Published on September 16, 2022 by Gaurav Singh

The growing adoption of solar power in the energy-generation mix has raised concern about land use, limiting scope for solar adoption in small countries and countries with hilly terrain. Countries such as Japan and Singapore have large-scale ground-mounted photovoltaic (PV) installations, resulting in expensive real estate. Even in countries with large vacant areas of land, away from residential and industrial areas, the cost of setting up a PV plant is high and not that economical and efficient because of the long transmission lines needed to transmit electricity to the residential and industrial areas. Western China faces similar issues. It has abundant wind and solar resources and large vacant areas of land, but the electricity produced cannot be used by areas nearby and requires long transmission lines, currently only partially built. Gansu and Xinjiang, therefore, see a 20-22% reduction in the power they could otherwise have received, limiting investor returns and confidence. Installing PV plants in urban or populated areas, on the other hand, is expensive due to higher real estate costs and opportunity costs.

Floating PV (FPV) plants offer a viable and much-needed solution. They use water surfaces that do not serve an ecological, economical or recreational purpose. Such bodies of water can be used at low or no cost, unlike land, which requires substantial capital for lease or purchase. To encourage power producers to use idle water bodies, countries such as China, the US and South Korea have started offering financial incentives for installing solar PV panels on water.

-

Vietnam’s Ministry of Industry and Trade introduced a feed-in tariff (FIT) scheme for on-grid utility-scale solar plant installation in 2017 that included FPV projects. Its latest draft (released on 12 April 2019) indicates the new FIT for FPV projects will be 8.5% higher than that for ground-mounted PV panels

-

Taiwan applies specific FITs for FPV plants; these are higher than FITs for ground-mounted PV systems. In 2021, the FIT for ground-mounted PV projects was NTD3.7236 per kWh, whereas for FPV panels, it was NTD4.1204 per kWh

-

In 2018, Massachusetts implemented the Solar Massachusetts Renewable Target (SMART) programme that allocated a location-based compensation rate add-on of USD0.03 per kWh (1-80MW) for FPV projects

-

Also in 2018, South Korea fixed an obligatory renewable service supply ratio for power producers with installed generation capacity of 500MW or more. Under this mandate, 6% of their total power generation must be through renewables. Based on the scheme, a weighting of 1.5 is applied for FPV installations compared with 0.7 for land-based systems

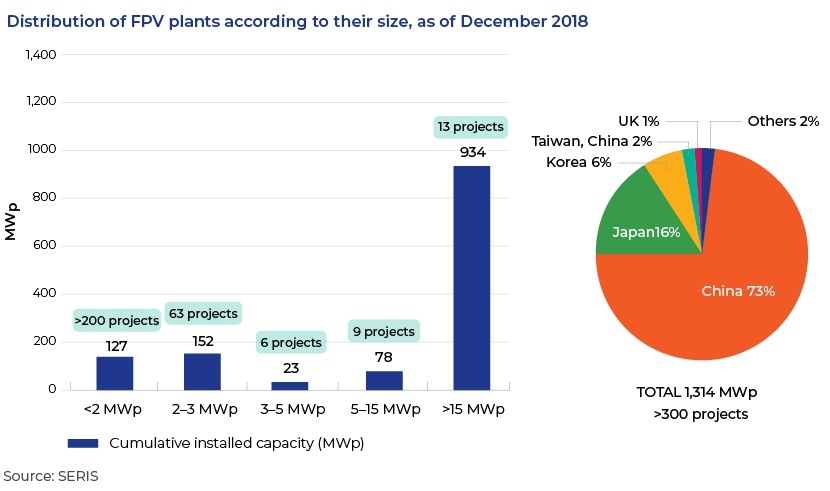

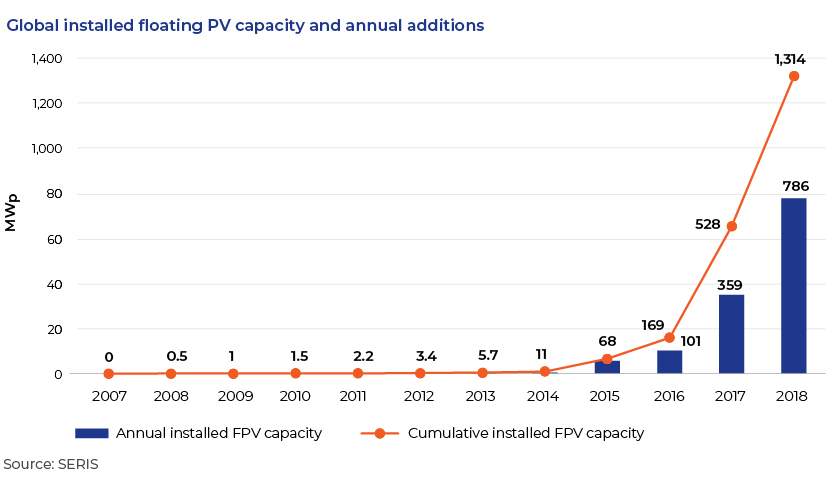

Floating solar farms are in vogue. The first pilot plant with 20kW capacity was installed in Japan in 2007, followed by the deployment of the first commercial plant of 175kW in the US in 2008. The first large-scale plant (larger than 10MW) was installed in 2016. Since then, FPV plant size has grown exponentially globally, increasing cumulative capacity from 169MW in 2016 to over 2.6GW in 2020.

Benefits of FPV projects

-

Avoids conflicts relating to land – between agriculture and energy production

-

Eliminates costs associated with land acquisition and site preparation

-

Improves performance of solar projects, as shading effects are reduced

-

Ensures larger installed capacity per unit area

-

Reduces costs and increases operational benefits if co-located with hydropower projects

-

Reduces water evaporation, increasing the availability of water for other applications

-

Reduces costs associated with waterbody maintenance (as it reduces algae growth)

-

Converts underused space into revenue-generating space

Despite the overwhelming benefits associated with FPV projects, they account for only 0.5% of solar PV installations globally. This is because the benefits are offset by obstacles such as the following:

-

Floating structures, mooring and anchoring systems and development costs add a further 20-25% to system costs

-

Challenges due to varying water levels, reservoir depth and bed type, and extreme climatic conditions could increase the capital expenditure requirement (to more than that required for a ground-based solar PV power plant)

-

The project base is subject to constant friction and mechanical stress due to its constant movement on the water body. Poor design could lead to catastrophic project failures

-

Projects also are prone to corrosion and degradation due to moisture. Hence, it is critical to select PV components based on the body material, so they can last for about 25 years in harsh weather conditions

-

Deep-dive technical due diligence is needed to assess suitable island and anchoring design, commercial viability and technical feasibility

Market overview

China is the leading international market in terms of FPV installations and will likely continue to dominate over the next five years, followed closely by India and South Korea. The installed floating solar power capacity has grown more than hundredfold across 35 countries, reaching over 2.6GW of capacity in 2020. China, Indonesia, India, South Korea, Thailand and Vietnam are expected to drive demand for floating solar in the future.

Asian countries are also taking the lead in terms of developing large-scale FPV projects. In January 2022, China commissioned the world’s largest FPV project with 320MW capacity in Dezhou, and South Korea is developing the largest project so far, with 2.1GW capacity, expected to be operational by 2025. India is building a 600MW FPV farm at the Omkareshwar Dam on the Narmada River; it expects to complete it by 2022-23.

With FPV power plants, the electricity can be self-consumed or transmitted to the grid of a local or national power utility. This also depends on government support schemes for FPV solar power plants, some of which are listed below:

-

Japan: The FIT for FPV power plants is high in Japan; hence, power producers sell their electricity to the grid. However, power projects larger than 2MW no longer benefit from FITs, and the trend will likely shift towards self-consumption

-

UK: The Queen Elizabeth II and Godley FPV plants sell their electricity to a local water-treatment facility, and the surplus is injected to the grid. Both FPV plants were commissioned under the UK’s renewable power obligation scheme

-

China: The majority of megawatt-scale FPV power plants in Anhui Province is built under the Top Runner Program. The electricity produced is supplied to local power companies at a rate determined through competitive bidding

Typical financing structures for FPV projects

-

Less than 5MW

-

Business model: Self-consumption (excess electricity produced is sold to the grid)

-

Ownership: Commercial and industrial companies

-

Financing structure:

-

Pure equity or a mix of equity and corporate financing

-

Owners should have the water body within their premises

-

Owners can borrow money against the company’s balance sheet

-

Vendor financing is also possible

-

-

More than 5MW

-

Business model: Power sold to the grid through PPA

-

Ownership: Independent power producers and public utilities

-

Financing structure:

-

Mix of debt and equity (80:20 ratio)

-

Balance sheet or non-recourse project finance

-

Projects with more than 10MW capacity can use a project finance structure similar to that used by a ground-mounted utility-scale solar PV project

-

-

-

In Japan, Taiwan and China, local commercial banks have financed FPV projects and taken advantage of long-term FITs available for FPV projects. Large international commercial banks and multilateral development finance institutions are also expected to get involved in providing financing for such projects.

Given the numerous benefits, the number of projects that merge FPV with hydropower is likely to grow. New financing structures could encourage FPV systems to be built on the reservoirs used for hydropower plants by giving the lenders financing the FPV systems a share of the cashflow.

How Acuity Knowledge Partners can help

The technology landscape in the energy and utilities sectors is evolving rapidly, much needed to meet targets of the Paris Agreement. Renewables including FPV and other clean technology such as battery storage, green hydrogen and carbon capture will play a vital role in this energy transition. Our Energy and Utilities team has been actively supporting our clients to adopt the transformation. The team has supported clients in areas such as market and competitive intelligence, strategy research, financial modelling, M&A support, valuations and supplier management research support. The team has executed projects on trending themes such as smart grid, renewable energy, electric vehicles and charging infrastructure, small-scale LNG, process automation, home generation and connected homes.

Sources:

https://openknowledge.worldbank.org/bitstream/handle/10986/31880/Floating-Solar-Market

https://smtnet.com/library/files/upload/Floating%20Solar%20Panels%20Market

https://www.nrel.gov/docs/fy19osti/73907.pdf

https://www.ifc.org/wps/wcm/connect/6ef92aa8-bf29-4c43-8edc-a0f7555e6a5d/IFC-Energy

https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/Nov/IRENA

http://www.diva-portal.org/smash/get/diva2:1290021/FULLTEXT01.pdf

https://www.teriin.org/sites/default/files/2020-01/floating-solar-PV-report.pdf

https://www.eqmagpro.com/taiwans-fit-scheme-for-2021-shows-rate-drops-for-solar-pv

https://chinadialogue.net/en/energy/floating-solar-ready-for-take-off/

https://earth.org/floating-solar-panels/

https://www.irena.org/events/2021/May/An-Action-Agenda-for-Deploying-Offshore

Tags:

What's your view?

About the Author

Gaurav is an Energy & Utilities practice lead in Acuity Knowledge Partners’ Private Equity & Consulting vertical. He has over eight years of experience in the energy and utilities sector, helping clients with various consulting and business research projects across domains including power infrastructure, clean technologies, energy storage, and renewables. He has also been a part of studies on trending technologies including green hydrogen, carbon capture, battery storage, EVs and EV infrastructure.

Gaurav holds an MBA degree from Institute of Management Technology (IMT Hyderabad) and B.E. from DY Patil College of Engineering, Pune

Like the way we think?

Next time we post something new, we'll send it to your inbox