Published on March 19, 2024 by Sreeja Roy Chowdhury , Debarati Dutta , Mahesh Agrawal , Jenil Mehta , Archana Anumula and Somya Dixit

Introducing Market Roundup, a monthly report with key takeaways on macro asset categories

Global market overview

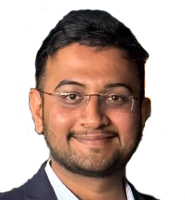

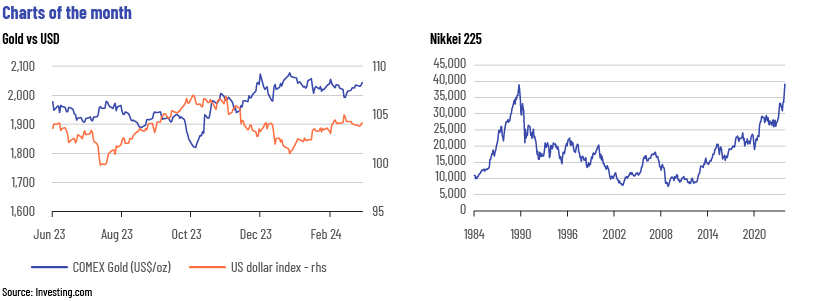

In February, the equity market performed strongly on the back of improved macroeconomic sentiment, with Asia outperforming. The commodities market was under pressure, mainly due to a stronger USD against other major currencies and demand concerns in China. Treasury yields moved higher as expectations of rate cuts in the near future eased following stronger economic data and higher inflation.

The CME’s FedWatch[i] shows a low probability of a rate cut at the March or May meeting; this should keep rates steady this month. The equity market could also take a breather as it waits for the first quarter’s earnings reports. Crude oil may enjoy support around the current levels as OPEC+ extends output cuts[ii] although demand remains soft and would likely cap any gains.

Equity market

-

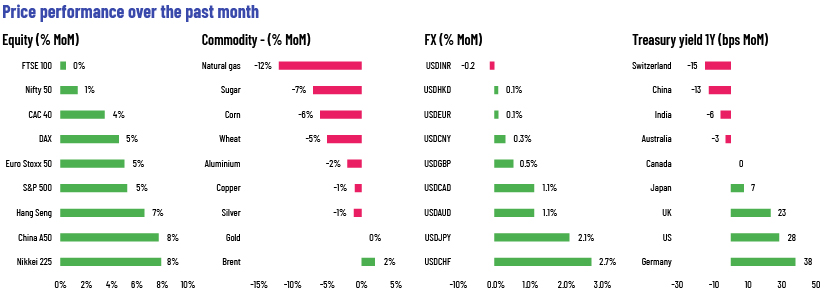

Review: The global equity market had an impressive bull run, with the Nikkei leading the pack. The Nikkei gained 8% last month, reaching an all-time high of 39,426. The year-to-date performance is equally noteworthy, standing at an impressive 17%. Several factors contributed to these moves, including a shift in investor interest from China to Japan, dovish sentiment around the NIRP and regulatory initiatives pushing companies to implement enhanced corporate governance and improve financial ratios. In China, Beijing's rollout of measures supportive of the economy and equity market boosted sentiment. Meanwhile, in the US, the technology sector experienced an upward surge, driven by positive earnings and guidance from companies such as Nvidia and Meta.

-

Outlook: The earnings season will start next month; first-quarter earnings in the US are likely to be subdued in the short term before picking up again over the second half of 2024[iii]. Market participants are also likely to watch closely for further developments on China's stimulus measures and assess whether the Nikkei can sustain its strong rally.

Commodities market

-

Review: Most commodity prices remained under pressure in February following the uncertainty surrounding the US Federal Reserve’s (Fed’s) plan to cut interest rates, higher exchange inventories and disappointing China demand after the New Year holiday. The energy sector traded mixed, with ICE Brent oil prices closing positive last month, primarily on expectations that OPEC+ members will extend their oil supply cuts until the end of June. In contrast, US natural gas fell sharply as rising exchange inventories and a warmer winter keep demand subdued. In metals, gold remained largely flat as the market awaited fresh buying signals, while industrial metals traded under pressure mainly due to swelling exchange stockpiles and weak China demand.

-

Outlook: Commodity prices are expected to perform better in March on rising hopes of stimulus support from China. At the latest meeting, China kept the GDP growth target unchanged at 5% for 2024 while hinting at stimulus support to achieve planned economic growth. With regard to oil, OPEC+ members agreed to extend supply cuts until 2Q24 as expected, primarily to avoid a major supply glut in the oil market and to create a floor at around USD80/bbl. Meanwhile, gold made a strong start in March, with prices breaking above USD2,100/oz to reach near-record levels as the release of mixed economic data from the US raised market expectations of a Fed rate cut in June.

FX market

-

Review: The USD fell in the first two weeks of February and recovered in the next two weeks but closed lower than the January levels as an upside surprise in CPI and a pushback in the Fed’s easing cycle failed to support the currency materially. The EUR continued its bearish trend as the macro backdrop remains challenging in the Eurozone and in China. The GBP weakened as the GDP release confirmed a “technical recession” and a downside surprise in CPI but strengthened on the back of better (than Eurozone) PMI prints. The JPY was back at the 150 handle, driven mainly by developments in the US and caution by representatives from the Bank of Japan (BoJ) that rate hikes will not be rapid.

-

Outlook: Demand for the USD is likely to return even as markets look for cues from the FOMC meeting, the inflation print and the labour-market report. In the UK, spring budget announcements on 6 March will likely trigger movement in the GBP. Soft data prints should keep the EUR and AUD range-bound. While it would be difficult to gauge the direction of the JPY, focus will likely be on the outcome of the shunto, or spring wage negotiations.

Debt market

-

Review: US 10y Treasury yields remained elevated in February as markets repriced easing expectations. Eurozone government bond yields ended higher, with markets pushing back expectations for European Central Bank (ECB) rate cuts. The UK 10y gilt yield was up slightly. In Japan, bond yields rose on hawkish comments from BoJ Board Member Takata.

-

Outlook: In March, the focus will be on the ECB policy meeting, the UK spring budget, the BoJ policy meeting, US employment data and the FOMC meeting. The Fed and the ECB are expected to keep policy rates on hold, indicating no significant movement in yields. The UK gilt market will likely play close attention to the publication of the new OBR fiscal forecast. JGB yields are expected to face upward pressure, driven by BoJ rate hikes.

How Acuity Knowledge Partners can help

Our large pool of macro experts is experienced in providing research and strategic support across the value chain. We have partnered with macro research firms, global investment banks, asset management firms and hedge funds over the years, working closely with their research, strategy, and investment teams to provide them with the information and analysis required in the investment decision-making process.

We also provide tech-enabled data management solutions, and modelling and analytics services covering macroeconomics, FX and commodities forecasts [Macro Economic Research, FX, and Commodities Analysis | Acuity Knowledge Partners (acuitykp.com)].

Sources

-

[ii] OPEC : Several OPEC+ countries announce extension of additional voluntary cuts of 2.2 million barrels per day for the second quarter of 2024

-

[iii] Investors Focus Attention on Corporate Earnings | U.S. Bank (usbank.com)

Tags:

What's your view?

About the Authors

Sreeja has over 5 years of experience in economics and equity research. She has been with Acuity Knowledge Partners (Acuity) since 2018, providing sell-side research support to a global investment bank. At Acuity, she is part of the Cross-Asset Research Support team, specializing in macroeconomics research, high-frequency data tracking and financial modelling. Prior to joining Acuity, she worked as an equity research analyst with Zacks Research. Sreeja holds a Master of Science (Economics) from the University of Calcutta, India.

A postgraduate in Economics with over 7 years of experience in economic research. Currently at Acuity Knowledge Partners, is Delivery Manager, supporting a leading investment bank specializing in macroeconomics research. Responsibilities broadly involve analyzing country-specific macroeconomic data, tracking macro indicator releases and their evolution. Debarati holds a Master of Arts (Economics) from Madras Christian College (Autonomous), India and Bachelor of Science (Economics) from the University of Calcutta, India.

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Jenil Mehta is part of the Specialized Solution team at Acuity Knowledge Partner. He is part of a team of Asian equity derivatives strategists at one of the leading Japanese investment banks. He contributes to highlighting and publishing trade ideas, bespoke reports, and idea back testing based on fundamental and quantitative analysis. Before working here, he was a fixed-income derivatives trader and research analyst for North American and Brazilian markets. Jenil holds a bachelor’s degree in computer engineering and has passed all three CFA Levels.

Archana has over 16 years of experience in economics research, with proficiency in areas such as writing country-specific economic reports, real-time macroeconomic indicator release coverage and building and maintenance of large datasets. She has been with Acuity Knowledge Partners since 2011 and currently manages the Macroeconomics Research teams for two top-tier global firms. She is responsible for hiring, client engagement and account management. She is also in charge of business development for the Macroeconomics Research sub-vertical under Quantitative Services. Archana holds a Master of Arts (Economics) from St Joseph‘s College (Autonomous), India and a Bachelor of Commerce from Bangalore University, India.

A management postgraduate with over 12 years of experience in the Commodities Market. Well conversant with the fundamental aspects, inter-market relationships and Geo-political issues impacting the market. Currently at Acuity Knowledge Partners as Delivery Manager responsible for providing market analysis and assisting the client in preparing research analysis for the commodities (Energy, Metals & Agri). Well-acquainted with the use of data sources such as Thomson Reuters and Bloomberg. Somya holds a postgraduate degree in finance and a bachelor's degree in electronics engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox