Published on May 6, 2024 by Ahamed Fawas

What is forensics analysis?

Forensic analysis is a critical, specialised skill that sharpens investment decision making. It demystifies numerical anomalies, reveals pivotal accounting issues and provides a clear interpretation of new financial regulations on reported performance. By dissecting complex accounting practices and corroborating short-seller claims, forensic experts empower hedge-fund clients with deeper financial insights. This not only enhances due diligence of financial statements, but also optimises onshore analysts’ focus on strategic, high-impact tasks.

Case study: Bio plastics; a breakthrough that wasn’t...

2017: AlphaShorts (not the real name), a hedge fund employing a long/short equity strategy and a long-term client, approached Acuity Knowledge Partners’ (Acuity’s) forensic analysis team with the missive to look at a company that it felt may be a candidate for short selling.

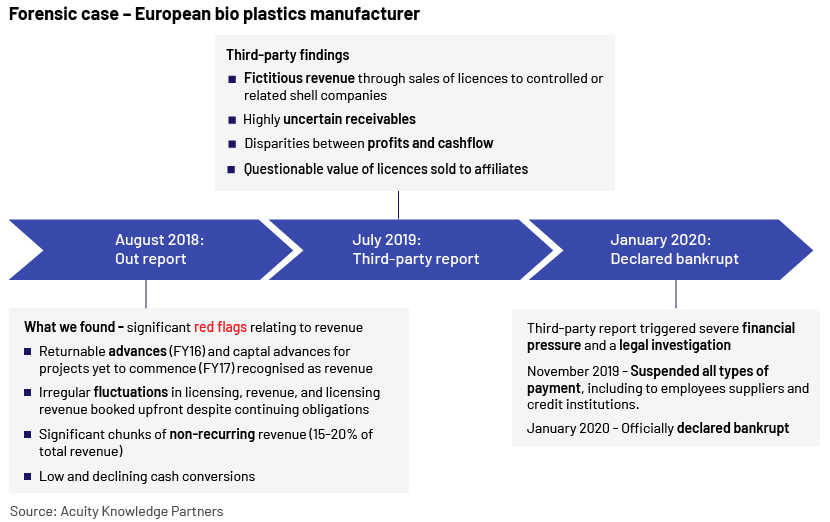

On the face of it, Plastics Pro (not the real name) was a great success story, driven by innovation and game-changing new technology. The company claimed to have made significant progress on a breakthrough in recycling technology that would make it possible to recycle more than 90% of daily-use plastics. Alpha Shorts, however, was sceptical about this claim and commissioned Acuity’s forensic analysis team to conduct an in-depth study to check for accounting anomalies, if any. A timeline-based view of what followed is presented below.

In brief, Acuity’s forensic analysis team found significant red flags relating to revenue, including irregular revenue licensing patterns not in line with how the company described the terms of contract. Significant related-party transactions leading to questionable non-recurring revenue made up a large portion of total reported revenue each year, and there was at least one instance where revenue appeared to have been recognised fraudulently (returnable contribution from a joint-venture partner was recognised as revenue at the start of the contract). Most of these findings were later corroborated by a third-party research report that triggered a chain of events that culminated in the company filing for bankruptcy.

This is one example of how a hedge-fund client following an active long-short strategy benefited from the forensic analysis team’s deep expertise in detecting accounting and analytical anomalies to “connect the dots”, i.e., weigh the financial and non-financial red flags, to ascertain whether the issues unearthed were part of a broader pattern that could unravel in the near term.

Short thesis support is one of the many ways in which forensic analysis can better inform hedge-fund strategies. Long-only managers are the second most prominent users of Acuity’s forensic analysis support, with the most common use case being a deep-dive forensic review of potential long positions and annual review of accounting practices in existing portfolio companies/positions. Support for long-only managers has historically been concentrated on emerging markets or mid- to small-cap stocks in developed markets. Short thesis support has covered developed and developing markets in equal measure. Listed below are the most common hedge-fund/asset-management strategies that use forensic accounting support.

Forensic support and different hedge-fund strategies

Long/short strategy or short-focused funds

-

Forensic deep dives – reporting on accounting problems that support the short thesis

-

Validating/disproving concerns expressed by insiders/other analysts relating to a potential short position

-

Review of potential accounting problems in a long position and how corporate governance and remuneration structures may facilitate or incentivise manipulation of financial performance

Long-only funds

-

Forensic deep dives that provide a deep understanding of historical financial performance and financial position and

-

Provide insights on whether management has a history of making questionable accounting choices.

-

Provide a clear idea of sustainable earnings, quality of the balance sheet and quality of cashflow.

-

Facilitate informed engagement with management, highlighting areas that need further clarification from management.

-

Optional – insights on how remuneration and corporate governance frameworks may influence financial reporting.

-

-

Checking the accuracy, long-term impact and materiality of accounting issues mentioned in short seller reports.

-

Reports demystifying complex accounting that affect a stock/industry sector and their impact on financial statements/reported performance.

-

Forensic accounting screeners – to identify potential areas of concern that may be worth investigating further. Also used at the initial stage to filter out stocks that could have major problems and would not be suitable for investment.

Different layers of forensic analysis

Acuity offers completely customisable forensic analysis support to clients. The services typically fall broadly within three different types of support of varying depth of scrutiny and timing as shown below. These range from custom-designed screeners (2-5 days) to full deep dives (15-20 days).

| Forensic screener | Focused forensic review | Forensic analysis deep dive | |

| Scope | 1. Uses 50-60 forensic indicators under eight different criteria 2. An initial gauge of the health of the company | 1. Focuses on six selected areas for in-depth analytical review: (1) revenue, (2) M&A, (3) working capital, (4) earnings, (5) debt and (6) cashflow 2. Deep review of selected red flags identified from initial analytical review of the areas mentioned above | 1. In-depth quantitative and qualitative analysis covering five historical years of published financials and other publicly available material 2. Includes a review of governance and remuneration structures that may indicate a potentially conducive environment/motivation for manipulation |

| Use case | 1. First-round screener: identifies analytical red flags that may require further investigation. | 1. Focused analysis on six areas where red flags are common or areas flagged by the client. | 1. In-depth review, providing a higher level of comfort. 2. Flagging governance and remuneration structure weaknesses as well. |

| Others | 1. Can be automated by linking to a data source (FactSet, Bloomberg) 2. Linking to a data source enables comparison and benchmarking with peers and running this for multiple companies within a short period of time | 1. Preferred product for hedge-fund managers seeking to take a short position. 2. Main areas of review and initial analytical procedures are based on literature and empirical evidence on common areas of red flags. | 1. Asset managers use this product as part of in-depth annual or pre-investment due diligence. 2. Captures a number of qualitative red flags, such as related-party structures, concentration of decision-making power and lack of independence etc., not covered in other models. 3. Also looks at weaknesses in governance that could influence financial statement manipulation. |

Examples:

The following table shows the extent to which each of the different layers of forensic analysis (discussed above) would have spotted the red flags highlighted in two recent high-profile scandals triggered by short-seller reports.

| Forensic screener | Focused forensic review | Forensic analysis deep dive | |

| Main statistics | |||

| Adani Group | |||

| Deterioration in leverage ratios | √ | √ | √ |

| Low cash conversions | √ | √ | √ |

| Significant inorganic revenue growth over the past four years | √ | √ | √ |

| Audited by a small firm | √ | √ | √ |

| Breach of covenant by parent company | √ | √ | |

| Promoter shares pledged for loans | √ | √ | |

| High CFO turnover | √ | √ | |

| Audit qualifications relating to weak financial control | √ | √ | |

| Extent of control by family members – material governance lapses, conducive environment for financial-statement fraud | √ | ||

| Extent and volume of related-party transactions | √ | ||

| Profiles of audit partners and the lack of audit experience | √ | ||

| Breach of covenants by group companies | √ | ||

| NMC Health | |||

| High margins cf. peers’ | √ | √ | √ |

| Decline in organic growth rates | √ | √ | √ |

| Low interest income cf. cash balance – questions the authenticity of cash | √ | √ | √ |

| High debt burden/likely understatement of debt (operating leases, convertible instruments, etc.) | √ | √ | √ |

| Increasing portion of balance sheet in intangible assets | √ | √ | √ |

| Indicators of undisclosed reverse factoring arrangements/payables stretching | √ | √ | |

| Large companies acquired at high premiums, with likely overvalued intangible asset balances | √ | √ | |

| Acquired companies making losses or underperforming | √ | √ | |

| Signs of overstated earnings (declining provisions, capitalisation) | √ | √ | |

| Large number of related-party transactions | √ | ||

| Control and governance lapses (company controlled by a single individual and the lack of independence of the board) | √ | ||

| Director remuneration tripled in two years | √ | ||

How Acuity Knowledge Partners can help

Forensic analysis has emerged as a very useful niche tool for investors. The role of forensic analysis differs based on whether an investor is bullish or bearish. For bearish investors, forensic analysis is important because accounting-related anomalies can be a strong catalyst for short positions. For bullish investors, forensic analysis provides an important layer of investment validation. It analyses whether a company’s historical results are sustainable and support projected results, or whether these results are tainted by factors such as questionable accounting. It also analyses companies’ strategic and operating choices.

Our Forensic Analysis team helps clients navigate complex accounting treatment in financial statements and its impact on earnings and the balance sheet.

Our team of forensic analysts have more than 10 years of experience in catering to this niche market, with hands-on experience in dealing with securities in diverse geographies and sectors. Our expertise seamlessly aligns with hedge fund research services, enabling clients to make informed investment decisions backed by comprehensive forensic insights.

What's your view?

About the Author

Fawas is currently the head of Acuity Knowledge Partners’ (Acuity’s) Forensic Analysis team. He has 12 years of forensic analysis experience and 16 years of total work experience. He is knowledgeable in forensic analysis, investment research (with a focus on quality of earnings) and auditing, and is well versed with corporate governance best practices and the UK Combined Code. Currently at Acuity, he manages a team preparing deep-dive forensic analysis reports for long-only asset managers, designing customised forensic analysis screeners and providing forensic accounting support to clients looking to short stocks. Fawas started his career at Ernst & Young, where he was an executive in charge of statutory audits..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox