Published on March 29, 2023 by Siddhartha Chabria, CFA® , Navaneet Gandhi and Anjana Viswanathan

Overview of municipal bonds and types

Municipal bonds (or munis) are debt instruments issued by government entities, states, cities, counties and municipal schools, highways or sewer systems. They may be short-term bonds that mature in one to three years or long-term ones that mature in at least a decade.

-

Taxability Interest on munis is exempt from federal income tax. It is exempt from state and local taxes if the bondholder resides in the state where the bond is issued. Munis are assumed to be tax-exempt vehicles preferred by HNIs and UHNIs.

-

Types of munis

-

General obligation bonds(GOs) are unsecured bonds issued by states, cities or counties. GOs are powered by the “full faith and credit” of the issuer that is qualified to tax residents to pay bondholders.

-

Revenue bondsare not supported by the government’s tax money. However, they are repaid using revenue from a specific project or source, such as highway tolls or lease fees. Some revenue bonds are “non-recourse”, meaning the bondholders do not have a claim on the underlying revenue source if the revenue stream dries up.

-

Private-activity bonds are debt instruments for private-sector investment used to develop public-facility buildings. They are issued by or on behalf of a local or state government for the purpose of financing projects of a private user, for example, bonds issued for constructing airports, hospitals or universities.

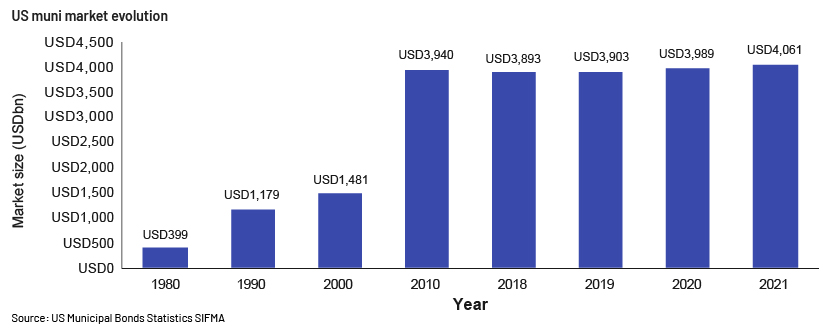

Evolution of the muni market

The muni market grew exponentially during the 1990s from a mere c.USD400bn in 1980 to a whopping c.USD4tn by 2021 (at a CAGR of c.6%). The first quarter of 2022 was the most challenging quarter for munis since 1980, as returns were impacted negatively by US market volatility, persistent inflation concerns and geopolitical tensions. Notably, credit fundamentals remain very strong, with positive economic growth boosting tax revenue to all-time highs.

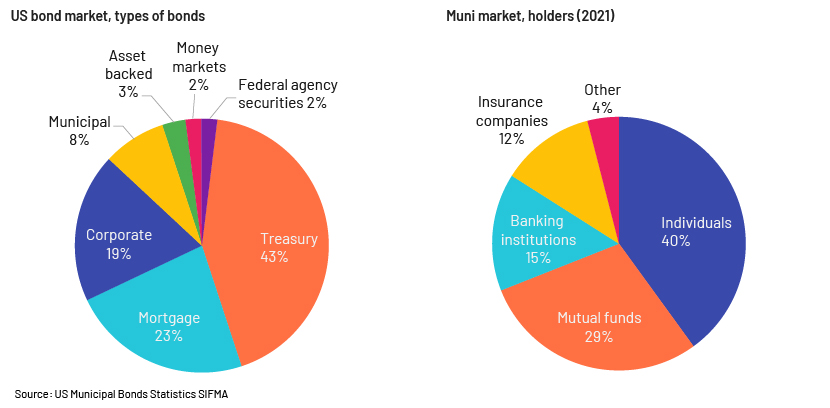

Composition of municipal market and market overview

Munis constitute a miniscule part of the large fixed income market, accounting for approximately USD4tn of the total USD53tn in US fixed income assets.

With respect to ownership, the muni market is mainly controlled and influenced by retail investors, thanks to munis being federal tax-exempt. Individual investors account for 70% of total muni ownership, which includes both direct investment in individual muni market instruments and indirect investment through mutual funds and ETFs.

