Published on August 2, 2023 by Vikram Kumar R

What synthetic risk transfer is and when and how it began:

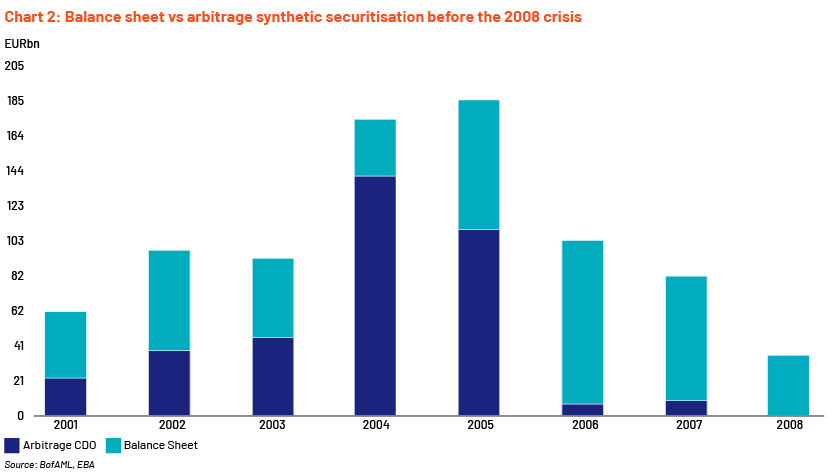

Synthetic risk transfer (SRT) instruments, an innovative method of transferring credit risk, effectively gained traction from 2001 in Europe. These are structured as unfunded credit default swaps or as credit-linked notes in a funded transaction, termed balance sheet synthetic risk transfer (BSST) and arbitrage synthetic transaction (AST), with a focus on achieving economic benefit from higher spreads in an underlying portfolio after accounting for lower spreads paid to investors. The pre-crisis market scenario was flooded with ASTs to cater to the needs of speciality investors such as hedge funds and money managers with good appetite for yields. Trouble brewed for ASTs when leveraging these instruments, coupled with the credit crunch and negative sentiment, and led to extremely high margin calls and, eventually, the downfall of ASTs.

Regulatory changes and their impact on the SRT markets:

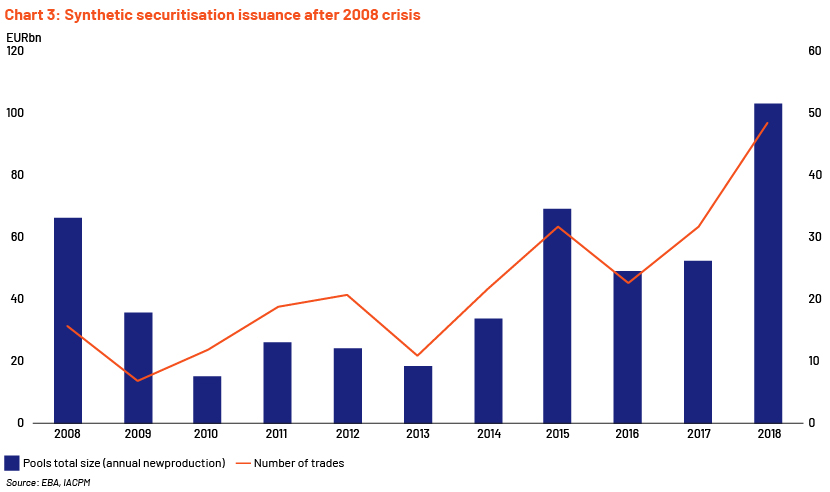

It all began in 2005-07, when ASTs slumped while BSSTs rose as the capital requirements directive (CRD) became effective, making issuers place their deals with monoline insurers and highly rated institutions. During the global financial crisis of 2008, monoline insurers and investors ventured out from this market, and issuers turned to repo markets for liquidity by placing retained true-sale transactions with central banks. This period was followed by stringent regulations that almost curtailed activity in European securitisation markets while US securitisation markets bounced back. AST issuance was close to nil (Chart 2) while BSST issuance found a place through credit-linked notes on thicker mezzanine notional. BSSTs started gaining traction in 2011 in Europe as large parts of loan portfolios were left behind due to traditional securitisation (Chart 1) because of lower investor appetite, increasing regulatory hurdles and higher administrative costs for issuing true-sale transactions. Issuers were prompted to print more synthetics, as they were light, less costly to administer and not so risky to operate. Counterparty risk from the investor side was the noteworthy complexity in synthetics, compared to others’. European regulators still felt the need to develop regulations for securitisation, as the scars from the 2008 crisis never faded. They also aimed to bring synthetic securitisation under the simple, transparent and standardised (STS) framework.

SRT comes under regulatory scrutiny:

To achieve its objective, the European Banking Authority (EBA) in consultation in 2015, recommended enhancing the scope of Article 270 of the capital requirements regulation (CRR) to bring SRT into its range. In 2016, the European Parliament’s Committee on Economic and Monetary Affairs ruled that synthetic securitisations were not eligible for inclusion in the STS framework. 2017 and 2018 saw a rebound in BSSTs while the regulators were finalising a regulatory framework as banks turned towards TLTRO apart from true-sale securitisations to raise capital. The European Central Bank opined that instead of changing the scope of the CRR, it would introduce a definition for BSST in applying lower capital charges, which became the starting point of a hurdle; little did it know then that a pandemic would shatter markets. Synthetic securitisation itself is tailored to the needs of investors, and fitting them into the purview of the STS framework would be futile. Alternative approaches are required to monitor performance of these deals, through monthly surveillance, tracking price changes due to developments, and tracking lower-rated buckets and any important factors that may affect a deal’s value. In a 2019 discussion paper, the EBA recommended that STS and CRR regulatory treatment should be applied to the senior tranches that were retained. The final treatment proposed was to adjust the prudential floor for senior tranches retained by credit institutions, in line with the STS traditional framework and corresponding risk weights applicable to it.

BSSTs a bright spot in the challenging market:

The regulators’ view on the final proposal was to stimulate market growth due to good historical performance of BSSTs; however, the EBA also cautioned that differentiated capital treatment is a deviation from Basel standards. Limited experience with the traditional securitisation STS framework, good past performance not being a guarantee of future performance and favourable capital treatment should not result in excessive use of SRTs as a capital management tool, curtailing other capital instruments and increasing leverage for banks. Regulatory bodies did not anticipate disruptions in the form of a pandemic, a supply-chain crisis and the Russia-Ukraine war sending energy prices sky high and inflation to levels not seen for the past couple of decades. Gloomy economic activity brewed a stagflationary situation that is difficult to overcome and is projected to diminish only after 2024. A higher cost of funding, deteriorating credit quality loans and clawing back on monetary supply have left few choices for investors who seek debt instruments with better management of credit risk and less administrative cost to focus mainly on BSSTs. Traditional securitisation in 2023 is not expected to reach 2019 levels until there is a sign that the central banks would start cutting rates to balance the market. BSST instruments should be in the spotlight for investors with a good appetite for yield. That said, implementation of the CRD and STS for synthetics is becoming a potential roadblock for SRTs, especially small and medium-size enterprises (SMEs) and large corporates, the prominent employment- and economic activity-generating machine in Europe.

SRT market – recent developments

Zooming in on regulatory developments, two substantial areas set to alter this market for new issuance are first, the EBA’s requirement for quantifying synthetic excess spread. It requires synthetic excess spread to be quantified from day 1 of an instrument’s life and the portfolio to be sold above par. The regulators’ stance is a prudent one, as there is a risk of inflating the notional on the retained senior tranche to project an inflated excess spread, which would cause harm during defaults. Although this sounds prudent, it could erode positive returns on the instrument, as the mechanism would produce better returns when lenders sell at par or at a discount, while the residual income flows back to originators. The EBA’s perspective on this is clouded with an issue, i.e., determining whether the risk transfer conducted is proportional to the capital relief achieved, as there is potential to inflate synthetic spread as senior tranches are retained, with less information available for decision making, while full-stack deals are sold to market completely except for the risk retention portion. The solution proposed by the EBA’s latest report is to treat 1,250% of risk, weighing the first loss tranche as synthetic excess spread, which would account for all the requirements to proceed with a commensurate risk transfer test to include the synthetic excess spread.A law effecting this was enacted in December 2020. Synthetic excess spread definitely makes transactions efficient, but the EBA’s clarification on future excess spread being deducted from capital only if the excess spread is higher than the expected loss would maintain efficiency of this mechanism. Identifying whether this has happened requires more clarity from the EBA in determining such calculations. Market participants are of the opinion that the cost of funding for an SRT is much less than the cost of funding for a true-sale transaction, due to which they may exclude the synthetic excess spread feature and increase the thickness of the mezzanine and junior tranches. To raise capital for lending, they may look at TLTRO as an option rather than true-sale securitisation.

Second, the troublesome Basel III reform standardised approach output floor (SAOF) is expected to be introduced in 2025, requiring banks to use the internal ratings-based approach (IRBA) to impose a floor on their risk-weighted asset (RWA) calculations. The regulatory justification is that the input should limit the regulatory capital benefits gained by banks using the IRBA relative to banks using lookup tables under the standardised approach (SA). A study of this by the association for financial markets in Europe (AFME) found that it would have a negative impact on SRT securitisation of large corporates and SMEs, affecting the funding available to corporates. There would also be a positive impact on residential mortgages, and auto and consumer loans. Pools pre-securitisation and post-securitisation have to pass the SA floor test. The market is of the opinion that the output floor, unless revised, will likely result in thicker risk transfer tranches, causing banks to structure SRT deals with two tranches to reduce overall blended cost. This means banks have to issue more mezzanine tranches for a limited investor base, pushing prices to worsening levels for issuers.

SRT securitisation to corporates and SMEs has an important role to play in Europe, and it enabled a release of c.EUR80bn of capital for lending, which was c.10% of SME lending in 2021. Existing SRT transactions will likely fail the test, leaving issuers to terminate such deals due to limited scope for re-issuance with new terms. Required capital is calculated as RWA multiplied by the minimum capital ratio (8% for SA banks and higher for IRBA institutions). In many cases, the maximum risk weight of 1,250% is calibrated on this 8% capital ratio, totalling a 100% capital requirement. However, while the risk weight scale from 0% to 1,250% has not changed, the capital ratio would be increased regularly.

The road ahead for the SRT market:

Securitisation has been gaining popularity over the years for maintaining liquidity in the lending market, as these loans are otherwise held in balance sheets with the additional burden of maintaining risk capital. The traditional securitisation wheel can be set in motion only when the interest rate environment is conducive for new loan supply and refinancing of existing loans. While such an environment is yet to materialise, the option available now is to use BSSTs for better capital management and transfer of credit risk. To set this wheel in motion, the EBA should provide grandfathering to the already existing deals and recalibrate the risk weights and capital ratios of existing deals, as far as it is prudential to do so. Amid the challenges, SRT issuance on SME and large corporate deals would thrive but be volatile. Therefore, more BSST deals are likely to be issued until the cost of funding becomes favourable for originators to issue true-sale securitisation, complementing true-sale securitisation at later stages when investor appetite has grown for such deals. 2023-25 would be an exciting timeline to understand who wins the race in true-sale vs BSST securitisation. Until then, a hawk-eye focus would be required to understand deal performance and take the necessary action when required in SRTs. True-sale securitisation has this default mechanism in the form of servicing, while in SRTs, it lies with highly qualified investors, and whether this would affect regulators’ decisions to relax the capital charge and risk weights would be interesting to observe.

How Acuity Knowledge Partners can help

Regulatory developments, incessant rate hikes and the Russia-Ukraine war have increased the odds in the synthetic risk transaction and structured finance market at large, causing uncertainty. Challenging times require additional analytical support to complete successful transactions in a competitive market. Collaborating with our Structured Finance team that specialises in SRT transaction support services such as deal structuring, cashflow modelling, deal surveillance, market research and bespoke services could help bulge-bracket banks, investment managers, pension funds and hedge funds in the US and Europe complete successful SRT transactions.

References:

-

(Association of Financial Markets in Europe) Funding to European corporates and SMEs at risk from Basel III regulatory changes finds new study | AFME

-

Santander transfers auto ABS risk at wider spreads (globalcapital.com)

-

Synthetic securitisation: Making a silent comeback (dbresearch.com)

-

AFME Securitisation Data Report Q4 2021 and 2021 Full Year | AFME

-

EBA proposes framework for STS synthetic securitisation | European Banking Authority (europa.eu)

-

In Brief: Regulation Q and You – Capital Relief Trades for U.S. Banks – Cabinet News & Views (cadwalader.com) – 16 June 2022

-

Securitisations: meeting significant risk transfer criteria (europa.eu) ECB – 18 May 2022

-

SRT market explodes as end of year approaches (globalcapital.com) – 2 December 2021

-

Case Study – Landmark Synthetic Securitisation of Housing Community Loans (alvarezandmarsal.com) – 4 July 2022

-

structured-debt-in-a-new-world.pdf (cliffordchance.com) – March 2022

-

Monitoring systemic risks in the EU securitisation market (europa.eu) – July 2022

What's your view?

About the Author

Vikram is a management postgraduate with over 10 years of work experience. At Acuity Knowledge Partners (Acuity), he has worked with multiple sell-side and buy side clients, including bulge-bracket banks, supporting their key functions such as cash flow modelling, deal surveillance, pre and post-securitization activities, bespoke data management, research and publication requirements across US, EMEA and APAC securitisation markets. Prior to Acuity, he worked with Accenture Credit Services (formerly Zenta Knowledge Services Pvt Ltd) and Silverskills Pvt Ltd on US commercial and residential-real estate property valuation. Vikram completed a Post Graduate Program in Management (Finance and Marketing) at Indus Business Academy and holds a Bachelor of Commerce from..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox