Published on August 4, 2022 by Pratap Singh

Co-investment deals are another means of parking investment in private equity (PE) that requires strong commitment from asset sponsors. Building a superior co-investment programme entails significant time, qualified PE talent and a strong evaluation process. PE continues to grow, and we believe the strong performance of co-investment deals so far makes sponsors’ efforts to enter them worthwhile.

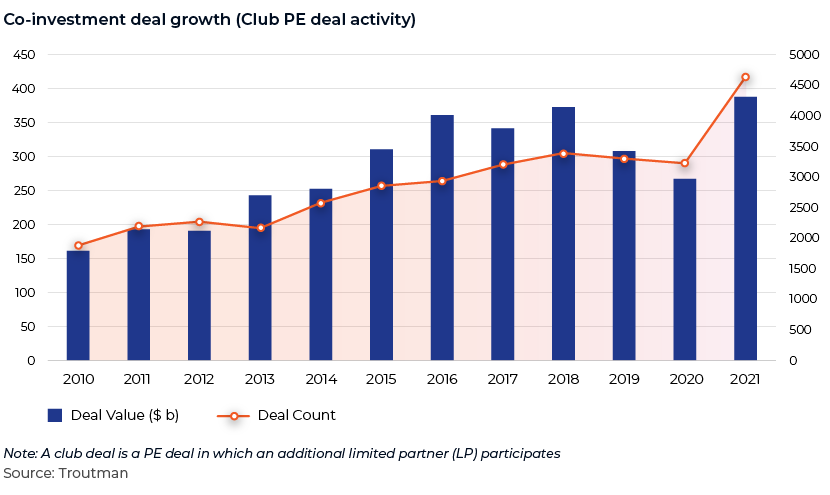

Co-investment deals are growing, for many reasons, but, as Troutman Pepper felt, due to the “ongoing utilization of co-investment capacity in other existing funds, co-investment activity surged to an all-time high in 2021 in terms of both deal value and volume”.

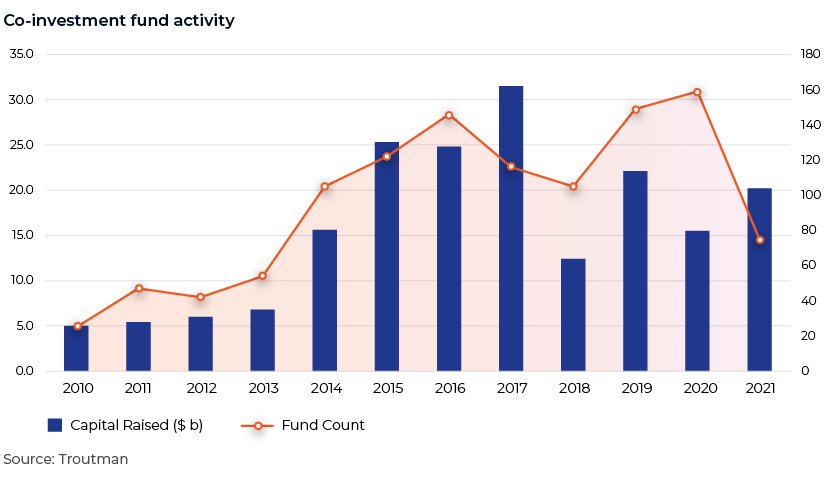

The co-investment space is growing rapidly. In 2020, 159 funds closed pools of capital aggregating USD15.5bn in commitments worldwide. There seemed to be a downturn in 2021, as only USD20bn was committed to co-investment vehicles. However, the overall trend is still supportive, as evidenced by club PE deal activity.

Growth has so far been driven by (1) LPs looking for more returns from investment in private markets, (2) increasing opportunities in the late stages and (3) competition among investment firms to retain LPs/maintain relationships.

However, this remarkable growth has inherent challenges. A co-investment programme requires time and talent, which is generally allocated to investment and evaluation processes. Co-investment challenges may also vary depending on the investment firm. For example, an investor may face challenges in conducting proper due diligence and reporting, according to DarcMatter (an alternative investment platform).

Although there is a significant increase in co-investment opportunities, there is a significant lack of the skills required to evaluate, filter out substandard deals and execute a co-investment programme. Co-investing has, in recent years, attracted LPs, as it enables generating high returns at reduced costs and presents an opportunity to be more actively involved in managing their portfolios.

As more investors consider co-investment deals or extending their allocations, it is critical to deploy a qualified team that understands both the dynamics of co-investing and the need for a strong evaluation process.

How Acuity Knowledge Partners can help

Our 20 years of experience in servicing funds of funds, co-investors and PE sponsors has helped us develop a strong framework for co-investment deal recommendation. Our PE co-investment team has the necessary insights and experience in this space, and is skilled in conducting in-depth assessment of deal-specific issues, transaction quality and return profiles, and general business analysis on more than 15 parameters, including industry, competition, quality of earnings, valuation and risk factors.

Sources:

Private equity funds and co-investment: A symbiotic relationship | Global law firm | Norton Rose

What's your view?

About the Author

Pratap leads the Private Equity and Venture Capital practices at Acuity Knowledge Partners, responsible for managing and developing client relationships and overseeing multiple accounts. He has extensive experience in managing direct investments, primary fund investments, FoFs and complex secondary transactions. Over the last 14 years, he has been involved in more than 5,000 Private Markets deals.

Like the way we think?

Next time we post something new, we'll send it to your inbox