Published on April 9, 2020 by Neha Agrawal

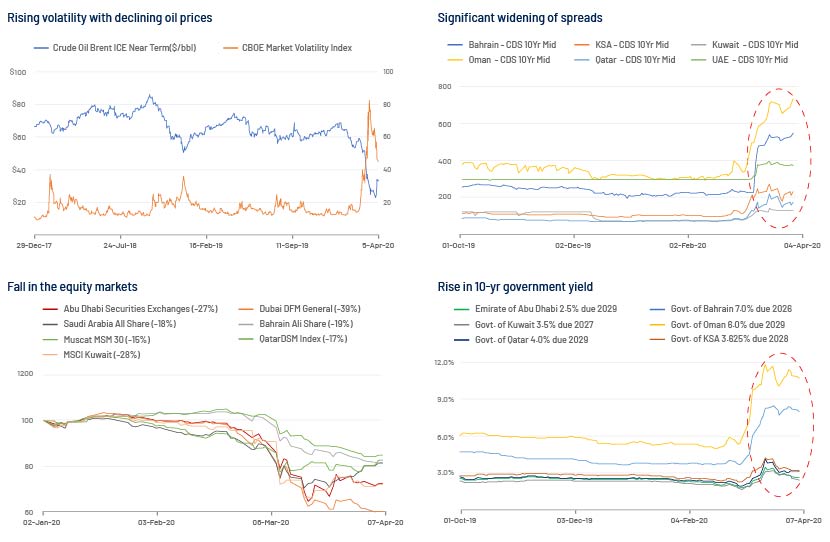

Markets are facing an unprecedented crisis as the global economy is disrupted by the coronavirus pandemic.The Middle East, however,is grappling with a double shock – the impact of COVID-19 and the oil price plunge.

The pandemic is causing significant economic turmoil in terms of a decline in demand, a negative impact on trade, reduced consumer confidence, and tighter financial conditions in the region. However, OPEC and Russia failing to reach an agreement on oil production cuts has led to a surplusof oil supply,and a subsequent price war, with oil prices tanking to their lowest in 17 years and significantly affecting these oil-based economies.

The region’s governments have responded with fiscal and monetary stimulus packages, but volatility in their respective markets will likely continue until the effects of COVID-19 subside. Equity markets are down across the region and sovereign spreads have widened. Such tightening in financial conditions could make raising capital a challenge.

Oil prices unlikely to recover in the near term, having a ripple effect on economies

-

Oil recently toucheda low of USD22.7/bbl, and a near-term recovery seems unlikely amid declining demand and abundant supplyheavily impacting the region’s exports. Oil price stability is the most important factor in forecasts of GCC project spending, driven by government spending and bank credit. The region’s oil exporters are impacted by lower exports, which are pressuring government budgets,with ripple effects on the rest of the economy. Prices surged 25% on 3 April 2020as President Trumpspoke of significant production cuts and on hopes that the price war would end.

-

Situation worsens as top oil firms declare force majeure on oil importsfrom major supplier countries such as Saudi Arabia, the UAE, Kuwait and Iraq on reduced demand due to travel restrictions and global lockdowns. Leading firms such as Indian Oil Corp. haveasked suppliers to defer some of the volumes they were to deliver in April. Goldman estimates that c.20m barrels will go into storage a day in April 2020, and IHS Markit expects the world to run out of space to store oil by the middle of the year.

Capital markets remain heavily exposed to global uncertainty; debt markets expected to surge

-

Portfolio inflowsdeclined by almost USD2bn since mid-February to 23March 2020 as global investorsparked funds in safer havens. Financial conditions tighten as equity prices fall and bond spreads widen. Nearly USD35bn worth of sovereign debt is estimated to be maturing in 2020. The respective sovereigns may find it difficult to refinance all this debt, especially Oman and Bahrain whose CDS spreads have widened significantly.

-

Sectors such as tourism, hospitality and real estate are deeply hit. Saudi Arabia attracts 20m pilgrims a year, and the UAE expected 25m tourists for Expo 2020, a six-month event scheduled to start in October 2020 and contribute 1.5% to the UAE’s GDP. The organisers are likely to recommend postponing the event by one year. Consulting firm EY had estimated an expenditure of AED40.1b (c.USD8bn) on related infrastructure projects for the expo, and direct and indirect economic benefits of up to AED84.9b (USD23bn)during 2020-2031 period. The real estate sector is likely to see a significant impact with a drop in international buyers and weaker market sentiment. Emaar Properties, Dubai’s leading property developer recently slashed staff and executive salaries across its businesses as the coronavirus pandemic halts projects. Developers are struggling with debt repayments that have been restructured a number of time, while property linked earnings have gone down significantly.

-

Fiscal deficits to widen with the fall in oil prices, accelerating drawdowns from wealth funds and debt issuances. Moody’s expected the Islamic finance markets to keep expanding and global sukuk issuances to remain stable at USD180bn in 2020 (vs 36% y/y growth to USD179bnin 2019) after expanding for four consecutive years. In addition to the GCC countries, Indonesia, Malaysia and Turkey are key markets for sukuk issuances. The agency expected this to be driven largely by sovereigns, given their higher financing needs owing to lower oil prices and a slowdown in fiscal consolidation, and as major issuers gradually increase the share of sukuks in fiscal deficit financing. As per S&P, the volume of sukuks issued in the six GCC countries increased to USD8.6bn in the first two months of 2020, from USD5.8bn in the same period of 2019. The volume of bond issuances in the region was stable at USD18bn in the first two months of 2020, vs USD17.9bn in the first two months o f 2019. Fitch expects the GCC funding mix to shift to drawdowns from fiscal reservesin 2020. With around USD110bn in drawdowns from fiscal reserves and wealth funds (vs only USD15bn last year), the region is also expected to issue around USD42bn in foreign debt in 2020, vs USD48bn last year.

-

Equity issuances have been affected. At the start of 2020, as many as 16 IPOs were expected in the GCC region, but they seem to be delayed now as the coronavirus outbreak hurts investor appetite. Aman REIF’sIPO, launched in January 2020 and priced in March 2020, did not see significant subscription. With the secondary markets in decline, there are concernsabout IPO valuations, subscription and price discovery. Markets have moved, indicating cheaper valuations. Saudi Arabia’s exchange Tadawul, the flagbearer of the GCC capital markets, recorded a P/E ratio of 16.34x as of 31 March 2020 (vs 19.51x as of 31 December 2019).However Saudi Arabia, which leads the region in terms of capital-market activity, has approved the direct or indirect listing ofgovernment assets planned for privatisation in the stock market. The privatisation drive is part of Vision 2030, a package of reforms intended to wean the economy off oil and create jobs for young Saudis.

The road ahead may not be easy with a weakening banking sector and declining growth

-

Banking sector heavily impacted, with risks of further rating downgrades: The slowdown is likely to weigh heavily on the banking sector. The lowering of interest rates by the US Federal Reserve, followed by most GCC central banks, could directly impact the banking sector’snet interest income, loweringnet interest margins (NIMs).GCC banks’ concentration of government deposits is high; therefore, a prolonged period of lower oil prices would lead to reduced deposit inflows from government and government-related entities. Cost of risk is also expected to increase, lowering banks’ profitability in the next 12-24 months. Mergers and acquisitions among Islamic and conventional banks in the GCC region are likely to continue.

-

Rating downgrades across the region: Moody’s changed its outlook on the banking systems of five GCC countries(Saudi Arabia, Qatar, the UAE, Bahrain and Kuwait)to Negative from Stable on 2 April 2020, while maintaining a Negative outlook on Oman’s banking system, due to the oil price collapse and coronavirus outbreak. S&P recently revised its outlook on a few UAE banks to Negative. Fitch, however, believes the Kuwaiti banks are better placed than most of their GCC peers. Downward pressure on profitability and loan quality due to deteriorating operating conditions is likely to result in more credit rating downgrades of banks in the region, according to the rating agencies.

-

Declining GDP growth, but better positioned than the rest of the MENA region: Growing pandemic fearsare likely to wipe out global growth, with growth rates already revised down a few times in recent weeks. The region’s GDP growth is expected to decline to 0.6% in 2020 (vs previous estimate of 2.2%), although better than the wider MENA region’s (-0.3% in 2020).

The situation continues to evolve as do the markets. Despite volatile markets, and a likely higher cost of borrowing, the Gulf countries would now need to come to the international markets as their deficits widen and oil revenue declines. Issuers with weak credit quality or significant direct exposure to affected industries will likely find it difficult to access capital markets.Consolidation in the markets seem to be on cards, looking back on lessons from from the 2008 crisis.It could be an opportunity to acquire high-quality assets to fuel growth in a recovering market, albeit at compelling cheaper valuations.The lower interest rates after the Fed’s rate cut should also allow more GCC debt issuances (conventional and sukuk). Corporates with sound fundamentals and good equity stories would remain resilient and may find a new normal as the situation improves, although how soon that would be remains to be seen.

Acuity Knowledge Partners, through its Investment Banking practice, is partnering with banks and corporate finance advisories across the Middle East to successfully achieve their objectives by leveraging our research and analysis services pertaining to M&A, capital markets and Islamic finance. We have partnered with leading investment banks in the Middle East since 2013, helping them scale up their coverage, while reducing overall costs and time-to-market through access to a large talent pool.

Explore our investment banking solutions for the middle east and see how you can benefit.

Sources

-

IMF

-

S&P

-

Moody’s

-

Fitch

-

Euromoney

-

Institute of International Finance

-

Bloomberg

-

Ernst & Young Middle East

-

Press releases

What's your view?

About the Author

Neha Agrawal has over 13 years of experience in investment banking and consulting. At Acuity Knowledge Partners, she leads various Middle Eastern Investment Banking engagements supporting across Capital Markets, Islamic Finance, Strategy, and proprietary investments. During her tenure with Acuity knowledge partners, has worked with consulting firms, boutique advisory firms and leading investment banks across the US, Middle East and Africa. Previously she worked with Bank of America Merrill Lynch, where she handled various roles across the investment banking division. Neha holds an MBA from ICFAI Business School, Hyderabad and is a Graduate in Science (Hons).

Like the way we think?

Next time we post something new, we'll send it to your inbox