Published on May 14, 2025 by Arvind Kumar Mahto

The middle office operations have been traditionally revolving around risk management, trade validation, performance evaluation, regulatory compliance & policy, and enterprise data governance, but now it is facing a tectonic change entailed by amorphous nature of challenges driven by middle office operations market trends, exponentially growth in trade volume, technological innovation and ever-expanding compliance requirement among global geopolitical dynamics. As per ESMA (European Securities and Market Authority), EU Securities Markets 2023, there were 512 EEA securities trading infrastructure active in 2022 which increased by 5% from 2021 which includes 310 trading venues (TVs), 188 systematic internalisers (SIs) and 14 approved publication arrangements (APAs). Among venues, there were 128 regulated markets (RMs), 152 multilateral trading facilities (MTFs) and 30 organised trading facilities (OTFs) at the end of 2022 which speaks volume of complexities involved.

These variable forces encapsulated in middle office operations market trends have been key factors for redefining the operational priorities and kept the middle office personnel on their toes adopting a fresh congruent model to demanding and sustainable needs being more agile and resilient.

1. Emphasis on Risk Management and Compliance

Over the time, the advent of new financial instruments and increased complexity under tight regulatory requirement has necessitated a robust risk management and compliance framework.

Middle office operations are exploring every possible avenue available to them, and reinventing its legacy operational and risk model to gain excellence in every sphere of its function driven by middle office operations market trends and adherence to ever evolving regulatory requirements.

-

MiFID II: Transparency and Reporting: The Markets in Financial Instruments Directive II (MiFID II) mandates rigorous trade transparency and transaction reporting across EU financial markets. Middle offices are responsible to report more than 65 data fields per transaction, including price, volume, and counterparty details.

-

The European Market Infrastructure Regulation (EMIR): Requires standardized derivative contracts to be cleared through central counterparties (CCPs). Middle offices must report trades to trade repositories within one business day, spanning more than 130 global jurisdictions.

-

Dodd-Frank: Swap Data Reporting: In the U.S., Dodd-Frank’s Title VII mandates real-time reporting of swap transactions to registered entities.

-

Basel III: Risk Management: Basel III’s liquidity and capital adequacy rules require middle offices to monitor leverage ratios and liquidity coverage ratios (LCR).

2. Technological Upgradation and Automation

Most of the organizations are facing challenges with their legacy systems that lacks the advanced technology and scalability to accommodate the industry’s changing need, , therefore In light of evolving middle office operations market trends it is very important to conduct a periodic review of their legacy system’s compatibility with automation, integration potential, operational efficiency and accuracy. The emergence of advanced technology and automated algorithm is fundamentally transforming the entire middle office function rendering enhanced efficiency, accuracy and scalability. Collaborating with Specialized knowledge Process Outsourcing (KPO) partners, who possess in depth operational knowledge along with having exposure across diverse platforms with different client environments, offer a strategic all-weather pathway to ensuring seamless and agile operations.

3. Market Growth of Middle Office Outsourcing

Outsourcing of middle office functions in part or whole has been key middle office operations market trends in response to increased cost pressure, skill scarcity and regular training.

Many small and big financial institutions are outsourcing its middle office functions to be more focused on its core competencies, to achieve cost efficiencies and operational excellence.

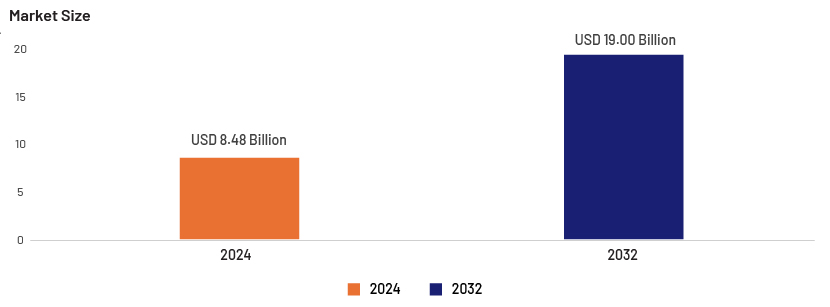

According to Data Bridge Market Research, the global middle office outsourcing market was valued at USD 8.48 billion in 2024 and is expected to reach USD 19.00 billion by 2032, growing at CAGR (Compound Annual Growth Rate) of 10.60%. This trend opens door for strategic partnership with specialized external party equipped with advanced technological solutions and operational skills.

4. Rising Operational Costs and Margin Pressures

The increased operational costs and shrinking fees driven by harsh competitive landscape are causing margin compression at very compromising level for most of the asset managers.

According to PWC report, approximately 73% of asset managers allude to the escalating cost of operations as a primary reason to seek solutions that enable scale and efficiency, with the fact that global AuM (Asset Under Management) estimated to touch $145 trillion by 2025 lend. This financial pressure is prompting firms to reevaluate their middle office operations and explore transformative strategies.

5. Demand for Customized Client Products

There is a growing demand for customized client products, requiring asset managers to respond more rapidly to client needs. Nearly 90% of asset managers already have exposure to customized client products, and almost half plan to increase this customization in the next 1–2 years. These middle office operations market trends necessitates more agile and responsive middle office operations to manage complex and tailored investment strategies.

Final Thought:

The middle office is at the forefront of transformation within the financial services sector. Adopting technological advancements, outsourcing strategic functions, and adapting to market demands are pivotal in navigating the evolving landscape. By staying attuned to these middle office operations market trends and dynamics, financial institutions can enhance their middle office operations, drive efficiency, and maintain a competitive edge in the market. The Acuity’s outsourcing solutions can enhance Middle and Back Office Operations, helping the organization optimize efficiency, reduce costs, and improve risk management.

Key Areas of Middle & Back Office Support:

-

Trade Processing & Settlements – Ensuring timely and accurate trade confirmation, clearing, and settlement.

-

Reconciliation & Reporting – Streamlining cash, securities, and P&L reconciliations for accuracy.

-

Risk & Compliance Support – Strengthening regulatory reporting, KYC /AML monitoring, and internal risk controls.

-

Corporate Actions & Reference Data Management – Managing dividends, mergers, splits, and security master data to minimize operational risks.

-

Treasury & Cash Management – Enhancing liquidity monitoring, forecasting, and cash flow optimization.

-

Client Onboarding & Lifecycle Management – Streamlining documentation, account setup, and ongoing maintenance.

What's your view?

About the Author

Arvind is a seasoned professional with strong technical and operational experience. He has over 16 years of experience in retail and wholesale banking operations. At Acuity Knowledge Partners (Acuity), he manages treasury, and banking operations . Prior joining to Acuity, he worked with a leading bank as a management consultant, helping set up back-end processes for its different divisions. His expertise spans a broad range of skills including process transition, operational governance, risk control, KPI framing and data analytics.

He holds an MBA in Operations from the Institute of Chartered Financial Analysts of India (ICFAI), Tripura.

Like the way we think?

Next time we post something new, we'll send it to your inbox