Published on February 21, 2024 by Shakun Singh

Hydrogen is increasingly being recognised as a crucial solution for reducing carbon emissions, primarily because its use for energy production does not directly release carbon dioxide (CO2). This significance arises from its unique trait of generating energy without direct CO2 emissions. “Decarbonised” hydrogen can be sourced from renewables, nuclear energy or even fossil fuels when coupled with carbon-capture technology. Its adaptability positions it as an asset in the quest to reduce the carbon footprint across complex sectors such as long-haul transport, chemical manufacturing, and iron and steel.

Hydrogen fuel can be classified by the method of production:

-

Grey hydrogen: Derived through fossil fuels such as natural gas or coal. Grey hydrogen from natural gas without carbon capture, utilisation and storage (CCUS) accounted for about 62% of the hydrogen produced in 2021. Following this, hydrogen from coal accounted for about 19% of hydrogen in 2021. Although cost-effective, it lacks emission-free attributes.

-

Blue hydrogen: Similar to grey hydrogen, blue hydrogen is also produced from fossil fuels. However, the key difference lies in the implementation of the CCUS processes that capture up to 90% of the CO2 This captured CO2 can be repurposed for various applications or stored in geological formations such as depleted oil and gas reservoirs or saline aquifers.

-

Green hydrogen: Produced through electrolysis powered by clean and renewable energy sources such as solar, wind, hydropower and geothermal, green hydrogen production is entirely devoid of carbon emissions.

This discourse primarily delves into green and blue hydrogen, chosen for their emission-free qualities.

Status of hydrogen production:

Demand for hydrogen is currently predominantly fulfilled through hydrogen production from fossil fuels without carbon capture. Total global hydrogen production reached 94m tons, leading to more than 900m tons of associated CO2 emissions, according to Global Hydrogen Review 2022 by the International Energy Agency (IEA) in 2021.

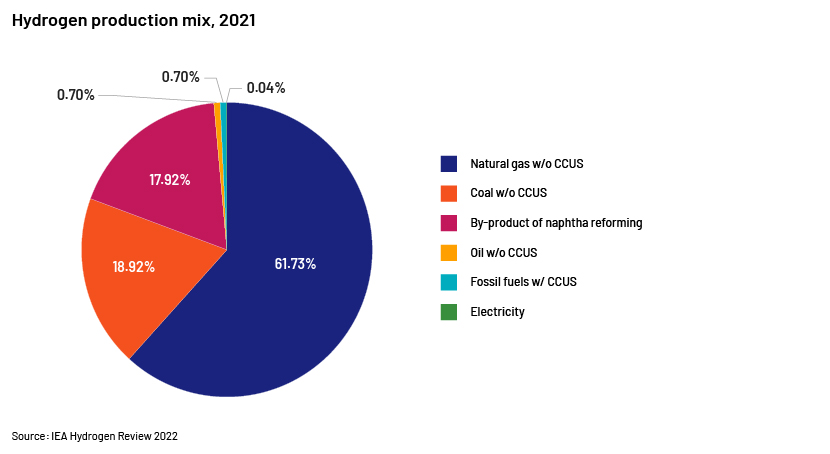

In 2021, natural gas, without CCUS, was the primary method of hydrogen production, accounting for 62% of hydrogen production. Hydrogen production from coal accounted for about 19% of total production, mainly concentrated in China. Hydrogen was also produced as a by-product of naphtha reforming at refineries, accounting for 18%. A small amount of hydrogen (less than 1%) was produced using oil.

Low-emission hydrogen production was limited, accounting for less than 1m tons (0.7%) in 2021. Almost all this low-emission hydrogen was generated from fossil fuels with carbon capture and utilisation. Only 35,000 tons of hydrogen were produced through water electrolysis powered by electricity, which represents a relatively small proportion but a significant increase of nearly 20% compared to 2020. This growth indicates a rising trend in the deployment of water electrolysers for hydrogen production.

