Published on June 3, 2022 by Anish Aggarwal

The increasing role of treasury in supply-chain management

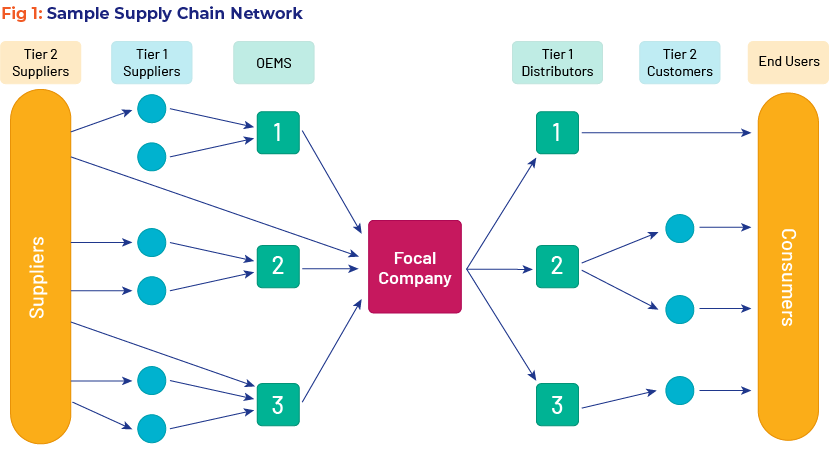

The supply chain of any entity can rarely be depicted by a single-line flow chart. It may look like a spider or an uprooted tree ( ), involving a number of suppliers, original equipment manufacturers (OEMs) and distributors that are interconnected and driven by a focal company. Managing multiple relationships across the supply chain is referred to as supply-chain management (SCM). With the globalisation of markets and a few countries becoming hubs of manufacturing and meeting the needs of customers globally, SCM has become not just a complex process, but also a challenging one.

According to Procumenttactics.com, the global supply-chain market is expected to grow at a CAGR of 11.2% from 2020 to 2027, increasing total market value to USD37.41bn in 2027. The pandemic disrupted supply chains around the world and impacted not just big businesses, but smaller businesses as well. Mergers and acquisitions (66%), extreme weather conditions (41%), factory fires (37%) and business sales (33%) are other common causes of supply-chain disruption, apart from geopolitical risks (such as Brexit and Russia’s invasion of Ukraine), talent-/labour-related concerns and cybersecurity-related risks.

Key operational issues due to supply-chain disruption:

-

-

In a study conducted by CFO Signals™, 40% of the CFOs surveyed indicated that supply chain-related shortages or delays had increased their companies’ costs by 5% or more. There is a pressing need for businesses to build long-term resilience in their supply chains to manage future challenges.

-

Businesses following a “just-in-time” approach are adding a 34% buffer to ensure supplies do not dry up by moving to a “just-in-case” one. Although a larger asset base may sound like a good thing, higher stocks mean not only additional rent for more storage space, but also more capital getting stuck in unproductive goods.

