Published on June 3, 2021 by Sudham Senaratne

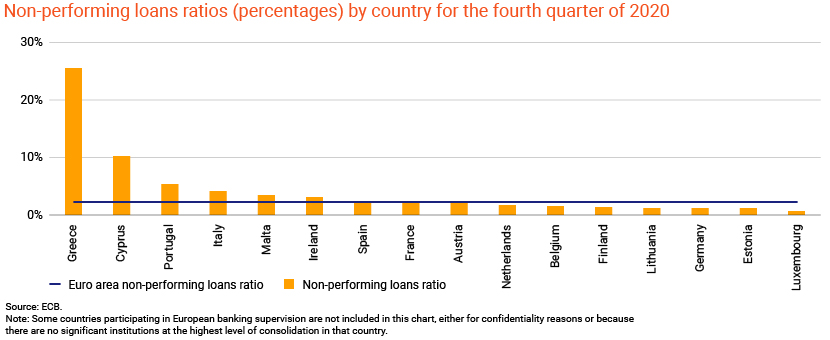

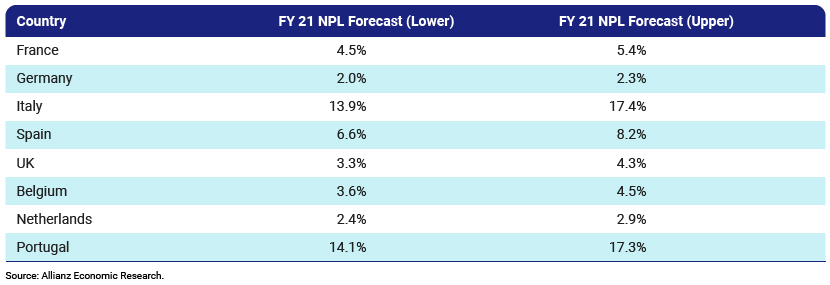

The impending COVID-19-induced surge in NPL volumes

With the pandemic causing a sustained global economic downturn, the NPL market looks primed to swell in volume, increasing the NPL stock in place since the global financial crisis. Particularly across Europe, large stocks of NPLs pose risks to financial stability. Even with some NPLs now foreclosed, many associated real estate assets have yet to be cleared. This poses the risk of additional non-performing exposure. With loan furlough schemes and payment holiday schemes primed to end or be scaled back in most jurisdictions, NPLs are highly likely to surge. As responsible financial institutions, banks must act swiftly to remove these loans from their respective balance sheets as efficiently as possible.

Securitisation – a potential solution to lower banking-sector risk?

In terms of options, the prime candidate is likely to be the traditional auction process, which has emerged as an intrinsic part of the NPL market. In practice, however, securitisation is likely to be stepped up to assume a critical role in banks’ balance sheet restructuring.

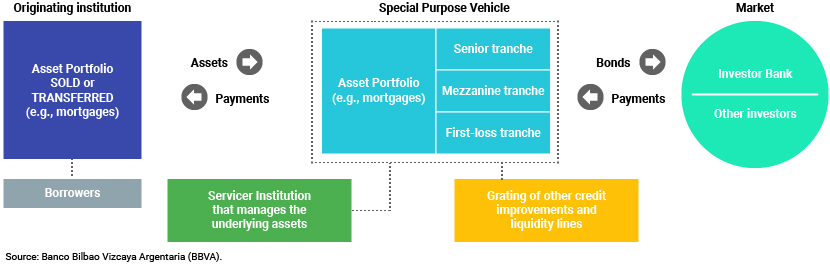

The concept of securitisation appears to be very clean and current, almost a tailor-made solution to the impending crisis of a surge in NPLs. In essence, this process would involve a bank selling a portfolio of packaged NPLs to a special-purpose vehicle (SPV), which would fund this acquisition by issuing debt securities via capital markets. The SPV would in turn appoint a servicing entity to manage the underlying loans on a daily basis with a fee structure that incentivises it to maximise recoveries.

Why banks are likely to prefer securitisation over the traditional auction process

Securitisation would enable banks to offload their NPLs through either one large deal or a series of large transactions. This would be far more attractive that the alternate scenario of a protracted period of auction procedures, where wide bid/ask spreads generally lead to low market valuations, impeding large-scale NPL sell-offs. Thus, securitisation would be more cost-effective for banks in the long term in terms of transaction/admin costs. Since European banks earn thin margins, they could also earn fee income by selling loan exposures to an SPV, as mentioned above. The only main limitation of this approach of structuring a transaction would be the universe of investors with the capacity to competitively price and absorb such issuance.

Empirical incidence/base method successes

Securitisation is not a new concept. This method has been successful, especially in the US, since the late 1980s, when securitisation technology played a vital role in enabling the Resolution Trust Corporation to liquidate assets once owned by savings and loans associations.

