Published on December 15, 2023 by Anurag Sikder

In the storied evolution of investing and asset management, there was a rare moment recently when a thematic element in investing commanded global attention as investors across the globe turned their focus towards sustainable investments. Dubbed as a game changer, environmental, social and governance (ESG)-themed investing aims to introduce a degree of sensitivity and a sense of responsibility among global investors. ESG investing increased significantly in 2021 as, in Europe alone, over half a trillion US dollars were invested in ESG-themed offerings. It is estimated that the ESG share of global assets under management will increase to more than one-fifth of all assets (21.5%) by 2026 from 14.4% in 2021.

As the goals of these types of funds differ from those of regular investment products, there is growing demand for alternative reporting and presentation in fund marketing collateral, including pitchbooks, client reports and, most importantly, fund factsheets.

What is ESG investing?

ESG investing is the practice of focusing on maximising financial returns and using ESG factors to help assess risks and opportunities, particularly over the medium to long term. Differentiating factors include the following:

-

Differentiated investment goal(s)

-

Alternative performance reporting standards

-

Active measurement of materiality

-

Active risk assessment of long-term ESG challenges and developments

These characteristics of an ESG fund are best reflected in the kind of investments the fund makes. This includes the companies the fund invests in, the sector it is focused on and the regions it finds appealing.

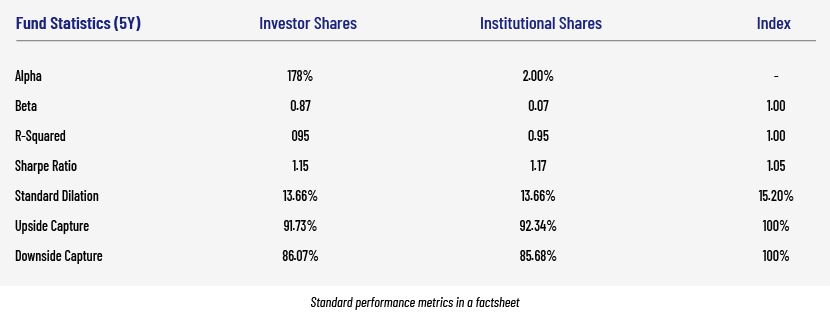

The essential elements of a fund factsheet

A fund factsheet is a critical marketing document that provides an overview of the mutual fund and its performance. It is beneficial for potential investors to go through this report to analyse and evaluate a mutual fund scheme and learn of its pros and cons. The basic takeaways from a factsheet should be general fund information, portfolio details, annualised returns, fees and the fund’s risk profile.

Examples of fund factsheets:

Examples of fund factsheets:

Features of the world’s top ESG funds’ factsheets

According to MSCI ESG Research, 88% of high-net-worth millennials actively review the ESG impact of their investment holdings. More than 50% of them have actively stopped investing in companies whose products have a direct impact on people’s health and mental wellbeing. ESG funds largely function similar to other mutual/exchange-traded and hedge funds. They also try to achieve the overall goal of maximised returns via a choice of sustainable securities. This mandate needs to be monitored constantly, and a fund’s factsheet is the best way of doing so.

Based on the factsheets of some of the world’s leading ESG funds, the following five features are critical for an ESG fund factsheet:

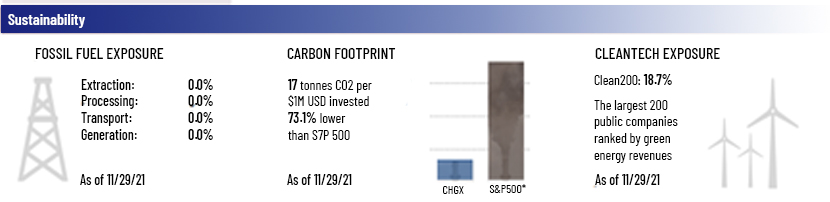

1. Sustainability rating: An ESG-compliant fund should publish its ESG rating in its factsheet. This is a good measure for assessing the extent to which a fund manager’s practices align with the fund’s responsible, sustainable objective. This rating is provided by the world’s renowned agencies and can be seen in the Morningstar™ Sustainability Rating for funds. These ratings are generally measured on a scale of 1 to 5. It has also become the norm to publish the ranking of a particular fund in a pool of funds with a similar strategy.

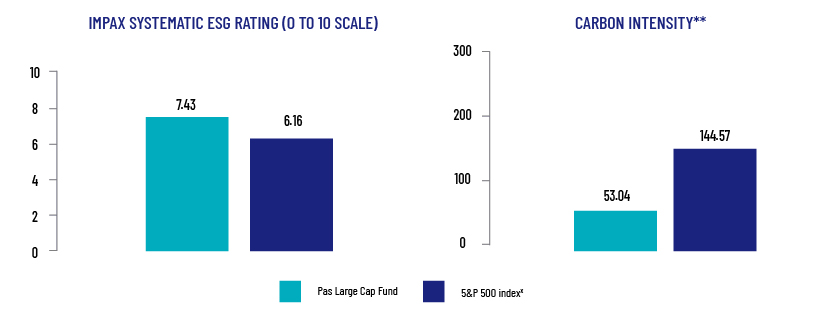

There are other ways in which funds show how well they align with their sustainable investment objectives. A comparison of the carbon footprint of a fund with that of the index it tracks is one such measure. Other measures are statistics related to fossil fuel exposure and exposure to clean technology.

2. Investment strategy: The investment strategy of a particular fund must resonate with its ESG objectives. The strategy needs to contain guidelines for stock picking and the profiling methods the fund manager uses. A typical example of an ESG-centric investment approach would be a strategy note in the factsheet that contains the following:

-

Quality companies: Investing in well-managed companies with positive ESG practices and attractive business fundamentals

-

Large-cap focus: Integrating traditional fundamental and ESG research to invest in large- cap companies across sectors

-

Proprietary responsible investment framework: Using an in-house framework to evaluate ESG factors and guide active engagement efforts with company management teams

An investment strategy must clearly highlight the guiding principles surrounding a fund’s investment decisions. The absence of such details could signal non-compliance, although deeper research may be required before determining that a particular fund is non-compliant.

3. Sustainability profile: This is the global definition of responsible investment in terms of governance and social justice. Avoidance of environmental dangers may be important for certain societies, while others may consider gender equality to be more important. Regardless of which factor is more important, a fund should showcase this and present associated metrics that highlight its importance.

However, some factors may be difficult to quantify, as they may be more qualitative. In culture-centric economies, these factors may have to be kept in mind, even before launching the fund. The impact of such a filter could be assessed from the fund’s performance figures. As an ESG-centric fund, factors that have a direct impact on its working should always be listed in its factsheet.

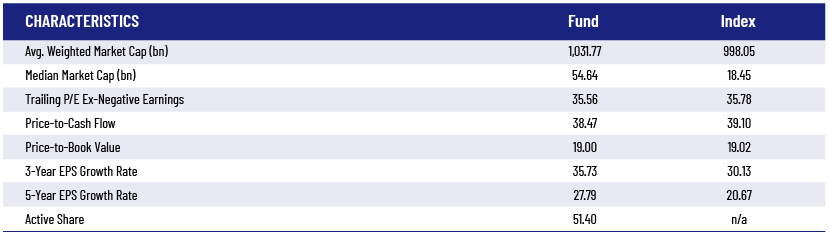

4. Fund vs index comparison: One of the fundamental ways to assess the performance of an actively managed fund versus a passive fund is to measure the performance against index performance. This is especially important in the case of ESG funds that actively put the welfare of society before profit maximisation.

By measuring the performance of an actively managed fund against the index, the fund’s ability or influence could also be assessed. Using a range of metrics would paint a clearer picture of the viability of investment in a particular fund.

5. Expense ratio:ESG funds are generally more expensive (0.61%) than their standard mutual fund counterparts (0.41%), according to Morningstar’s 2020 US Fund Fee Study. This is an average figure but indicates the importance of looking at the ratio of every fund being considered for investment. While a high expense ratio may be a deterrent at first, it is important to weigh this expense ratio against the objectives and strategy of a particular fund.

A fund that is actively managed and aims to capture a higher return than that of the index may command a higher expense ratio. Such a fund must be analysed and if the return and ESG-centric philosophy do justify the cost, it may be a good idea to invest in such a fund. However, this would not be true in every case, and careful scrutiny is important.

Adopting the new reporting standards set by prominent ESG fund managers

While this is not an exhaustive list, these features of an ESG fund are slowly becoming essential for investors to identify a sustainable investment opportunity. Global ESG AuM has grown at an annual rate of approximately 21%. Asset managers globally are expected to increase their ESG-related AuM to USD33.9tn by 2026, at an annual growth rate of 12.9%, according to PwC’s Asset and Wealth Management Revolution 2022 report. By identifying the specific ESG-related filters a fund uses and then juxtaposing its performance against that of the index, investors form a well-rounded picture of how responsible investing works. We have helped asset managers incorporate ESG metrics and information into their fund factsheets, but others have been slow to move on this front, incorporating ESG information based only on client requests.

ESG investing is still growing in importance. As future generations become sensitised to inclusive growth and investing, these factors may go from being a novel addition to a regulatory requirement for ESG funds. This may especially be true in the case of sustainability ratings and profiles. Hence, it is advisable for investors, and fund managers alike, to stay abreast of these new additions to performance reporting. This would be not just in terms of regulatory requirements, but also for providing unique insights to investors.

How Acuity Knowledge Partners can help

As part of our financial marketing services, we provide a wide range of fund marketing material support in addition to our extensive expertise, using specialised tools. Our teams have extensive experience in writing, organising and generating marketing collateral for international asset managers. Factsheet development for a wide variety of funds, automated report generation and compliance with the various regulatory and regional needs of such funds are some of our primary areas of expertise. Having provided years of support, we have acquired a unique ability to offer both artistic and technical insights on the factsheet manufacturing process.

References:

-

https://markets.ft.com/data/funds/tearsheet/summary?s=no0010272412:nok

-

https://www.factset.com/solutions/business-needs/esg-solutions

-

https://www.reuters.com/markets/us/how-2021-became-year-esg-investing-2021-12-23/

-

https://www.amfiindia.com/investor-corner/knowledge-center/myth-mutual-fund.html#accordion2

-

https://www.msci.com/our-solutions/esg-investing/esg-fund-ratings

-

https://greencleanguide.com/ten-largest-esg-funds-and-their-performance/

-

https://impaxam.com/assets/pdfs/factsheets/fact_sheet_largecapfund.pdf

-

https://www.jhinvestments.com/investments/esg/us-equity-funds/esg-large-cap

-

https://www.ishares.com/us/products/239692/ishares-msci-usa-esg-select-etf

-

https://impaxam.com/assets/pdfs/factsheets/fact_sheet_largecapfund.pdf

-

https://www.putnam.com/individual/mutual-funds/funds/67-sustainable-leaders-fund/A

-

https://corpgov.law.harvard.edu/2022/11/17/exponential-expectations-for

-

https://www.investopedia.com/esg-fund-inflows-plunge-2022-7106493

-

https://hbr.org/2022/12/2022-a-tumultuous-year-in-esg-and-sustainability

-

https://www.pwc.com/gx/en/news-room/press-releases/2022/awm-revolution-2022-report.html

-

https://www.globenewswire.com/news-release/2023/01/25/2595563/0/en/

Tags:

What's your view?

About the Author

Anurag Sikder has over 13 years of experience in producing content for a wide range of industries. At Acuity, Anurag leads a range of different teams providing qualitative insight for numerous sectors in the form of market reports, white papers, thought leadership pieces, and commentaries.

Like the way we think?

Next time we post something new, we'll send it to your inbox