Published on December 27, 2022 by Rakesh Kumar

The Consumer environment is choppy, challenging, and uncertain this holiday season amid high inflation, rising interest rates, muted disposable income, record low saving rate, and broadly weaker consumer confidence. U.S. Retailers need to be more promotional to attract customers as they shy away to shell-out for shopping, look for value, trade-down, are hunting for deals and being very selective in shopping during the holidays. Big-ticket and discretionary spending, in particular remains at the risk due to high inflation and rising rates. Moreover, industry-wide elevated inventory levels pose a risk to margins. So, retailers that offer value, provide flexible payment options, and are able to turn inventory efficiently are expected to be well placed fundamentally this holiday season, however margins are expected to remain under pressure as they roll out more promotions to drive sales and churn the inventory. As such, discount and dollar stores, closeout/off-price retailers, and warehouse retailers seem to be strongly placed in this environment than department stores, and speciality retailers.

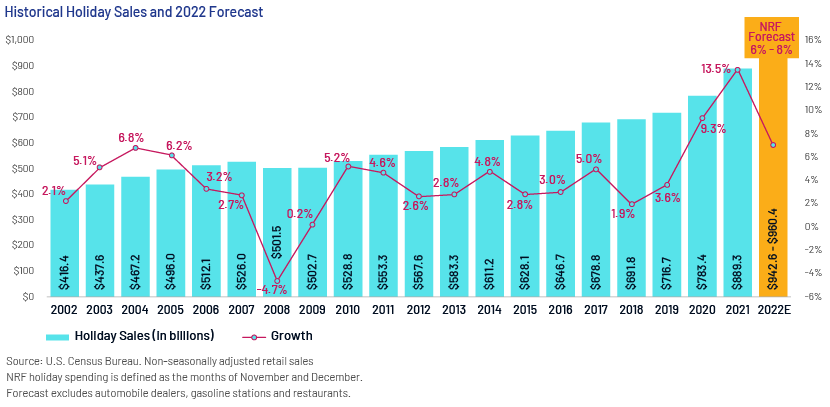

Early Prediction and Current Trends. In November 2022, the National Retail Federation (NRF) had predicted holiday retail sales to grow by 6-8% in 2022 (below last 2 years’ growth), including e-commerce sales predicted to grow 10-12%, supported by the strong job market that encourages Americans to keep spending. However, preliminary data trends from Adobe Analytics suggest that holidays had a modest start this year with Thanksgiving Day online spending increasing 2.9% y/y to $5.29 billion that compares to the typical double-digit increases in previous years since 2012. Black Friday sales increased 2.3% y/y to $9.12 billion, and Cyber Monday sales increasing 5.8% y/y to $11.3 billion. Further, the advanced retail sales estimate from the Census Bureau showed a decline of 0.6% m/m in total retail sales for November, with the pullback widespread across categories - furniture and home furnishings stores decreasing 2.6%, building materials and garden centers down 2.5%, and motor vehicle and parts dealers dropping 2.3%. On a y/y basis, retail sales increased 6.5%, compared with a CPI inflation of 7.1%.

Disposable Income, Inflation and Interest Rate Point to Weak Spending Environment. Personal disposable income is at muted levels, and the real disposable income growth has been in the negative territory this year due to decades’ high inflation rate. As per recent data available for October 2022, personal disposable income grew 2.8% y/y, while on a real basis, it decreased 3.0% y/y. The decline in real disposable income suggests decreased purchasing power of consumer and therefore pose a risk to consumer spending this holiday season. The inflation rate though has moderated from the peak, but still remains high, and the food and energy Inflation is even higher than overall inflation rate, resulting in higher cost for necessity items. Thus, lower- and middle-income consumers are facing more pressure as they spend more on grocery, energy, and shelter. Higher prices for necessities is resulting in lower discretionary spending potential for consumers, which is believed to be weaker category this holiday season from consumers’ spending perspective. Moreover, higher interest rates are expected to be an obstacle in the big-ticket items purchase and discretionary spending.

