money transfers and deposit-taking. Training of employees for technology integration and regulatory compliance can help these institutions come up to speed and add to the current infrastructure of pay-out locations.

For players in the eco-system to succeed and gain scale, collaboration is the only way forward. No single technology can be applied to overcome the remittance challenge; however, creating the right environment and infrastructure for adopting digital channels in the last mile will remain key.

Acuity Knowledge Partners supports several MTOs – both traditional and digital players – to scale up their operations and leverage various partnership opportunities to sustain growth. We have dedicated teams of highly qualified analysts that work with clients in strategy research assignments, including target identification and evaluation, market monitoring, competitor strategy analyses, peer benchmarking, and financial modelling.

Sources:

What's your view?

About the Author

Anandita Ray has over 7 years of experience in the research and consulting industry. She currently works in the Strategy Research and Consulting practice at Acuity Knowledge Partners and supports clients in the payments and remittance industry with assignments related to growth strategy formulation, go-to-market strategy, market entry and expansion, and competitor analysis and benchmarking. Anandita holds B.Com (Hons.) from Calcutta University and Masters in Finance from Amity University.

Like the way we think?

Next time we post something new, we'll send it to your inbox