Published on March 31, 2020 by Sharmi Basu

-

Safe-haven assets to remain in vogue over the near term given the uncertainty and volatility

-

Default rates to increase in the riskier segments of the fixed income universe, with default rates in the high-yield segment likely north of 10% by end-2020 (vs 3% as of end-2019)

-

Attractive investment opportunities appear whenever the market yields to prolonged indiscriminate selling. Given the current scenario, opportunities could arise in the distressed debt, high-yield debt, emerging-market debt and leverage lending spaces

The coronavirus outbreak in China and its subsequent spread globally have led to a massive and secular sell-off across asset classes on heightened risk aversion. We expect this to continue until a vaccine is tested or the number of new cases stabilises globally.

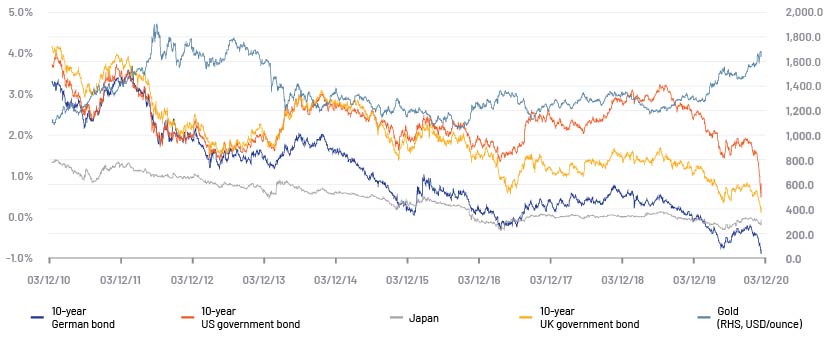

Hunt for safety: Yield on 10-year sovereign bonds declines, while gold price increases

Source: FactSet

Opportunities in the credit space

The unpredictability of the spread of COVID-19; country lockdowns, resulting in lower economic activity; and weakening macroeconomic fundamentals have led to a sell-off in the fixed income investment universe.

-

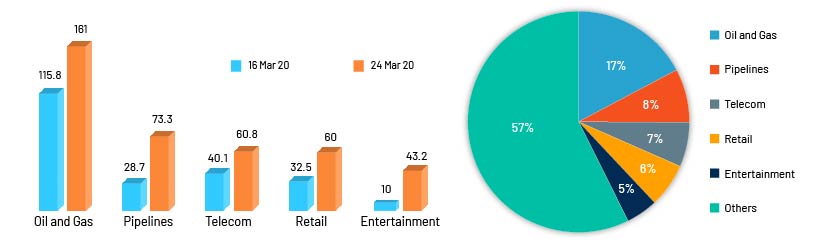

Distressed debt: The distressed debt market increased fourfold in the first four weeks of March to ca. USD1tn. The oil and gas, and travel and tourism sectors have suffered the most collateral damage due to the COVID-19 pandemic. The US shale sector that has financed its expansion primarily through inexpensive debt could see higher default rates as funding costs increase, while profitability takes a hit due to low oil prices.

Five sectors accounted for 42.5% of distressed debt as of the week ended 24 March 2020 (USDbn)

Source: Bloomberg.com

In our white paper published late last year, we had noted that distressed debt would be the theme for 2020. You may access the paper here.

-

Fallen angels: Investment houses expect USD200-USD250bn worth of fallen angels in 2020. Fallen angels have tended to outperform investment-grade (IG) and high-yield (HY) peers after crises. For instance, statistics from Bloomberg suggest that the VanEck Vectors Fallen Angel HY Fund returned c.85% from its inception in 2012 to February 2020. Even after the sharp fall in March 2020, the fund has returned c.40%, much more than the HY or IG funds (which have returned 20-25%).

-

Emerging-market debt: Emerging-market debt saw a steep sell-off (the ICE BoFA Emerging Markets Corporate Plus Index fell ca. 12% from 1 February to 25 March 2020) due to the twin shocks – the coronavirus outbreak and the oil price war. We believe the current decline presents an opportunity for investors, like during the 2008 financial crisis, when the Index generated a return of ca. 52% in the one year following the decline.

-

Leveraged loans (LLs): Although as an asset class loans are generally slower to react to outside events, underpinned by their active collateralised loan obligation (CLO) base and other long-only funds, they have followed the equity market into the red zone amid the outbreak. The S&P/LSTA US Leveraged Loan 100 Index fell to 1,826 on 20 March 2020 from 2,234 on 1 March 2020 as new deals were cancelled or postponed. However, mounting demand for the asset class before the pandemic and the declining credit quality of corporates on a crumbling top line are likely to lead to an increase in LL demand and, in turn, higher returns when the market stabilises. You can access our blog on the trends and risks of leveraged lending here.

-

Direct lending: We expect demand for direct lending to spike given heightened market volatility, restricting borrowers from tapping capital markets and borrowing from banks. Higher demand, together with USD271bn in capital available in the private debt sector (as per capital market company Preqin), is likely to support direct lending activity.

Trade-off: Idea generation or repetitive tasks

Acuity Knowledge Partners, with its rich experience in covering emerging markets and its on-the-ground presence in China, India and Sri Lanka, supports some of the largest asset managers in improving their investment performance. The customised cost-efficient solutions we present to asset managers in investment research provide sufficient flexibility to ensure that their onshore teams have time for more high-end tasks, while we, as the offshore team, handle the repetitive tasks and provide the necessary bandwidth for idea execution

Sources:

Bloomberg.com

International Monetary Fund

World Health Organisation

Coronavirus cases - John Hopkins

Standard & Poor

Financial Times

USenergyjobs.org – The 2019 US Energy & Employment Report

What's your view?

About the Author

Sharmi Basu has 11+ years of experience in fixed income research with a focus on Utilities, Telecom, Automobile and Retail sectors. Over the course of this time, she has worked for asset managers and hedge fund managers across the US and Europe and UK, helping them make investment decision by preparing detailed credit reviews – including detailed forecast based models with opinionated investment notes on corporates. Currently, she is supporting a large global asset management firm and covers US and European issuers across sectors for investment purposes and monitoring the portfolio on a day-to-day basis. Sharmi holds a Master of Business Administration (Finance) and a Master of Science..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox