Published on June 28, 2021 by Devin Kandage

The UK Financial Conduct Authority (FCA) has stated that it will no longer compel banks to submit rates for LIBOR after the end of 2021. This raises the likelihood that LIBOR will cease to exist/fail to be financially relevant after 2021. Since LIBOR is calculated from rates given by panel banks, if these panel banks do not give the rates, it would be impossible to calculate LIBOR.

Benchmark fallbacks are the replacement rates that would apply to financial contracts with rates referencing a particular benchmark. These fallback rates would come into effect if the relevant benchmark becomes unavailable during the life of the contract or as market participants have exposure to that rate. For example, with the LIBOR transition, the ICE Benchmark Administration (IBA) will cease to compel banks to submit their rates for LIBOR by end-2021; this means that contracts referencing LIBOR after end-2021 may not have the relevant benchmark to calculate payments. As such, a fallback provision would need to be set up. In this case, it would be the alternative reference rate (ARR). This simplified example does not address the structural issues between interbank offered rates (IBORs) and risk-free rates (RFRs), which is what will be discussed in the next few sections.

Without these fallback provisions, there would be no clarity, certainty or consistency for the rates contracts are to reference should LIBOR or key IBORs cease to exist.

Most contracts would have some fallback language in place, but because IBORs have been around for a long time, the current fallback language is inadequate for IBOR transition, as a permanent or indefinite cessation of key IBORs was never anticipated.

The previous fallback language that references the 2006 ISDA fallback supplement requires the calculation agent (one of the counterparties) to obtain quotes from major dealers in the relevant inter-dealer market should the rate not be available for any reason. This worked well for a temporary situation, e.g., when a rate was not available for a day or so because of a technical glitch. However, the Libor transition impact has raised concerns as major dealers are very unlikely to be willing to provide these quotes and even more unlikely to do so each time a rate is needed over the remaining term of the contract. Even if the dealers were to provide quotes, they would vary significantly.

Fallbacks are based on the ARRs identified by working groups in different jurisdictions such as the Alternative Reference Rate Committee (ARRC) in the US and the Sterling Risk-Free Reference Rates Working Group in the UK.

Structural differences between IBORs and RFRs would mean that adjustments would need to be made so that the original objectives of the financial contracts are met once the fallback provisions are triggered. These would fall under the benchmark adjustment replacement waterfall. The spread adjustment will be calculated from the historical median of USD LIBOR and SOFR differences over a five-year lookback period1 . Bloomberg has published the methodology to calculate the spread adjustment2 .

A key point to emphasise is that the fallback rates are economically appropriate, parties to the contract will neither be advantaged nor disadvantaged and the stated use of the contract will continue to function as normal.

1 ARRC_Spread_Adjustment_Methodology.pdf (newyorkfed.org)

The ISDA has partnered with Bloomberg to publish ARRs with appropriate adjustments as reported in the methodology. Bloomberg will publish these rates, and they will appear on the screen just as LIBOR/IBORs did. This will be used in the same way counterparties would look up rates when referencing key IBORs; parties will now look up the fallback rates after the cessation date.

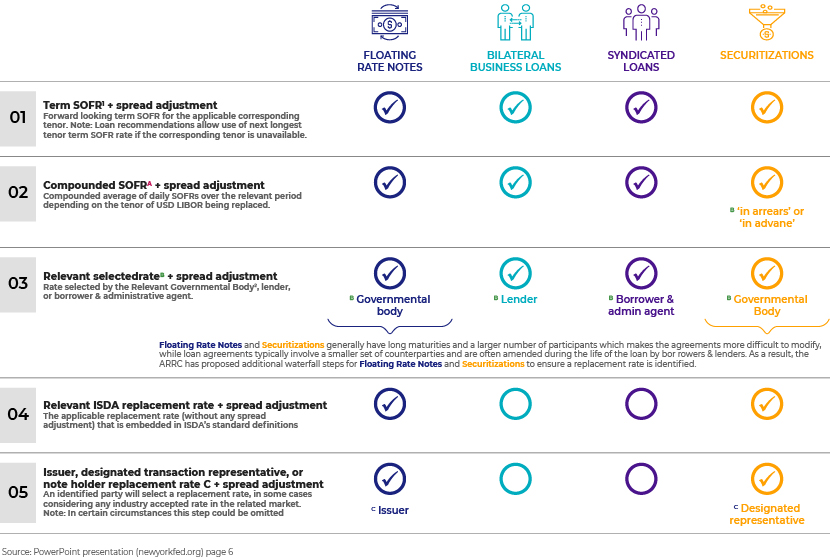

There are many ways in which to calculate the fallback benchmark for products of different interest rates:

With LIBOR, financial-market participants have gotten used to a term structure that may not be available for overnight rates such as the SOFR. The ARRC maintains the view that the lack of a term structure should not hinder the use of an ARR. This is because most products can use an “in arrears” compound SOFR rate, and very specific financial products (such as home loans and asset-backed securities) require a term structure, as borrowers may want to know in advance the amount to be paid. The Libor Impact has necessitated these adjustments, ensuring that the transition to SOFR does not disrupt the normal functioning of these financial products.

There is a term structure for SONIA rates, as the derivatives market for SONIA-based derivatives has ample trading and liquidity. It is calculated and published by Refinitiv. SOFR derivatives still need to reach this level of trading and liquidity. A number of vendors may produce forward-looking term rates for the SOFR. The ARRC will evaluate these against its own criteria and recommend one that satisfies this criteria. The working paper published by Federal Reserve economists Erik Heitfield and Yang-Ho Park is used as the basis for the term SOFR calculated and published by the CME Group3 . On 21 May 20214 , the ARRC released an update on its RFP process to select an administrator for a forward-looking term SOFR; it has identified the CME as term rate administrator5 .

3CME Term SOFR Reference Rates Benchmark Methodology (cmegroup.com)

420210521-ARRC-Press-Release-Term-Rate-RFP.pdf (newyorkfed.org)

With the above transition to SOFR/alternative RFRs from LIBOR, a number of financial products will be affected. The ARRC has finalised its fallback language recommendation, for most products.

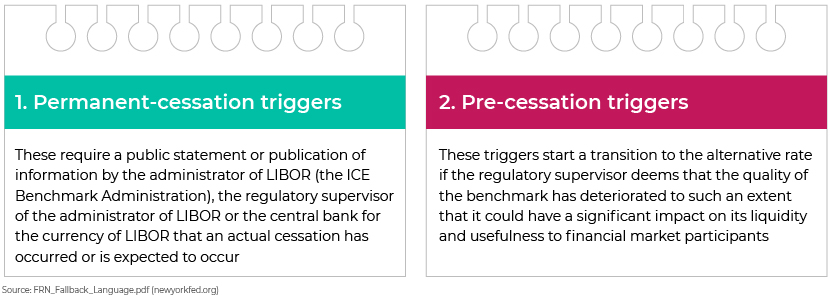

For most interest-rate products, there will be two types of triggers:

The term “benchmark replacement” means the successor rate plus any spread adjustment. The defined term prior to adjustment is known as the “unadjusted benchmark replacement”.

We will now focus on the fallback language for the following instruments: floating-rate notes (FRNs), securitisations and adjustable rate mortgages (ARMs).

FRNs

For FRNs that are LIBOR-referenced and USD-denominated, the fallback language states that only if certain intermediate tenors of the benchmark rate have been affected by the trigger event, but other rates required for interpolation are available, the FRN can use an interpolated value based on the nearest benchmark tenor. This is known as the interpolated benchmark. This provision was made to address the possibility that the middle tenor (three-month LIBOR) would be discontinued but shorter and longer tenors would remain (one-month LIBOR and six-month LIBOR). However, these rates may not accurately represent the current financial landscape.

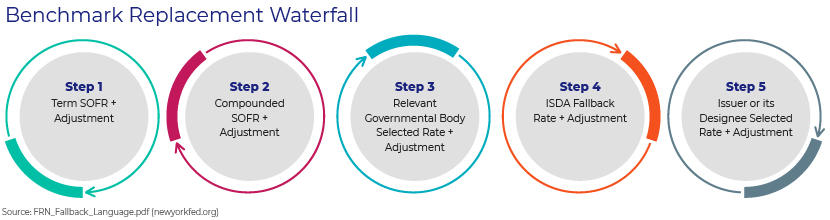

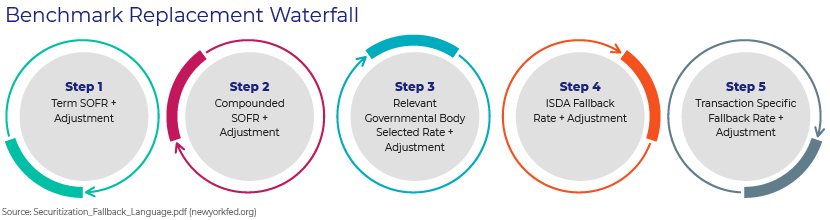

If it is not possible to determine the interpolated benchmark, the benchmark replacement rate follows a waterfall for the particular successor rate to be used. To maintain consistency across asset classes, each step in the waterfall must be evaluated as of the first time a trigger event with respect to the benchmark becomes effective.

5 20210521-ARRC-Press-Release-Term-Rate-RFP.pdf (newyorkfed.org)

Term SOFR is a forward-looking rate for the corresponding tenor (a period equivalent to the LIBOR tenor, e.g., one-month SOFR, three-month SOFR, as selected by the Federal Reserve Board). As stated previously, there is currently insufficient liquidity and trading in the SOFR futures market, but these are increasing. However, the Working Group on Sterling Risk-Free Reference Rates indicated in its 12 December 2017 minutes that there should be no need for forward-looking term rates to be used for cleared and listed derivatives. The US ARRC has also indicated that derivatives should reference the overnight RFRs and that forward-looking term rates would be most appropriate for cash products.

Should the ARRC conclude that a robust forward-looking term rate does not exist or is unavailable, the fallback rate would go to step 2, which is the compounded SOFR with a benchmark replacement adjustment.

It is important to note that in contracts referencing LIBOR, the interest rate applicable for a payment period and the interest due at the end of the period are known at the beginning of the period. The SOFR is an overnight rate, with the SOFR for a given day published the following day. Since the tenors of these contracts tend to be longer than overnight (monthly, quarterly), the daily SOFRs would have to be aggregated to determine the amount of interest for each period. The compounding applies only to the SOFR and not to the benchmark replacement adjustment or margin. As there are different methods of compounding, the rates will reflect “in arrears” the daily rates over the given interest rate period.

While this approach seems to be the most favoured as the second step, some of the consultation feedback received by the ARRC has mentioned that most FRNs issued to date have used a “simple average” rather than a “compound average”. This is because there are quite a few methods to computing compound rates and no standard set of conventions for use in the FRN market. One such convention would be to use a lookback (also known as a lag). To achieve certainty regarding cash flow before an interest payment, the SOFR-referencing FRN would shift backwards the period of time in which the rates were observed. Another method is to provide a lockout period (suspension period) of varying lengths. This means the SOFR rate is repeated for the final few days of each observation period.

Due to the complexities arising from compounding, market participants may find it easier to use and calculate a simple average of SOFRs. It will be in arrears with a lookback and/or suspension period as a mechanism to determine the interest amount payable prior to the end of each interest period. A simple average will include a lookback or suspension period as a mechanism to determine the interest amount payable prior to the end of each interest period.

Step 3: This is in the event the SOFR ceases to exist and the benchmark replacement cannot be calculated on the basis of a SOFR-linked replacement rate as shown in the first two steps in the waterfall. The purpose of step 3 is that if the SOFR were to be discontinued, a committee similar to the ARRC would be formed to recommend a replacement for a SOFR-based rate.

If the benchmark replacement cannot be determined using the abovementioned waterfall steps, it would be because the SOFR is discontinued and the ARRC or other government agency has not recommended a replacement for the SOFR-based rate. The ISDA fallback rate is embedded in the ISDA’s definition of “USD-SOFR-COMPOUND”. It would first look at the rate published by the relevant government agency, then the overnight bank funding rate (OBFR) published on the Federal Reserve Bank of New York’s website and then the FOMC target rate published on the Federal Reserve’s website. ISDA fallbacks are not static and may change in the future, and consultation feedback has indicated a preference to reference ISDA definitions when the relevant benchmark is discontinued.

The final steps in the waterfall are aimed at addressing the risk that the SOFR may be discontinued in the future. Even though it may be difficult to envision such a scenario, and considering the fact that FRN maturity could be long-term, the ARRC believed that it was important to include provisions that would protect participants beyond the end of LIBOR.

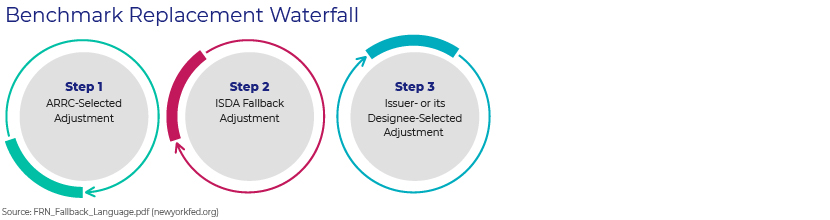

Just as there is a waterfall for the replacement rates, there is also a waterfall for the benchmark replacement adjustment.

All three steps follow similar language as above.

Securitisations

For securitisations, the fallback language follows a similar process as for FRNs but with a few changes, most notably the asset replacement percentage.

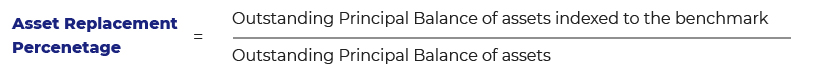

The asset replacement percentage is calculated as the ratio of the outstanding principal balance of assets indexed to the benchmark replacement for the corresponding tenor to the outstanding principal balance of the assets.

Just as for FRNs, there is the notion of future-proofing in the unlikely event that the successor to LIBOR is discontinued during the term of the contract.

Cessation and pre-cessation triggers are also similar to those mentioned for FRNs. The additional pre-cessation trigger is for the asset replacement percentage. This would be triggered if the asset replacement percentage is greater than 50% as of the most recent service report. This trigger exists to minimise the basis risk between the securities and assets underlying these securities. If the threshold is met where the underlying assets have been converted to the replacement benchmark or have been replaced by assets that reference the replacement benchmark, the securities would also then convert to the replacement benchmark.

This trigger needs to be customised to the specifics of the securities transaction; this includes the structure of the transaction, the nature of the underlying assets and the reporting mechanics. As different assets can be securitised and in order to minimise the basis risk, different securitised products may wish to change the definition of the asset replacement percentage to better fit the particular transaction. There may be transactions where this trigger may not be suitable such as when a specific transaction may have liabilities based on LIBOR but the assets earn interest with respect to another reference rate (e.g., the prime rate).

The benchmark waterfall is very similar to that for FRNs, with the exception of step 5.

The fifth step is an optional one that may be included if the participants wish to have additional protection. The likelihood of moving to step 5 without finding a rate after following the first four steps is highly unlikely, but given the heterogeneous asset classes in securitisations, the language determined by the transaction parties as being suitable for a particular securitisation may vary across asset classes or within a certain asset class.

There is also an optional retesting provision. The ARRC believes that term SOFR is a sufficient benchmark replacement and should be included even though it may not be available initially at the time of the benchmark transition event. To determine whether retesting mechanisms should be incorporated into the transaction, participants should consider the effect they may have on investors’ capabilities to hedge the issued securities and their likely impact on the operation.

Just as for FRNs, the same benchmark adjustment waterfall is present for securitisations.

Adjustable-rate mortgages (ARMs)

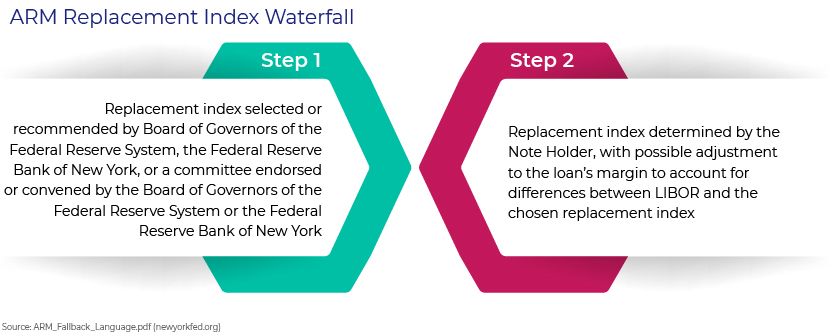

The fallback language for ARMs is, again, very similar to that for FRNs and securitisations, but because they are consumer products and also cash products, the benchmark replacement waterfall comprises just two steps.

