Published on August 30, 2021 by Vikas Jha

We hear that credit has become “tighter”. This means credit issuers are taking steps to reduce risk, such as by lowering credit limits or canceling credit card accounts. Often, they also make requirements for credit approval less flexible. This happened during the great recession of 2007-09. More recently unemployment claims were filed by more than 40 million in the US on account of loss due to the pandemic and related restrictions, according to reports until May 2020. Revenue for the nation’s 30 million small businesses dried up, and many businesses had to lay off employees. Even charities, governments and creditors seemed to struggle to implement programmes to support those affected trying to minimize future economic fallout. In addition, many individuals have been placed in hardship programs, making it even more difficult for lenders to decide who is creditworthy and who is not. This is where the FICO Resilience Index comes in. It is an analytical tool, not a new credit score. Whether this tool helps you obtain approval for credit depends on whether it classifies you as being "resilient".

What does resilience mean?

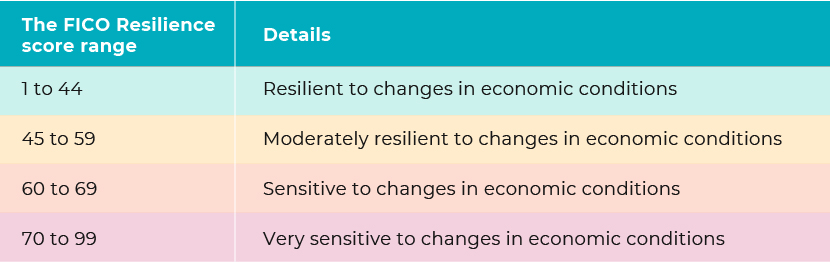

The FICO Resilience Index is a number-based point/score provided to each borrower. The point/score informs the lender of the likelihood of a borrower paying bills as agreed in situations such as an economic shutdown. The Index, developed by the FICO Corporation to check creditworthiness, measures resilience on a scale from 1 to 99. The lower the score, the better. The following chart explains the ranges:

Example: If a borrower applies for a loan, and an assessment shows his FICO resilience score is 10, it indicates a high likelihood of his paying his bills in a time of economic disturbance such as a recession or pandemic. If, on the other hand, his score is 92, it indicates a high likelihood of his failing to pay on time.

A person who is resilient (in this case, economically resilient) adjusts well to changes in circumstances. According to FICO, four factors suggest a consumer will bounce back from financial adversity:

-

Has experience in managing credit

-

Maintains low amount revolving balances, which means a low credit utilisation ratio

-

Has generated few credit inquiries in the past year

-

Has only a few active accounts

These are good credit habits that would generate a very good FICO score.

The last factor may be somewhat confusing. An individual could have a number of accounts and still generate a good score, but in the context of a pandemic, this could be viewed as being desperate for credit.

Difference between Traditional FICO Score and FICO Resilience Index:

FICO Scores are designed to predict credit risk independent of the economy. The FICO Resilience Index is not designed to measure consumers' current credit risk, but rather to predict consumers' resilience in the event of an economic downturn, including either a national recession or a regional downturn. The FICO® Score, which ranges from 850 to 300, the FICO® Resilience Index outlines a scale from 1-99. Consumers with scores in the 1 to 44 range are viewed as the most prepared and able to weather an economic shift.

How will lenders use the new Index?

The FICO Resilience Index is designed for lenders to assess an individual's creditworthiness. A credit card company, for instance, would use the Index in conjunction with a consumer's FICO score to generate an adjusted FICO score. If this is no higher than 44, the consumer would be considered to be resilient during an economic downturn. The number is accompanied by codes that help a lender understand the factors that influenced the index number.

Who benefits from the Index?

Consumers would benefit only if a lender actually uses it. Let's say you applied for a credit card that requires a good credit history, and your lender asks to see your FICO Resilience Index number. If you have only a fair-to-good FICO score between 660 and 690 but a low index number, the index tool may help you get approved. The lender may see this as a sign that you are resilient and more creditworthy than your FICO score of, say, 680 would suggest. But the opposite could happen as well. You could have a good FICO score but generate a high FICO Resilience Index number. This combination could keep you from being approved for credit.

It is always good to be aware of what a lender looks at when reviewing your credit application. A lender will evaluate your credit report, your FICO score and, possibly, your Index number. If you think the Index number bolsters your case for credit, you can mention it to your lender. Remember that it is the lender who decides whether it will be used and what it’s effect will be on the approval process.

How Acuity Knowledge Partners can help

We support global and regional commercial banks and investment banks with constant and granular monitoring of their portfolios. Our analysts (MBAs, chartered accountants and CFAs), based in our delivery centres in India, Sri Lanka and Costa Rica work as an extension of the client team and provide support on portfolio monitoring activities in the credit space. This includes financial modelling, financial spreading, covenant monitoring, extrapolating bankruptcy threshold triggers, providing refined early warning signals, customised credit reports, and a host of other value-added research. All credit solutions we provide are customised to reflect a client’s proprietary and differentiated analysis, giving the client a unique, sustainable edge.

Sources:

https://www.experian.com/consumer-information/fico-resilience-index

https://www.credit.com/blog/fico-resilience-index/

https://creditcards.usnews.com/articles/what-you-need-to-know-about-the-fico-resilience-index

Tags:

What's your view?

About the Author

Vikas Jha has over 14 years of experience in working with leading global organizations in the banking and commercial lending domains. His expertise spans a broad range of credit analysis, financial statement spreading, covenant testing and monitoring, annual review report writing, audit, risk management & consulting.

At Acuity Knowledge Partners, he leads a team for a mid-size US bank. He has previously worked in spreading automation team and lending credit analysis team covering diverse industries. Vikas holds a Post Graduate degree in finance, also, went to The Institute of Chartered Accountants (ICAI) and The Institute of Company Secretaries (ICSI) with specialization in Finance, Accounting and Companies Law.

Like the way we think?

Next time we post something new, we'll send it to your inbox