Published on February 9, 2022 by Abubakar Siddeeqh

Introduction

Fund houses were not spared the effects of the pandemic and have had to integrate complex measures just to stay afloat. Fund administrators play a pivotal role in back-office support and in providing fund accounting and transfer agency services, and are emerging as a vital part of the system as they become more resource-intensive and specialised. In this paper, we analyse what practices helped them survive the crisis.

Mitigating the effects

The major challenge fund administrators faced was having their workforces and operations up and running. Having to adopt a work-from-home framework to ensure the health of wellbeing of employees, technical and operational challenges had to be overcome, and that with limited infrastructure and within a short timeframe.

The lockdowns led to price fluctuations and market volatility, resulting in an unprecedented number of transactions with many fixed income trades being effected. Fair-value pricing was more widely deployed, interfering with automated net asset value (NAV) processes, which in some cases resulted in delaying NAV calculations.

First responders

For fund houses, the pandemic disrupted key value-chain systems, in terms of workforce, operations, finance, liquidity and strategy.

In response, the SEC issued orders in March 2020 providing investment funds and investment advisers with additional time to hold in-person board meetings and meet certain filing and delivery requirements, removing some of the regulatory burden. In addition, many governments launched special tax support programmes (including deferred tax payments, cash grants, tax rebates and extending tax return filing deadlines).

Navigating the crisis

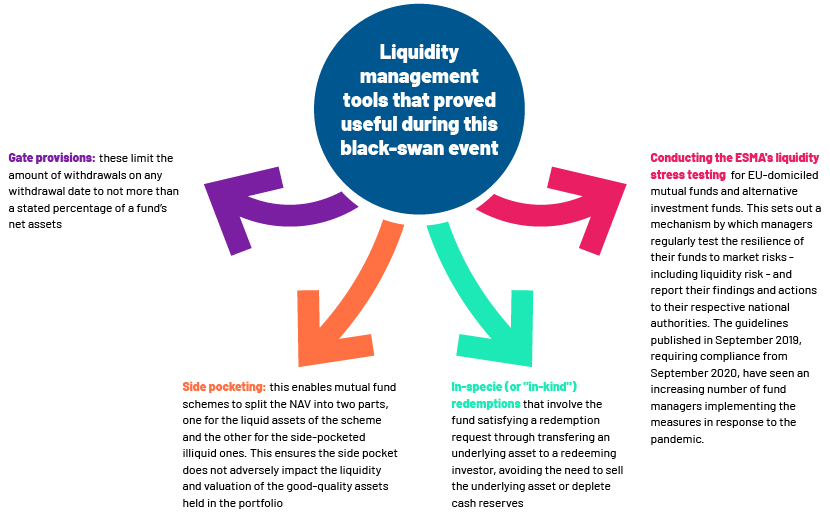

At the peak of the crisis in March 2020, risk-off sentiment dominated markets as investors globally withdrew funds, resulting in a c.32% crash in the S&P and triggering a liquidity crisis for fund houses due to increased incidence of redemption requests. Liquidity management tools played a key role in navigating the crisis

Key challenges faced amid the pandemic

-

Funding challenges

-

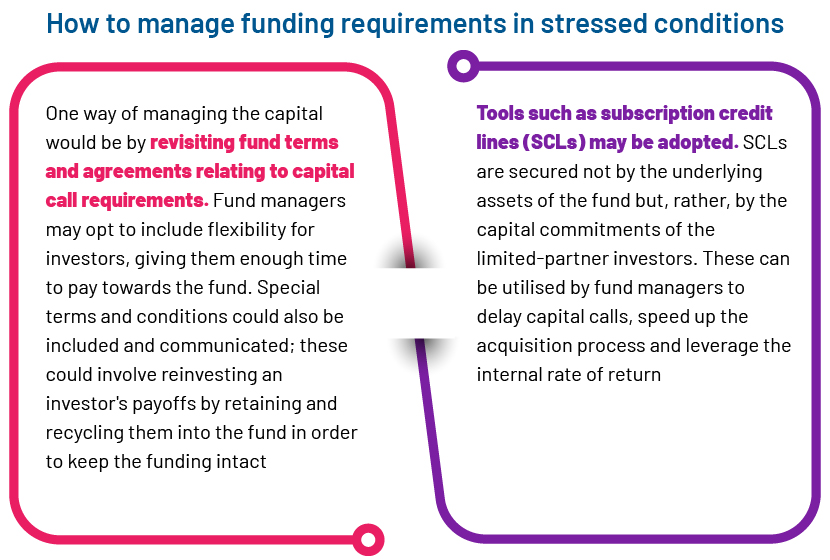

Efficient management of funding during uncertainty is a challenge for a fund administrator. A satisfactory funding buffer needs to be managed for meeting capital calls, distribution of payoffs, and redemption and other costs.

-

The pandemic caused difficulty for first-time funds, as few investors looked to sponsor such funds. In a survey by Preqin, 82% of investors surveyed said travel restrictions and social distancing affected their ability to make new investments because they viewed face-to-face meetings as either fairly important or essential to decision-making.

-

-

Valuation-related challenges

-

Credit products. Due to the increased uncertainty surrounding the pandemic, credit rating agencies (such as S&P Global, Moody’s, Fitch and DBRS) have communicated a number of rating downgrades and credit outlook revisions on corporate and sovereign debt. From a valuation standpoint, it is challenging to assess whether non-payment, deferral or forbearance is a temporary, pandemic-related liquidity event or indicates future default. At the peak of the pandemic, there was increasing incidence of credit risk benchmarks diverging, another challenge for valuations. Instruments are valued assessing quoted bond benchmarks and/or credit default swap (CDS) benchmarks for debt securities; however, CDS and bond spreads for corporates diverge significantly across industries.

-

Lack of recent transaction data to support valuations. The limited availability of recent transaction data makes it harder to infer valuations of portfolio companies. Pre-pandemic transactions may not be useful in the current environment because transaction multiples are typically based on historical financial metrics.

-

-

Management/performance fee revisions

-

Reassessment of existing portfolios has led to a decline in management/performance fees; with the pandemic driving market volatility, the business valuations of portfolio companies has been impacted. Changing valuations of existing portfolio investments (including writedowns) have resulted in a decline in AuM and, therefore, significant reduction in the management fee income of investment managers. Furthermore, the deflation in values of certain existing investments has made it harder to achieve their hurdle rates and, consequently, affected the performance fees earned by investment managers.

-

Damage control

Fund administrators have recently been able to more closely supervise their cost bases and value chains. With markets edging closer to normalcy, there seems to be more emphasis on core competencies and generating stronger investment performance. With increased competition in the industry and interest rates hovering close to zero, third-party providers continue to push back on prices and fees; this, combined with monetary policies unlikely to made more favourable in the near future, will likely further squeeze margins.

Fund administrators continue to widen their horizons by including new markets, asset classes, strategies and hybrid fund structures. Providers offering digital and innovative solutions, with emphasis on real-time data and improved data analytics, have further bolstered the fund administration space. Firms are now offering real-time NAV calculations, regulatory reporting, fund accounting capabilities and support with new products and services in the ESG space. Providers are catering to different geographies and different fund structures – pooled, passive or active funds, funds of funds or a combination of all.

Conclusion

Fund administrators now offer not only back-office support but also middle-office support, reducing the burden on asset managers. Collaboration with technology has gained significant traction and provided a much-needed boost for fund administrators to streamline their processes. The entry of fund houses into the data-centre investment space allows for compact asset diversification and enhanced risk-adjusted returns. Amid the pandemic, specialisation seems to have gathered pace.

How Acuity Knowledge Partners (Acuity) can help

Acuity is a leading global provider of support for portfolio operations, risk analytics, investment and performance reporting, and middle-office activities. We offer support in areas such as portfolio strategy and construction, portfolio operations, portfolio analytics and reporting, data management, middle-office operations, fund accounting, shadow accounting, trade operations, corporate action support, reconciliation and technology. We understand our clients’ products and the associated regulations. Our experts keep track of evolving regulatory frameworks and help our clients maintain compliance.

Sources:</strong

-

Bloomberg

-

Dealogic

-

DBRM Morningstar

The author acknowledges the contribution from Nikita Sushil and Sridhar Gokul”

What's your view?

About the Author

Abubakar Siddeeqh has nearly 18 years of work experience. He has been associated with Acuity for the last 9 years and is currently part of the Specialized Solutions ex DTS department managing multiple teams and clients. Prior to Acuity he was associated with Societe Generale (Socgen) for 6 years and has worked in various roles in fund admin services. Prior to Socgen he was associated with Butterfield fulcrum fund services and JP Morgan chase. He holds Master of business administration (finance) degree from VTU and has delivered multiple lectures at different Indian Institute of Management’s(IIM’s) across India.

Like the way we think?

Next time we post something new, we'll send it to your inbox