Published on October 27, 2021 by Shanaathanan Shivanandan

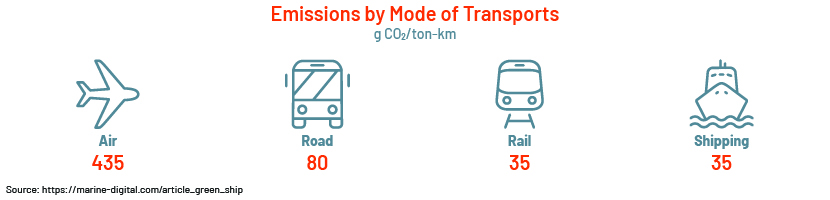

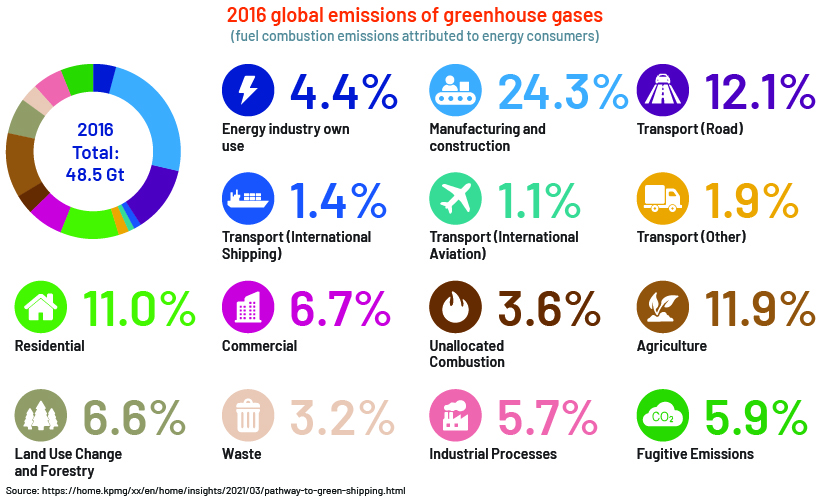

The shipping industry is evolving, like every other industry. It has quadrupled in size since 1970 and is as critical as it has ever been, contributing significantly to world trade. Shipping is the greenest method of transport in terms of carbon emissions per ton per mile. Although it is the most climate-friendly form of freight transport, the fuel on which it typically relies is a cocktail of pollutants. In 2016, the shipping industry was responsible for around 1.4% of the world’s greenhouse gas emissions, the bulk of which was emitted by container ships. Most vessels use heavy fuel oil, a residue of crude oil distillation with a high level of sulphur. Sulphur oxides (SOx) harm the environment, as they lead to acid rain that damages crops, forests and aquatic species and contributes to the acidification of the oceans.

Regulatory, financial and social pressures continue to compel the shipping industry to control its environmental impact and enhance the safety of its operations. The International Maritime Organization (IMO) targets halving greenhouse gas emissions by 2050 compared with levels in 2008. Its environmental regulations mandate that new vessels be built to ensure an immediate reduction in greenhouse gas emissions of 15-20% by 2020 and 30% by 2025. This industry has, therefore, faced challenges not only due to the pandemic, but also due to the need to increase investment in green shipping. Meeting the IMO’s targets depends on generating smart ideas and new technologies and innovation.

Potential strategies to reduce greenhouse gas emissions and improve operational efficiency

Increasing pressure from global regulators such as the IMO has triggered R&D on green/sustainable technology for the shipping industry. “Green shipping” involves pollutant control at all stages of shipping – from vessel building to vessel decommissioning. “Sustainable shipping” denotes smarter and safer shipping, including sustainable vessel building and sustainable operations. Industry stakeholders are engaged in initiatives such as improving hull shape to improve operations, streamlining shipping routes and reducing port turnaround time to make the industry environmentally friendly.

a) Adopt alternative energy sources and explore new propulsion systems

The global fuel market is striving to comply with the IMO 2020 regulation to reduce sulphur content in fuel oil to 0.50% from 3.50%. This restriction has opened the way for several new fuels such as ultra-low sulphur fuel oil (ULSFO), very-low sulphur fuel oil, liquefied natural gas (LNG) and marine gas oil (MGO)/distillate marine fuel oil. Vessel owners are considering these new fuel options to meet the new sulphur cap. However, switching to them depends heavily on fuel price levels, availability of new fuels and fuel quality.

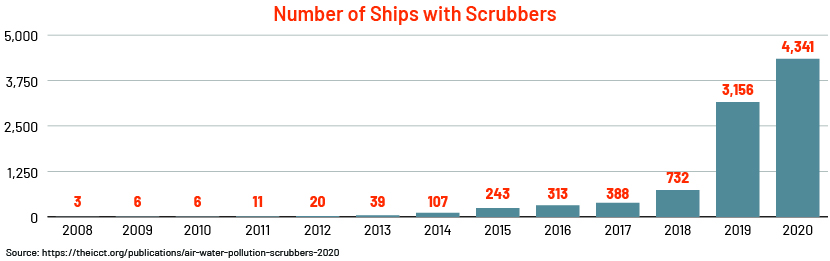

Alternatively, ships could continue using high-sulphur fuel oil (HSFO) by installing scrubbers on exhaust funnels. Scrubbers are used to remove harmful components such as nitrogen oxides (NOx) and SOx from exhaust gases produced by combustion processes in marine engines. Approximately 4,350 ships worldwide were equipped with a scrubber system as of 2020.

b) Sustainable ship manufacturing

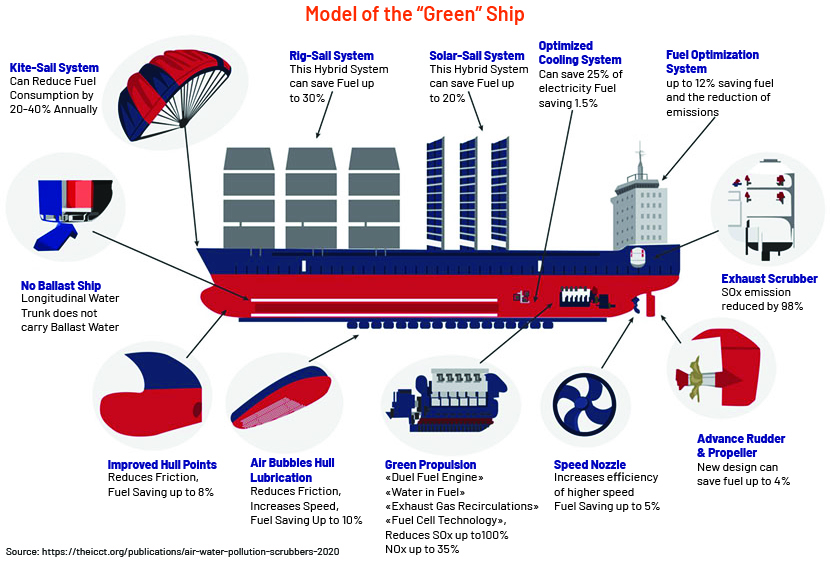

Shipbuilders now focus on every aspect of shipbuilding to minimise the environmental impact. Strategies/technologies currently being tested include determining the best anti-fouling hull paint, use of speed nozzles, installation of ballast-free systems, implementation of kite-sail systems, installation of solar-sail systems and installation of steaming bubbles.

c) Adopt renewable energies in port operations

Carbon dioxide emissions can be reduced by using renewable electricity generated from offshore wind turbines and solar energy instead of diesel generators in port operations. For example, Port Esbjerg in Denmark is working towards cutting down its carbon dioxide emissions by 70% using renewable offshore wind and efficient energy management systems.

Well-organised and integrated port operations would significantly reduce the unnecessary rush at sea and the burning of excess fuel due to waiting in line outside a port. Improved "energy management systems" designed on cloud systems enable ports to monitor the emissions and resource consumption of each vessel. The practical application of connected technology is essential to converting ports into smart ports. This system uses artificial intelligence (AI) and machine learning algorithms in combination with data collection to optimise port operations.

The transition from diesel-powered cranes to hydrogen-powered cranes and the use of smart systems for container loading and unloading are the latest enhancements to port operations that would help achieve zero-carbon-emissions targets. For example, China’s Qingdao port became the world's first hydrogen-powered 5G port in 2019. The 5G technology enables wireless communications in port operations, especially in areas such as crane control (e.g., bridge, rail, gantry and quayside container cranes), cross-vehicle control, video surveillance and AI recognition.

d) Digitalise maritime operations

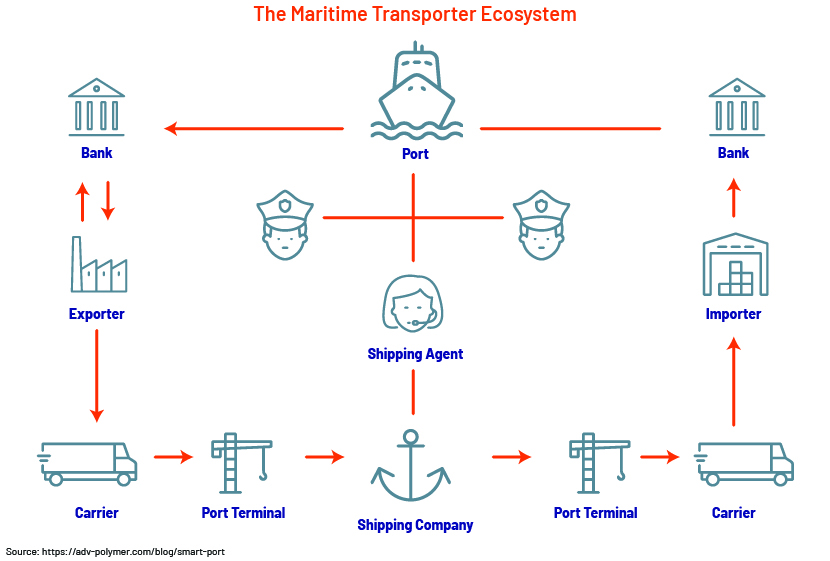

Important information on the entry and exit of vessels needs to be exchanged with stakeholders such as port authorities, maritime pilots, maritime administration and health authorities. Digitalisation would play an important role in sharing this information, improving the quality of the information sent and reducing error.

Since 2019, the IMO has required data to be exchanged electronically between a ship’s reporting parties. It also recommends “single window” concepts, where information is submitted via a single portal. However, to share and understand the data, both vessels and ports need to adhere to international harmonised standards. To this end, the IMO and other standardisation bodies such as the International Organization for Standardization (ISO), United Nations Economic Commission for Europe (UNECE) and World Customs Organization (WCO) have agreed on an IMO dataset, known as the “IMO Compendium” (the IMO reference data model contains a set of standards governing the submission of maritime-related data). The IMO encourages all stakeholders to adopt the IMO Compendium when developing their digital systems. Enabling interoperability of a single window and systems eliminates paperwork and reduces the administrative burden in the shipping industry.

Possible opportunities for financial institutions

Banks and financial institutions could play a pivotal role in cutting down greenhouse gas emissions by providing financial support to environmentally responsible projects and innovative technologies that would enable the shipping industry to become more environmentally friendly.

Green financing” is gaining popularity in the shipping industry due to the restrictions set by the IMO on greenhouse gas emissions. As a result, most shipping companies are now required to modernise their existing vessels, manufacture new sustainable ships and adopt digital transformation to reduce their CO2 footprints. This opens up new financing opportunities for financial institutions to offer shipping companies green lending loans that combine financial terms and sustainable goals.

Heightened concerns relating to climate change have led to the growth of the “green bond market”. This opens new avenues for banks and financial institutions to raise capital by issuing green bonds in the capital markets. Green bonds are gaining in popularity among investors as investors embrace socially responsible projects. This makes it easier for bond issuers not only to raise funds, but also to raise funds at lower issuance costs. However, funds raised through green bonds may only be used for green projects that meet green/sustainable criteria. Financial institutions need to ensure that green projects funded with capital raised through the issuance of green bonds comply with the terms of such bonds; this also requires compliance with additional reporting requirements.

Fine-tuning the shipping industry to make it a green/sustainable one requires substantial investment in developing essential technologies. Finding feasible energy sources and developing techniques to store them are the main challenges in green shipping.

How Acuity Knowledge Partners can help

Our team of subject-matter experts leverage their expertise to provide financial services to industries and companies willing to implement green initiatives. We offer customised research solutions to help our clients achieve their green/sustainable goals, including pre-investment screening to ensure investments are compatible with green targets and assessing results of green projects via periodic monitoring of additional reporting requirements. Our Commercial Lending team is experienced in adapting to the evolving green finance market and analysing new covenants relating to green loans, providing the full spectrum of lending solutions to global commercial banks and helping them standardise andhttps://www.acuitykp.com/blog/the-shipping-industry-green-revolution/ digitalise their processes.

Sources:

https://fuelcellsworks.com/news/worlds-first-hydrogen-powered-5g-port-put-into-service/

https://www.adv-polymer.com/blog/marine-fuel-oil

https://www.statista.com/statistics/1098994/marine-bunkers-product-demand-by-fuel/

https://www.adv-polymer.com/blog/green-shipping

https://marine-digital.com/article_decarbonization

https://marine-digital.com/article_maritime_transport2020

https://www.thebalance.com/what-are-green-bonds-417154

https://theicct.org/publications/air-water-pollution-scrubbers-2020

https://marine-digital.com/article_green_ship

What's your view?

About the Author

Shanaathanan is a Delivery Lead, with more than 7 years of work experience in Financial and MIS reporting. He is currently attached to the Commercial Lending division at Acuity Knowledge Partners, and part of the Transport and Logistics sector team undertaking covenant monitoring and validation, financial spreading and performing risk raters for a leading European based bank. Prior to joining Acuity Knowledge Partners, he worked as an Executive in the Financial Reporting division of a local bank. He has also worked in the field of Financial Reporting and Analysis for a UK based leading insurance company, and gained exposure in Audit and Assurance from a global..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox