Published on March 12, 2024 by Rohit Tyagi

Introduction

With the rapid expansion of renewable energy sources and growing concerns regarding grid stability due to the variable nature of solar and wind projects, the need for energy storage solutions has skyrocketed. Bloomberg NEF (BNEF) expects battery storage capacity to increase 16x from 2022 to 2030, reaching an impressive 720GW[i]. Lithium-ion batteries (LIBs) are expected to dominate the battery energy storage market, accounting for approximately 80% of the market[ii]. However, the substantial increase in LIB production to meet the surging demand presents significant supply-chain, safety, and environmental challenges. Consequently, exploring alternatives to traditional LIBs has gained significant momentum.

In contrast to lithium, sodium is widely available and abundant, constituting a significant portion of the salt found in oceans. Researchers have recently discovered that layered-oxide cathodes, which use sodium instead of lithium, can function effectively without the need for cobalt or nickel additives (used in LIBs to achieve higher energy density, although like lithium, these have restricted the supply chain and are environmentally degrading). This breakthrough has sparked considerable interest, particularly in China, in the scalability of sodium-ion (Na-ion) batteries.

Advancement in Na-ion batteries

CATL, the largest producer of lithium-ion vehicle batteries globally, made headlines in 2021 with the introduction of the world's first sodium battery designed for electric vehicles. Chinese automaker Chery has announced plans to incorporate CATL's sodium batteries, alongside lithium batteries, in its new iCAR brand. BYD, a formidable competitor to CATL, is also actively pursuing sodium battery technology. Their Seagull hatchback, unveiled at the Shanghai Auto Show in April 2023, is set to feature Na-ion batteries soon. Farasis Energy, an established battery manufacturer, has partnered with Jiangling Motors. At the same time, HiNa Battery Technology, a specialised firm focused on Na-ion battery development, is collaborating with JAC Group, another prominent carmaker. Svolt, a subsidiary of Great Wall Motor, benefits from its parent company's automotive expertise as it ventures into the realm of Na-ion batteries. Benchmark Mineral Intelligence, a firm in London, lists 36 Chinese companies that are either making or investigating sodium batteries.

Outside China, Natron Energy (USA), Altris (Sweden), Tiamat (France) and Faradion (UK) are some of the leading players developing Na-ion batteries[iii].

Benefits of adopting NA-ion batteries over LIBs

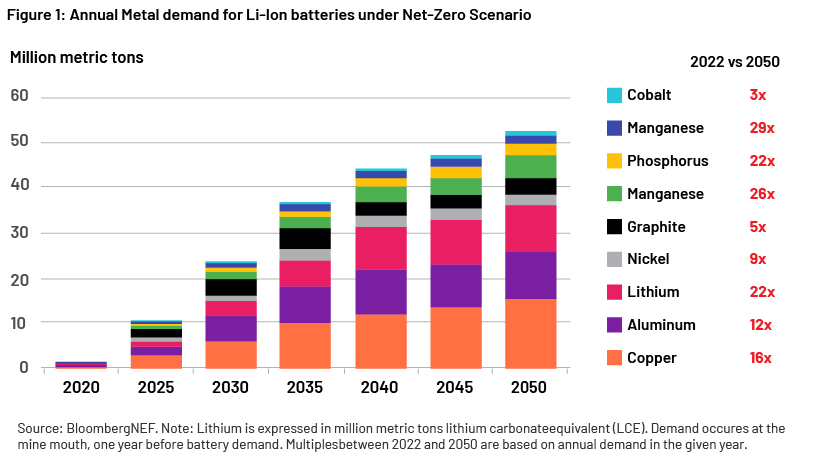

1. Availability of raw material. NA-ion batteries offer an alternative that reduces the need for mining of critical minerals such as lithium, copper, and aluminium used in LIBs. Sodium, one of the most plentiful and widely distributed resources on Earth, can be found in rock salts and brines in different geographies. Its abundance and lower cost than lithium make it less vulnerable to challenges relating to resource availability and price fluctuations. Demand for lithium will increase to 22x current demand by 2050, according to BNEF’s net-zero scenario; this seems to be challenging to meet, with current reserves already depleting, despite recycling[iv]. However, the primary concern arises from battery supply chains struggling to meet escalating demand for electric vehicles (EVs), resulting in soaring lithium carbonate prices due to this supply squeeze[v].

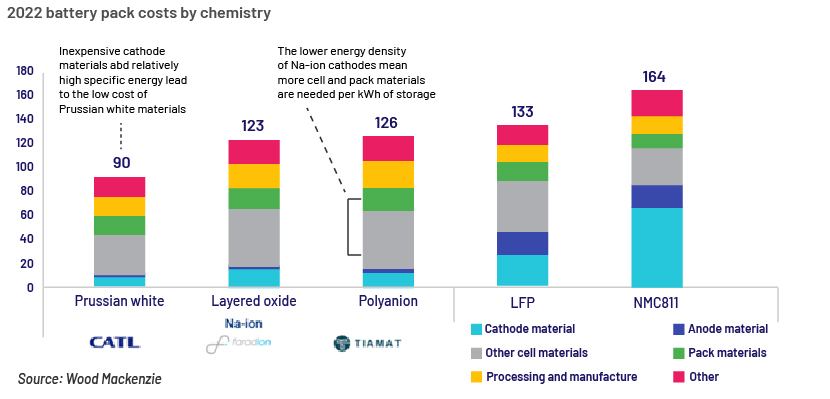

2. Cost advantage and scalability. The cost advantage is a key benefit. With Sodium the sixth most abundant element on Earth, the cost of Na-ion batteries is likely to be significantly lower than that of lithium (Li)-ion batteries. Additionally, Na-ion chemistries use materials that are cheaper than materials used for Li-ion counterparts, making Na-ion cells less susceptible to increasing costs of lithium, cobalt and nickel. In a scenario where all material prices increase by 10%, Na-ion material costs would experience only a modest increase of 0.8%, while lithium iron phosphate (LFP) costs would rise by 3.2%. The lower pack cost of Na-ion batteries is as a compelling reason for substituting them for Li-ion applications. Moreover, Na-ion manufacturing processes align with those employed in Li-ion giga-factories, enabling rapid scalability of production capacity[vi].

Figure 2: Sodium-ion batteries present a lower cost option than do Li-ion batteries

As the figure above shows, each of the three main Na-ion cathode types – Prussian white, layered oxide and polyanion – each use lower-cost materials than do Li-ion cathodes LFP and NMC811.

3. Safety and performance. In terms of safety, Na-ion batteries have demonstrated encouraging outcomes, offering broader operating temperature ranges and a more stable anode-electrolyte combination than Li-ion batteries. They are also safely transportable while fully discharged, in contrast to LIBs, which should not be discharged below 30% for transport/storage. In terms of performance, Na-ion batteries exhibit remarkable capacity retention even in freezing temperatures. They boast fast charging capabilities, reaching an 80% state of charge (SOC) within 15 minutes. They also have long cycle lives, retaining 80% of their capacity after 4,000-5,000 cycles, surpassing the performance of lithium batteries. In addition, they have a much smaller carbon footprint than do lithium batteries. The Northvolt Group, a manufacturer of Prussian white batteries (made of sodium and iron), claims that their batteries emit only 10-20kg of CO2 per kWh, significantly less than the 100-150kg of CO2 per kWh typically associated with comparable battery technologies[vii].

Applications and outlook

Na-ion batteries exhibit versatility for a range of applications, including promising potential in stationary applications. The increasing integration of variable renewables necessitates affordable energy storage solutions, both on a utility scale and behind the meter in homes and businesses. Na-ion batteries offer advantages such as low cost, extended lifespan, safety and impressive performance characteristics. In the stationary context, where size and weight are less critical, Na-ion batteries could emerge as competitive alternatives to Li-ion batteries. Moreover, the potential use of Na-ion batteries extends to EVs. Particularly in short-range EVs, with their current energy density of 160 Wh/kg, Na-ion batteries present a viable option. Chinese battery and car manufacturers have already begun announcing compact EVs powered by Na-ion batteries, providing ranges of approximately 250km[viii].

The International Renewable Energy Agency (IRENA) projects the production capacity of Na-ion batteries to grow a substantial 350% – to 186GWh/year by 2030 from 42 GWh/year in 2023. Chinese players are expected to contribute most of this capacity, accounting for approximately 94% of the market share. This significant increase in the production capacity would be sufficient to power approximately 4.6m EVs manufactured annually, assuming an average vehicle capacity of 40 kWh.

Conclusion

Na-ion batteries present a sustainable and cost-effective alternative to Li-ion batteries, addressing concerns relating to resource availability and price volatility. With excellent safety features, wide temperature ranges, and stable performance, they are ideal for stationary storage and low-performance EVs. The scalability of production, coupled with the growing interest from major players, indicates a bright future for Na-ion batteries. The market is projected to witness significant growth, providing a robust solution for inexpensive energy storage. Na-ion batteries have the potential to revolutionise the sector, offering a sustainable, efficient and competitive option for the energy transition.

References:

-

[i]BNEF – Scaling the Residential Energy Storage Market, Nov 2023

-

[ii]ET Auto – LFP battery to retain dominant market share in energy storage sector,

-

[iii]The Economist – Firms are exploring sodium batteries as an alternative to Lithium,

-

[v] Energypost.eu: Sodium-ion batteries ready for commercialization: for grids, homes,

-

[vi] Wood Mackenzie – Sodium-ion batteries: disrupt and conquer?

-

[vii] ING – Can sodium-ion batteries replace lithium-ion ones?

-

[viii] DIGITIMES Asia – China sees two EVs powered by sodium-ion batteries rolled off product

Tags:

What's your view?

About the Author

Rohit is aligned with Acuity's, Strategy Research and Consulting team with over 12 years of experience in management consulting with expertise in energy transition and decarbonization strategies.

He specialises in the implementation of sustainable strategies across Europe, Asia, and Africa. Proven insights in emerging markets including Green Hydrogen, CCUS, Renewables, EVs, Energy Storage, and Carbon markets, among others, enable him to provide informed guidance to clients from diverse sectors including Power, Steel, Cement, and Infrastructure.

Rohit has wide experience working with stakeholders across the energy sector value chain including project developers, regulators, policymakers, financial institutes, investment agencies etc. with a focus on market strategy, new investments, deal advisory,..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox