Published on October 30, 2023 by Anjana Viswanathan

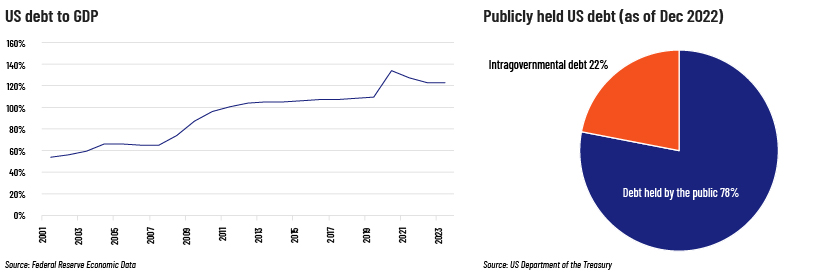

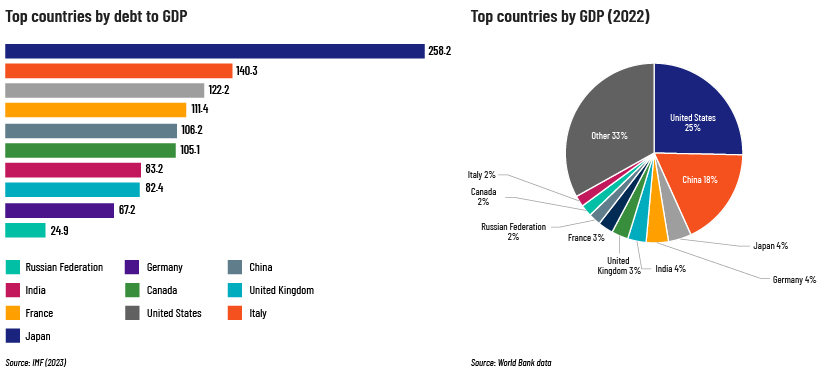

The US accounted for 25% of global GDP in 2022, but its debt-to-GDP ratio was at 122%. It has a large amount of debt, mainly due to lower tax revenue, increased government spending on Medicare and social security and high interest rates on outstanding debt. The decision to suspend the country’s debt ceiling after it reached the c.USD32tn mark on 31 May 2023 also caused uncertainty in the market. All this led to Fitch downgrading the US debt market to AA+ from AAA.

Current status of US debt

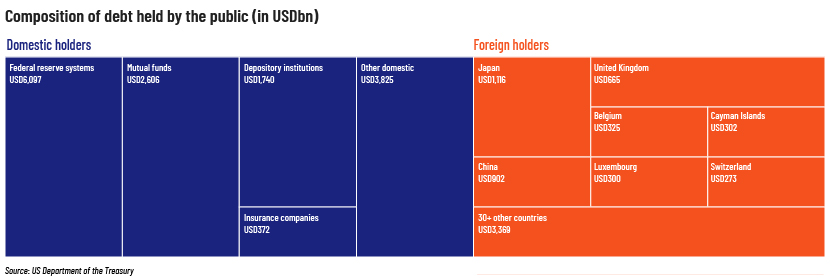

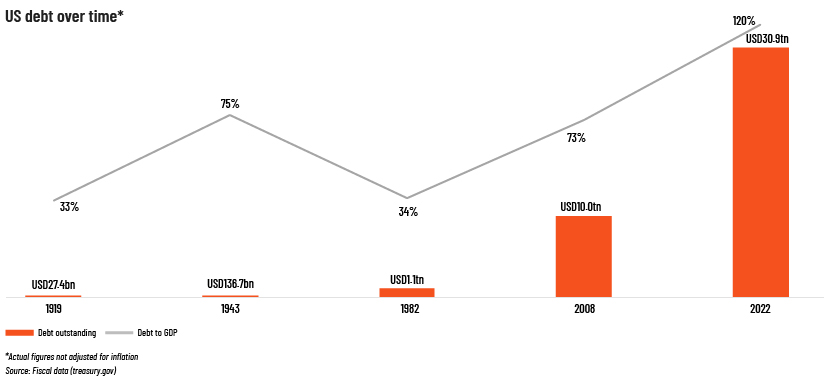

US debt rose to USD32tn, with a c.123% debt-to-GDP ratio in June 2023. While c.78% of this debt was held by the public, indicating borrowing from domestic and foreign investors, the remaining 22% was intragovernmental debt, signifying deals between federal government departments.