More recently, the fact that the governments of Italy and Greece have employed securitisation for their Garanzia Cartolarizzazione Sofferenze (GACS) and Hellenic Asset Protection Scheme (HAPS) initiatives, respectively, could in itself be regarded as a significant endorsement of the role this approach can play. The GACS initiative in particular has been a success.

Trends in legislation

Prior to the pandemic, the BASEL Committee on Banking Supervision at the Bank for International Settlements amended the capital requirements for NPL securitisation (to be implemented no later than 2023). This aimed to introduce a risk weight that is ≥ 100% for exposures to certain senior tranches of NPL securitisation.

Nonetheless, there have been efforts recently, particularly in Europe, to gradually ease the restrictions surrounding the NPL securitisation procedure. The European Commission has acknowledged that the existing capital requirements and risk retention requirements are too high for NPL securitisation transactions. As such, subject to European parliamentary approval, the Commission has put forward a range of new measures to ease the procedure, including (1) allowing the servicer to take on a risk retention slice and (2) calculating the risk retention (Article 6 of the Securitisation Regulation and Article 10(1) of the risk retention RTS) at 5% of the net discounted value of the non-performing exposure as opposed to its nominal value going forward.

Changes since the global financial crisis and recent trends

A common application of securitisation is the creation and issuance of debt tranches. These are essentially baskets of loans that have similar characteristics and appeal to specific investors. Furthermore, improved and more transparent regulation surrounding the credit rating of securitisation should result in higher investor confidence and, therefore, improved market activity. The resulting higher competition among investors would enable banks to reap the benefit of higher pricing

A resurgence in European NPL securitisation bolstered by governmental guarantees

Since 2016, transactions worth EUR88.8bn by gross book value (GBV) and EUR28.2bn by notional value have been reported, with over 75% of the deals in Italy, followed by Greece, Ireland, Portugal, and Spain. Around 75% of these have included an element of government guarantee. Thus, the countries most affected by NPLs during the global financial crisis have successfully incorporated securitisation to restructure their balance sheets effectively.

Parting thoughts

In conclusion, given their relatively simple, standardised, and transparent nature, these structures would enable banks to reduce a large number of NPLs from their balance sheets in a timely manner. Thus, if combined with quantitative NPL-reduction targets backed by credible operational strategies, banks should consider securitisation as a primary solution for NPLs.

How Acuity Knowledge Partners can help

We have extensive expertise in fast-tracking cost optimisation and revitalising the processes of global banks and financial institutions in Europe, the US, and the Middle East.

Our Commercial Lending team is experienced in managing client credit portfolios and providing support with credit reviews, covenant monitoring, financial spreading, and risk ratings.

We have the expertise necessary for (1) performing credit research on NPL securitisation transactions, (2) monitoring NPL portfolio covenants and flagging early warning signals, and (3) assisting in appropriately pricing NPLs via risk ratings.

Sources

https://www.bankingsupervision.europa.eu/press/pr/date/2021/html/ssm.pr210412~487158bae9.en.html

https://www.bankingsupervision.europa.eu/press/pr/date/2021/html/ssm.pr.210113~ad67989b26.en.html

https://www.worldfinance.com/contributors/securitisation-the-antidote-for-non-performing-loans

https://ec.europa.eu/commission/presscorner/detail/en/IP_20_2375

http://pubdocs.worldbank.org/en/460131608647127680/FinSAC-COVID-19-and-NPL-Policy-Note-Dec2020.pdf

https://think.ing.com/articles/bank-non-performing-loans-the-silence-before-the-storm

https://www.bankingsupervision.europa.eu/press/pr/date/2021/html/ssm.pr.210113~ad67989b26.en.html

https://www.lexology.com/library/detail.aspx?g=4da8f3b5-0bf3-461f-ac07-c9454934e8d6

https://www.structuredfinanceinbrief.com/2020/11/navigating-the-npl-securitisation-maze/

https://www.investopedia.com/ask/answers/what-tranche/

https://ec.europa.eu/commission/presscorner/detail/fr/MEMO_13_13

https://www.statista.com/statistics/1121416/quantitative-easing-fed-balance-sheet-coronavirus/

What's your view?

About the Author

Sudham is an Analyst attached to the Commercial Lending division at Acuity Knowledge Partners. He is currently part of the Global Balance Sheet Distribution sector undertaking covenant monitoring, performance trigger validations and EWS monitoring for a large European Bank. Prior to joining Acuity Knowledge Partners, he has interned at two large local banks. He also holds a Bachelor’s degree in business management from the University of London.

Like the way we think?

Next time we post something new, we'll send it to your inbox