Published on February 22, 2022 by Hitesh Acharya

The pandemic has accelerated changes in the retail banking industry, reshaping the competitive landscape, disrupting traditional banking areas such as branch banking and speeding up digitalisation. Lenders are adopting new strategies to overcome current challenges such as the low interest rate regime, the slow response time to new loan applications, high IT investment costs and regulatory compliance requirements.

Following are the trends in retail banking

1) Continued rise of fintech lenders:

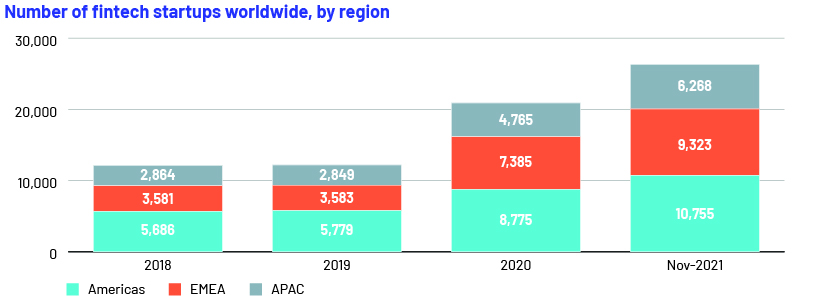

Legacy banks’ slow and cumbersome loan processing setups are being surpassed by the faster and easier online processes of fintech lenders or “neo-banks”. The rise of such “digital-only” lenders is fuelled by a combination of megabanks’ bureaucratic processes, physical customer interaction not being required, due to the pandemic, and the easy availability of IT infrastructure. This has reduced the number of barriers to entry in the retail lending industry. A CapGemini study found fintech banks 1.8x more able to innovate and offer personalised products than legacy banks. Allied Market Research expects the global fintech lending market to grow at a CAGR of 27.4% from 2021 to 2030 to reach USD4.95tn by 2030. The chart below indicates growth in the number of fintech startups by region.

Fintech lenders’ digital-only presence keeps operating costs low, while innovative marketing techniques enable low-cost customer acquisition. For instance, fintech lenders have targeted niche groups that were underserved by big banks’ “one-size-fits-all” marketing strategy. Paybby, Fortú and Cheese are fintech startups that cater to the Black, Latino and Asian-American communities, respectively. Niche online lenders also exist to solely finance, say, automobile purchases or education loans. Specialised financing products such as “Buy Now, Pay Later” have gained sufficient popularity to replace credit cards and personal loans. These lenders may offer additional services such as insurance, payments and checking accounts to further encroach on legacy bank territory.

2) Data-driven credit risk models:

Credit scoring models relying only on credit bureau-generated scores, such as FICO scores or VantageScores, are being supplemented with data analytics models to provide reliable alternative scoring systems. Credit decisions are increasingly based on behavioural data (spending patterns, bank account patterns, psychometric test data), personal data (such as level of education, occupation and number of years in current job) and income and asset data (such as stability of cash flow, property ownership and timely payment of rent and utility bills). Thus, thousands of data points can track not just the borrower’s ability to pay, but also their willingness and discipline to settle debts. For example, ZestFinance is a machine-learning, risk-predicting platform that auto lenders (including Ford Motor) have used to reduce losses considerably.

Traditional credit bureaus such as FICO and Experian have started offering credit scoring models (e.g., UltraFICO and Experian Boost) that incorporate a borrower’s transactional information using utility, telephone and television bill payment data, along with their deposit account information. Individuals denied access to lending products due to a lack of conventional credit scores may be able to avail themselves of credit based on these data-driven scoring models. However, concerns over the privacy of a consumer’s personal information may be an impediment for such models.

3) Greater use of technology:

The biggest cost savings banks can make are in using process digitisation and automation to replace inefficient and manual processes in middle and back offices, according to KPMG. Banks in North America alone could save over USD70bn up to 2025 by leveraging technology. Technology was initially only meant to replace repeatable, “high volume, low value” tasks. However, artificial intelligence (AI), machine learning (ML) and automation are adding extra value at every step of the lending process. Some common examples are outlined below.

-

Personalised customer interactions: AI chatbots, which learn with every customer interaction, can deliver a human-like, conversational customer experience using natural language processing and help reduce call-centre volume. Advanced AI-powered chatbots also give users personalised financial recommendations and customised guidance.

-

Accelerated KYC and lending decisions: ML-enabled tools can scan and analyse documents such as identity and address documents, application forms, bank statements, pay slips, tax filings and invoices to verify borrower credentials and assess loan eligibility.

-

Fraud prevention: AI-/ML-enabled bots process millions of transactions to detect suspicious loan applications, fake or compromised credentials, security breaches, gift card cracking and fake users. Advanced tools enable lenders to prevent hacking and cyberattacks, help with anti-money-laundering and detect sanctioned entities.

-

Loan pricing: Data analytics can help measure price sensitivities and opportunities across borrower segments. Lenders can analyse how differential pricing strategies can impact volumes and margins, and design and market the loan product accordingly.

4) Hyper-personalised customer journey:

Retail consumers are increasingly choosing lenders that go beyond the traditional focus on sales and customer service, and prioritise the customer experience. Personalisation involves using data and analytics to predict the best loan-offer recipients, determine their individual needs at the time, provide on-demand information and relevant advice and build long-lasting relationships. Banks pitching traditional mortgage loans, for example, will be at a disadvantage to lenders that can engage with and support borrowers through every stage of the home-buying process. A BCG study confirms that by personalising a customer’s journey, a bank can increase revenue by up to USD300m for every USD100bn in assets it owns. Personalisation can also help improve loan-recovery practices. For instance, a 2018 McKinsey study indicates that engaging digital-only borrowers though their preferred channel of communication can increase loan instalment repayments by over 10%.

5) Greater use of centralised teams and offshore partners:

The high productivity of employees working from home (WFH) during the pandemic has helped mitigate employers’ concerns about the efficacy of remote work delivery, whether by onshore or offshore employees. During the WFH period, many companies started looking at flatter, non-hierarchical team structures, with clearly assigned responsibilities and accountability, to speed up decision making and improve execution. The WFH framework has provided access to new talent pools of onshore or offshore employees able to remotely execute complex processes previously conducted face-to-face. A majority of retail lenders are looking for offshore partners to reduce costs associated with hiring, training and onboarding staff, and lower office rent and maintenance overheads. Outsourced teams with relevant expertise can be deployed based on business demand for employees at a fraction of onshore costs, while providing flexibility, agility and innovation. Additionally, offshoring supports prudent business continuity practices as disruptions due to social unrest and natural calamities increase. For instance, during the pandemic, Bank of America (BofA) added close to 3,000 jobs in India to support the increase in retail and small business loans in its home market, the US.

Conclusion:

After the pandemic, lenders would need to enhance their resilience across capital, operations, technology, and human resources. Acuity Knowledge Partners (Acuity) enables lenders to capitalise on irreversible marketplace trends and decide on strategies that would improve their competitive advantage and help them enter new areas of growth.

Do agree with our analysis of trends in retail banking? Do let us know your thoughts by adding your perspective in the comments section.

Acuity’s retail lending solutions help banks optimise their retail banking value chains (origination, processing, underwriting, closing and post-closing) by centralising, standardising and digitalising processes. We have a domain-driven suite of business automation tools, along with retail lending expertise across products such as consumer mortgages, personal and auto loans and credit cards. These could help banks improve speed to market, increase customer-facing time, manage higher volumes and utilise flexible staffing for one-time projects or spikes in work volumes. Partnership with Acuity has supported lenders in increasing revenue, implementing global best practices and transforming their operating models. With over 19 years of experience, we have an established record of enabling financial institutions to streamline their operations, speed up decision-making and deploy capital efficiently.

References:

-

Allied Market Research – FinTech Lending Market Size, Share & Analysis | Trends – 2030

-

McKinsey report – Reshaping retail banking for the next normal | McKinsey

-

Boston Consulting Group: What Does Personalization in Banking Really Mean? (bcg.com)

-

Forbes: Why The Pandemic Led To An Increase In IT Outsourcing (forbes.com)

-

The Economic Times – Indian outsourcing has outshone world in pandemic; BofA added 3,000 jobs

-

Deloitte: Outsourcing relevancy in a post-Covid-19 environment

-

Top 10 Lending Business Trends for 2022 [Technology & Business Models] (leadsquared.com)

-

8 Fintech Trends Changing Banking Forever (thefinancialbrand.com)

What's your view?

About the Author

Hitesh has over 14 years of experience in working with leading global organizations in the banking and commercial lending domains. His expertise spans a broad range of analyses, including credit appraisal, leveraged lending, stressed assets, industry reports, cash flow modelling, and client pitch presentations. At Acuity Knowledge Partners, he has led sector and product-specialist pilot teams in Commercial Lending, focusing on diverse sectors such as real estate, manufacturing, aerospace and defense, transport and logistics, and business services.

Hitesh holds a Masters in Management Studies from K.J. Somaiya Institute of Management Studies and Research, University of Mumbai, and a B.Com from University of Mumbai.

Like the way we think?

Next time we post something new, we'll send it to your inbox