Published on March 26, 2024 by Saswata Mohanty and Akshata N. Upadhyaya

Emerging markets likely to outperform developed market

Emerging markets (EMs) have recovered faster than developed markets (DMs). We expect EMs to enjoy a positive environment in terms of equities, the debt market and the general economy in 2024 due to inflation declining and macroeconomic momentum increasing. Against the backdrop of a lagging China market, the EM Index (except China) is outperforming the S&P Index and other major indices. With positive economic growth due to inflation declining and a strong middle class, we expect EMs to perform better in 2024. The IMF forecasts a number of EMs to grow more than DMs.

EMs to perform better than DMs

We expect EMs to enjoy a positive environment in terms of equities, the debt market and the general economy in 2024 due to inflation declining and macroeconomic momentum increasing. EMs account for around 60% of global GDP, with tailwinds from increased consumption by a growing middle class. We expect the middle class in these economies to account for more than 50% of the global middle-class population by 2030.

Economic growth in EMs: Some of the markets have entered a significant or higher-than-expected phase of economic growth as their interest rates have fallen. The central banks of many of these markets, such as Brazil, Chile, Hungary, Peru and Poland, started cutting interest rates in 2023 and saw a sharp fall in inflation.

They are likely to continue cutting rates in 2024. We expect such easing of interest rates ahead of the Fed to favour earnings growth in EMs in 2024. The GDP growth rate was revised multiple times in 2023 to reflect positive growth, driven largely by India, Mexico and Brazil. We expect the growth premium over DMs to continue widening in 2024, with Asia contributing the most to global GDP.

EMs are showing positive economic growth, unlike developed economies, and with the fall in interest rates, we expect their economies to be stronger than those of DMs in 2024.

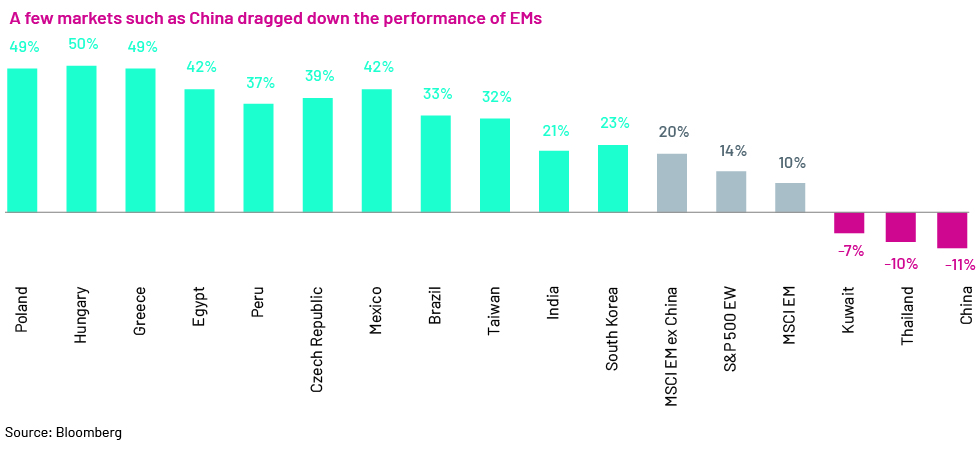

EM equities outlook: EM equities have outperformed most DM equities. The MSCI EM Index shows annualised returns of 7.83% over 1999-2023 versus S&P’s 7.55% over the period. Many EMs, such as Poland, Hungary and Greece and larger markets such as Mexico, Brazil, India, South Korea and Taiwan outperformed the US and other DM indices. The major headwind in the EM Index is China.

EM debt market outlook: We expect EM debt to lead financial markets in 2024. EM debt has historically been correlated positively with market volatility/cyclicality. The trend seems to be changing due to recent improvements in infrastructure and sectors, and as wealth increases. The US and China dominate the global economy, and their slower growth would have a major impact globally, but EMs are likely to be resilient, with the IMF forecasting higher growth among EMs than among DMs.

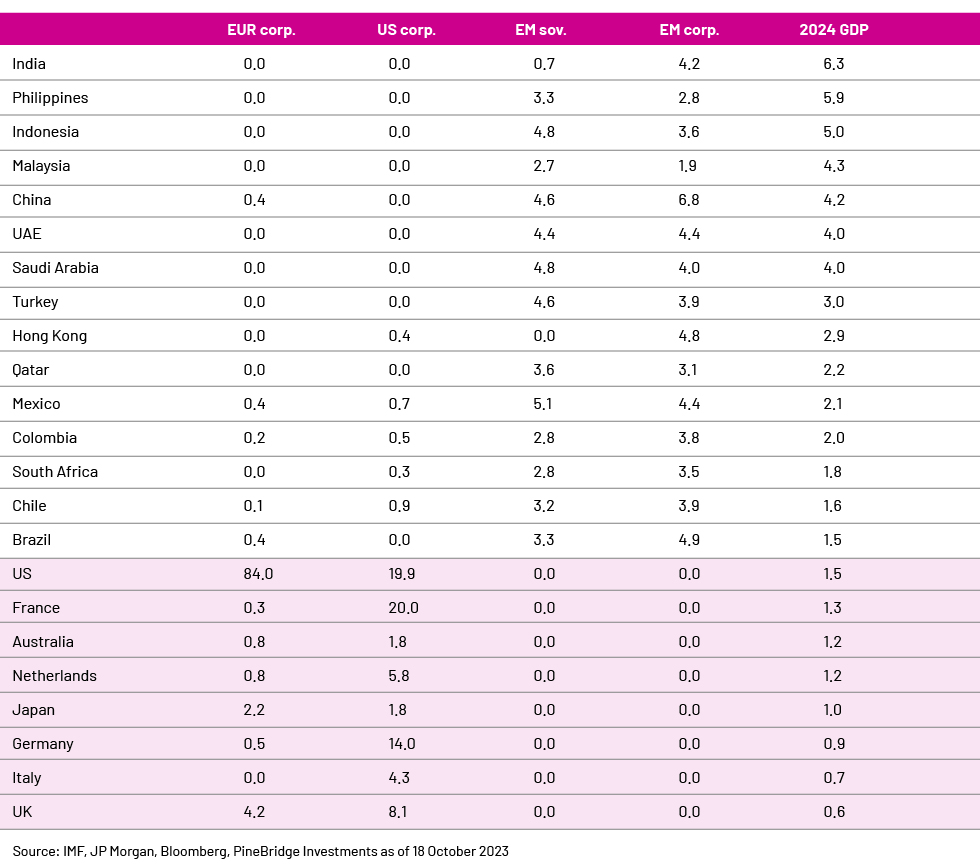

Growth forecasts for many EMs exceed those for the US and other DMs Index market value and 2023 GDP growth forecasts (%).

The Fed’s rate hike also has a greater impact on USD-dominated bond markets. Some IG countries in Asia and the Middle East will not be significantly impacted by the hike, as they have active local-currency markets in which they can issue bonds profitably since interest rates are much lower than in the US. Non-IG would be impacted by the hike, as they do not have active local markets and would need to refinance at the current high rate.

However, more than three-fourths of the EMs have active local markets for USD EM corporate bonds, providing an alternative for capital raising. The EM corporate bond market is also less sensitive to foreign exchange; only 15% of the market is vulnerable to currency volatility; the rest is supported by FX hedges or issued by countries with pegged currencies.

EMs are set to meet all challenges and avert the risks associated with cyclical interferences, and investors expect them to offer more attractive returns in 2024. We expect EMs to enjoy a favourable environment this year, with inflation trending lower and macroeconomic momentum improving. Economic growth, combined with lower leverage, would provide better returns to investors with large and diversified portfolios.

What's your view?

About the Authors

Saswata Mohanty has over 13 years of experience working across different value chain in the Investment Banking domain. Currently, supports Public Finance / Project Finance team, with a focus on Municipal Finance and Infrastructure - Public Private Partnership(P3). He is also responsible for quality check and overall functions of Investment Banking team, for a U.S. based mid-market Investment Bank, in Bangalore. Prior to joining Acuity, he was with Verity Knowledge Solution (affiliate of UBS) for close to 6 years. He holds a Master’s degree in Business Administration in Finance.

Akshata is a Delivery Lead at Acuity Knowledge Partners, completing a decade of experience since joining the company as a fresh graduate. Akshata is an integral member of a mid-market U.S. Investment Bank’s team based in Bangalore. Throughout her tenure, she has adeptly navigated through various roles, supporting a diverse range of sectors and product teams. She actively engages with onshore bankers and supports across the value chain, from deal origination to execution, for various live pitches. Alongside the service delivery, Akshata takes an active role in delivering training to enhance team competencies and mentoring

Like the way we think?

Next time we post something new, we'll send it to your inbox