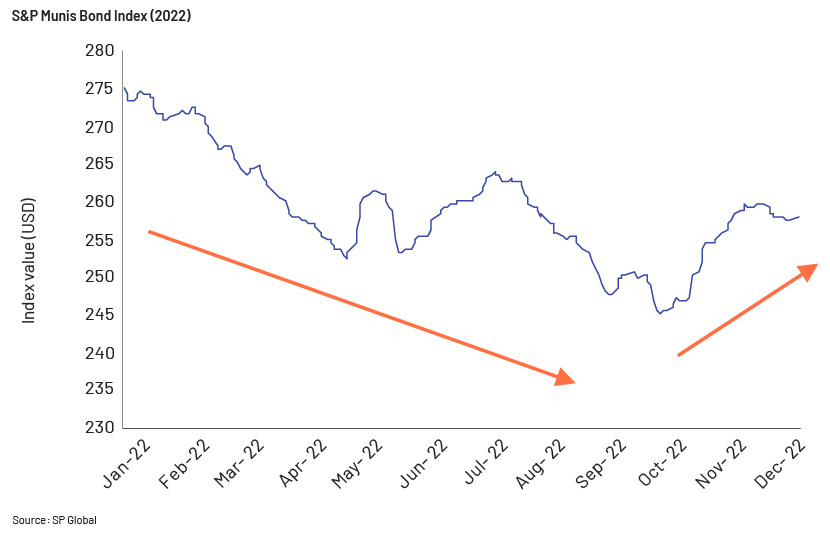

Dismal muni performance in the first three quarters of 2022

A range of concurrent macroeconomic factors, such as the Russia-Ukraine conflict, global supply-chain disruptions, rising interest rates and unexpected inflationary pressure, drove the 2022 selloff, making it a painful year for muni investors.

At the start of 2022, inflationary pressures were still considered to be transitory. This prediction will likely prove to be accurate, although the time frame would now be longer than most investors expected. Once the Fed abandoned the transitory concept and pivoted towards rate hikes in an attempt to prevent inflation from touching historical highs, the terminal rate forecast suddenly jumped by 425bps or more.

The effect was felt across the muni market, and it faced a challenging environment, as evidenced by the S&P Munis Bond Index that delivered a return of -8.05%, the lowest in more than 20 years, while return for the nine months ended September was approximately -10.00%. This weak return is attributed mainly to initial low yields that drifted higher as the Fed aggressively hiked interest rates by a cumulative 425bps (until now).

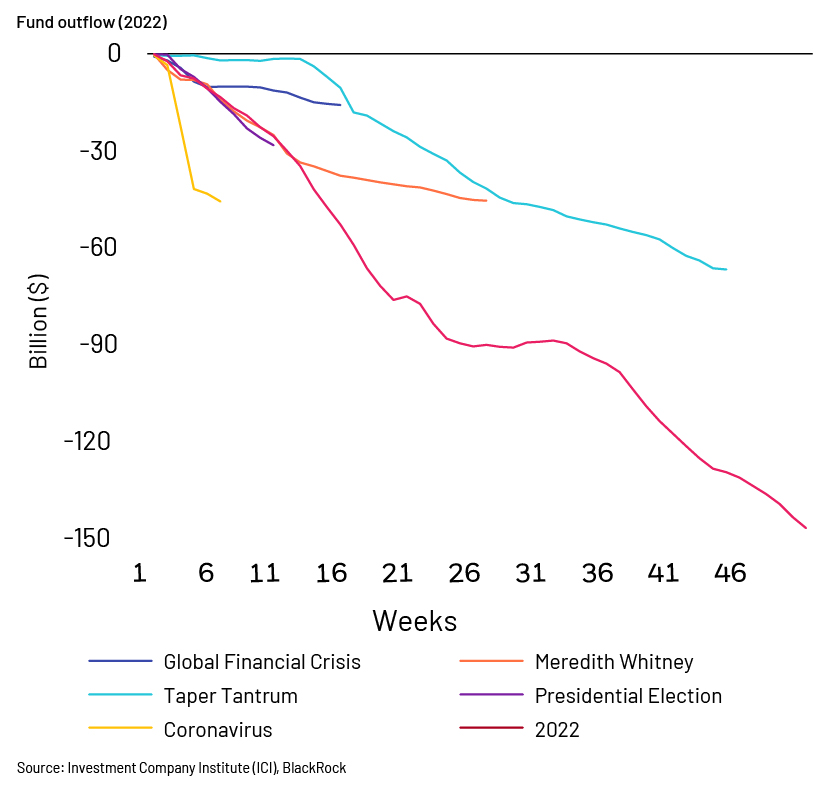

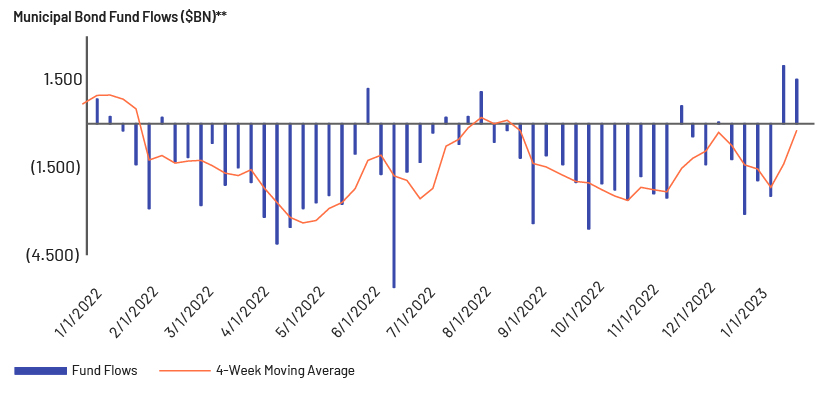

This also influenced investors’ wealth-creation ability over 2022, with muni funds seeing record one-year outflow in excess of USD150bn.

Current yield comparison, munis and US Treasuries

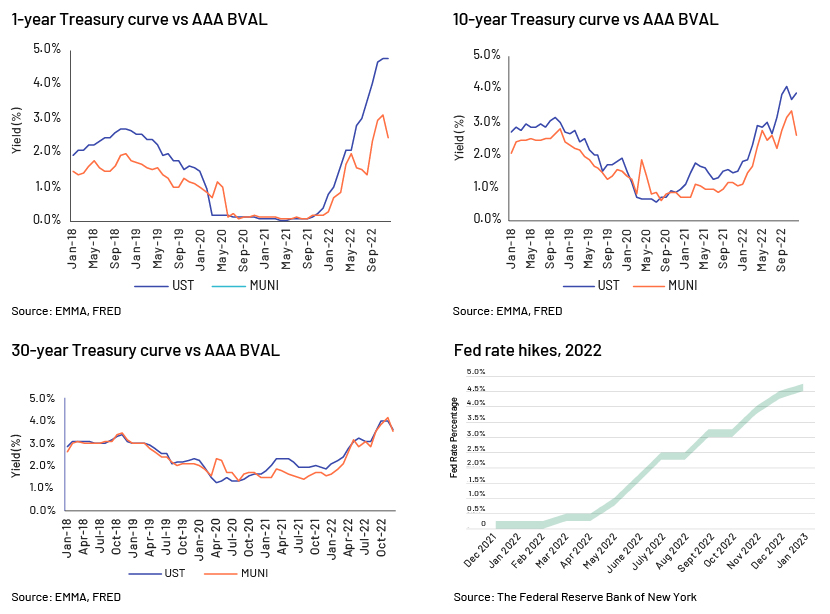

At the start of 2022, 10-year and 30-year AAA BVAL muni yields stood at 1.09% and 1.63%, respectively. While they started at a low point, the yields eventually increased to offer a taxable-equivalent yield above 6%. The increase in yield was driven predominantly by the Fed’s aggressive rate hikes to curb decade-high inflation. Seven consecutive rate hikes of 25-75bps in 2022 led to a Fed rate of 4.25-4.50% by the end of 2022. In February 2023, the Fed rate is up by 0.25%, bringing the range to 4.50-4.75%.

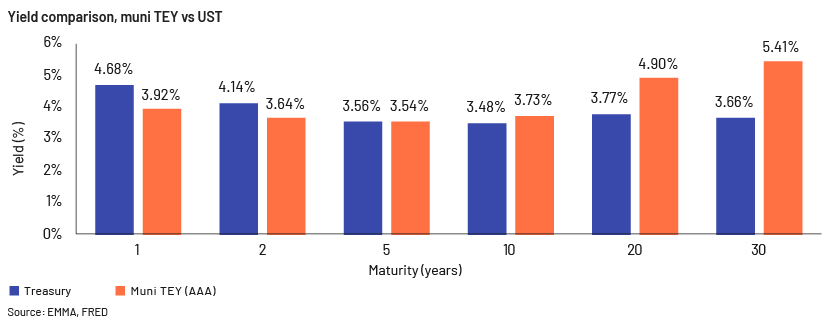

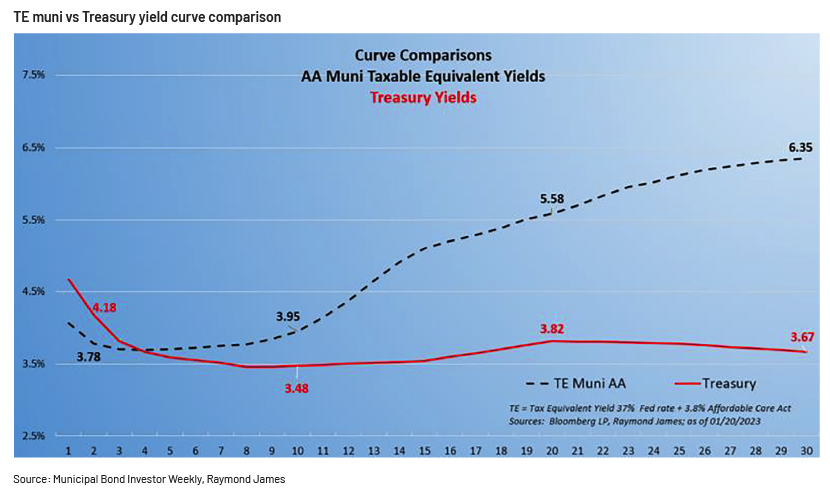

Comparing the yield on a tax-free muni with the yield on taxable US Treasuries using munis’ tax-equivalent yield (the pre-tax yield that a taxable bond must provide to equal the returns that could be earned from a tax-exempt bond) brings consistency around the taxability factor.

The tax-equivalent yield for longer-term maturities is higher, indicating that munis currently have a better prospect of delivering higher yield and more value than US Treasuries.

The Treasury yield curve is currently inverted, while the muni yield curve (AAA) has maintained its traditional upward slope, implying that while investors may be able to find more attractive yields in short Treasuries, in the intermediate and long term, they are better compensated for extending out over the muni yield curve rather than staying on the Treasury yield curve.

Intermediate- and long-term bonds are currently yielding more than corporate bonds on a tax-equivalent yield (TEY) basis, giving them an advantage over other corporate and Treasury bonds. For investors in the top tax bracket looking to lock in yields, AA rated munis in intermediate- and longer-term maturities offer a TEY significantly higher than Treasuries. The TEY on a 10-year AA muni is 3.95%, 47bps higher vs 10-year Treasuries at 3.48%. At 20 years, AA munis with a TEY of 5.58% offer 176bps more than Treasuries. At the very long end, 30 years, AA munis have a TEY of 6.35%, a 268bps pick-up in TEY vs Treasuries’.

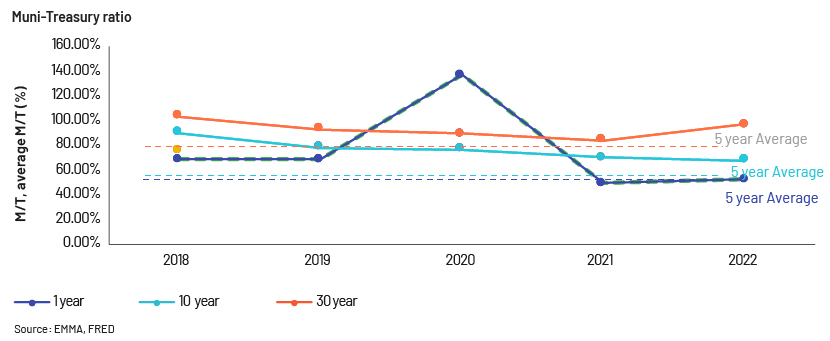

The attractiveness of munis in comparison to Treasuries is also evident by looking at the muni-to-Treasury (M/T) ratio (a yield ratio between munis and Treasuries using the same maturity for both). As illustrated in the chart below, the ratio for the longer-term maturity (30 years) is above its five-year average while ratios for the short (1 year) and intermediate (10 year) terms are below the five-year average on the curve, suggesting that longer-term munis are more attractively valued then Treasuries of similar maturity. Hence, investors should consider extending duration in 2023 to take advantage of the move up in longer-term yields

Recovery in muni performance in 4Q 2022

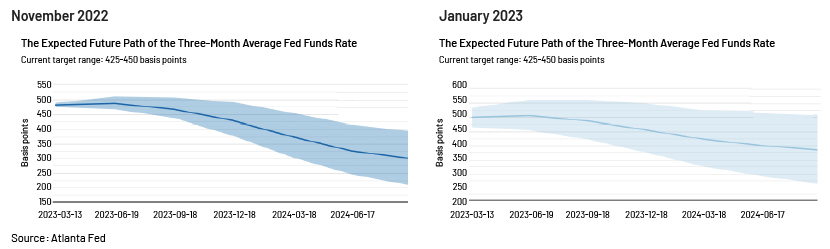

Despite the poor performance over most of 2022, the muni market posted a surprisingly positive performance in the final quarter of 2022. This was due to improving inflation expectations amid the Fed’s aggressive monetary policy. With this, the market observed a subtle drift from the Fed’s hawkish stance, substantiated by the decelerating pace of rate hikes. This is evident by comparing the Fed funds future rates from November 2022 to January 2023, where the upper range of the distribution shifted down from a level of c.550bps to c.500bps.

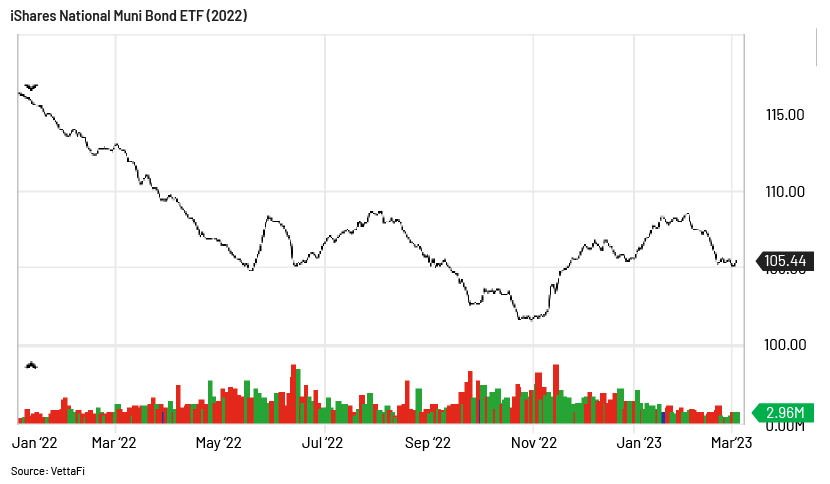

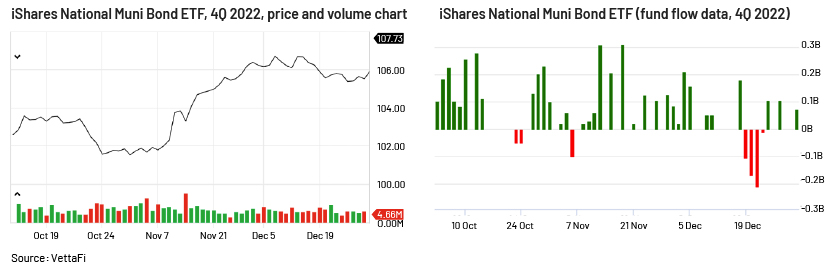

The iShares National Muni Bond also shows the positive return in 4Q 2022. This was also supported by strong fund net fund inflow to the tune of c.USD11bn, as represented by the iShares National Muni Bond ETF.

After witnessing significant net fund outflows throughout 2022, muni fund flows finally witnessed a pick-up in fund inflows over the second half of January, with cumulative net inflow of over USD3bn.

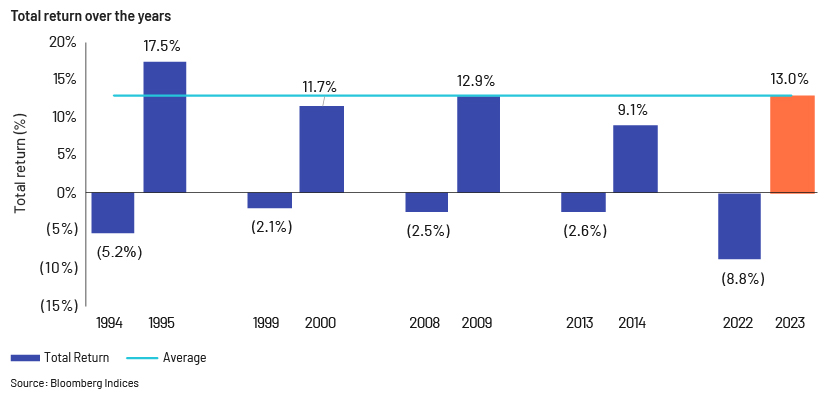

This change in course bodes well for an expected reversal during the course of this year, with the expectation that fund inflows could continue. In addition, going by historical trends, munis have displayed strongly positive returns after a negative year, with an average total return of c.13%. For 2023, the average expected bounce-back return of 13% may be possible given the Fed has shifted from its aggressive stance.

Improving global economic factors and a less aggressive Fed should pave the way for the muni market to recover this year.

Improving global economic factors and a less aggressive Fed should pave the way for the muni market to recover this year.

Resilient fundamentals of munis keeping default rates at bay

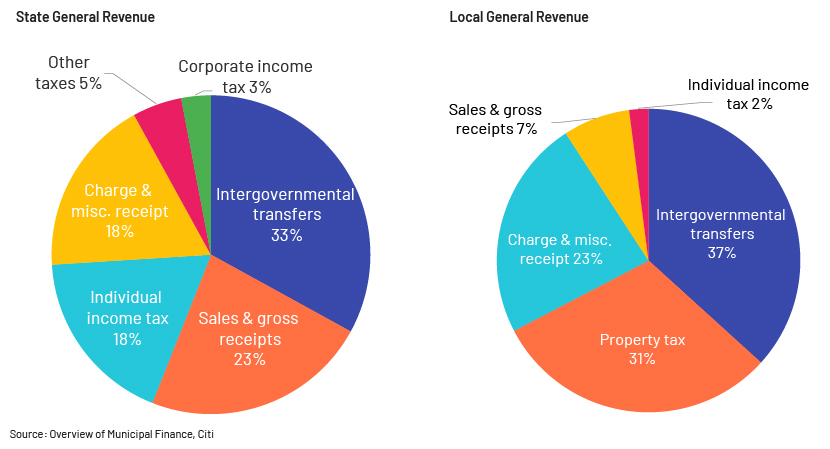

Intergovernmental transfers constitute around a third of revenue. Sufficient cash was pumped into the system, aided by favourable fiscal and monetary policy amid the pandemic, providing staggering upside to muni revenue in the past two years. In 2022, the US public finance system was found to be flush with liquidity as it received funds from federal government-funded relief, including the Coronavirus Aid, Relief and Economic Security (CARES) Act and the American Rescue Plan Act (ARPA). With increasing home prices, this would contribute to higher muni revenue in the form of property taxes (tax receipts up 18.2% in 2022, on average, in the 40 states that provided tax data through July).

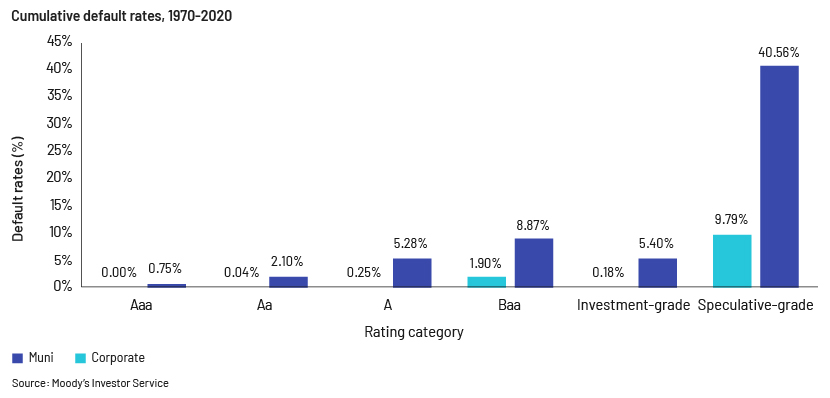

Another positive factor is that munis have historically had lower default rates than corporate bonds. Municipal credit quality is currently strong, with favourable trends. Like the trajectory of federal government tax revenue, state government tax revenue collections are historically high and increased 22% in 2021 compared to 2020. This is 20% above pre-pandemic levels in 2019. Reserves reached a record collective high of USD82.3bn, and state pension funds are expected to be more than 80% funded for the first time since 2009. Moody’s issued 817 upgrades and just 307 downgrades in 2021, compared to 296 upgrades and 209 downgrades in 2020.

Given the abovementioned factors, muni issuers are less likely to default on their payments, even if the economy goes into a recession.

Given the abovementioned factors, muni issuers are less likely to default on their payments, even if the economy goes into a recession.

Outlook for the muni market for 2023

Munis are coming off a difficult three quarters in 2022. Negative returns, market volatility and weak supply/demand technicals contributed to record muni fund outflows. In contrast to the sublime performance in the first three quarters of 2022, the market’s tone turned around in the final quarter of 2022 and remains positive, supported by inflows.

Although investors are still cautious, they believe credit fundamentals are strong and valuations are attractive.

It is paramount that both issuers and investors gauge the Fed’s stance on the US economy and whether it believes there will be a downward shift in interest rates, stimulating muni debt issuance and rescuing investors from the negative returns last year.

The Fed's challenge will be to calibrate tighter monetary policy to achieve the desired reduction in inflation without creating a recession and excessive job losses. The Fed recently signalled that three rate hikes may be warranted in 2023 due to inflationary concerns. The central bank's next interest rate hike is expected in February 2023. Volatility and uncertainty are expected to remain elevated in the near term as stubbornly high inflation, a heightened risk of recession and the war in Ukraine continue to pressure the global landscape. However, increased income from higher yields could provide a cushion against negative returns and rising interest rates. Future returns look more promising for longer-term investors.

Opportunity knocks

Despite the recent underperformance, investors may carry on with their holdings and take advantage of this unusual moment, with an opportunity to earn attractive yields without having to take on undue risk.

There are near-term opportunities in the muni debt markets that should be capitalised on:

-

Munis have been used as a safe haven during post-tightening economic environments, i.e. recessions. Muni defaults have historically been lower, and in 2022, they were lower than in 2021; we expect this to be the case in 2023 as well.

-

Muni issuance dropped significantly in 2022 due to higher interest rates. Net negative new issuance for tax-exempt munis will likely persist; this, combined with stabilising demand, should be supportive of total returns for the year.

-

The hallmark of munis is that they are free from federal income taxes and, potentially, from state/local taxes as well.

-

They currently yield more than corporate bonds on a TEY basis, giving them an advantage over corporate and Treasury bonds; this, combined with robust balance sheets, makes munis a highly attractive option for investors this year.

-

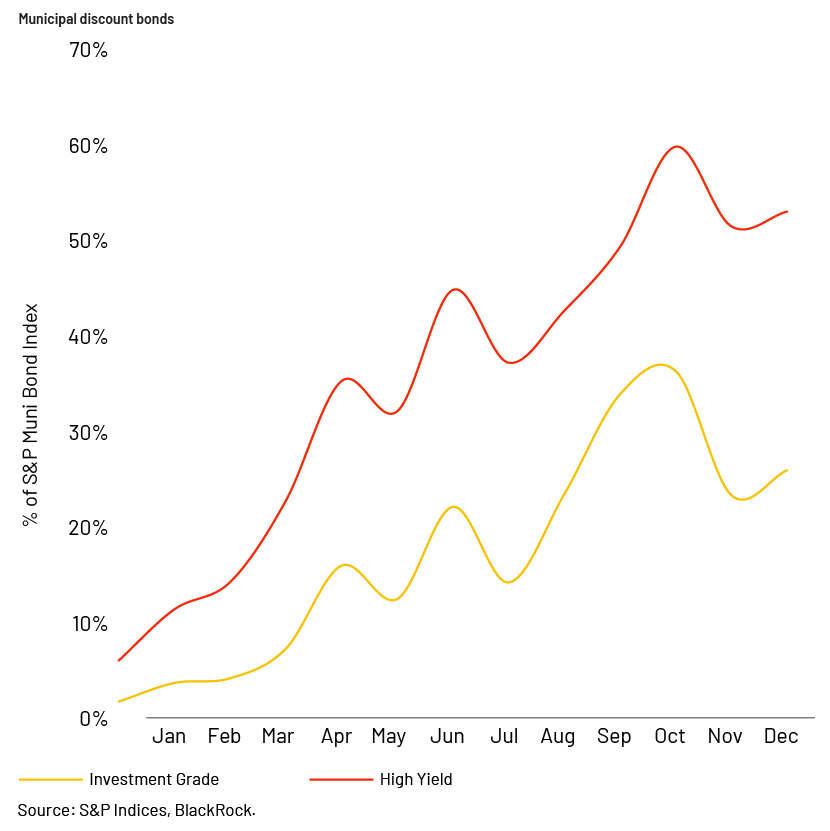

A significant number of investment-grade and high-yield bonds are now priced at a discount versus in 2022, offering a better risk-reward profile going forward.

How Acuity Knowledge Partners can help

We help investment banking teams scale up their public finance underwriting practices and drive value for their clients. By leveraging dedicated teams of experienced analysts in our offshore delivery centres, clients benefit from operational efficiency and cost optimisation. Our team of public finance experts are well versed in covering municipal financing and public sectors and are vested with state-of-the-art modelling capabilities. Many of our clients working with our specialised public finance investment banking teams have benefited from our integrated suite of services along the investment banking advisory value chain.

Sources:

-

https://www.atlantafed.org/cenfis/market-probability-tracker

-

https://www.spglobal.com/spdji/en/indices/fixed-income/sp-municipal-bond-index/#overview

-

https://www.lordabbett.com/en-us/financial-advisor/insights/markets-and-economy/municipal-

-

Muni Bonds An Attractive Opportunity | John Hancock Investment Management (jhinvestments.com)

-

https://www.nerdwallet.com/article/finance/fed-rate-look-back-look-

-

https://www.nuveen.com/global/insights/municipal-bond-investing/municipal-market-update

Tags:

What's your view?

About the Authors

Siddhartha is an Investing Banking Senior Associate at Acuity Knowledge Partners, having around 2.5 years of experience working with one of the leading credit-rating agencies in India and around 7 years of capital market experience. He is skilled in investment research, financial modelling, report writing, investment recommendations. His areas of interest are equity, fixed income, derivatives, portfolio-management along with keeping a track of the global-macro scenario. He has also made notable submissions in CFA Asia Pacific Research Exchange. He is currently a CFA Charter holder and has completed his Masters from the University of Calcutta, he is also certified by NSE as a Capital Market Professional.

Navaneet is an Investment Banking Associate at Acuity Knowledge Partners, having around 3 years of experience in financial services sector. Currently, he is a key member of Public Finance team, supporting a U.S. based Investment Bank with a focus on Municipal Finance for. Navaneet has hands-on experience of working on key projects covering Investment Research and Financial Analysis. He holds a Master’s degree in Business Administration specializing in Finance from Bharati Vidyapeeth University, Pune and completed Applied Financial Risk Management (Executive Development Programme) from IIM (Kashipur).

Anjana is a Delivery Lead at Acuity Knowledge Partners, having more than six years of experience in the financial services sector, predominantly investment banking and equity research. Currently, supports Public Finance team, with a focus on Municipal Finance for a U.S. based Investment Bank, in Bangalore. Prior to joining Acuity, she was with William O’Neil India as equity research analyst for three years. She holds a Master’s degree in Business Administration in Finance from IMT Hyderabad

Like the way we think?

Next time we post something new, we'll send it to your inbox