Published on November 28, 2024 by Nupur Aggarwal and Puja Singh

Introduction

“COP29” refers to the 29th Conference of the Parties to the United Nations Framework Convention on Climate Change. The yearly climate COP brings together representatives from almost all nations to negotiate and establish global goals for addressing climate change, showcase their respective countries' strategies towards these goals and provide updates on their progress.

This year, Azerbaijan was selected as the Presidency of the 29th Conference of the Parties (COP29), hosted in Baku in November 2024. The latest financial objective of COP29 builds on the substantial progress made on global climate initiatives at COP27, where a groundbreaking Loss and Damage Fund was established, and at COP28, which reached global consensus to rapidly and equitably phase out all fossil fuels in energy systems, triple renewable energy sources and enhance climate resilience. This year's conference emphasised the pressing importance of sustainable finance and the crucial role played by financial institutions in addressing climate change.

Key takeaways:

COP29 brought together nearly 200 countries in Baku and with a central focus on climate finance, reached a breakthrough agreement that would do the following:

-

Triple financial support to developing countries, from the previous goal of USD100bn annually to USD300bn annually by 2035.

-

Scale up finance to developing countries, to the amount of USD1.3tn per year by 2035, via public and private sources and efforts of all actors to work together towards this goal.

This was agreed after two weeks of serious negotiations and many years of preparatory work, in a process requiring every party to agree on all words of the agreement, formally known as the New Collective Quantified Goal on Climate Finance (NCQG).

COP29 also reached consensus on carbon markets, something that several past COPs had struggled to accomplish. After nearly 10 years of deliberation, the parties have settled on the final components that dictate how carbon markets will function under the Paris Agreement, enabling trade between countries and establishing a carbon-crediting mechanism as fully operational. On the first day of COP29, the parties established standards for a centralised carbon market under the UN (Article 6.4 mechanism). This development is positive for developing nations, as they stand to gain from new financial flows. It is especially beneficial for the least developed countries, which will receive the capacity-building assistance they require to enter the market.

Significant agreements were entered into regarding clear climate reporting and adaptation efforts. All transparency-related negotiation topics were successfully finalised at COP29, with the parties acknowledging the prompt completion of the Enhanced Transparency Framework (ETF) reporting tools, the technical training sessions and the assistance provided to developing nations for reporting under the ETF of 2024. Additionally, COP29 made significant progress on amplifying the participation of indigenous peoples and local communities in climate-related initiatives by approving the Baku Workplan and extending the Facilitative Working Group ( FWG) mandate of the Local Communities and Indigenous Peoples Platform (LCIPP).

The parties also reached consensus on gender and climate change, prolonging the improved Lima Work Programme on Gender and Climate Change for an additional decade, restating the significance of gender equality and promoting gender integration across the convention.

COP29 emphasised the significance of innovation in developing new sustainability-linked financial products. The financial sector is exploring different approaches to connect economic expansion with environmental conservation via measures ranging from sustainable loans to climate-related derivatives. Moreover, there is strong momentum towards green bonds and sustainable investments due to recent pledges from both governments and private sectors. A significant inflow of funds to green projects and renewable energy-related endeavours is anticipated due to this change. Moreover, the financial sector is reassessing its risk-management tactics to integrate climate-related risks. This involves conducting stress tests for various climate scenarios and incorporating environmental risks into credit evaluations.

Work on the subjects mentioned above does not stop in Baku. The parties have given the Supervisory Body creating the new carbon-crediting mechanism a lengthy to-do list for 2025, and the Body will remain accountable to them. They have also decided to create a fresh gender action plan to be adopted at COP30, outlining how to put it into practice. Additionally, progress on the international target for adaptation paves the way for the Indicator Work Programme towards COP30, offering experts a framework within which to carry out their technical tasks before handing over responsibilities to the parties. Furthermore, the financial agreement reached at COP29 coincides with the upcoming deadline for stronger national climate plans (Nationally Determined Contributions, or NDCs) from all countries. Lastly, financial institutions worldwide are collaborating to create consistent standards and practices for sustainable finance. It is vital that financial institutions adopt these changes and take the lead in promoting sustainable growth.

To conclude, COP29 has had a deep impact on the financial sector, marking a major advancement towards a more sustainable and robust global economy. In whole, the agreements entered into at COP29 would help the parties implement their climate strategies in a more efficient and cost-effective manner, leading to swifter advancements in cutting global emissions by half within this decade, as stipulated by scientific research.

How Acuity Knowledge Partners can help

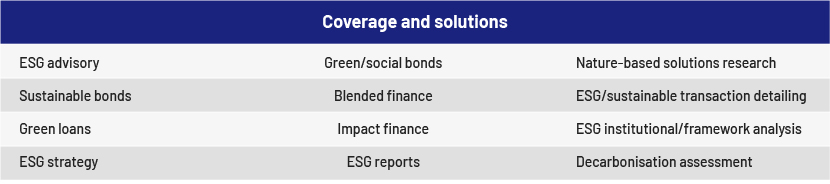

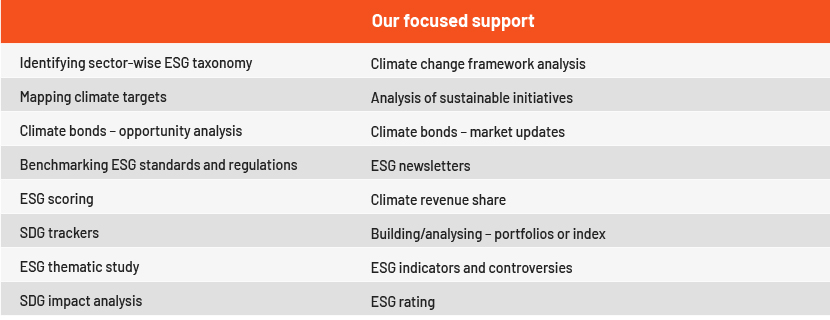

Our wide range of customised analysis and support covers the entire spectrum of financing products along the sustainable finance investment lifecycle and enables investment banks and advisory firms to establish and grow their sustainable finance practices:

We have ESG domain expertise and help banks ramp up their onshore verticals, focusing on incorporating ESG analysis and decarbonisation assessment, saving a significant amount of senior bankers’ time. We standardise templates and provide coverage across APAC, EMEA, the US and Sub-Saharan Africa.

Sources:

What's your view?

About the Authors

Nupur has around 5 years of experience of working across the financial services sector. She comes from a finance background with experience in decoding the business value of Environmental and Social Governance (ESG), Impact Management and Measurement (IMM) and evaluating impact oriented ESG solutions.

Puja has 7 years of extensive experience in ESG, Climate Change & Sustainability and she is supervising the ESG team at Acuity. She also has diverse experience in conducting ESIA, EHS compliance audits, ESG Risks and Controls, EHS & ESG Due Diligence assessments. Prior to joining Acuity, she was working with companies like KPMG Global Services, EY India and ERM India. She has expertise in provisioning extensive research requirements for clients through preparation of Peer Benchmarking, Target Compilation, Sustainability report, Sustainable Finance Updates and Sectoral ESG Thematic Detailing Engagement.

Connect with the experts at contact@acuitykp.com

Like the way we think?

Next time we post something new, we'll send it to your inbox