-

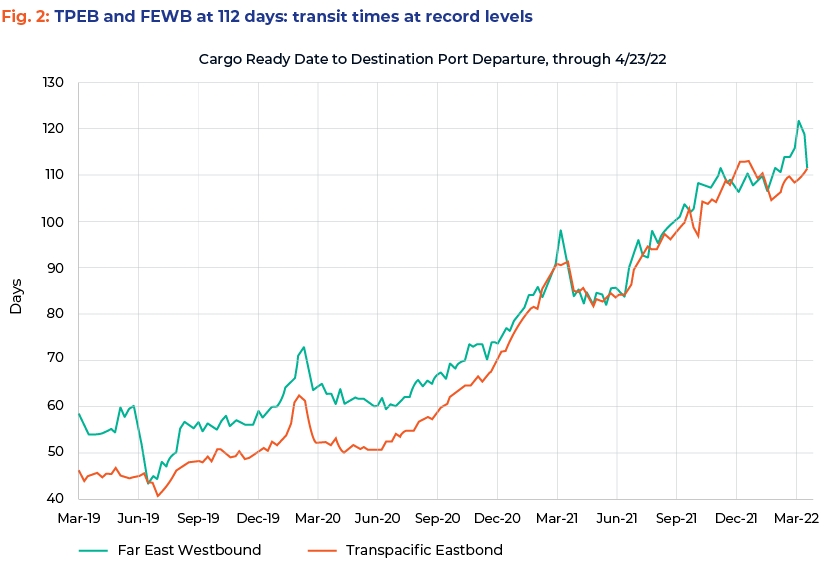

It now takes almost double the time (in number of days) for cargo ships to reach North America or Europe from Asia, according to Flexport research. With US demand topping pre-pandemic levels, the twin ports of Los Angeles and Long Beach, where almost 40% of the nation’s imports are unloaded, are suffering from overloading, and ships have to wait for weeks before they are allowed to dock and discharge payloads.

-

With most companies following the same T+30 payment terms, the order cycle is prolonged, resulting in higher costs of financing.

-

“Out-of-stock” items were estimated at USD1.14tn in 2020, against USD626bn worth of overstocked items due to the pandemic. Another need of the hour is to understand demand and plan production in a way that scarce inputs are utilised in the most prudent manner. Companies are investing in market research and using big data to make better predictions of demand and detect fraud.

-

Twenty-four percent of small business owners still use accounting software such as QuickBooks for inventory management, while 67.4% of supply-chain managers use Excel spreadsheets as a management tool. With supply-chain disruptions impacting sales, more businesses are likely to accelerate adoption of digital technologies for better management and monitoring. A cloud-based digital B2B network and SCM platform could help gather customer feedback promptly, mobilise command centres in a timely manner, reprioritise, support decisions such as on whether to make or buy and manage contingencies.

Role of Treasury and Finance in improving SCM

Although SCM remains primarily a prerogative of the operations space, amid disruptions and the changing global scenario, the roles of finance and treasury cannot be ignored. Adoption of advanced technology like a cloud based digital SCM platform is on top priority for Finance managers. Technology can help improve business efficiency enabling real time tracking of order and digital invoicing as well as payments. At the same time, use of data science in SCM can help save costs through better prediction of demand, help identifying cheaper and non-traditional sources of finance and insurance at competitive rates, cost effective and faster assessment of creditworthiness of the supplier, and early fraud detection.

Apart from technology, Finance team need to be invested in reconfiguring the supply chain like making “make-or-buy” decisions based on new world challenges, revamping accounts payable and receivable to optimize working capital management, renegotiating payment terms with suppliers on both short term and long term basis, sourcing locally and treasury managers have their plates full, and this phenomenon may not end anytime soon.

The federal government was forced to tighten liquidity to control inflation through a Fed rate hike due to the geopolitical crisis in Ukraine entering the third month and increasing COVID-19 infections in China increasing inflation. This may contain demand to some extent in the future, easing pressure on supply chains. However, steps taken to strengthen supply chains may not yield results in 12 months’ time; therefore, the situation is unlikely to return to normal in 2022.

How Acuity Knowledge Partners can help

We have nearly two decades of experience in helping 400+ banks and financial institutions transform their operating models and cost structures. Our Lending Services team provides offshore support to banks and corporates by helping them in prudent origination, underwriting and monitoring of loans. Our credit experts provide granular insights and help banks’ credit risk teams identify potential risks in the portfolio.

Sources:

https://www.wired.com/story/supply-chain-crisis-data/

https://hbr.org/2022/03/are-the-risks-of-global-supply-chains-starting-to-outweigh-the-rewards

https://edition.cnn.com/2022/03/30/business/global-supply-chain/index.html

https://procurementtactics.com/supply-chain-statistics/

https://www.flexport.com/blog/same-better-or-worse-whats-the-logistics-outlook-for-2022/

Tags:

What's your view?

About the Author

Anish Aggarwal has over 16 years of experience in working with Investment Banking, Shared Services and Commercial Lending domains.His expertise spans across broad range of services including credit analysis, target screening, valuation, process migration and onshore client-facing roles.At Acuity Knowledge Partners, he leads a portfolio management team for a regional US bank. He has previously led specialized teams supporting Investment Banks and Credit Ratings Agency covering diverse geographies and industries.Anish is a Chartered Accountant and holds a Bachelors in Commerce (Hons).

Like the way we think?

Next time we post something new, we'll send it to your inbox