Published on November 3, 2022 by

The CLO market and participants

Collateralised loan obligations (CLOs) are securities backed by a pool of loans that typically range from AAA to B in the rating category. The CLO manager pools the loans in a warehouse (which has a typical holding period of 6-12 months) and subsequently sells tranches in the form of notes. Interest on these notes is paid through the yield from the original loans financed by the CLO manager. The CLO market works as a channel for large institutional investors to lend to non-investment-grade borrowers via investments in rated CLO debt, albeit with structural and rating advantages for CLO investors. CLOs continue to consistently offer a significant yield premium over other corporate credit instruments for an equivalent credit rating.

Market participants prefer to invest in CLOs due to their more attractive returns than similar investment-grade (IG) fixed income assets. BB rated CLO notes provided an estimated return of c.9% in 2021, according to Deutsche Bank. In addition, the corporate default rate was at a 10-year low (0.4%) in 2021 versus a historical average of c.2.8%. The 2022 default rate is expected at c.1%.

New interest from first-time CLO buyers has come, notably, from insurance companies and public and corporate pensions investing in the senior and junior mezzanine debt and equity segments of the capital structure. US insurance companies had exposure of c.USD193bn (c.23% y/y growth) in 2020, with c.90% invested in IG-rated CLOs.

CLO sector – developments and forecasts

High inflation from August 2022 ensured the US Federal Reserve (Fed) maintained the tempo, and it again raised the interest rate by 75bps at its September 2022 meeting (after two consecutive 75bps hikes). Market participants expect the Fed to maintain an upward trajectory and the interest rate to reach c.4.50% by March 2023. With a higher-interest-rate regime expected to be the norm as the 2023 recessionary environment approaches, investors could look to diversify their risk via IG financial instruments, as these instruments would provide attractive returns in a high-interest-rate environment and assure safety of returns during an economic slowdown. Investors could shift from riskier non-IG CLO tranches to publicly rated CLO tranches. The recessionary tendencies could have a bearing on CLO issuance in 2023, as CLO managers would have to re-strategise their portfolio mix to still attract investors looking for risk premium.

The US accounted for c.80% of the global CLO market of USD1tn in 2021 and witnessed a record c.USD185bn in new CLO issuance.

Top five US CLO managers (2021 issuance)

|

CLO manager |

No. of vehicles issued |

2021 issuance (USDbn) |

|---|---|---|

|

Blackstone Group |

16 |

9.1 |

|

Carlyle CLO Management |

11 |

5.9 |

|

KKR Credit Advisors |

9 |

5.1 |

|

GC Investment Management |

9 |

6.1 |

|

Palmer Square Capital Management |

8 |

5.7 |

2022

The global CLO market is expected to reach USD1.2tn in 2022. Europe could witness new CLO issuance to the tune of EUR30-35bn in 2022, supported by strong supply and demand factors.

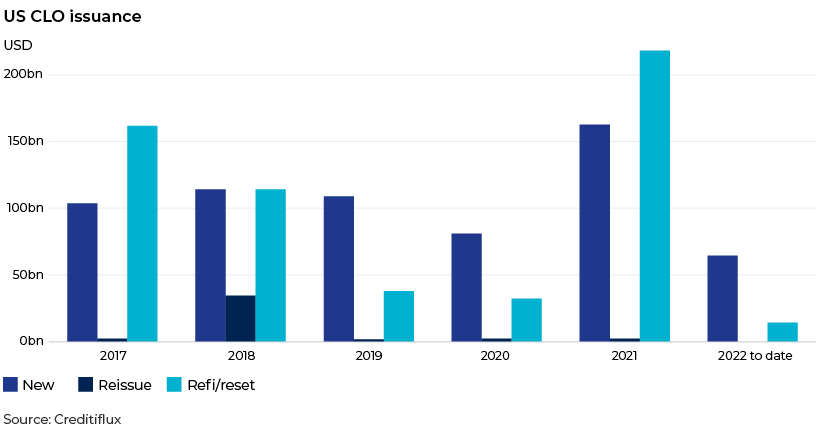

The US CLO market was worth c.USD900bn in 1Q22. US 2022 new issuance is forecast at USD135-145bn. The forecast of lower issuance than in 2021 runs counter to record institutional loan supply of c.USD613bn in 2021. Financial institutions are flush with c.USD900bn in available capital that could fund M&A/LBO activity in 2022, according to Deutsche Bank. Refinancing activity is expected to fall to USD70-80bn in 2022 (from c.USD200bn in 2021) due to strong primary supply (new issuance) weighing on spreads.

US CLO issuance was USD30.7bn in 1Q22 (down 23% from 1Q21) but in line with 1Q18 and 1Q19 volumes of USD32bn and USD28bn, respectively. This lower issuance in 1Q22 could be attributed to managers coming to terms with transitioning from LIBOR to SOFR for pricing new deals. In addition, c.USD45bn worth is outstanding in c.220 US warehouses (older than nine months) that CLO managers are struggling to sell in the markets.

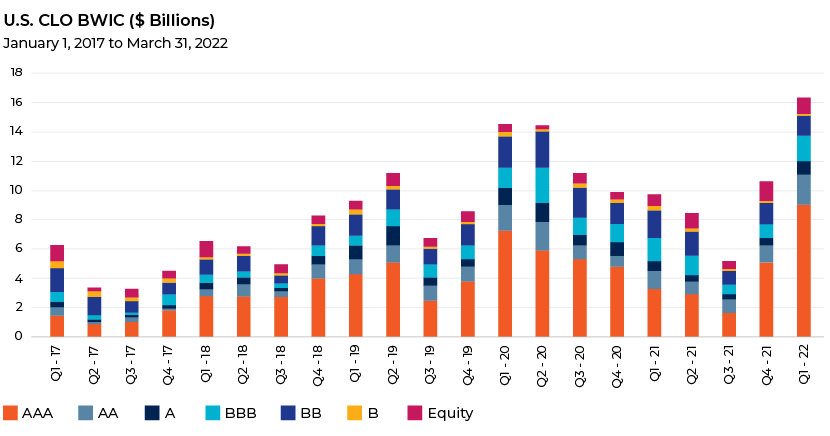

US CLO issuance in 1Q22 was clearly tilted towards issuance of IG notes (c.80%), highlighting investor preference for conservative returns in the current market conditions. Overall, with the US embarking on a rate-hike cycle to mitigate recessionary fears, 2Q22 witnessed issuance of 79 new broadly syndicated loan CLOs in the US. New-money CLO issuance in the US stood at c.USD65bn YTD in June 2022while refinancing stood at c.USD16bn. CLO markets could face lower issuance in the coming quarters due to higher spreads and shorter reinvestment periods, among other factors.

Challenges faced by CLO managers

-

With an imminent recession and higher interest rates, CLO managers would need to recalibrate their CLO portfolios to attract investors looking for risk premium.

-

Covenant-light financing to corporates that are highly levered could be the trigger if their businesses face operational issues, leading to default.

-

CLO managers’ focus on ESG-based investing is also attracting attention, with one-third of global CLO managers incorporating negative screening criteria for their portfolios traded in Europe. Around 65 US CLO managers (managing c.USD480bn) are bound by the UN's Principles for Responsible Investment and need to incorporate the ESG guidelines for the loans they extend to companies. However, there is a lack of clarity as to what constitutes green or diversity-driven investments. CLO managers are now introducing machine learning to identify sectors they should ideally exclude from their portfolios or to determine an appropriate ESG rating.

-

With US insurance companies having invested significantly in US CLOs, CLO managers could resist any move by the US National Association of Insurance Commissioners (NAIC) to monitor the US CLO sector.

Mitigants

-

Close to 33% of the CLOs originated by US banks are held to maturity, providing a buffer for these financial institutions if the US anticipates a recessionary environment in the second half of 2023

-

CLO portfolio holdings for banks have historically been of the highest-quality, lowest-risk variety. Like bonds, CLO tranches (labelled senior, mezzanine, junior and equity) are evaluated based on credit metrics. In a default scenario, a waterfall analysis is adopted to pay tranches than rank higher than tranches with lower lien.

The road ahead

A number of uncertainties will likely continue to influence sentiment in global financial markets. Topping the list include the conflict in Ukraine, elevated inflation and input costs, tightening monetary policy and rate volatility and COVID-19 variants, which could have a bearing on corporate earnings.

On the other hand, adequate economic growth, low unemployment, generally healthy corporate balance sheets and solid consumer data are providing somewhat of a buffer against heightened risks.

We could also see CLO managers implementing ESG metrics in their portfolio so as to comply with regulations.

CLO managers are not concerned about defaults in 2022 but are taking a cautious approach to inflation, which could result in suppressed CLO new issuance versus 2021. With the financial markets trying to factor in recessionary signals, especially in the US, new CLO issuance could trend lower versus the stellar performance in 2021.

Seasoned investors, who have invested across market cycles, could evolve their investment strategy when investing in CLOs from 2022.

How Acuity Knowledge Partners can help

We have nearly two decades of experience in helping 400+ banks and financial institutions transform their operating models and cost structures. Our Lending Services team provides offshore support to banks in on-boarding CLO portfolio and re-underwriting and monitoring loans. Our credit experts provide granular insights and help banks’ credit risk teams identify potential risks in their portfolios.

Sources:

- https://industrygrowthinsights.com/

- https://www.marketwatch.com/

- 3.CLO and Loan Market Review & Outlook: 1Q22 (voya.com)

- 2021 US CLO Wrap: Yet another record quarter caps unprecedented year for segment

- 2022 US CLO Outlook: Optimism abounds, but surpassing 2021 levels unlikely | S&P Global

- US banks' CLO security holdings near USD100B after 12% jump in 2019 | S&P Global Market

- https://content.naic.org/

- CLO and Loan Market Review & Outlook: 4Q21 (voya.com)

- Barclays forecasts modest slowdown in CLO issuance in 2022 | S&P Global Market Intelligence

- 2022 Outlook: European CLOs set for another year of bumper issuance | S&P Global Market

- How will the CLO market fare in 2022? | Collateralized loan obligations (CLO) | Structured Credit

- Global CLO Quarterly Shows Tougher Conditions for US, European CLOs in 2Q22

- LevFin Highlights 2Q22: Turning tide – Leveraged issuance sinks 77% YoY | ION Analytics

Tags:

What's your view?

Like the way we think?

Next time we post something new, we'll send it to your inbox