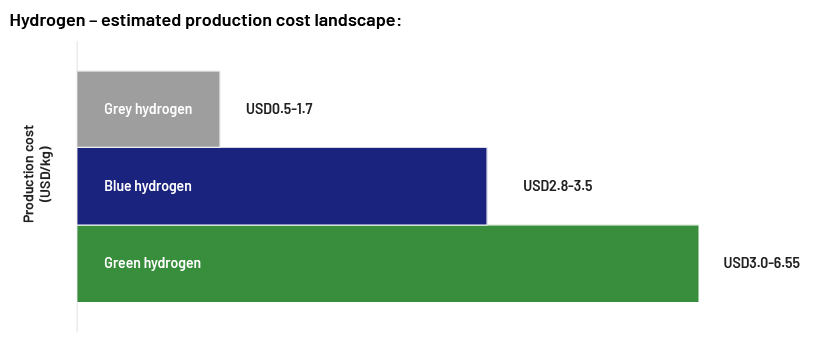

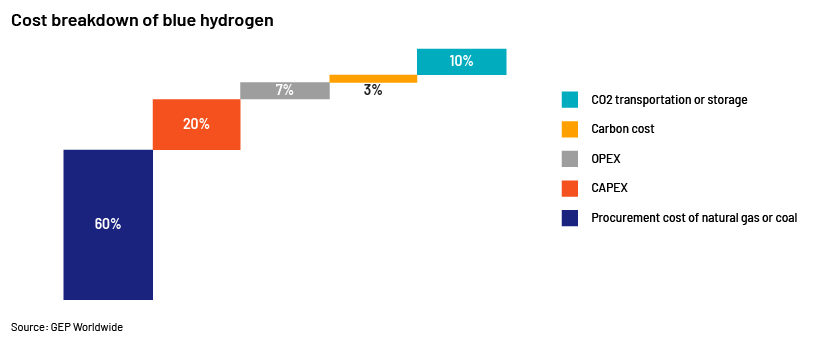

Blue hydrogen: The production cost of hydrogen from natural gas ranges from USD0.5 to USD1.7 per kg; incorporating CCUS technologies to reduce CO2 emissions from hydrogen production increases the average cost to USD2.8-3.5 per kg. Key factors influencing the cost of production include the price of natural gas (which generally accounts for 50-65% of total production cost) and the outlay associated with carbon storage, transport, and utilisation (7-10%). Other factors are CAPEX (17-22%), OPEX (5-8%) and carbon cost (2-4%).

Blue hydrogen: The production cost of hydrogen from natural gas ranges from USD0.5 to USD1.7 per kg; incorporating CCUS technologies to reduce CO2 emissions from hydrogen production increases the average cost to USD2.8-3.5 per kg. Key factors influencing the cost of production include the price of natural gas (which generally accounts for 50-65% of total production cost) and the outlay associated with carbon storage, transport, and utilisation (7-10%). Other factors are CAPEX (17-22%), OPEX (5-8%) and carbon cost (2-4%).

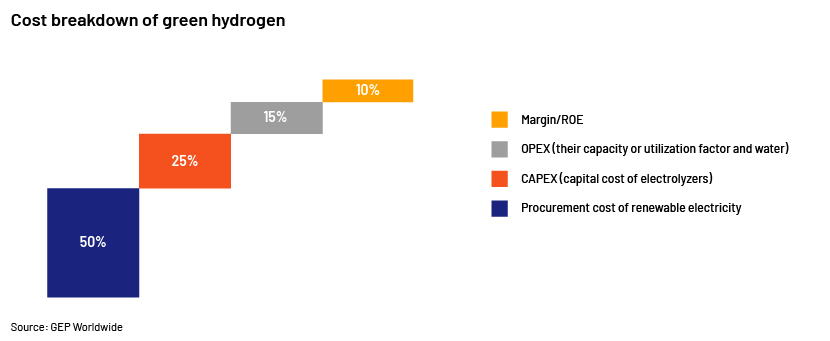

Green hydrogen: The current scenario is primarily attributed to the levelized cost of producing hydrogen from renewable electricity, at USD3-6.55 per kg. The trajectory towards cost reduction revolves around reducing the cost of low‐carbon electricity, contingent on the source of electricity and geography. Electricity expenditure constitutes 50-55% of the total cost of production. Other determinants include the capital outlay for electrolysers (CAPEX: 30-35%), their capacity or utilisation factor, water (OPEX: 12-16%) and margin/ROE (8-10%).