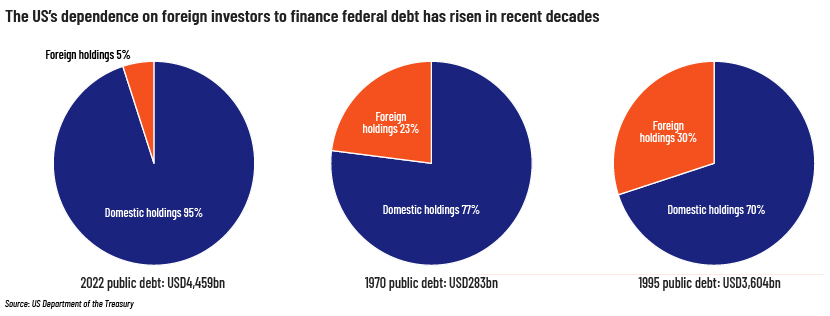

Foreign investors hold c.30% of US debt, considering it to be an ultra-safe asset. Despite a gradual increase in the share of US debt held by foreign countries, countries such as China are reducing their holdings to minimise their reliance on the US currency. Japan and the UK, however, have increased their shares.

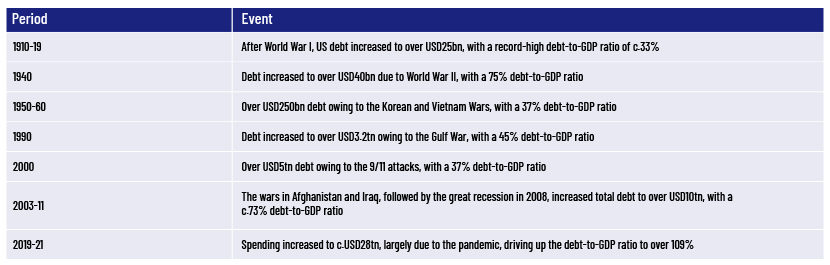

History of US debt

Despite being debt-laden for over 200 years, the US has not once been bankrupt, although the US Treasury has not been able to resolve the debt obligations. The following table shows the gradual increase in debt and the accelerated increase in the past two decades:

Comparison with other countries

The global debt obligation has escalated to over USD305tn, with a c.336% debt-to-GDP ratio. The US is among the top 15 countries in terms of debt to GDP, according to the IMF.

Although a major contributor to the global economy, the US’s substantial debt may reduce the use of the US dollar as the main currency for trade in the long term.

Drivers of US debt

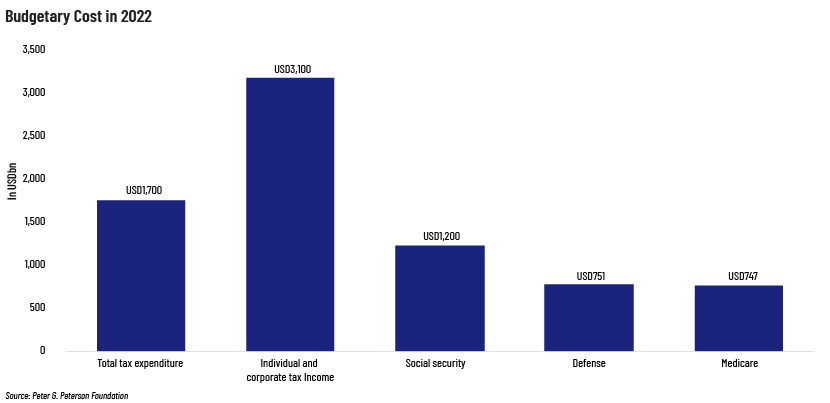

The main cause of rising US debt is the disparity between the nation’s income and expenses. The following are the primary reasons for the country’s more-than-100% debt-to-GDP ratio.

Insufficient revenue from individual income tax receipts: The US tax system is inefficient, with tax spending allowed only for specific purposes and certain population groups. Individual income tax receipts are expected to decline by 4%, from USD2.6tn (or c.11% of GDP) in 2022 to USD2.5tn (or 10% of GDP) in 2023, according to the Congressional Budget Office’s (CBO’s) projections in May.

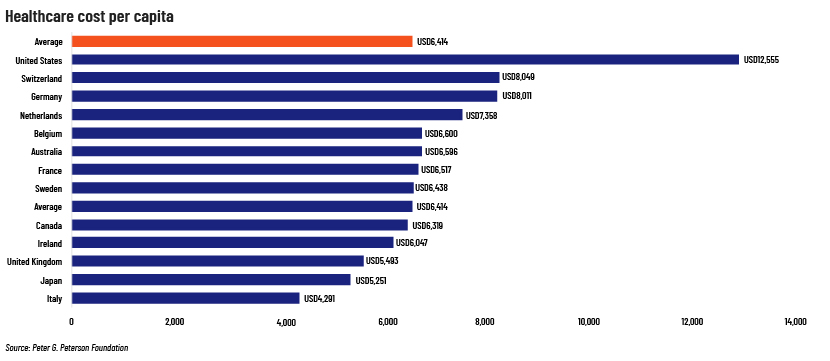

Expenditure on healthcare and social security programmes: The nation spends more on healthcare than any other developed country. It also has the lowest life expectancy and increasing incidence of individuals with multiple chronic health conditions, according to a new report by the Commonwealth Fund. The CBO expects Medicare expenses to increase by 10%, from USD747bn in 2022 to USD826bn in 2023, owing to the increasing number of recipients and rising medical care costs.

Social security is the largest programme in the federal budget, accounting for c.20% of total federal spending. This is projected to increase by 11%, from USD1.2tn to USD1.3tn in 2023, largely due to the 8.7% cost-of-living adjustment effective from January 2023, the highest increase in c.40 years. The number of senior citizens is expected to rise at a c.4% CAGR, from 54.0m in 2022 to 72.1m by 2030, increasing expenses of the social security programme.

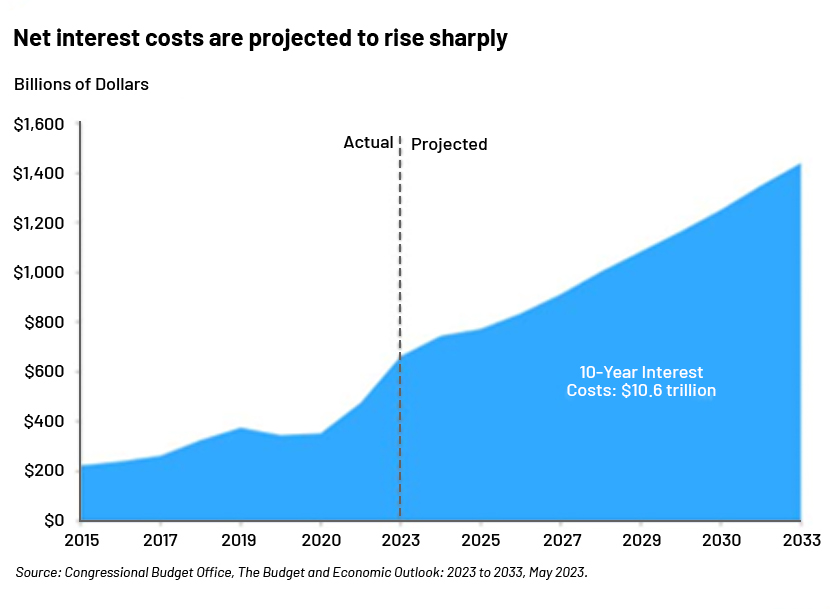

High interest rates: The largest element in the federal budget is debt repayment – larger than expenses on the healthcare programmes. The CBO expects interest expenses of more than USD10.0tn in the next 10 years.

Politics: The tax cuts, efforts to mitigate a recession and bipartisan spending contributed to this piling up of debt. US lawmakers passed the debt-ceiling package to suspend the debt limit until the start of 2025, marking the 78th instance of lifting the debt ceiling since 1960, leading to uncertainty in fiscal management.

Significance of the Fitch downgrade

Despite the US facing a debt crisis for a prolonged period, US debt is believed to be secured and low-risk. However, the Fitch downgrade on 1 August suggests it has lost some of its merits. Fitch cites “the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to AA and AAA-rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions” as reasons for its downgrade.

This is not the first downgrade of US debt. In August 2011, S&P downgraded it due to the debt-ceiling crisis, causing a 7% slump in the stock market.

On 2 August 2023, Wall Street's three main indices reported losses. The 10-year US Treasury note yield, which moves conversely in relation to prices, increased and was at its highest since November 2022. The S&P also lowered the rating from AAA to AA+ for large federally backed mortgage companies Fannie Mae’s and Freddie Mac’s long-term issuer default ratings (IDR) and senior unsecured debt.

Conclusion

While the Fitch downgrade has led to debate as to whether it was due to negotiations on the US debt limit, the root cause has yet to be addressed. The US economy may collapse if expenditure and debt continue to grow. We believe the government should focus on increasing tax revenue by broadening the tax base to include all income groups, increasing taxes on the wealthy and reducing tax breaks. It should also address the major cost drivers, mainly expenditure on healthcare.

How Acuity Knowledge Partners can help

Our more than two decades of experience in supporting global financial institutions and expertise across fixed income asset classes position us well to partner with buy- and sell-side institutions to support their research teams to take advantage of this opportunity.

References:

-

https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

-

https://finance.yahoo.com/news/25-countries-highest-debt-gdp-002918661.html?

-

https://www.pgpf.org/the-fiscal-and-economic-challenge/drivers

-

https://edition.cnn.com/2023/08/01/business/fitch-downgrade-us-debt/index.html

-

https://www.visualcapitalist.com/timeline-150-years-of-u-s-national-debt/

-

https://www.theguardian.com/business/2023/may/16/what-is-debt-ceiling-limit-explainer

Tags:

What's your view?

About the Author

Anjana is a Delivery Lead at Acuity Knowledge Partners, having more than six years of experience in the financial services sector, predominantly investment banking and equity research. Currently, supports Public Finance team, with a focus on Municipal Finance for a U.S. based Investment Bank, in Bangalore. Prior to joining Acuity, she was with William O’Neil India as equity research analyst for three years. She holds a Master’s degree in Business Administration in Finance from IMT Hyderabad

Like the way we think?

Next time we post something new, we'll send it to your inbox