Published on June 6, 2025 by Rohit Paul

Collateralised loan obligations (CLOs) are actively managed investment products that pool corporate loans into a portfolio; these are predominately below investment grade. These loans are securitised, slicing them into “tranches” according to credit rating based on risk exposure, making the instruments available to investors as interest-paying bond packets.

CLO Collateralized Loan Obligations now fund around 74% of the USD1.4tn in leveraged loans outstanding, up from 71% in 2024; their structure and surrounding ecosystem [issuers, borrowers, lenders, private equity (PE) sponsors, arranging banks, credit rating agencies, lawyers, collateral administrators, trustees, investors] have been improved over the past two decades following a number of iterations after the 2008-09 global financial crisis.

Collateralized Loan Obligations (CLO) stakeholders are very attentive to the implications of the new U.S. administration’s fiscal and trade policy, and how the regulatory climate may affect credit markets. Borrowers of underlying loans could come under stress if there is an uptick in inflation or in the event of a liquidity crunch, affecting the overall credit risk level and lowering appetite for new issuance. The stress scenario is likely to depress secondary market activity for existing CLOs.

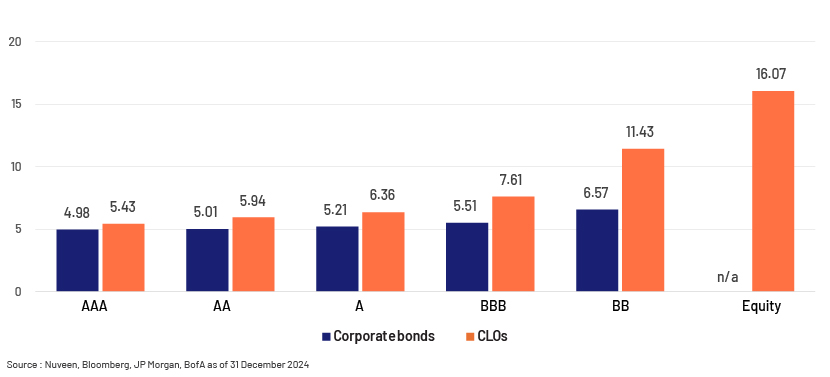

While collateralized loan obligations liquidity has expanded in recent years, the asset class is not as liquid as treasuries or corporate debt (especially for junior tranches in periods of market stress); this likely adds a layer of liquidity premium since spreads have been compressed for similarly rated debt instruments. Some of this spread premium may erode over time, although collateralized loan obligations (CLO) are expected to maintain a healthy yield advantage for the foreseeable future.

Figure 1: CLO debt yields vs. similarly rated corporate bonds (%)

Representative indices :

-

Investment-grade corporates AAA-BBB : Bloomberg U.S. Corporate Investment Grade Index

-

High-yield corporates BB-B : ICE BofA US High Yield Index

-

Investment-grade and high-yield CLOs AAA-BBB : J.P. Morgan Collateralized Loan Obligation Index (CLOIE)

-

CLO equity : US BSL CLO Equity Distributions (IO) Median

The yield quoted is yield-to-maturity except for CLO equity where the yield is the median annualised US broadly syndicated loan obligations equity distribution.

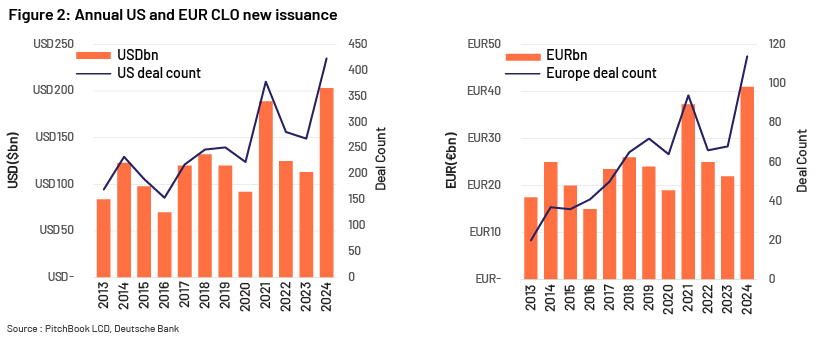

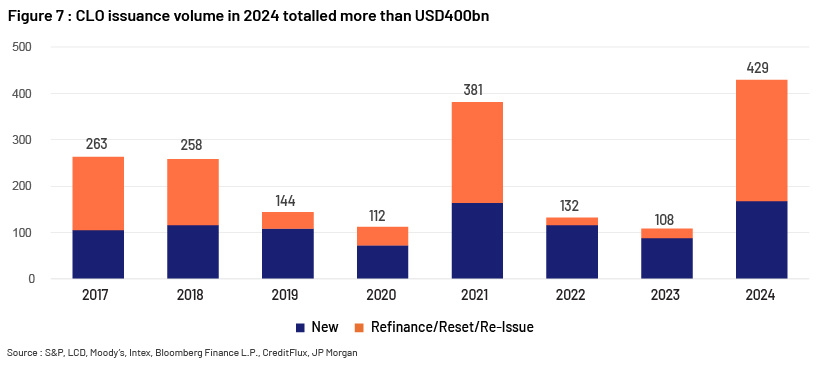

In 2024, the US market had USD202bn in new issue deal volumes priced, USD223bn in resets, and USD38bn in middle-market/private-credit (MM/PC) deal activity, while in Europe, transactions were USD52bn (EUR48bn) in new-issue volume and USD33bn (EUR31bn) in resets - above the amount of the previous two years combined.

New issuance for US broadly syndicated loans (BSLs) and middle-market Collateralized Loan Obligations combined is projected at USD180-215bn in 2025. A substantial portion of CLOs is expected to come from middle-market or private credit, accounting for 20% of US new issuance in 2024. In Europe, research desks forecast EUR45-50bn of new issuance and EUR33-60bn of repricings in 2025.

Median equity distributions in 2024 reached the highest in years, with 16% annualised distribution in the US across deals, and 19% in Europe. On average, collateralized loan obligation (CLO) investors target a 14-15% yearly return, making last year’s performance a substantial surprise.

The following provides insight on the challenges and opportunities in the CLO market :

1. Interest rate elevation – Interest rates continue to ease in 2025 and could eclipse the performance in 2024.

A spike in investor demand owing to high all-in yields and a benign credit environment have caused CLO collateralized loan obligation bond spreads to tighten further over the past 12 months. BSL market activity shows leveraged buyout (LBO) borrowers achieving higher B2 corporate ratings over a lower B3. AAA CLO bonds (the highest rated and least risky) are forecast to reach a three-month SOFR of +110 basis points (bps) in the first half of 2025, lower by a significant 15-20 bps from the pricing range tagged to standard BSL deals at the end of 2024.

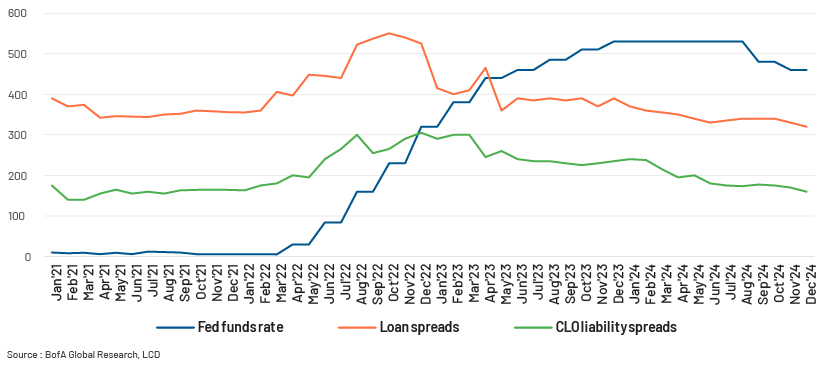

Figure 3 : Decline in spread in loans and CLOs due to falling inflation and a favourable credit environment expectation

(all figures are monthly averages of daily data)

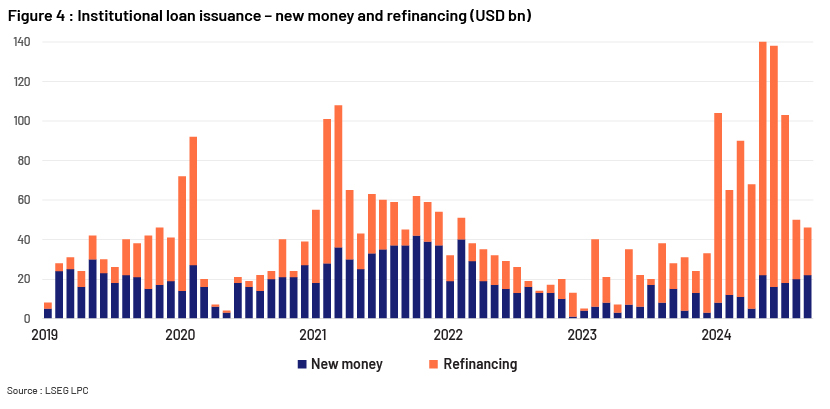

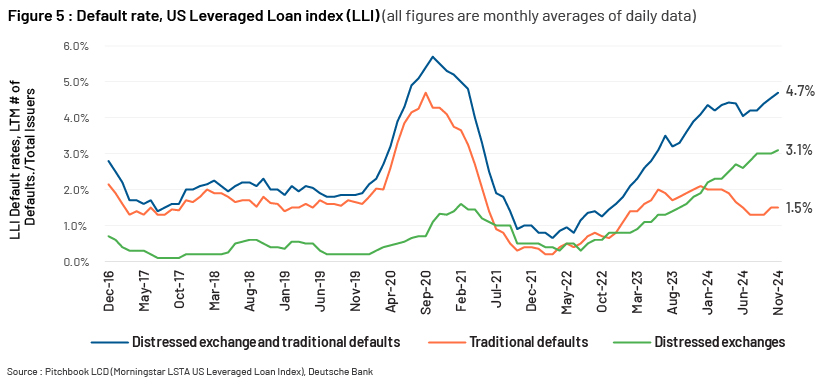

2. Refinance persistence – Deals were structured with shorter non-call and reinvestment periods enabling transactions to refinance their debt as soon as spreads declined, as was evident from the volumes in 2024. Collateralized Loan Obligations (CLO) portfolio defaults are expected to decline in 2025 : CLO portfolio defaults are expected to decline in 2025 : projections for October 2024 were to reach 2.6% from 5.6% in the US, and 2.7% from 3.3% in Europe, indicating a lower market trend. Accordingly, about USD117bn in CLOs set to exit their non-call period dates in outstanding transactions providing a continued flow of refi issuance, with USD94bn of this offering favourable refinancing spreads. Moreover, while 2024 saw refinance volumes of USD213bn, falling defaults, improved credit conditions, positive interest environments, and high refinancing potential in 2025 are set to drive a shift towards new loan transactions, rather than stabilising existing deals.

3. Credit convergence – The usual covenants and provisions associated with BSL collateralized loan obligation (CLOs) will start to reflect in the private credit space owing to the intensifying competition between broadly syndicated lenders and direct lenders (private credit). This migration of characteristics and being flush with liquidity would cause middle market CLOs to remain a major component of new US CLO issuance despite regulatory changes [Basel III reforms, risk retention requirements, or liquidity coverage ratio (LCR) rules] giving banks more room for risk on their balance sheets. Weaker borrowers would get more access to larger fund transactions from private-credit lenders. Spread levels between the two will likely continue to drift closer in CLO 2025 because of this covenant flexibility.

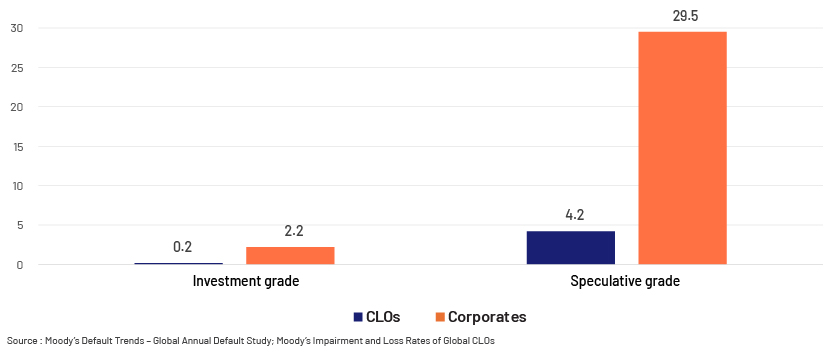

Figure 6 : Cumulative default/impairment rates have been relatively low (%)

-

Corporates : 10-year horizon average cumulative issuer-weighted global default rates by alphanumeric rating

-

CLOs : US CLOs, 10-year horizon WR-unadjusted cumulative impairment rates by original rating

4. Market broadening – CLO exchange-traded funds (ETFs) surpassed cumulative AUM of USD20bn across 14 different CLO ETFs as of end-2024, 2% of the USD1tn CLO collateralized loan obligation market, in stark contrast to 2023 when CLO ETFs had AUM of USD2.25bn, just 0.2% of the roughly USD1tn US CLO market, almost a ten-fold increase expanding the appeal of CLOs from institutional to retail investors and further enhancing the mainstreaming and liquidity of this segment. Implications of this increased marginal demand were seen in AAA spread tightening, together with a net addition of USD15bn of capital in the market, or roughly 7% of the total USD202bn in new issuance in 2024. The global ETF market is valued at around USD14tn, supported by CLO ETFs showing up in 401(K)s and IRAs.

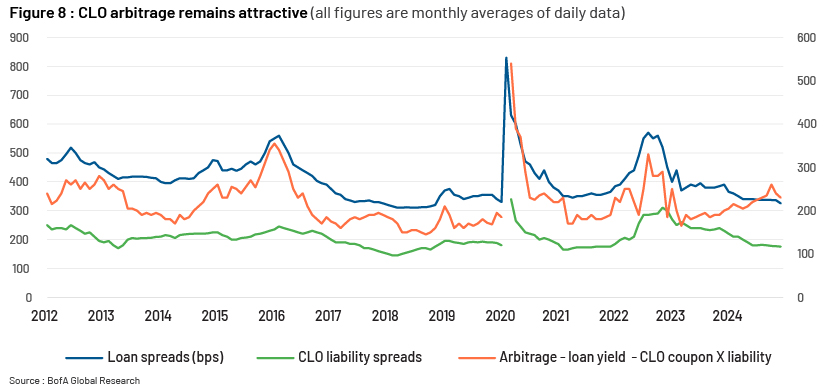

5. CLO arbitrage attractiveness – Collateralized Loan Obligations equity arbitrage is the difference in loan asset and CLO debt (liability) spreads that represents the residual income that CLO equity investors receive from the loan portfolio after all debt tranches are serviced. Arbitrage remained relatively balanced as of 2024, as there was a sequential decline in both asset and liability spreads. On average, 2024 was a more attractive year than 2023 for equity arbitrage. Arbitrage remains attractive in 2025 relative to levels seen over the past two years, as well as compared to 2021 and the years preceding the pandemic, with a declining trend in recent months. While arbitrage is a point-in-time measure, the optionality currently afforded by the tight CLO liability spreads continues to represent an attractive opportunity for entry.

6. Technological advancements – Artificial intelligence (AI) and machine learning (ML) algorithms are being integrated to predict default rates and optimise asset selection through analysing years of loan performance data to identify patterns that precede defaults, enabling CLO managers to make more informed decisions.

Blockchain is being incorporated to enhance the transparency and efficiency of CLO collateralized loan obligation transactions. All parties can have real-time access to the same information through recording transactions on a decentralised ledger, reducing the likelihood of disputes, error, and fraud.

Automation of payment flows and CLO covenants using smart contracts and risk-management software that can simulate various economic scenarios and their potential impact on the collateralized loan obligation (CLO) portfolio in different stress conditions help managers mitigate adverse outcomes.

Managers with existing proprietary systems recognise the advantages of buying versus building by embracing the trend towards cloud-hosted vendor applications, which includes the added benefit of expensing vendor fees to their funds.

Conclusion

The mix of factors expected to persist in 2025 in varying degrees is as follows :

-

New entrants in the market driven by the opportunity to acquire loans

-

Structuring transactions to provide attractive yield relative to comparable/related asset classes

-

The BSL market’s preference for B2/B rated issuers will likely relegate most B3/B-minus borrowers to private-credit/direct-lending options

-

Optimised capital structures increasing acceptance of CLOs by existing investors

-

Increased sensitivity to interest rate duration risk, leading investors to embrace CLOs as a rates hedge

It is advisable to proceed with a more cautious bias to position portfolios owing to geopolitical risks such as a resurgence of inflation or unexpected government policy that could complicate the economic picture and return the market to a more volatile state: this would enable finding a more attractive loan entry point and compelling relative value opportunities.

| Public markets | Opportunities | Risks |

|---|---|---|

| Systematic credit | Enhanced value signals identifying opportunities that compensate investors relative to controlled risk factors | Highly indebted companies |

| Defensive higher quality credits | Significant exposure to generic risk factors, such as raw value/carry | |

| Global investment grade | Shorter-dated, lower-beta assets with a preference for financials | Longer dated US credit |

| Global high yield | European financials and idiosyncratic single B opportunities | Overpriced US credit and cyclical sectors |

| Stressed refinancing | US banks and consumer-focused sectors | |

| Liability management exercises | ||

| Emerging market debt | Select opportunities in emerging market (EM) foreign exchange (FX) | Tight valuations in hard-currency credit |

| Large external imbalances have disappeared | Stickier US inflation than that priced in | |

| Wide dispersion in local rates | Fat tails related to the Trump presidency | |

| Emerging-market corporate bonds | Opportunities in high yield | Mexican issuers |

| Select opportunities in Brazil and Argentina | Directional exposure in China | |

| Special situations and stressed situations in Asia | Larger investment grade (IG) issuers | |

| Stressed refinancing | ||

| Asia credit | Domestically driven credit | Potential trade tariffs |

| Asia financials | Geopolitical tensions | |

| Japanese credit, particularly Japanese insurers | ||

| Idiosyncratic opportunities | ||

| Convertible bonds | Ongoing small- and mid-cap rally | Sector concentration due to opportunistic issuance trends |

| Recovery in mergers and acquisitions (M&A) volumes | ||

| Catastrophe bonds | Increasing growth of cyber risks as a peril | An outsized catastrophic US wind or quake event |

| Private markets | ||

| Middle-market direct lending | Sponsor-backed direct lending | Sectors exposed to US consumers |

| Core middle market | Highly cyclical businesses | |

| Recession-resilient sectors |

How Acuity Knowledge Partners can help

We provide comprehensive credit research and support with writing detailed investment committee memos during deal execution. We use automation to ensure deal surveillance, support and maintenance to global collateralized loan obligation (CLO) managers to help manage risks efficiently across the full investment lifecycle. This covers support for streamlined loan trading, modeling interest and principal waterfall payments, and a robust CLO compliance calculation engine with native support for pre-trade, post-trade and hypothetical trade scenarios and enhancing operational efficiencies.

We conduct covenant monitoring and offer performance dashboards and periodic portfolio valuations (including data management and coordination with stakeholders), tracking performance triggers and evaluating risks in securitisation transactions, helping clients optimise their advisory roles in structured finance management. Partnering with us gives private-market players access to our knowledge and analytical strength, ensuring they maintain a competitive edge.

We are a market leader in using technological advancements and providing bespoke solutions. FolioSure is a tool developed in-house to provide a comprehensive portfolio monitoring and reporting solution for private markets. It features a unique blend of cutting-edge technology and human intelligence to streamline the overall data journey, from collection to report generation for private equity funds, venture capital funds and fund of funds. It can be fully integrated into an existing technology stack and processes and can be configured in line with client requirements to take full control of the portfolio lifecycle.

References :

-

US CLO outlook 2025 - Let it CLO, let it CLO, let it CLO | 9fin

-

What’s in store for leveraged loans and CLOs in 2025 | Moody’s

-

Outlook for CLOs in 2025 – reason for optimism? | Deutsche Bank

-

2025 US CLO Outlook: Another gangbusters year expected | PitchBook

-

CLO Ready for Better Performance, Refinancing Opps in 2025 | CRE Daily

-

2025: Changing of the Guard: New Regimes in Politics and Markets | Man Group

-

The Role of CLO Managers in Structuring and Managing Portfolios | FasterCapital

What's your view?

About the Author

Rohit has over 10 years of experience in structured finance focusing on CLO transactions. His knowledge expands to multiple asset class research, performance report and scorecard publication, cashflow and rating analysis.

Like the way we think?

Next time we post something new, we'll send it to your inbox