Introduction

Libor Transition Impact by the numbers graphic - Executive Summary

LIBOR’s discontinuation is shaking up global financial markets leaving the firms grappling to navigate the Libor transition impact. One of the biggest challenges to a smooth transition away from LIBOR lies in the existence of legacy LIBOR-linked fixed income contracts maturing after 2021.

Legacy contracts, typically issued prior to 2018, have inadequate fallback language, providing only for short-term LIBOR disruptions. Renegotiating or amending all legacy LIBOR-linked contracts that expire after 2021 is unfeasible, given the sheer magnitude of the volume of contracts outstanding and the typical requirement for unanimous/majority noteholder consent.

Acuity Knowledge Partners (Acuity) has developed proprietary tools and solutions to help market participants by analysing their LIBOR exposure and to help them achieve a smooth transition away from “the world’s most important number”, assisting them minimise the impact of LIBOR transition.

Libor Transition Impact - An Introduction

Given LIBOR’s historically central role in financial markets, fixed income issuers did not anticipate permanent LIBOR cessation – despite issues relating to rate manipulation and lack of underlying transaction activity – until the Financial Conduct Authority (FCA) announced that it would no longer compel/persuade panel banks to submit rates. Consequently, legacy fixed income contracts were drafted with fallback language that only provides for short-term LIBOR disruptions (e.g., LIBOR screen page unavailability on Reuters or Bloomberg due to a technical malfunction) and are unsuitable for permanent LIBOR unavailability. It is clear that while these fallback terms can be used for a short period of time without a major impact to either party to a financial contract, they are unworkable as a long-term solution to address the Libor transition impact.

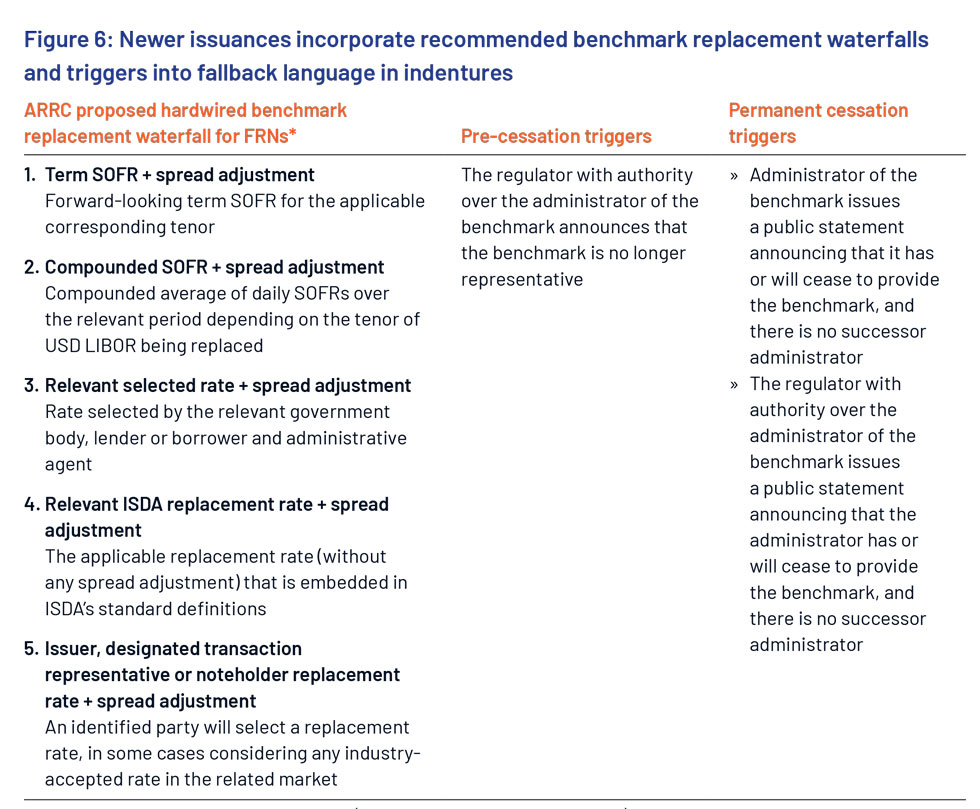

Newer issuances, however, have incorporated (1) ARRC-recommended (USD LIBOR-referenced contracts) hardwired benchmark replacement waterfalls and benchmark replacement adjustments, (2) pre-cessation triggers and (3) permanent cessation triggers into their indentures. Holders of these instruments are, therefore, relatively well prepared for LIBOR cessation.

Libor Transition Impact - Key Challenges

Renegotiating or amending all legacy LIBOR-linked contracts that expire after 2021 is unfeasible, given the sheer magnitude of the volume of contracts outstanding and the typical requirement for unanimous/majority noteholder consent. Moreover, the proposed LIBOR replacement rates are not direct equivalents to LIBOR in several aspects, so some degree of value transfer is likely to be involved in the change of reference rate, resulting in economic winners and losers.

Benefits

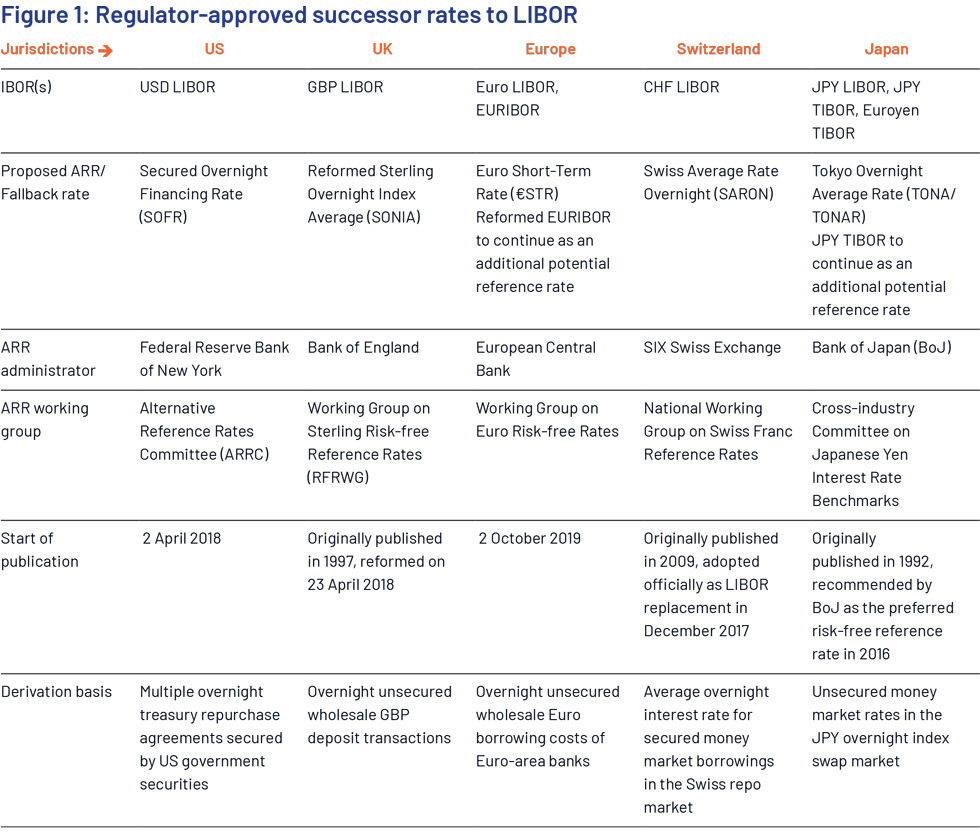

There has been an erosion of market trust in LIBOR following the manipulation scandal discovered in 2012. Moreover, the declining rate of active/underlying transactions and increasing use of expert judgment in submissions by contributor banks has left LIBOR vulnerable to further manipulation. Consequently, the transition to transaction-based reference rates, such as secured overnight financing rate (SOFR), should restore market trust as these rates are less susceptible to manipulation. SOFR sees daily transaction volumes of around USD1tn, whereas three-month LIBOR (the most commonly referenced rate in financial contracts) is estimated to have underlying transaction volumes (in the wholesale interbank lending market) of around USD500m.

Libor Transition Impact - Future outlook

In the absence of regulatory intervention, many legacy fixed income contracts would likely see interest rates being fixed at the last published LIBOR rate, or left to the issuer’s discretion – which brings in an element of rate risk and other uncertainties.

Conclusion

Asset managers, who have not already done so, should carry out inventories of their LIBOR exposure, draft LIBOR transition plans, and review their legacy contracts to determine their state/country of legal jurisdiction. Issuers or bondholders disadvantaged by the switch to SOFR may issue legal challenges, leading to a wave of lawsuits.

Acuity’s Value proposition

Acuity, with its proven record in providing scalable outsourced research solutions to the world’s leading financial services institutions, is best placed to support clients through the LIBOR transition. Acuity has leveraged its expertise in the analysis of fallback language – across floating-rate notes (FRNs), securitisations, municipal bonds, fixed-to-floating bonds, bonds referencing a swap rate and convertible bonds – and developed a range of tools to assist our clients.

Acuity has developed a proprietary scorecard that ranks fixed income indentures as “Well Prepared”, “Moderately Prepared”, “Ambiguous” or “Worst Prepared” in terms of preparedness for LIBOR cessation, helping asset managers analyse their risk. This standardised approach improves comparability across issuers, supporting better decision making.