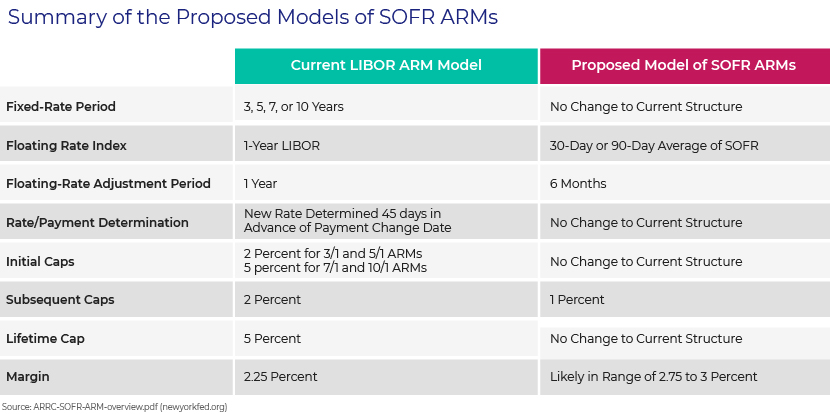

The ARRC conducted a series of proposed models for SOFR ARMs and also published a whitepaper6 to identify the best way to transition from LIBOR to the SOFR. The ARRC has proposed recommendations in line with its conventions, and the latest transition progress report indicates the fallback rate will be a 30-or 60-day SOFR in advance. This rate was arrived at by taking the considerations of members of the Consumer Products Working Group made up of consumers, originators, servicers and investors.

An average SOFR would accurately reflect movements in interest rates over time and smooth out any day-to-day fluctuations in market rates. As stated earlier, the Working Group recommended considering 30- or 90-day averages of the SOFR. The choice of a simple or compound average of the SOFR would depend on the originators and the investors. However, they have stated that it would be better to use a trusted and publicly available source such as the Federal Reserve Bank of New York that has stated it will publish averages of the SOFR7 . It is also recommended that the rate follow an “in advance” structure, in that it would be an average of the SOFR, before the current interest period begins. This would make it easier for servicers to provide the required notice to borrowers ahead of the payment date. In addition, using an “in arrears” structure may not be in line with consumer regulations, as it would give consumers very short notice of the payment period. Investors may prefer an “in arrears” structure to an “in advance” structure. To balance out these concerns, they would update the frequency of rate changes in SOFR-based ARMs to twice a year compared to the once-a-year regime observed in LIBOR-based ARMs.

6ARRC-SOFR-indexed-ARM-Whitepaper.pdf (newyorkfed.org)

7SOFR Averages and Index Data – FEDERAL RESERVE BANK of NEW YORK (newyorkfed.org)

How Acuity Knowledge Partners can help

We provide quantitative analytics support as well as data management and technology support to help banks in their LIBOR transition exercise. Under quantitative analytics, we help banks with quantitative model development, pricing/risk analytics platform development, multi-curve valuation frameworks, calibration, pricing model enhancement, stress testing, model validation and documentation. Under technology support, we develop technology infrastructure for scalable risk analytics platforms, establish data pipelines and help with automated data validation, ETL processes, system integration, reporting and business intelligence.

Sources

Fallback language

FRN_Fallback_Language.pdf (newyorkfed.org)

Bilateral_Business_Loans_Fallback.pdf (newyorkfed.org)

Syndicated_Loan_Fallback_Language.pdf (newyorkfed.org)

Securitization_Fallback_Language.pdf (newyorkfed.org)

ARM_Fallback_Language.pdf (newyorkfed.org)

Fallback-Consultation-FAQ.pdf (isda.org)

Transition updates and other documents

USD-LIBOR-transition-progress-report-mar-21.pdf (newyorkfed.org)

ARRC-SOFR-indexed-ARM-Whitepaper.pdf (newyorkfed.org)

ARRC-SOFR-ARM-overview.pdf (newyorkfed.org)

LIBOR_ARM_Transition_Resource_Guide.pdf (newyorkfed.org)

LIBOR Transition Playbook (fanniemae.com)

LIBOR Transition FAQs (fanniemae.com)

What's your view?

About the Author

Devin Kandage is a senior associate within the Investment Operations and Risk Services team at Acuity Knowledge Partners. He has over three years of experience in quantitative research, working with a diverse group of clients, spearheading process automation, supporting a benchmark index provider by conducting research on emerging market bond liquidity, supporting investment research through investment and technical analyses in addition to several other ad-hoc projects that include data cleaning, web scraping and training incoming quants analysts. He has a first class degree in Economics and Finance from the University of London. He is also a CFA charterholder.

Like the way we think?

Next time we post something new, we'll send it to your inbox