Published on March 26, 2021 by Arjun R D

Exponential growth in personalisation initiatives, powered by an unparalleled level of access to massive datasets, has increased customer-centricity across global corporations including financial institutions. There are thousands of professionals working across business functions to make sure customers are engaged at every stage of CLM.

For example, a banking customer could own products such as deposit instruments, loan instruments and investment products. Different types and volumes of datasets emerging from unit-level legacy platforms often present serious challenges to arriving at a single version of the truth. A carefully vetted BI solution can help stakeholders create centralised data warehouses with transformed datasets that could, in turn, be used for data analysis, leading to informed decisions.

In this blog, we will talk about

1. The three phases of CLM – acquisition, engagement and retention

2. The key benefits of using business intelligence (BI) in CLM

3. Selected illustrations of pragmatic BI applications

1. The three phases of CLM – acquisition, engagement and retention

Let’s consider deposit products for example, to take a closer look at these phases and related key performance indicators (KPIs).

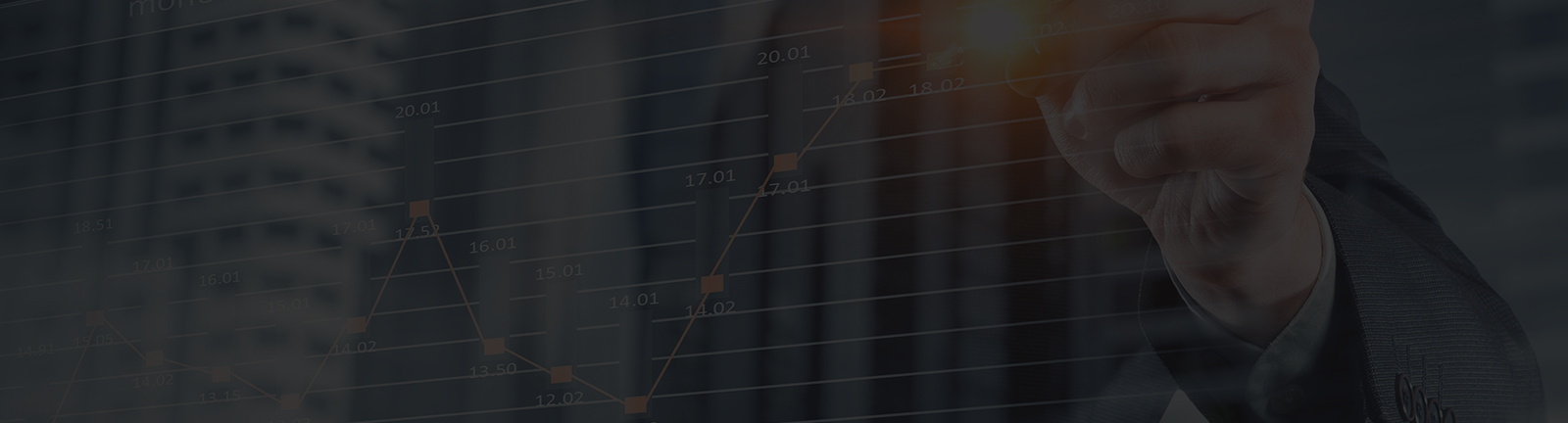

1.1 Customer acquisition:

The customer lifecycle starts with a business reaching out to prospects, followed by a prospect moving through the sales funnel and finally becoming a customer. To reach out to prospects, a campaign needs to take into consideration factors such as demographics and financial conditions of prospects. For example, a millennial customer would require a deposit product such as a checking account with good digital capability to manage the account online. A baby boomer would require pension products, with a relationship manager assisting the planning. Thus, targeting the right prospect for the right product at the right time is key.

The customer acquisition process involves a number of steps:

-

Campaign design and measurement: Reaching out to prospects requires understanding their demographics, advertising the right product and choosing the right channel for advertisements. Machine-learning models can be used to identify suitable prospects. Once the campaign is launched and then concluded, measuring its success is important. For more details on campaign design and campaign measurement, refer to the blogs hyperlinked.

-

Sales funnel: Prospects are generated through the campaign. A prospect moves through the sales funnel and becomes a customer. Understanding the sales funnel process leads to better prospect-conversion ratios.

-

Customer onboarding: Once a prospect is converted, it is important to make them understand factors such as how hassle-free the account-opening process is, and for the business to understand which type of customer buys which type of product and how much money the customer brought in.

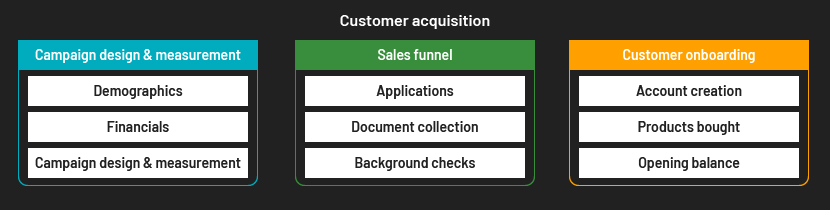

1.2 Customer engagement:

After customer acquisition, understanding a customer’s relationship with the bank would help keep them satisfied. It also identifies cross-selling and up-selling opportunities.

-

Customer life stage – Understanding customer demographics and financial status helps to align with their transactional behaviour and suggest suitable products and services

-

Transactional behaviour – Understanding how often the customer transacts, the frequency of transactions and the value of transactions helps calculate profitability by customer

-

Touchpoints – A single customer may buy multiple products and use multiple services. Looking at a holistic picture helps understand the customer better

-

Customer value – This is closely related to the customer life stage. Identifying high-value customer vs low-value customer helps a bank utilise its resources efficiently

1.3 Customer retention:

Customer Think estimates the cost of acquiring a banking customer at around USD200, while the typical customer generates only USD150 in revenue a year. This means the relationship does not become profitable for the bank until well into the second year; hence the importance of customer retention. Retaining an existing customer is also much easier than acquiring a new one in terms of cost and effort.

Understanding customers’ balance and transactional behaviour to identify inactive customers, attrition rates and drivers for inactive customers and attrition helps in customer retention. NPS scores from surveys could also be used to identify unhappy customers and reach out to them proactively. Machine-learning models could be used to rate customers for attrition risk. For more details on customer retention, refer to this blog.

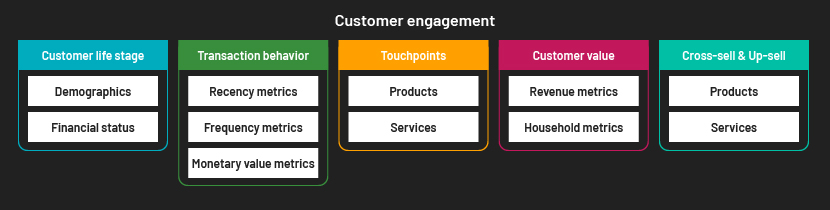

2. Key benefits of using business intelligence (BI) in CLM

-

Centralised source of information – Data for different stages of the customer lifecycle is obtained from different sources. BI tools help aggregate this in one place for data visualisation and analysis

-

Real-time reporting – BI tools are able to refresh the data in real time and, thus, make sure the latest data is always available for analysis

-

Self-service and actionable insights – Users of BI can interact with dashboards using a number of slicers and dicers to generate actionable insights

-

Integration with machine-learning (ML) models – ML models used for prospect scoring, attrition risk modelling, etc. can be integrated with BI to understand model performance

3. Selected illustrations of pragmatic BI applications

From the various KPIs mentioned in the customer lifecycle section of this blog, it is clear that getting a holistic picture of the customer lifecycle is a challenge. BI tools, with their ability to connect to a wide variety of databases, help to bring them together to one place, enabling a one-stop reporting and analytics solution. A sample dashboard for customer acquisition and engagement created using Tableau is shown below.

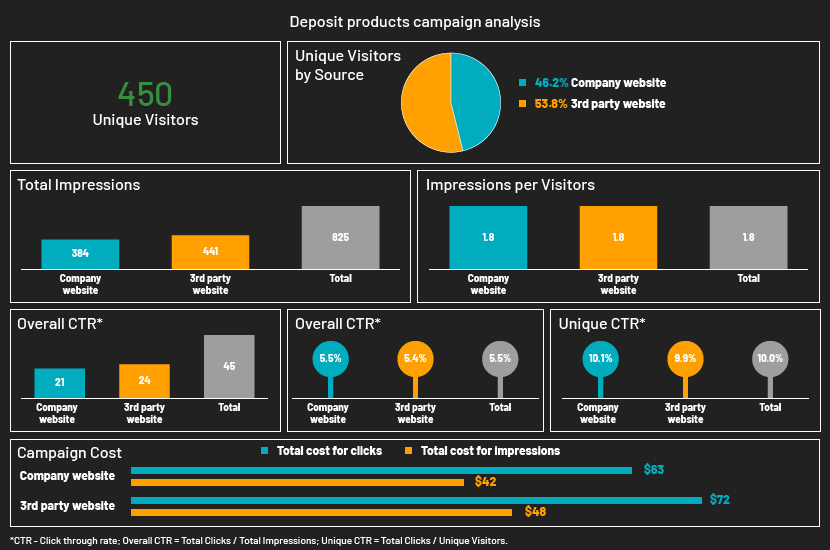

Sample 1: The following snapshot of deposit products campaign analysis shows the performance of a campaign targeted at acquiring customers for a bank’s deposit products. The bank ran advertisements through two different sources – its own website and third-party websites related to banking

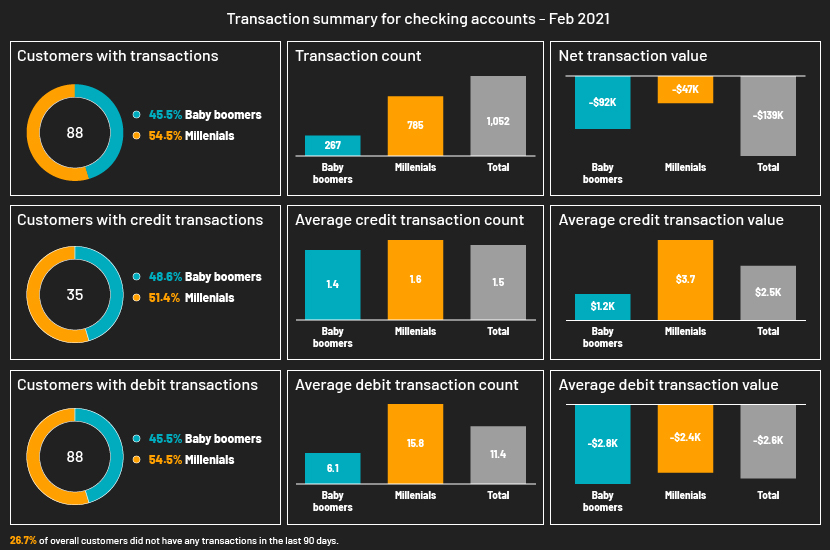

Sample 2: The following snapshot is a transaction summary for checking accounts for February 2021. For the sake of simplicity, only two age groups of customers are considered – baby boomers and millennials.

Conclusion

Understanding customers in this multi-product, multi-channel world is difficult. Given the number of competitors in the banking space and startups offering digital capability, it has become easier for customers to switch from one bank to another if they are unhappy with certain products and services. Thus, understanding the customer lifecycle is important if a bank seeks to acquire, engage and retain the right customers. BI enables such one-stop analytics solutions. C-level executives could use such dashboards to take high-level decisions; even at a more on-the-ground level, these dashboards help identify cross-selling, up-selling and customer-retention opportunities.

How Acuity Knowledge Partners can help:

Acuity Knowledge Partners (Acuity) has been providing research and analytics services for over 18 years to more than 300 buy-side and sell-side firms globally. Our dedicated data science practice was launched in 2019, supported by 15 years of experience in providing quantitative and technology solutions to our clients. Acuity’s data science team of over 70 professionals works closely with 220 technologists and 2,000 analysts to provide digital insights by analyzing structured and unstructured datasets.

Sources:

https://www.bernardmarr.com/default.asp?contentID=1371

https://www.reviewtrackers.com/blog/bank-customer-retention/

https://www.rishabhsoft.com/blog/business-intelligence-in-banking-and-finance

Tags:

What's your view?

About the Author

Arjun R D has over six years of experience in providing data analytics for financial services firms. His areas of expertise cover product analytics, sales and marketing analytics, campaign measurement, secondary research, statistical modelling and data visualization. At Acuity, Arjun provides product analytics, business intelligence and bespoke reporting solutions to a leading US bank. Previously, he provided analytical solutions to the sales and marketing practice of a leading asset management firm with over USD3tn in assets. He holds a master’s degree in Management specializing in Finance and a bachelor’s degree in Engineering specializing in Computer Science.

Like the way we think?

Next time we post something new, we'll send it to your inbox