Published on October 12, 2021 by Junfang Wang

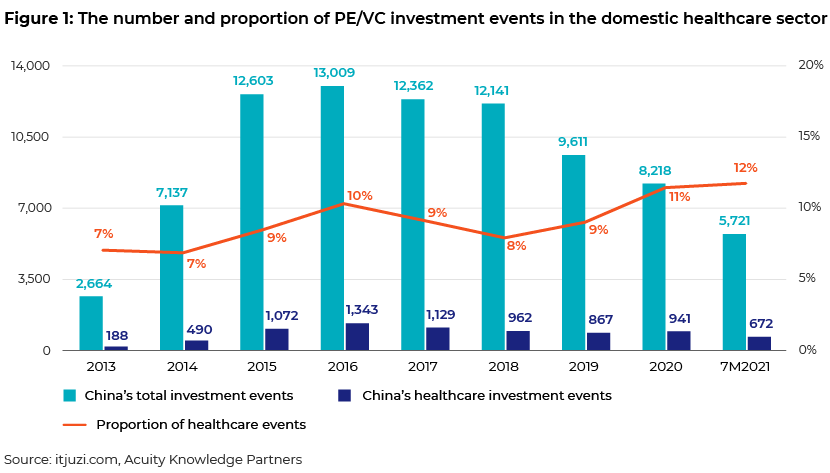

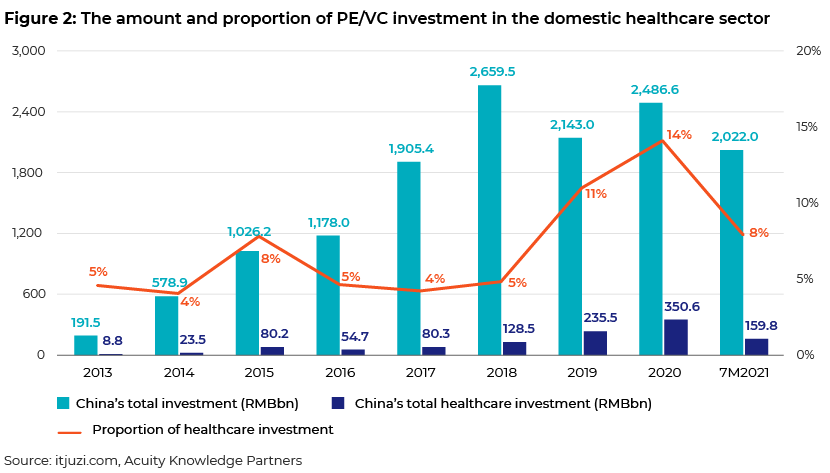

The private equity and venture capital (PE/VC) industry and the number of related investment events grew significantly in 2014, when China experienced the first bull market after a five-year bear market. However, the market started cooling in 2019 with a sharp drop in the number of investments due to the explosion in peer-to-peer (P2P) lending and new regulation prohibiting multi-layer nesting. With the outbreak of the pandemic in 2020, the number of investment events reduced further, but the amount of investment actually exceeded that in 2019 since more money was invested in high-value sectors such as healthcare and integrated circuits. By July 2021, the number of investment events was almost 70% of the total in 2020, and the amount of investment was more than 80% of the total in 2020.

The high-value healthcare sector has become a hot spot for investment in recent years, attractive to large PE/VC institutions. Since the start of the pandemic, the number of investment events in the sector has increased significantly. While the total number of investments dropped in 2020, the number of investments in the healthcare space increased, accounting for 11% of total investment events and 14% of the total amount of investment.

The main reasons for increasing investment in the healthcare sector:

-

Introduction of policies to promote industry standardisation and efficiency. Since China’s health system reform in 2015, the state has issued a number of policies on pharmaceutical production and commercialisation. While the quality of drug production has been strictly controlled, new drugs’ time to market has been shortened, the number of circulation links has been reduced and retail prices of drugs have been controlled, helping increase market scale of scarce drugs such as those for serious diseases. After innovative drugs were approved for medical insurance cover, more anticancer medicines have been covered than chronic illness medicines. Innovative drugs are an emerging trend in the domestic market and present significant growth potential for biotech companies.

-

The cost of medical research and development is high, and biotech companies need continued financing. A significant amount of time and money is required from the time a drug is discovered to the time it is listed. Startup companies that have good projects but no capital can only resort to seeking external venture capital. With the success of Zanubrutinib, China’s first innovative drug that was developed completely independently and listed overseas, prospects seem to be bright for injecting capital into pharmaceutical innovation.

-

IPO listing conditions have been relaxed, and capital exit is guaranteed. The Hong Kong Stock Exchange and Shanghai Stock Exchange have relaxed listing conditions for biotech companies that have not made profits but whose valuations exceed the entry threshold. With this relaxation, the listing time for biotech companies is shortened, exit risk for investors is reduced and investor enthusiasm is heightened.

A number of domestic institutions, such as Hillhouse Capital, focus on investment in the healthcare sector. Hillhouse Capital is best known for participating in eight financing rounds from BeiGene since 2014 – from round A to listing. BeiGene is one of China’s leading biotech companies, with a current market capitalisation of more than RMB200bn. In the 11 years since it was founded, it has achieved total financing of RMB44.1bn, has been listed on two markets and is likely to be listed on a third this year.

With healthcare in constant demand and a dearth of therapeutic drugs for a number of diseases, healthcare investment remains a hot area. Domestic policy is now trending towards innovative drugs, and PE/VC and other investors will likely focus on pharmaceutical companies with strong research and development capabilities.

How Acuity Knowledge Partners can help

We provide in-depth interpretation of macro policy and industry news, and research the fundamental values of listed and unlisted companies based on our professional valuation and financial analysis skills to support investment recommendations.

We are experienced in healthcare research and compiling professional valuation reports including analysis of policies implemented by China’s National Medical Products Administration (NMPA), the healthcare sector and the target company to help clients estimate the value of an investment.

Sources:

Tags:

What's your view?

About the Author

Junfang Wang has 3 years of experience in private equity investment analysis with a focus on China market. At Acuity Knowledge Partners Beijing office, Junfang supports investment services to clients, covering various industries. She holds a master degree in Finance from University of International Business and Economics.

Like the way we think?

Next time we post something new, we'll send it to your inbox