Key drivers of interest in green hydrogen and blue hydrogen:

1. Declining solar and wind electricity costs:

-

The major cost driver for green hydrogen is the cost of electricity. The price of electricity derived from solar photovoltaic (PV) and onshore wind plants has declined significantly over the past decade. The average price of solar energy dropped to USD0.056/kWh in 2018 from USD0.25/kWh in 2010, and the price of onshore wind to USD0.048/kWh from USD0.075/kWh over the period, underscoring the growing economic viability of green hydrogen production.

2. Technological advancements:

-

Multiple components within the hydrogen value chain are ready for commercialisation, backed by technological innovation and new investments in upscaling operations. Electrolysis capital costs have dropped a sharp 60% since 2010, triggering a reduction in the cost of hydrogen to as low as USD3-USD6.55/kg from USD10-USD15/kg.

-

CCUS technologies are expanding possibilities for circular carbon economy development, unlocking additional avenues for progress.

3. Global government initiatives towards net-zero energy:

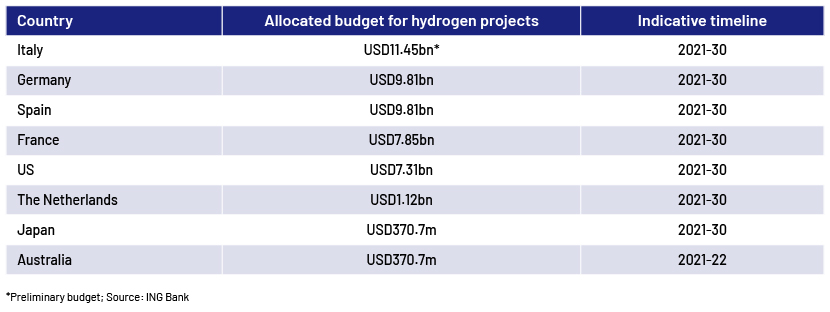

Many nations are steering their energy systems towards net zero, with a primary emphasis on green hydrogen. Notably, the focus is shifting from grey and blue hydrogen, despite their better economics. The nations shifting their focus include the following:

- The Americas:

-

In the US, hydrogen accounts for 7% of the energy transition budget, with a proposed tax credit system likely to attract more players to the blue and green hydrogen space. The credit system encourages producers to generate not more than 0.45kg of CO2-equivalent emissions per kg of hydrogen produced to claim a USD3/kg credit. Additionally, the US National Infrastructure Plan’s USD1tn budget allocates USD114bn for energy transition, according to BloombergNEF

-

- Asia Pacific:

-

China announced its long-term plan for hydrogen, covering 2021-35. According to this plan, China aims to produce 100,000-200,000 tons of green hydrogen annually and have a fleet of 50,000 hydrogen-fuelled vehicles by 2025.

-

India envisions energy independence by 2047 and achieving net zero by 2070. The National Green Hydrogen Mission was approved by the Union Cabinet in 2022 and strives to make India a prominent global green hydrogen producer, aiming for a production capacity of 5m metric tons annually by 2030, linked to about 125 GW of renewable energy capacity growth.

-

Japan has set a budget of JPY70bn for research and development and eight hydrogen pilot projects; it is scheduled to initiate full-scale hydrogen generation by 2030.

-

- Europe:

-

The EU envisions incorporating hydrogen in its energy mix on a significant scale, targeting a share of 13-14% by 2050. The strategic objective revolves around elevating hydrogen’s market contribution from less than 2% in 2020 to a substantial 13-14% by 2050. The optimistic estimates project an even more pronounced role for hydrogen, with the potential for up to a 24% share of the energy mix by 2050.

-

Italy, in a proactive move, has earmarked a preliminary budget of USD11.45bn dedicated to hydrogen development for the period spanning 2021 to 2030. This strategic allocation shows Italy’s commitment to fostering hydrogen-based energy.

-

4.Entrepreneurial engagement and private-sector enthusiasm:

-

Propelled by global governmental incentives, the drive to innovate within this domain has attracted interest of both startups and established private and public enterprises.

-

Government support in the US has translated into substantial funding opportunities for private and public entities proposing hydrogen hub initiatives, catalysing a slew of strategic initiatives.

This collaborative synergy underscores the dynamic traction that startups and private and public companies are garnering as they contribute to shaping the evolving landscape of hydrogen advancements.

These compelling factors collectively show the rise of both green and blue hydrogen within the energy landscape, signaling a promising trajectory towards sustainable solutions.

Conclusion – a comparison of blue and green hydrogen:

Green hydrogen’s production cost is typically 2-3x higher than that of blue hydrogen. As a result, blue hydrogen sees more widespread use than green hydrogen.

In the realm of blue hydrogen, the expenses linked to generating clean hydrogen from fossil fuels with carbon capture and storage (CCS) vary by region due to disparities in fuel costs. In regions with cheap gas, capex is the principal cost factor influencing the overall cost structure. Conversely, gas is the major cost driver in locations with expensive gas. Generating hydrogen via coal gasification with CCS involves a larger initial investment than does using steam methane reforming with CCS.

Green hydrogen, on the other hand, is produced through the process of electrolysis, using electricity typically derived from renewable sources such as solar, wind or hydropower. This approach has a significantly lower carbon footprint than does blue hydrogen. However, it entails higher production costs due to the electricity-intensive nature of the process.

Despite these cost disparities, green hydrogen plays a crucial role in achieving the goal of net-zero CO2 emissions, particularly in sectors characterised by high energy consumption and facing decarbonisation challenges, such as steel production, chemical manufacturing, long-distance transport, shipping and aviation. Financial mechanisms, including green lending services, can play a vital role in funding these transitions and accelerating adoption.

In contrast to green hydrogen, the production of blue hydrogen often involves steam methane reforming, where natural gas is mixed with extremely hot steam and a catalyst. This chemical reaction yields hydrogen and carbon monoxide; carbon monoxide is further processed into carbon dioxide and more hydrogen. However, a significant concern with blue hydrogen is that natural gas production inevitably results in methane emissions. While methane has a shorter atmospheric lifespan than CO2, its potency as a greenhouse gas is significantly greater. One ton of methane equals 28-36 tons of CO2 over a period of 100 years, according to the IEA.

Consequently, the prominence of green hydrogen within energy scenarios is underscored by its vital role in addressing sustainability challenges. The escalating interest in green hydrogen is fuelled by the pursuit of low-carbon solutions and its distinctive advantages. These benefits further solidify its standing as a promising solution to the energy crisis.

How Acuity Knowledge Partners can help

We offer comprehensive assistance to a number of corporate segments, helping them navigate transitions, leverage prospects, enhance operational efficiency, streamline expenditures and foster adaptability in the dynamic global business landscape.

Our array of ESG research solutions includes building databases at both the company and country level, formulating frameworks and models, in-depth analysis, writing reports and preparing presentations. In the realm of climate change-related solutions, our ESG support extends to opportunity evaluation, risk analysis, climate financing and guidance on disclosure and reporting. Our holistic ESG assistance includes risk assessment, scoring, integrated analysis and audits.

Energy and utility research: https://www.acuitykp.com/solutions/energy-and-utilities/

Technology research services: https://www.acuitykp.com/solutions/technology-research-services/

ESG research services: https://www.acuitykp.com/solutions/environmental-social-and-governance-esg/

Sources:

International Energy Agency:

-

https://www.iea.org/energy-system/low-emission-fuels/hydrogen

-

https://iea.blob.core.windows.net/assets/GlobalHydrogenReview2022.pdf

S&P Global:

International Renewable Energy Agency:

CNBC:

-

https://www.cnbc.com/2022/01/06/what-is-green-hydrogen-vs-blue-hydrogen-and-why-it-matters.html

-

https://www.cnbc.com/2022/01/06/what-is-green-hydrogen-vs-blue-hydrogen-and-why-it-matters.html

Others:

-

https://energy.ec.europa.eu/topics/energy-systems-integration/hydrogen_en

-

https://think.ing.com/articles/hold-3of4-governments-are-shaping-their-hydrogen-ambitions/#a3

-

https://www.csis.org/analysis/china-unveils-its-first-long-term-hydrogen-plan

-

https://www.sciopen.com/article/pdf/10.26599/NRE.2022.9120032.pdf

Tags:

What's your view?

About the Author

Shakun is an associate with nearly three years of experience in research and consulting, specializing in metals, mining, and critical minerals. At Acuity Knowledge Partners, he supports clients with a variety of strategic research initiatives. He holds a PGPM degree with a specialization in finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox