Published on August 29, 2023 by Varad Sharma

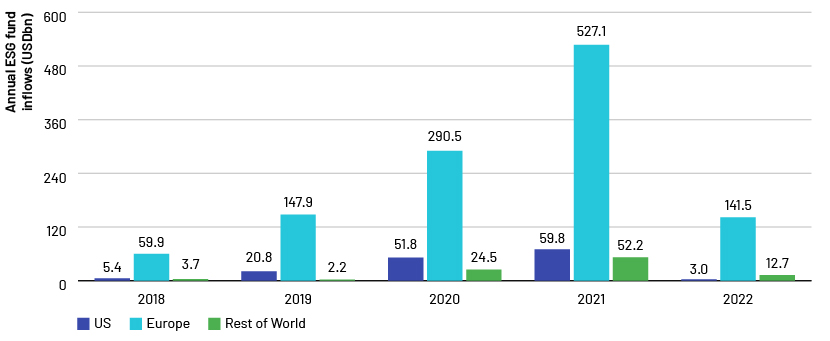

Since the pandemic, there has been a concerted effort to look at economic growth through a sustainability lens. This has resulted in an increasing role of environmental, social and governance (ESG) factors in the approach to investing. ESG investing encompasses a group of standards employed by socially conscious investors to measure a company’s behaviour for the purpose of screening potential investments.

Sovereign wealth funds disinclined to allocate capital to emerging markets

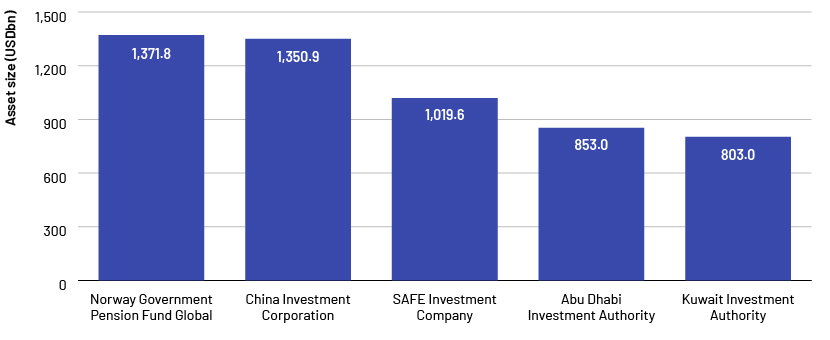

Total allocations by sovereign wealth funds and pension funds to emerging markets are minimal. Only 22% of capital allocation (equivalent to USD49.1bn) was directed towards emerging markets in 2021, according to SWF Global. Furthermore, the Norwegian government has directed the Norway Government Pension Fund Global (with assets of USD1.4tn) to not add new emerging-market companies to its portfolio because weaker institutions and meagre protections for minority shareholders obstruct responsible investment strategies.

The global financial sector’s adoption of ESG as part of investment decision making has its own challenges. Eighty-eight percent of asset owners surveyed were implementing or evaluating sustainable investing in their investment strategies in 2022 compared to 76% in 2021, according to FTSE Russell’s 2022 Global Asset Owner Survey. Mitigating long-term risk is the primary reason behind sustainable investing, although underlying factors differ from region to region. Notably, social themes are preferred over climate/carbon issues.

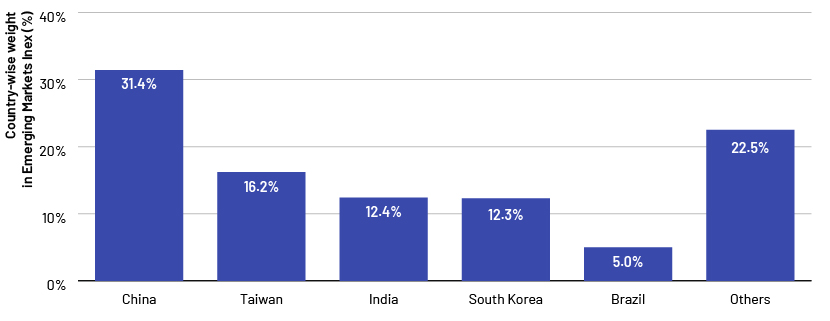

China dominates the MSCI Emerging Markets Index

Only a handful of large economies dominate emerging-market stock indices – China has a 31.4% weight in the MSCI Emerging Markets Index, followed by Taiwan at 16.2%, India at 12.4%, South Korea at 12.3% and Brazil at 5.0%. This skews the indices towards large markets, whereas emerging markets are diverse in terms of economy, geography and demography.

Institutional investors select emerging markets to invest in for a number of reasons, such as for gaining exposure to growing economies, portfolio diversification and making a positive impact on the country’s development.

In countries such as India, China, Malaysia, Thailand, the Philippines, South Africa, Morocco and the United Arab Emirates (UAE), there has been considerable improvement in ESG data availability. An integrated approach to assessing ESG parameters is the need of the hour while considering each country’s domestic factors.

Mitigating exposure to emerging markets

ESG investors are concerned about risks posed by emerging markets, as the focus has shifted from enhancing livelihoods and conserving natural resources to excluding or mitigating the exposure. A June 2022 study conducted for the UK government found that investments based on parameters relating to key issues such as corruption and inequality resulted in capital flight from emerging markets. Developing countries’ annual deficit in investment required for meeting the UN's Sustainable Development Goals stands at USD4.3tn, according to the UN Conference on Trade and Development (UNCTAD).

Due to a lack of adherence to ESG benchmarks, capital diversion from emerging markets is expected to have an adverse impact. For instance, divestment from fossil fuel stocks may imply that ownership of such assets will now rest with investors not concerned about sustainability.

Conclusion

ESG investment in emerging markets depends on ESG data, the unavailability of which makes the process difficult. There is an imbalance between information available on companies in emerging markets and the requirements of ESG screening. Companies operating in emerging markets may face difficulties in meeting the global benchmarks that ESG investors need to meet, such as ensuring biodiversity and compensating displaced communities. Some companies may also lack the mechanisms for meeting ESG requirements. This leads to the concern that ESG screens designed for developed markets may not be suitable for use in emerging markets. Overall, emerging markets face peculiar challenges such as higher dependence on environmentally harmful industries for economic growth and poor climate-related frameworks that make it all the more difficult to meet energy transition goals.

How Acuity Knowledge Partners can help

We have been supporting global asset managers for more than two decades. We offer comprehensive thought leadership and specialised ESG research solutions. We also provide end-to-end support across ESG-specific RFPs/DDQs and marketing collateral. We leverage our extensive experience, built over the years through collaboration with leading investment management firms, to help organisations communicate their ESG themes better.

Sources:

-

Making funding flows fair: Must ESG be bad news for emerging markets? – Financial Times, 20 October 2022

-

Sustainable growth in emerging markets starts with the data – Refinitiv, 7 December 2022

-

Asset owners widely adopting sustainable investment – FTSE Russell, 2022

-

Top 100 Largest Sovereign Wealth Fund Rankings by Total Assets – Sovereign Wealth Fund Institute (SWFI), accessed on 11 August 2023

-

Developing countries face $2.5 trillion annual investment gap in key sustainable development sectors – UNCTAD, 24 June 2014

-

Emerging Markets: Where will sustainable finance grow? – Economist Intelligence Unit, 9 January 2023

-

Global Investments in ESG Funds Plunged 76% in 2022 – Investopedia, 8 February 2023

Tags:

What's your view?

About the Author

Varad Sharma is part of Acuity Knowledge Partners’ Investment Research team. He has over eight years of experience and currently supports a buy-side client with research assignments. Varad holds a Post Graduate Diploma in Management (PGDM) with a specialisation in Finance from the Institute of Management Technology, Hyderabad and a Bachelor in Engineering (Mechanical) from the University of Pune.

Like the way we think?

Next time we post something new, we'll send it to your inbox