Published on August 11, 2023 by Gaurav Sharma and Surbhi Joshi

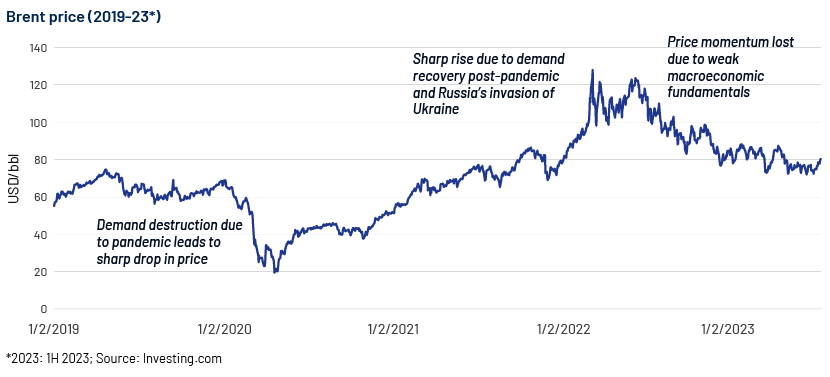

The Brent oil price showed high volatility and reached close to pre-pandemic levels in 1H 2023. It averaged around USD80/bbl, a sharp decline of nearly 38% from its peak of USD128/bbl in 2022. The inflated price in 2021-22 due to economies reopening after pandemic-related restrictions and Russia’s invasion of Ukraine struggled to maintain the momentum in 1H 2023 as macroeconomic gloom overpowered market fundamentals.

Price volatility so far in 2023 is largely attributed to OPEC+ moves to keep prices high, weaker-than-expected demand growth in China, soaring inflation, persistent interest rate hikes by central banks, the failure of a number of major US banks, the prolonged debate on the US debt-ceiling limit and the unexpected resilience of Russian supply after the 2022 EU ban and the G7 price cap.

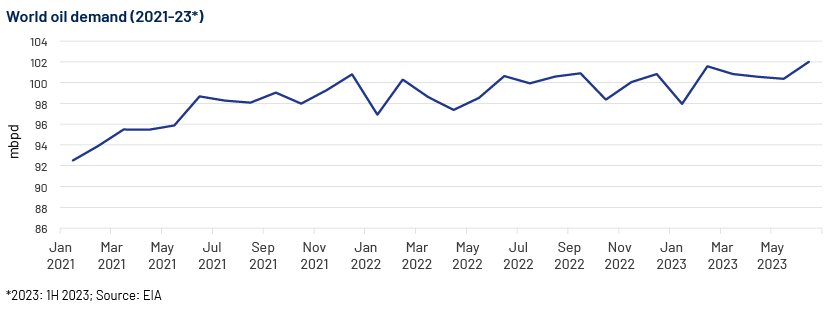

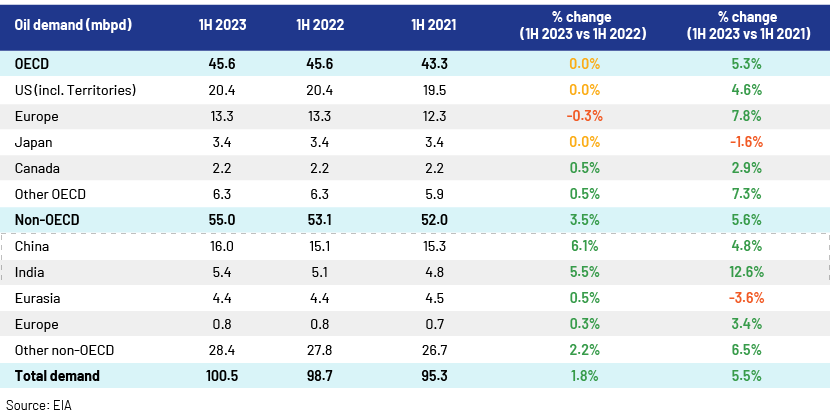

Average global oil demand increased by 1.8% to 100.5 million barrels per day (mbpd) in 1H 2023 compared to 98.7 mbpd in 1H 2022, and by 5.5% from 95.3 mbpd in 1H 2021.

Although China’s demand growth was lower than market expectations, as the country’s manufacturing sector struggled with the PMI recording below 50 in 2Q 2023, the country’s reopening led to some rebound in travel demand, supporting crude oil prices. China’s service sector also witnessed growth.

Growth in India’s manufacturing and service sector also supported global oil demand; the country’s PMI recorded above 50 regularly in 1H 2023 along with growth in the travel sector, highlighting economic expansion.

In contrast, macroeconomic concerns such as high inflation and increasing interest rates in the OECD nations, particularly in the US and Europe, impacted industrial output, creating headwinds to growth in oil demand in 1H 2023.

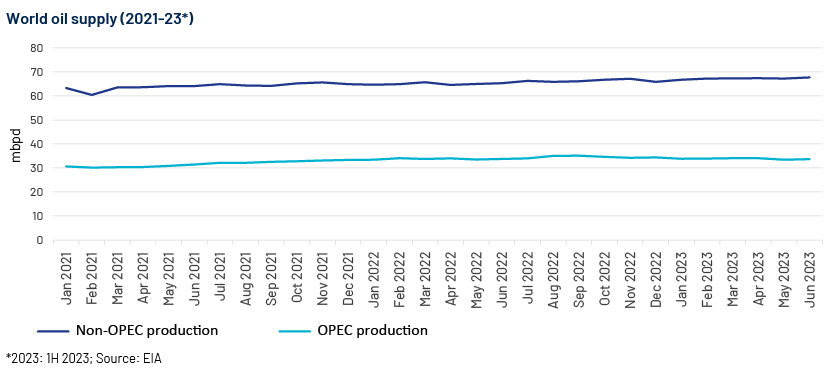

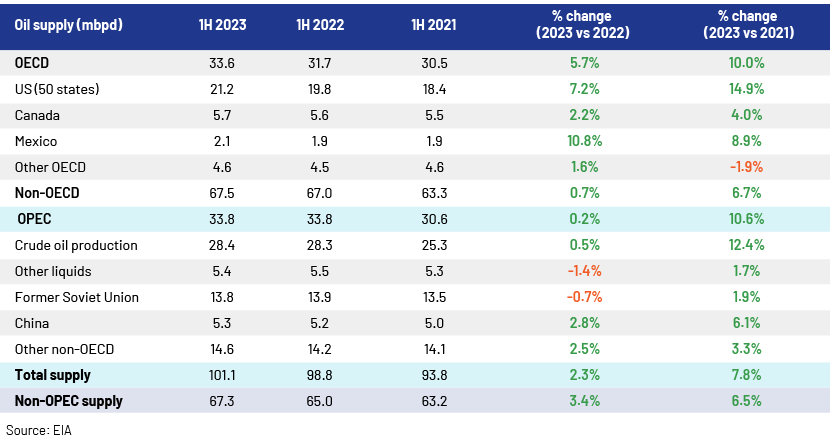

Average global oil supply increased by 2.3% to 101.1 mbpd in 1H 2023 compared to 98.8 mbpd in 1H 2022, and by 7.8% from 93.8 mbpd in 1H 2021.

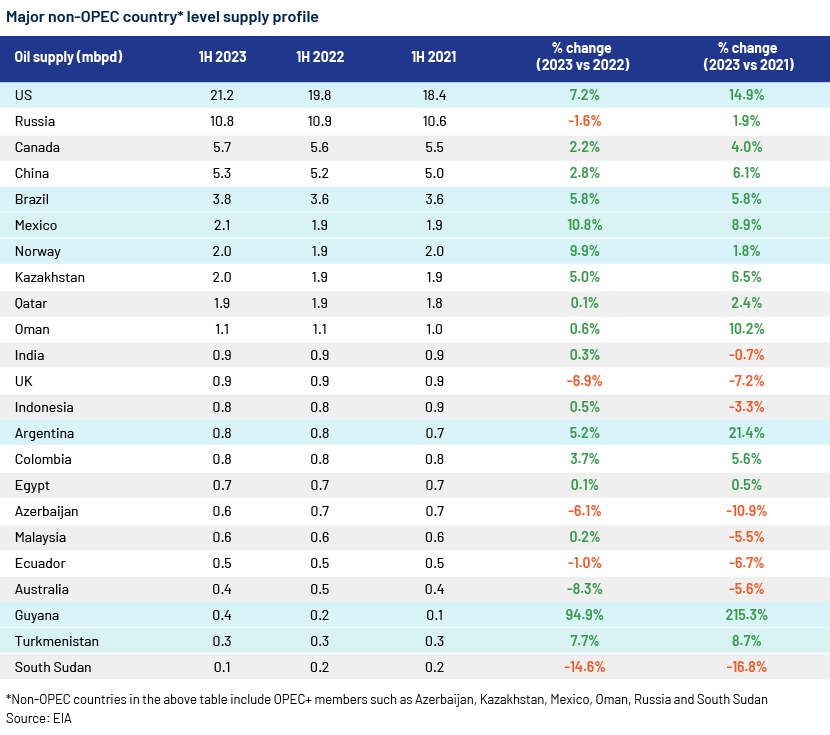

On the supply side, the picture emerged against market expectations of tight supply as non-OPEC production increased to 67.3 mbpd, an increase of 3.4% from 65.0 mbpd in 1H 2022 and 6.5% from 63.2 mbpd in 1H 2021.

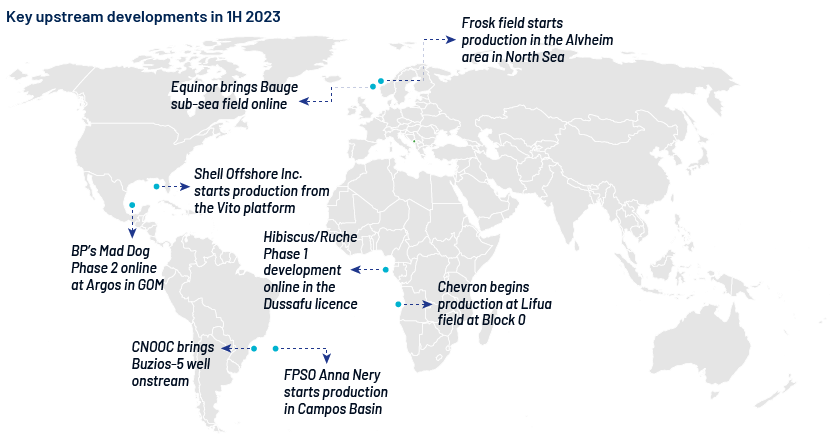

Oil supply increased mainly from North America (primarily the US and Mexico) and Central and South America (primarily Guyana, Brazil and Argentina), Norway and Turkmenistan.

Despite the high oil prices, OPEC members’ production remained flat in 1H 2023 from 1H 2022 at 33.8 mbpd. OPEC+** production averaged 37.7 mbpd in 1H 2023, 4.8% lower than the average target production quota of 39.6 mbpd announced during the period.

**Excludes members exempt from cuts: Iran, Libya and Venezuela and the member that announced non-compliance with cuts: Mexico

However, sanctioned countries such as Russia (OPEC+) and Iran (OPEC) performed against market expectations. Russian supplies showed resilience despite the EU ban and G7 price cap on its oil trade; production averaged 10.8 mbpd in 1H 2023, compared to 10.9 mbpd in 1H 2022 and 10.6 mbpd in 1H 2021. Iran’s exports at 2.7 mbpd in 1H 2023 were 5% higher than the 2.5 mbpd in 1H 2022 and 14.8% more than the 2.3 mbpd in 1H 2021. The country’s production at c.2.8 mbpd in May 2023 and June 2023 was the highest since 2018.

OPEC+’s Kazakhstan also showed significant growth in production in 1H 2023.

Other major supply-side events that impacted prices in 1H 2023:

-

US’s release of crude oil from the Strategic Petroleum Reserve (SPR): The US Department of Energy (DOE) announced the sale of 26m barrels of oil from the SPR from 01 April to 30 June 2023, after releasing a record 180m barrels in 2022.

-

OPEC+’s production cut announcement: OPEC+ announced oil production cuts in April 2023 by core OPEC (1.16 mbpd) and Russia (500,000 bpd); in June 2023, Saudi Arabia added a further 1 mbpd cut. In July 2023, Saudi Arabia (1 mbpd), Russia (500,000 bpd) and Algeria (20,000 bpd) extended the output cuts to August 2023.

-

Halting Iraq’s crude exports: Turkey halted Iraq's 450,000 bpd of exports via a crude oil pipeline from the semi-autonomous Kurdistan region in northern Iraq to the Turkish port of Ceyhan on 25 March 2023. The halt had cost the Kurdistan Regional Government (KRG) over USD2bn until mid-June 2023, according to Reuters.

-

Wildfires in Canada: In May 2023, these wildfires prompted producers to close at least 280,000 boed, more than 3% of Canada’s total oil output.

-

Decline in US rig count: The US rig count declined by 17% to 717 on 30 June 2023 from 860 on 01 January 2023.

Notes :

OPEC: Organization of the Petroleum Exporting Countries: Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iraq, Kuwait, Nigeria, Saudi Arabia, the UAE, Iran, Libya and Venezuela

OPEC+: Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iraq, Kuwait, Nigeria, Saudi Arabia, the UAE, Iran, Libya, Venezuela, Azerbaijan, Kazakhstan, Mexico, Oman, Russia, Bahrain, Brunei, Malaysia, Sudan and South Sudan

OECD: Organization for Economic Cooperation and Development: Australia, Austria, Belgium, Canada, Chile, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, Latvia, Lithuania, Luxembourg, Mexico, the Netherlands, New Zealand, Norway, Poland, Portugal, Slovakia, Slovenia, South Korea, Spain, Sweden, Switzerland, Turkey, the UK and the US

Investment in the oil and gas sector, which slumped in recent years after peaking in 2014, has now gained pace. This year, the market focus has shifted to energy security, forcing oil majors and big companies to commit a larger share of their capital budgets to developing oil and natural gas businesses. For instance, Shell announced a USD100bn investment in upstream and LNG through 2030. The oil and gas sector has 70 large projects under development, 25% more than in 2020, but still 35% below the 2014 level, according to Goldman Sachs’s July 2023 statement. The International Energy Agency (IEA) estimates global upstream oil and gas investment to increase by 11% in 2023 to USD528bn from USD474bn in 2022.

Acuity Knowledge Partners’ view:

Despite OPEC+’s efforts to keep oil prices high, Brent prices remained under pressure in 1H 2023 amid weak global economic performance, with major economies witnessing a contraction, PMI indices at their lowest over a number of months and high inflation levels. With global banks’ efforts to keep inflation in check and expected stimulus from China, 2H 2023 could see economic growth, with a positive impact on crude demand and prices. If, however, prices remain higher for longer due to supply tightness, this could dampen expectations for a global economic recovery and impact crude demand negatively.

How Acuity Knowledge Partners can help

We have a large pool of oil and gas experts experienced in providing strategic support across the value chain. Over the years, we have partnered with leading energy companies and have worked closely with their strategy, business development, market intelligence and M&A teams, providing the information and analysis necessary to achieve business objectives.

We also offer expertise in the power; renewables; metals and mining; environmental, social and governance; (ESG) and sustainability space.

Sources:

OPEC, Oil Price, YCharts, CNBC, CNBC1, Business Today, Economist, Reuters, DOE, IEA, World Bank, Reuters, STEO, EIA , BP, BWEnergy, OGJ , API , AkerBP, Clarksons , Market Screener, Trading Economics, IEA1, IEA2, IEA3, IEA4, IEA5, IEA6, IEA7, Investments, CNBC, DOE , Reuters ,Reuters, Reuters, Equinor, Oil and Gas Report, Goldman, Enverus, Forbes, Upstream, Reuters, TE, OP, OP , OPE, Europa, OPEC, OPEC1, OPEC2 , PMI , SP, UK PMI, EIA , NYTimes , ECB, Oil PriceWhat's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox