Published on December 15, 2020 by Raghu Patale

“Normality is a paved road: It’s comfortable to walk, but no flowers grow on it” –Vincent Van Gogh

Whenever someone has taken the road less travelled, the world has been made a better place. Although social acceptance may be poor and the challenges large, when the odds are overcome, the success could be phenomenal and inspiring. A number of organisations prove this, for example, Apple, Tesla Motors and SpaceX.

Companies are not only foraying into unfamiliar territory, but are also challenging conventional thinking. Consider, for example, growing interest in life sciences and healthcare technologies from unrelated businesses. This augurs well for more innovation in and transformation of the healthcare sector.

The following are recent examples of organisations leading the unconventional way.

Samsung Biologics

Fortune favours the brave” is truly applicable to Samsung Biologics.

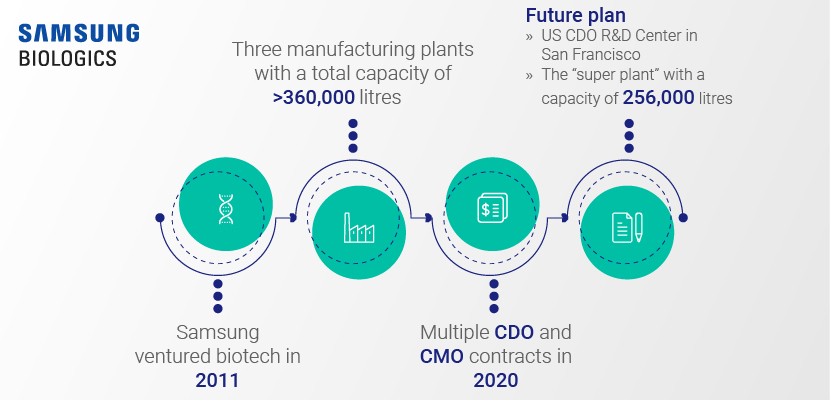

Samsung ventured into unfamiliar territory by launching its biotech entity in 2011. The vision was simple – to apply what it had learnt from being the world’s largest manufacturer of mobile phones in streamlining and maximising operational efficiency in the development and manufacturing of rather complex biotech products.

It built three manufacturing plants with a total capacity of >360,000 litres (making it one of the biggest contract development, manufacturing and research organisations, or CDMOs, at a single site) and generated record sales of USD601m in 2019.

It seems as if Samsung Biologics has been preparing for 2020: it is currently riding the biotech wave – a perfect example of outperforming adversaries using unconventional strategies. It has already bagged multiple contract development organisation (CDO) and contract manufacturing organisation (CMO) contracts with pharmaceutical giants such as AstraZeneca and GlaxoSmithKline(GSK) in 2020 and expects to exceed last year’s sales (refer to appendix for deals). This is prompting other companies to look beyond their limits – for example, Kodak is creating a new business arm to produce essential ingredients for non-biological pharmaceuticals.

Samsung's plans solidify its position – it opened the first US CDO R&D Center in San Francisco and plans to complete its fourth plant, famously dubbed “the super plant” with a capacity of 256,000 litres, by 2022.

Walmart Healthcare

The US healthcare sector is overcrowded, and the cost of its products and services far higher than in other countries. Other issues relating to healthcare are accessibility, affordability and transparency. Walmart, a well-known retail corporation that operates a chain of hypermarkets, saw an opportunity amid these issues. It is applying the concept of hypermarkets to healthcare, making frequently used products available under one roof and affordable.

It tested customer sentiment in 2006, offering up to a 30-daysupply of generic drugs at commonly prescribed dosages for USD4. This revolutionised and forced pharmacies to keep costs of prescription drugs in check. Since then, Walmart has been pilot testing multiple new experimental models.

First, it established Care Clinics in its existing retail stores, with minimal appointment charges ranging from USD59 to USD99 (in Texas, South Carolina and Georgia).

Recently, it launched a “super clinic” in Dallas, Georgia – a one-stop shop providing primary care, urgent care, diagnostics, behavioural health and dental care under one roof. The critical differentiators are transparency and affordability, with appointment costs at less than the USD50 copayment insurance charges and 30-40% less than competitors’. Importantly, this model is able to tap the uninsured who have not visited hospitals for a long time.

With the significant success of such “super clinics”, Walmart has already established six super centres and plans to launch 15+ such centres by 2021. It is undoubtedly disrupting the US healthcare system with a hypermarket model.

How to apply this to what we see

Innovation and technology adoption have been increasing amid the pandemic. There has also been a significant push in the areas of automation and digitalisation – we believe other sectors, too, will undergo Industry 4.0 transformation sooner than expected

This has been a year of learning and experimentation: if you are working on an idea or invention you want to bring to market, the timing could not be better.

About Acuity Knowledge Partners

With our deep understanding of industry dynamics and nearly two decades of experience, we are able to empower and assist healthcare clients to navigate challenging times by strengthening their strategies and businesses

For more information on our capabilities, please visit our Life science solutions page.

Appendix:

Samsung Biologics’ CMO deals:

1. USD330m deal to produce AstraZeneca’s therapies

2. Eight-year agreement with GSK, valued at more than USD231m

3. USD362m agreement with Vir Biotechnology

4. CMO agreement with Immunomedics

5. USD314m CMO deal with an unnamed European client

6. Expansion of partnership with Checkpoint Therapeutics

Samsung Biologics’ CDO agreements:

1. Dinona for development of DNP-019, a potential COVID-19 antibody therapy

2. Panolos Bioscience to develop PB101, to treat solid tumours

3. Partnership agreement with PharmAbcine

4. BioEleven to develop and manufacture BN-101A, immunotherapy to treat cancer

5. Kanaph Therapeutics to develop KNP-301, to treat retinal diseases

6. STCube to develop a cancer monoclonal antibody candidate

7. GeneQuantum Healthcare to develop ADC asset

Sources:

-

https://samsungbiologics.com/front/en/mediaCenter/pressReleasesList.do

-

https://i5.walmartimages.com/dfw/4ff9c6c9-9378/k2-_0769cdec-ad81-46f5-9e50-a463dbfabc2e.v1.pdf

What's your view?

About the Author

Raghu Patale serves as Delivery Manager leading the Life Sciences Corporate Strategy Research and Consulting vertical. His responsibilities include thought leadership, setting up new client engagements, client management, and generating business insights. He has over 10 years of experience in conducting life science research as a competitive intelligence and strategy consultant. He has supported a wide spectrum of client engagements focusing on competitive intelligence, therapy area research, market opportunity assessments, M&A support and report writing in oncology and other therapy areas for US, EU5, and Asian geographies.

Prior to this, Raghu was a Group Manager, leading the Pharma Practice at Evalueserve. He holds a Master’s degree in Pharmaceutical..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox