Published on August 4, 2022 by Anshul Sehgal

Key takeaways

-

Covered bonds are an integral part of European bank funding, particularly in periods of volatility, with global covered bonds outstanding totalling almost EUR3tn

-

The differences in legislation governing covered bonds among EU member states made it difficult for investors to assess credit risks, and accorded the same regulatory treatment to a diverse array of instruments

-

The harmonisation of European covered bonds aims to ensure principal structural similarity across the EU, with regular reporting, better supervision and clarity on cover pool composition

-

Discretion on the transposition of the Covered Bonds Directive to law means technical differences across credit risks in member-state covered bonds frameworks are likely to persist

The covered bond – a pivotal bank funding instrument

Covered bonds are an integral source of funding for European issuers. Data from the European Covered Bond Council (ECBC) fact book 2021 suggests the outstanding volume of covered bonds stood at EUR2.9tn at end-2020. There are active covered bond markets in 30 European countries, with Denmark, Germany and France being the largest issuers.

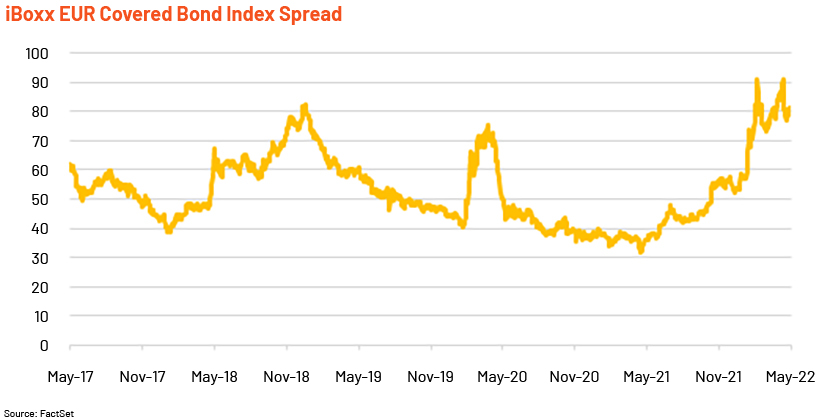

The current volatility, driven by the Russia-Ukraine conflict, has had a positive impact on covered bond issuance. Nord/LB estimates EUR covered bond issuance crossed EUR117bn by end-June 2022. With the conflict continuing to affect funding markets and the expiration of inexpensive central bank funding availability, momentum in the issuance of covered bonds by European banks will likely continue in 2022.

The need for harmonisation

A key theme with regard to covered bonds in recent years has been the harmonisation of covered bond legislation across Europe; the framework came into force on 8 July 2022. We summarise here the key tenets of the harmonisation framework.

The covered bonds market is a multi-trillion-euro market, but it is fragmented and concentrated. Each member state has different legislations governing covered bonds, varying in terms of eligibility of cover assets, disclosures and supervision. As such, it is difficult for investors to assess credit quality across jurisdictions. Furthermore, different instruments were subject to the same EU regulatory treatment. The covered bond harmonisation framework aims to create uniform product, disclosure and supervision standards across the EU.

The Covered Bonds Directive aims to achieve principal structural similarity, to progress towards an integrated EU covered bond market. The key drivers of the Directive were the facilitation of an EU-wide covered bond regime with uniform disclosure, supervision and cover pool structure. This would lead to some sense of parity across the varying covered bond regimes, facilitate the development of smaller covered bond markets, promote investor confidence and lower funding costs for issuers.

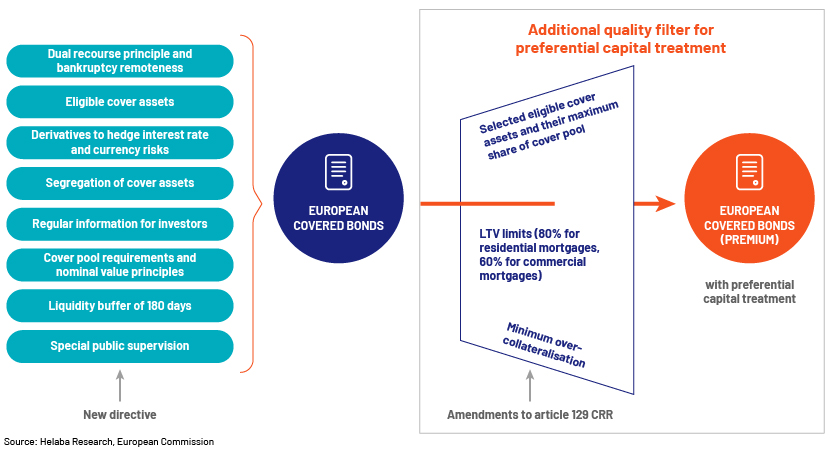

In November 2019, the EU parliament ratified the EU Covered Bonds Framework (the Covered Bonds Directive plus amendments to Article 129 of the Capital Requirements Regulation, or CRR), setting the stage for truly harmonised European covered bonds. The framework was published in January 2020 and became fully binding from 8 July 2022. However, national legislators have discretion on the transposition of the Covered Bonds Directive to law; technical differences across member states’ covered bonds frameworks are, therefore, likely to continue for the time being.

Key tenets of the EU Covered Bonds Framework

Starting 8 July 2022, only premium European covered bonds that satisfy the Directive’s guidelines and meet the requirements of Article 129 of the CRR will benefit from preferential regulatory treatment. Those that meet the requirements of the Covered Bonds Directive but not the amendments to the CRR can use the European covered bonds label. Covered bonds issued under existing legislations will be grandfathered to maturity.

A long road to harmonisation

Of the 27 EU countries, 19 member states (70%) had announced the full transposition of the Covered Bonds Directive to national law as of 2 June 2022. The remaining member states have either published draft legislations or are simply yet to report their implementations to the European Commission. Countries such as Germany, France, Denmark, Spain and Austria, which account for the bulk of the covered bond market, have already completed the transposition, while in the Netherlands, the new covered bond legislation became effective on 8 July. We expect most of the remaining members to have met the July deadline, driven by the risk of losing preferential regulatory treatment.

However, with implementation differences across member states, there are still issues that need addressing. For example, the treatment of soft-bullet covered bond maturity extensions differs. Similarly, over-collateralisation levels vary, with a 5% requirement in Spain, 2% in Germany and 0% in Italy.

The calculation of the liquidity buffer also varies, depending on whether scheduled or extended maturities are used for covered bonds. In addition, the Directive falls short in terms of giving concrete guidance on the maturity mismatch risk. There is also scope for improvement in managing interest rate and FX risks, and setting limits on the concentration of pool assets.

With the Covered Bonds Directive now effective, further measures will be taken up for consideration. The Commission should submit reports by 8 July 2024 focusing on third-country equivalence regimes for covered bonds issued by non-EU countries, risks and benefits of extendable maturity structures and the introduction of European secured notes (ESNs). In addition, the differences in implementation across member states will be analysed, and proposals on further alignment measures and the development of covered bond markets should be submitted by 8 July 2025.

Outlook

-

We believe the introduction of a harmonisation framework is a positive move, leading to structural uniformity and reduced investor risk, but we expect spreads to continue to diverge across legislations and more reforms to be required.

-

The credit quality of covered bonds is driven by the creditworthiness of the issuer in addition to the strength of the covered bond legislation. Cover pool assets are strongly influenced by national preference.

-

The degree of macroeconomic impact and movements in house prices will likely mean the impact on the issuer and the cover pool is not uniform across EU member states.

-

As such, we do not expect covered bond credit spreads to converge across EU member states for now. This is further supported by the recent fragmentation in peripheral and German sovereign spreads following the ECB’s announcement of interest rate hikes.

-

Nevertheless, further reviews would build on this first step, likely leading to further uniformity in covered bond structures across the EU.

How Acuity Knowledge Partners can help

Covered bonds are generally treated as safe investments given their superior credit ratings, indicating low risk levels. However, considering low default risk as homogenous along with “home bias” could make investors miss out on rightfully assessing credit risk and the diverse opportunities present in the markets. We have been supporting asset managers invested in covered bonds globally. The team combines qualitative and quantitative fundamental credit research with technological solutions that not only improve our speed to market, but also provide actionable insights. The team is supported by access to long-serving in-house sector and asset-class experts.

Sources:

-

Scope Ratings, Helaba Research, Nord/LB Research, EC, ECBC

-

Covered Bond Quarterly: Q1 2022

-

EU covered bond harmonisation on the home stretch but gaps remain

-

Implementation of EU covered bond harmonisation package: Little change to the Pfandbrief

Tags:

What's your view?

About the Author

Anshul Sehgal has around nine years of experience in credit research, with a primary focus on the European banking sector. Currently, he works as the financial sector credit analyst for a UK-based credit hedge fund, providing trade recommendations across the capital stack for global banks through a mix of bottoms-up fundamental research and relative valuation. Prior to this, he was the desk analyst of a global investment bank’s top-ranked European banks team covering regulations, issuance, ratings and bank debt trade opportunities. Anshul holds an MBA from IIM Raipur and a Bachelor of Technology (Computer Science and Engineering) from Maharaja Surajmal Institute of Technology, New Delhi.

Like the way we think?

Next time we post something new, we'll send it to your inbox