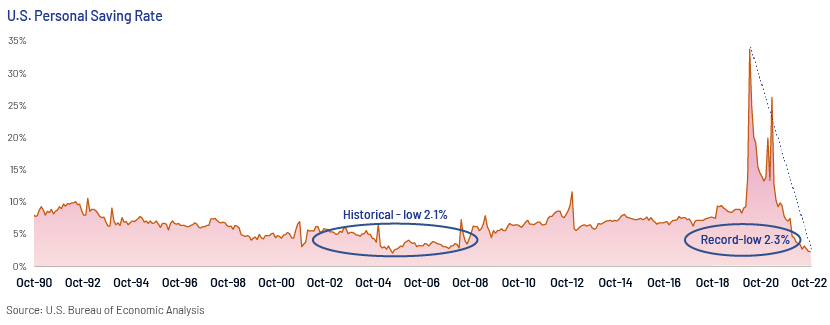

Record Low Savings Resulting in More Credit Utilization. The personal savings have dried up as the high inflation and rising borrowing costs are eating up what Americans accumulated during the pandemic. The personal saving rate currently stands at 2.3%, the lowest since the all-time low of 2.1% in July 2005. This clearly shows worrying situation as the saving rate is even below the Great Financial Crisis level of 2.9%. Consumers are looking for flexible payment plans such as “Buy Now Pay Later” and are utilizing increasingly more credit as they face significant financial challenges of lower savings in the inflationary environment. In October 2022, consumer credit increased at a seasonally adjusted annual rate of 6.9%, comprising of revolving credit (credit card) increase at 10.4%, and non-revolving credit (auto, personal, and student loan) increase at 5.8%. Consumer loan delinquency increased throughout 2022 and increased to 1.92% in 3Q22, which is at the highest level since 4Q20. Credit card delinquency also increased to 2.08%, the highest since 4Q20. As the credit utilization increases and the delinquency trending upward, banks are expected to tighten the credit policy and the credit card approval rates.

Consumer Confidence Remains Weak. Consumer confidence improved in December, but remains broadly weak due to the deteriorated expectations and gloomy short-term outlook as consumers remain pessimistic about the short-term income prospects, and business conditions outlook. Inflation expectations however retreated in December to their lowest level since September 2021, likely due to recent declines in gas prices. Vacation intentions improved, but plans to purchase homes and big-ticket appliances further cooled.

Holidays Outlook Commentary from Key Retailers Suggest Margin Pressure. Retailers have warned on the margin pressure during holidays due to inflationary pressure, elevated inventory levels, promotional environment, and higher growth in the low-margin products as consumers trade-down. Walmart had noted higher-income customers shopping more often, which clearly indicates trade-down behavior from consumers. Target is already doing the inventory right-sizing to get rid of slow moving inventory, primarily on the discretionary side of the business, which is adversely impacting operating margin. Dollar General’s margins have been impacted by a greater proportion of sales coming from the consumables category, which generally has a lower gross margin. Macy’s noted adverse impact on merchandise margin due to increase in promotional and permanent markdowns, as the company sold through slower moving categories including casual apparel, soft home, and warmer weather seasonal goods. These comments from key retailers clearly show the margin pressure risk in the most-important holiday season, which seems less likely to combat.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our research experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs, CFAs) to support our clients on a wide range of activities including idea generation, financial analysis, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.

Sources:

-

Personal Income and Outlays, October 2022 | U.S. Bureau of Economic Analysis (BEA)

-

FRB: Charge-Off and Delinquency Rates on Loans and Commercial Banks (federalreserve.gov)

-

Adobe - Adobe: Cyber Monday Drove $11.3 Billion in Online Spending, Breaking E-Commerce

Tags:

What's your view?

About the Author

Rakesh is an Assistant Director with Acuity Knowledge Partners (Acuity). He has 15 years of experience in investment research in both, buy-side and sell-side equity research, with a focus on the US retail sector. He joined Acuity in December 2019 and currently supports a sell-side client with research assignments including financial modelling, earning previews/reviews, industry research, economic research and thematic reports. Prior to joining Acuity, he worked with Guggenheim Partners’ Transparent Value Private Limited as a senior equity analyst covering the consumer staples sector. He holds a MBA in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox