Published on October 8, 2021 by Gayathri Bodhidasa and Sudharshan Balaji

“95% of media coverage is on ETFs comprising 5% of your portfolio” – Eric Balchunas, Senior ETF Analyst, Bloomberg

The 2008 financial crisis reiterated the importance of greater portfolio diversification and effective risk management when identifying sources of returns. This meant diversifying investments across asset classes and investing in vehicles that are flexible and agile. Exchange traded funds (ETFs) were introduced as an investment vehicle to address varied portfolio objectives, providing low-cost options for nearly every asset class. Specifically, balanced ETFs have gained popularity in the recent past, allowing for effective diversification through one simple holding. Furthermore, empirical evidence suggests that ETFs act as shock absorbers during volatile periods since buyers and sellers transact directly with each other in the secondary market without trading the underlying assets.

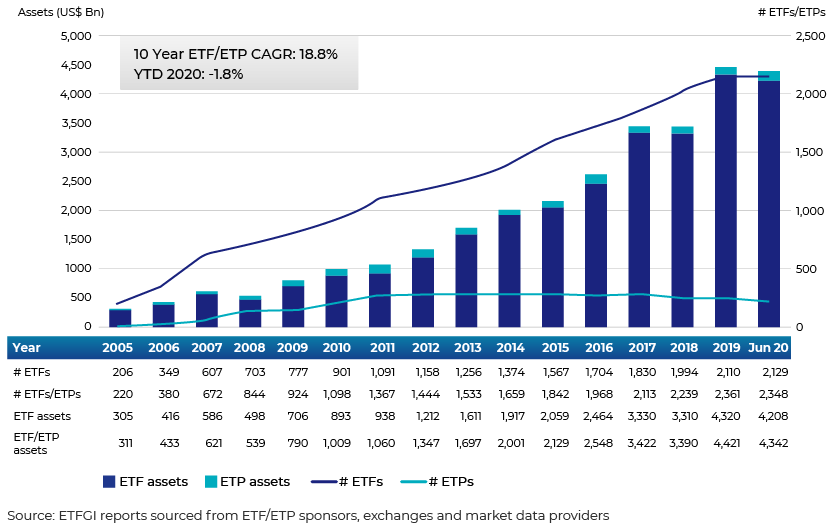

The ETF revolution has expanded globally, with over 7,700 ETFs/exchange-traded products (ETPs) from over 411 providers listed on 72 exchanges in 58 countries.

Ways to balance a portfolio with ETFs

A portfolio seeking moderate risk and diversification can be built with an optimal mix of equity and fixed-income ETFs (e.g., 60% equities and 40% bonds). These portfolios aid easy rebalancing, if required. For instance, certain ETFs track the Morgan Stanley Capital International All Country World Index (MSCI ACWI), which provides exposure to developed- and emerging-market stocks. Others track the Barclays US Aggregate Bond Index, which covers multiple bond types including Treasury, government agency, mortgage-backed, investment-grade corporate and dollar-denominated international bonds.

An intermediate approach to an ETF-inclusive portfolio would consist of about 10 ETFs with the right balance. For example, for stock exposure across markets, a portfolio can have a large-cap US ETF, an international developed-market ETF and an emerging-market ETF. Similarly, for bonds, a portfolio could include ETFs that invest in Treasury bonds, sub-investment-grade (high-yield or junk) bonds and international bonds. This approach ensures adequate coverage across asset classes and offers the ability to adjust portfolio weights.

Fine-tuning: core-and-satellite strategy

A fine-tuned portfolio normally invests in 20 or more ETFs and prefers specific allocations that are expected to perform best. The allocations are divided into thinner slices (core and strategy ETFs). The strategy builds the core with ETFs that provide broad market exposure to deliver performance and stability. The strategy then builds a “satellite” portion to benefit from market opportunities through access to specific industries, sectors, regions, commodities and macroeconomic trends. In the case of investors focusing on a specific sector, they have the opportunity to identify with a growth trend over the long term while minimising their risk exposure, compared with a single-stock allocation.

|

Before ETF model portfolios |

After ETF model portfolios |

|---|---|

|

Individual client portfolios require unique rebalancing |

Helps simplify rebalancing of all client accounts |

|

Extensive time spent managing each client account |

Reduced time on administrative tasks for each client account |

|

Higher expense ratios for mutual funds |

Lower expense ratios for ETFs, aiding overall fee reduction |

|

Unique tax implications for each client account |

Tax efficiencies when using an ETF model portfolio |

|

Inconsistent investment process |

Defined and consistent investment process |

|

Differing client returns that share the same risk profile |

Helps maintain consistency in client returns that share the same risk profile |

Pioneers in liquidity (despite COVID-19-related market turmoil)

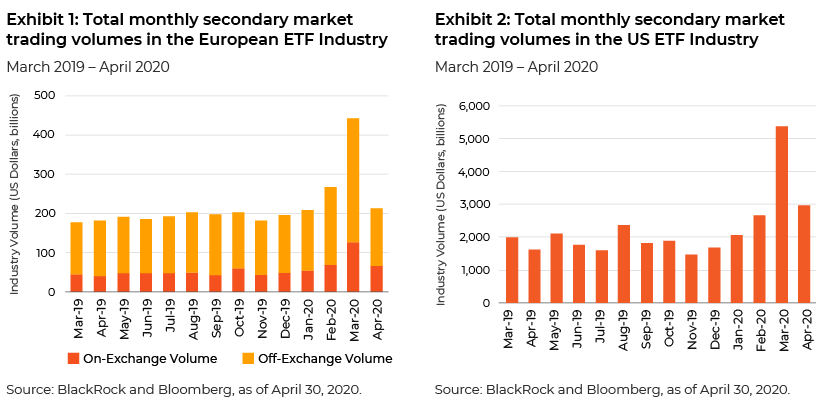

The past year and a half has been troubled by high levels of market volatility, forced redemptions in the equity market and extremely unfavourable bond-market conditions. Pandemic-induced market behaviour enhanced demand for stability in investments and a liquid, non-volatile market for trading. Particularly in markets hard hit by the pandemic, ETF solutions had the following advantages over other instruments.

-

ETFs (with their comparatively low volatility) were a catalyst for cautious investing as investors turned increasingly to them to manage risk

-

Bid-ask spreads for ETFs widened in line with the market (other instruments had wider spreads) largely due to increased trading volumes and hedging costs

-

Liquidity deterioration in the bond market encouraged institutional investors to shift to ETFs for fixed-income exposure

-

ETFs provided transparency in bond-market prices when cash bond markets were frozen or difficult to trade in

-

Exchange-market trading of ETFs accounted for 34% of all cash equity trading in Europe and 41% in the US, compared with daily average trading volumes of 21% and 27%, respectively, in 2019

-

A record USD81.6bn of primary-market trading was reported in iShares European-domiciled ETFs in March 2020, representing a 168% y/y increase that was 155% higher than the trailing 12-month average

Trading volume trend

Recent innovations/popular ETF launches

For the above mentioned reasons, a number of managers have designed and launched new products. Fund launches by leading asset managers could be viewed as a sign of good times to come for institutional investors, whose interests are skewing increasingly towards ETFs. The funds launched belong to a diverse spectrum of exposures (including ESG, thematic, multi-asset, inflation-linked, commodity-backed, technology, conservative, moderate, growth and value). We list below examples of recently launched reputed ETFs:

-

Goldman Sachs Future Tech Leaders Equity ETF

-

Hartford Schroders Commodity Strategy ETF

-

VanEck HIP Sustainable Muni ETF

-

Xtrackers Emerging Markets Carbon Reduction and Climate Improvers ETF

-

BNY Mellon Ultra Short Income ETF

-

BlackRock Future Climate and Sustainability Economy ETF

-

Goldman Sachs Future Planet Equity ETF

We believe it is rational to have a portfolio with controlled and multiple exposures, whether they be the most sophisticated institutional money managers or novice investors in the embryonic investment stage. Whatever the size of the investment, it does not require a complicated portfolio with several holdings to achieve targeted returns – a few carefully selected ETFs in different areas could get the job done.

“Think of ETFs as the market’s version of a wolf pack picking off and weeding out the slower and weaker active fund managers in the herd, those with consistently poor returns and high fees” – Vito J. Racanelli, Managing Director, Fundstrat Global Advisors

Sources:

https://money.usnews.com/investing/etfs/slideshows/balanced-etfs-for-diversification?slide=9

https://www.kiplinger.com/investing/mutual-funds/601491/16-best-sector-funds-to-invest-in-now

https://www.barrons.com/articles/why-2017-could-be-the-year-of-the-stockpicker-1482555870

Tags:

What's your view?

About the Authors

A Certified Public Accountant (CPA) and an Associate Member of CIMA with nearly 11 years of experience in capital markets, asset management and finance. Currently supporting a US-based asset manager in the preparation of RFPs/RFIs for institutional and retail businesses and performing quality reviews for team members. Prior to joining Acuity Knowledge Partners, was a Management Consultant at a chemical manufacturing firm, where she was responsible for assessing product profitability and improving business processes.

Sudharshan has over 6 years of experience in the financial services industry. In his current role, he supports the RFP team in the fund marketing services department. He has previously worked in financial markets forecasting and fund accounting at BNP Paribas. Sudharshan holds a Bachelor of Commerce (Honors) from Shri Ram College of Commerce(Delhi), and also a Master of Science in Financial Management from Middlesex University (London).

Like the way we think?

Next time we post something new, we'll send it to your inbox