Published on March 29, 2024 by Anurag Sikder

In the ever-evolving landscape of asset management, effective communication is paramount. A key tool is the investment fund commentary, offering insights on investment philosophy, market performance and outlook. These commentaries are more than just informational documents; they are strategic instruments for asset managers (AMs) to engage with stakeholders, articulate investment strategies and differentiate themselves in a crowded marketplace. These narratives offer investors a glimpse into the rationale behind investment decisions, risk management approaches and outlook for market dynamics.

Acuity Knowledge Partners recently conducted a thorough study among AMs of the trends shaping these commentaries. The funds under consideration belonged to some of the biggest AMs in the US, and the reporting period was the last quarter of 2023. The observations indicate how much importance and resources AMs assign to the production of fund commentaries.

Methodology

The following parameters formed the basis of the study:

-

Domicile of funds: USA

-

Types of funds: Open-ended, closed-ended, collective investment trusts and money-market funds

-

Asset classes: Equity, fixed income, commodities and alternatives

-

Reporting period: Fourth quarter of 2023

-

Publishing frequency: Quarterly

-

Research period: 1 January 2024 to 15 February 2024

-

Minimum fund size: USD4.6bn

Date of publication, content and whether the commentaries were published consistently or were a one-off, indicating inconsistency in the publishing pattern, were analysed.

The qualitative aspect was analysed to find a correlation between the depth of content and the publication date of the final commentary. The correlation would be critical in understanding, over a longer period of observation, whether the need to publish a detailed analysis impacts an AM’s ability to publish commentaries regularly.

Findings

The comprehensive research conducted provided insight on AMs’ approaches to investment fund commentaries. Some AMs consider commentaries to be essential for communication with investors and the wider target audience, while some have ceased regular publication or publish only intermittently, when convenient.

1. Commentary publication

For a month after quarter-end, c.32% of the AMs who publish commentaries have stale commentaries on their website. This means that on 1 February 2024, they had commentaries relating to 3Q 2023.

The main inference from this finding is that many of the world’s largest organisations do not believe that commentary writing is a serious function, likely due to reasons ranging from resource availability to not prioritising the process.

2. Fastest commentary turnaround in the sector

One of the AMs surveyed was able to publish a commentary by the fifth business day after quarter-end, although this related to just one fund in its extensive portfolio. The findings suggest a correlation between publication timeliness and the AM’s market relevance, with delayed commentary potentially diminishing its perceived industry significance.

3. Industry average of commentary publication

The average time taken by AMs to publish all their commentaries is the 14th business day after quarter-end. Twenty-six percent of them prefer to publish all their commentaries on the same day, while 11% publish them within 10 days of publishing their first commentary and 8% publish within 20 days.

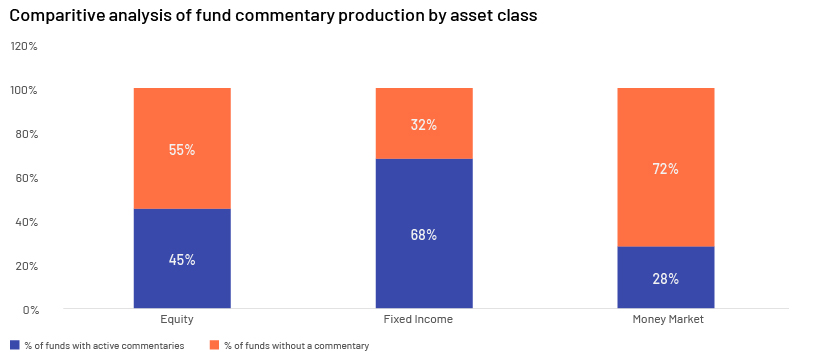

4. Active asset

Equity funds are the main focus of AMs actively publishing commentaries, accounting for 52% of total commentaries issued. Despite this dominance, fixed income fund managers are more proactive with their fund commentaries than are fund managers of equity funds. In fact, there were more fixed income fund commentaries produced during the reporting period than commentaries on any other asset class.

Source: Acuity Knowledge Partners’ survey of fund commentaries, 1Q 2024

Money-market funds lagged significantly in terms of production – 75% of the fund managers had not produced any commentary. Alternative investments, multi-asset funds and real assets had published commentaries.

5. Correlation between complexity of content and timing of publication

The study identified a clear correlation between the two. Commentaries that incorporate extensive analysis, with elements such as charts, diagrams, performance data tables and environmental, social and governance (ESG) analysis, tend to be published in more than 15 business days after quarter-end. This delay is attributed to the time taken to gather all the information that AMs consider pertinent. It may also indicate resource constraints.

Additional finding: Another observation was the use of AI in the commentary writing process by some of the world’s biggest AMs. The use of generative AI has been touted as a possible game changer in the sector. While the study could not capture to what extent AMs use AI in their commentary process, our experience with AMs in terms of commentaries since the recent increase in adoption of AI indicates that at least 15% of the world’s biggest AMs (with more than USD200bn in assets under management) use AI in their commentary process to some extent.

Recommendations

The findings underscore the pivotal role of investment fund commentaries in AMs’ communication strategies. Yet, disparities in publication practices suggest underlying operational challenges. Resource constraints, competing priorities and evolving regulatory landscapes pose significant challenges. The need for collaboration between investment analysts, writers and compliance teams adds another layer of complexity to the production process.

We have long been at the forefront of championing the commentary production process for AMs across the globe. We have adapted to the changing technological and regulatory landscape for marketing material production. Based on this experience, we provide the following recommendations for AMs to optimise the investment fund commentary production process:

Leverage technology

AI-powered tools promise to automate repetitive tasks, generate insights from vast datasets and enhance the speed and accuracy of content creation. Many AMs already use the technology. However, its adoption requires careful consideration of data privacy, regulatory compliance and ethical implications.

Other innovative approaches to commentary creation are emerging. Natural language processing (NLP) algorithms can analyse market data, sentiment and investor feedback to tailor commentaries to specific audiences.

Awareness of regulatory requirements

In an increasingly regulated environment, AMs must navigate a complex web of compliance requirements while striving for transparency and clarity in their communications. Regulatory bodies such as the Securities and Exchange Commission (SEC) impose strict guidelines on the content and dissemination of fund-related information, necessitating a careful balance between regulatory compliance and effective communication.

The evolving investor landscape

Beyond regulatory considerations, AMs must also contend with shifting investor preferences and expectations. With the rise of sustainable investing and ESG considerations, investors are demanding greater transparency and accountability from AMs. As such, fund commentaries play a crucial role in articulating how AMs integrate ESG factors into their investment processes and decision-making.

Conclusion

Our study provides a nuanced view of fund commentary-related practices among some of the world's leading AMs, indicating the value they place on such communications. While many AMs diligently publish commentaries for all their funds, others publish selectively or not at all. Some AMs adhere to a set publication schedule while others publish on an ad hoc basis. The production of effective commentaries, pivotal in attracting and retaining investor interest, requires the expertise of skilled analysts and writers familiar with the nuanced demands of portfolio managers, investor communication and regulatory compliance.

Production delays or not producing commentaries at all could be due to the lack of a dedicated team and tools for commentary creation. A lack of investment in structured production and collaborative insight could in turn hamper the quality and timely use of these marketing tools. AMs must, therefore, reconsider the strategic importance of fund commentaries, especially as the sector becomes more competitive.

Sources:

What's your view?

About the Author

Anurag Sikder has over 13 years of experience in producing content for a wide range of industries. At Acuity, Anurag leads a range of different teams providing qualitative insight for numerous sectors in the form of market reports, white papers, thought leadership pieces, and commentaries.

Like the way we think?

Next time we post something new, we'll send it to your inbox