Published on June 19, 2023 by Salinda Perera

“Never, ever, think about something else when you should be thinking about the power of incentives.”

– Charlie Munger (Berkshire Hathaway)

In this blog post, we look at two aspects of the Silicon Valley Bank (SVB) collapse that have not, in our opinion, received the prominence that was due: (1) Even under the available-for-sale (AFS) classification, marked-to-market losses affect net income and EPS numbers only at the point when these securities are sold or management “decides to sell”. (2) Perhaps more importantly, SVB and some other regional banks had a considerable share of senior decision-makers’ remuneration tied directly to the net income and related return ratios; this would almost certainly have served as a strong added incentive to postpone the sale of AFS assets and/or acknowledge the need to sell these assets to beyond 4Q22.

A quick primer on accounting for investments in debt securities

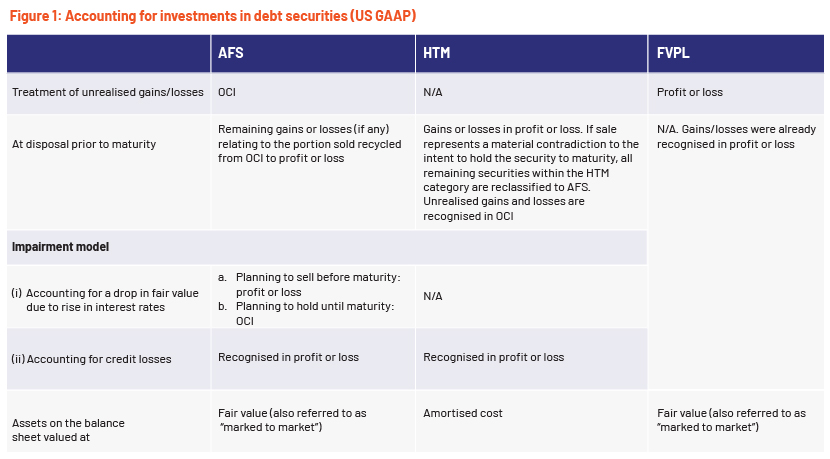

A key distinction in accounting for AFS debt investments[1] is that an entity should recognise related unrealised gains or losses in other comprehensive income (OCI). This is different from debt securities classified under the other two categories: fair value through profit or loss (FVPL) requires gains or losses to be recognised immediately in profit or loss, while held-to-maturity (HTM) does not require recognition of unrealised gains or losses unless the securities are disposed of prior to maturity (Figure 1).

8.2 AFS debt security impairment model (pwc.com)

Handbook: Investments (kpmg.us)

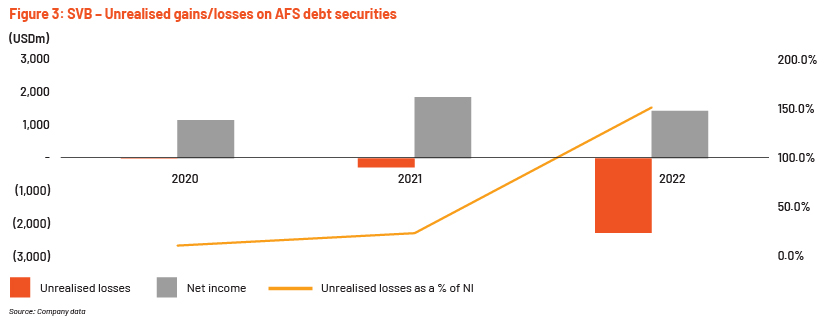

However, the AFS impairment model requires recognition of unrealised losses in profit or loss immediately if the securities are expected to be disposed of prior to maturity: ASC 326-30-35-10 states that an entity should recognise any unrealised fair value losses in profit or loss if it expects to sell an AFS debt instrument at a loss prior to its maturity. This distinction is important in the case of SVB, as it had a significant amount of unrealised losses in relation to AFS securities in its OCI as of end-2022. We believe that it may have anticipated disposal of some of the securities within its AFS portfolio at a loss amid increasing interest rates as of end-2022.

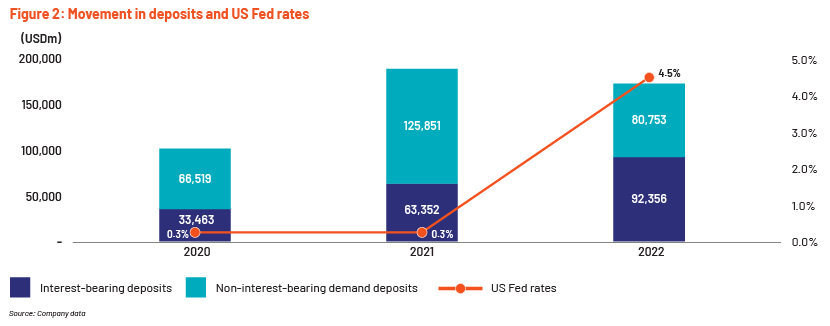

SVB’s interest-bearing deposits (presumably at higher interest rates) increased 45.8% to USD92.4bn as of end-2022 from USD63.4bn as of end-2021 and USD35.5bn as of end-2020, while its AFS portfolio was yielding only 1.8% (at disposal vs the 4.5% Fed rate as of end-2022). An investor communication issued less than two weeks after the financial statements for 2022 were released stated that SVB had sold substantially all AFS securities with the intention of reinvesting them in response to higher interest rates, pressured public and private markets, and elevated cash burn levels from clients. The 8.5% drop in deposits, driven mainly by non-interest-bearing deposits, also likely played a key part in the disposal of AFS securities to manage its liquidity needs.

Hence, there is strong evidence to suggest that SVB intended to sell some AFS assets prior to issuing its 2022 annual report. Therefore, SVB should have recognised the loss in 2022 as per the US GAAP accounting requirement that losses be recognised in profit or loss if there is an expectation to sell.

However, no losses were recognised in profit or loss until it disposed of USD21.0bn of AFS debt securities at a loss of USD1.8bn in March 2023.

Hence, the problem was not only that SVB classified a lot of its investments as HTM and avoided marking these assets to market; there was also the issue of AFS securities that were marked to market on the balance sheet without a corresponding impact on net income/EPS.

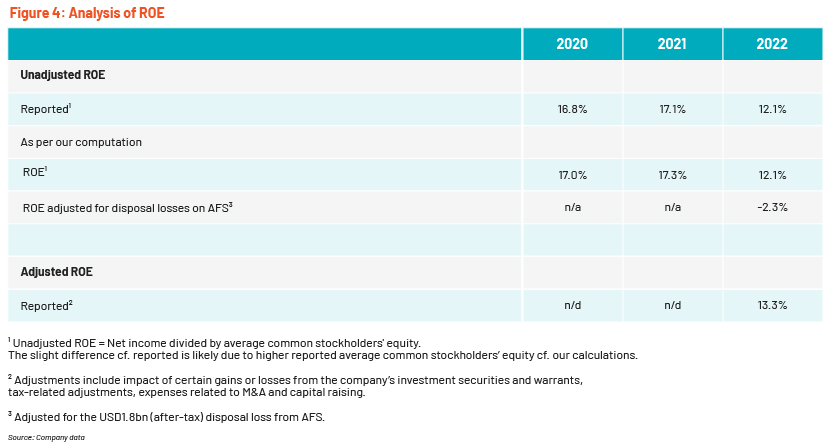

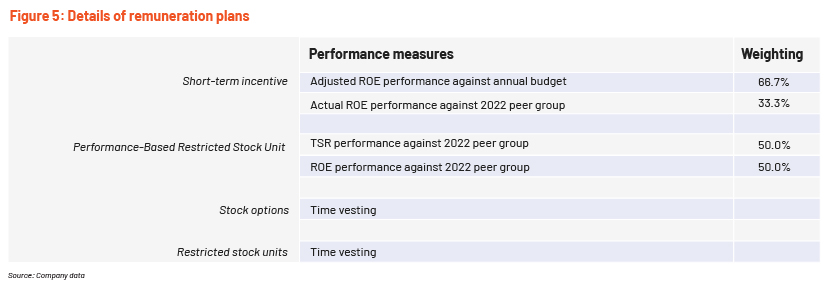

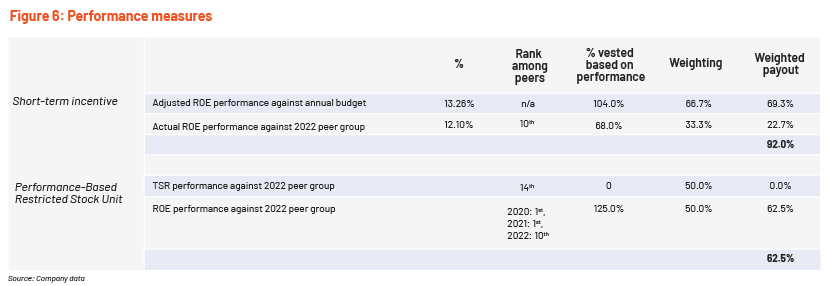

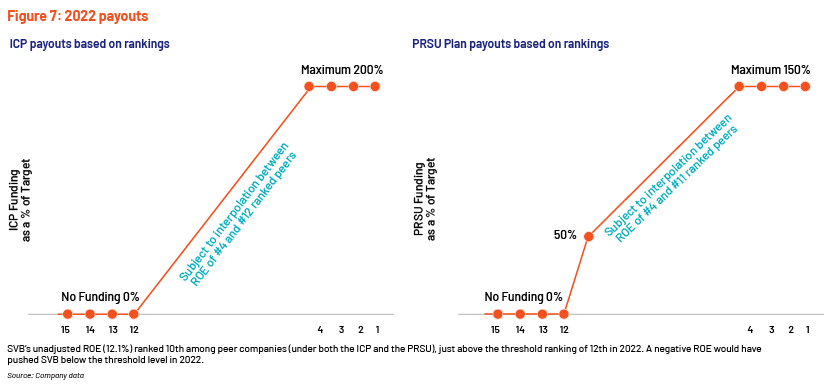

Decision to not recognise unrealised losses on AFS debt securities may have been influenced by their negative impact on executive pay: Had SVB recognised the USD1.8bn in 2022 (the loss related to the AFS securities disposed of) on the basis that the disposal was anticipated as of end-2022, SVB’s ROE would have turned negative (vs a reported ratio of 12.1%). Unadjusted ROE is used as a performance measure of the Incentive Compensation Plan (ICP; 33% weighting) and the Performance-Based Restricted Stock Unit (PRSU; 50% weighting). Refer to Figures 4 and 5.

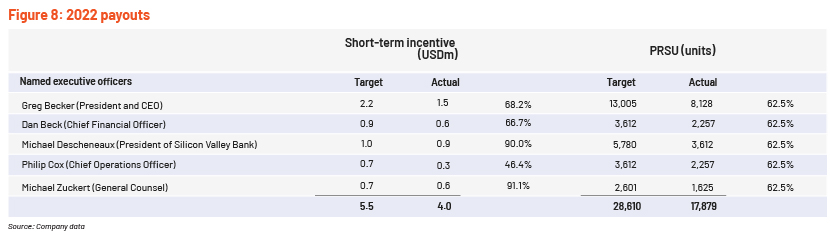

Negative ROE would mean that payout under the ICP would be 22.7% less and the PRSU, too, would be lower: The ICP payment would have been 22.7% less than the 92.0% payout made (against the target pay) in 2022. PRSU payments would also have been lower since the payment was entirely dependent on ROE over 2020-22, as TSR, the other performance measure, did not meet the minimum performance threshold over the period (Figure 6). Therefore, the negative impact on executive pay may have been a reason for non-recognition of fair-value losses despite disposal of AFS debt securities being probable as of end-2022.

CEO sold shares worth USD3.5m and CFO sold shares worth USD0.6m less than two weeks before the collapse. This may be another indication that the senior executives were trying to protect their own interests at the expense of the survival of the bank.

SVB’s close peers, too, appear to have been incentivised to defer recognition of AFS losses in the income statement

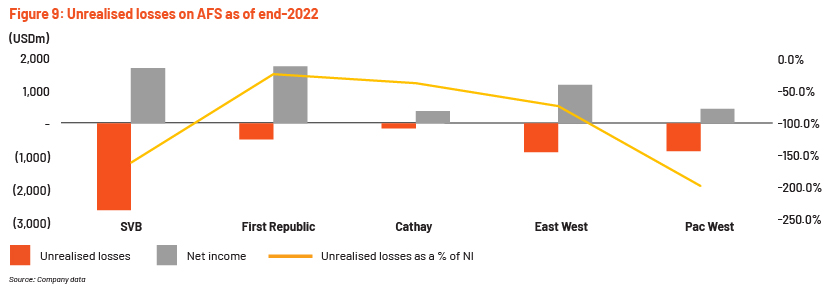

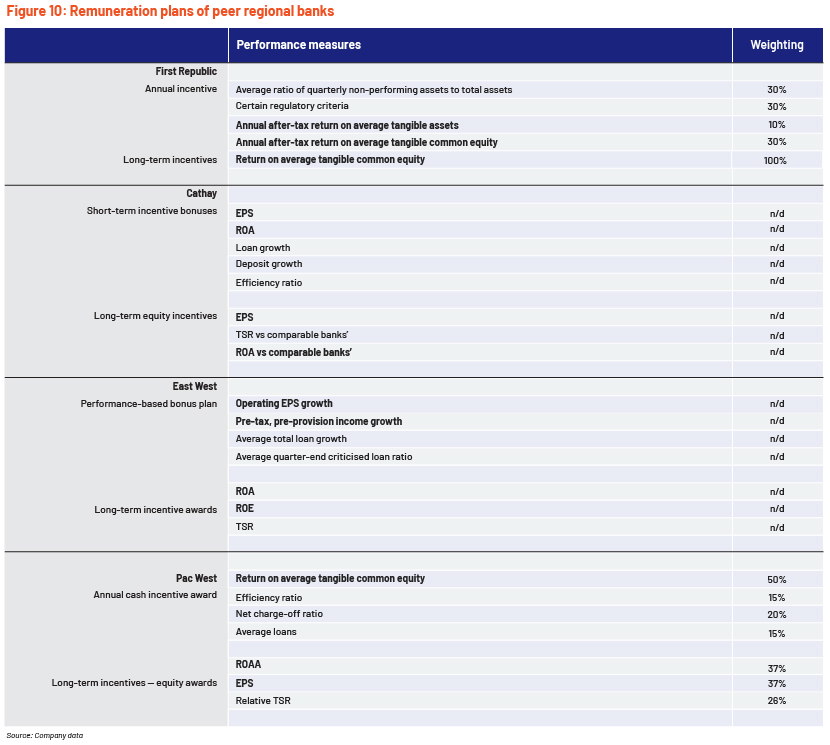

Figure 9 shows unrealised losses on AFS for selected peers (regional banks) and the materiality of unrealised losses from AFS debt securities as of end-2022, some of which may need to be disposed of at a loss given the rising interest rates. Similar to SVB, these banks may need to book unrealised losses on AFS in profit or loss in line with US GAAP. These banks also have remuneration policies that tie certain performance measures to net income-related ratios, which may make top executives reluctant to report AFS losses in their financial reports on time (see Figure 10).

How Acuity Knowledge Partners can help

As part of in-depth forensic analysis review, we also look at the interplay between executive remuneration matrices, reported performance and the accounting choices that impact reported performance, in order to identify accounting choices that may have been influenced by management reward structures and, therefore, may make reported performance unsustainable.

Forensic analysis has now emerged as a very useful niche tool for investors. The role of forensic analysis differs based on whether an investor is bullish or bearish. For bearish investors, forensic analysis is important because accounting-related anomalies can be a strong catalyst for short positions. For bullish investors, forensic analysis provides an important layer of investment validation. It analyses whether historical results of a company are sustainable and support projected results, or whether these results are tainted by factors such as questionable accounting. It also analyses strategic and operational choices of companies.

Our team of forensic analysts have more than 10 years of experience in catering to this niche market, with hands-on experience in dealing with securities in diverse geographies and sectors.

Sources:

-

Impairment of AFS Debt Securities under ASC 326 | GAAP Dynamics

-

Explainer: What Is The Silicon Valley Bank Crisis All About? (outlookindia.com)

-

United States Federal Reserve Interest Rate Decision (investing.com)

-

[1] Accounting for equity securities under AFS is different from that for AFS debt securities under US GAAP

- https://frv.kpmg.us/reference-library/2022/handbook-investments.html

Tags:

What's your view?

About the Author

Salinda had been a part of Acuity Knowledge Partners’ (Acuity’s) Forensic Analysis team for 7 years and has 11 years of total work experience. He is experienced in providing forensic support and quality-control support on deliverables of team members and preparing accounting diagnostic reports on a number of sectors, including banking, energy and technology. Prior to joining Acuity, he worked as an assistant manager at Ernst & Young, where he was responsible for leading a team in financial statement audits of companies in different sectors, including banking, manufacturing and trading. He is an Associate Member of the Institute of Chartered Accountants of Sri Lanka and a Level III candidate in..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox