Published on April 22, 2020 by Manish Mohan Raj

To preserve its reputation and uphold the highest standards of service, a firm’s employees need to maintain integrity. C S Lewis defined integrity as “doing the right thing even when no one is watching”. One of the key directives of the compliance function is to ensure that regulatory requirements and company policies in terms of integrity and confidentiality are upheld to the highest levels. In this blog, we explain how a company can use its compliance resources to ensure an effective telecommuting environment.

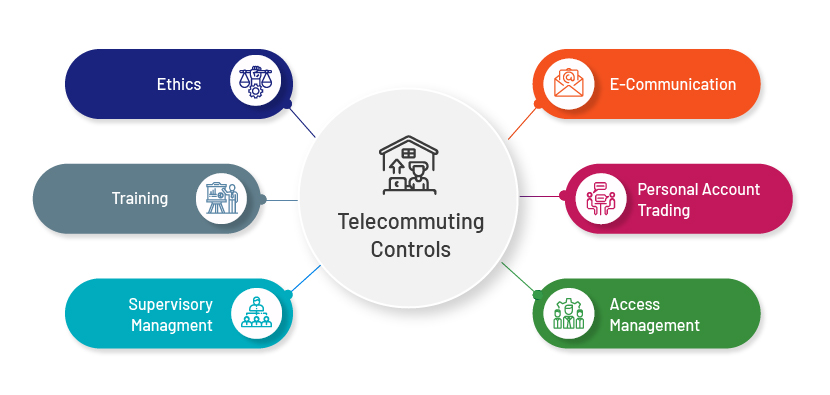

Ethics

A company’s DNA is its ethical values. One employee’s decisions could impact its reputation. One of the biggest drivers of business continuity is each employee abiding by a company’s ethical values. A company’s core values are encompassed in its code of conduct, which guides its actions. When in doubt, abiding by the company’s ethical values would help an employee take decisions in the company’s and its clients’ best interests.

E-communication

Effective e-communication surveillance is as an effective and integral part of a company’s monitoring programme that checks misconduct. Putting the right triggers in place and ensuring the surveillance programme highlights risks are critical when employees work from home. This is particularly so in situations that call for ensuring business continuity when employees rely more on electronic forms of communication than on face-to-face interaction, for example, when an employee required to communicate via a recorded line requests a call on their personal line.

Personal account trading

The personal account trading policy ensures that the best interests of a company and its clients are protected. Personal trade monitoring also ensures clients that the company is taking all necessary steps to eliminate conflict of interest, protecting their interests.

Access management

Access management ensures that companies safeguard information that has been provided to employees and that the information is shared only on a need-to-know basis. Supervisors play a key role in ensuring that any access that is not required has been revoked.

Supervisory management

Supervisors at all levels of a company make up the ecosystem for detecting misconduct. It is, therefore, important that they be the company’s culture carriers. Recent regulations have been directed towards supervisors, and it is important they take an active role in driving policies that cover reputational risk.

Training

Training in areas such as maintaining confidentiality and reputational risk should be part of initial and annual training sessions. If a company has yet to do so, now would be an appropriate time to reiterate policy. A number of channels are available for delivering such training, and it is important that the training covers all employees.

While the above are the very basics that almost all companies are likely to already have in place, we acknowledge that it takes just a small stone to crack a window, in this case, a company’s reputation. It is vital, therefore, to ensure that all steps are taken to ensure it is maintained.

Acuity Knowledge Partners’ solution

Acuity Knowledge Partners’ solution is to develop an ecosystem of controls that are dynamic, robust, and proficient. To this end, we aim to address risk at all levels of a company. We review processes and identify gaps in compliance programmes, address regulators’ requirements, and create unique solutions with the help of our technology teams that deploy state-of-the-art processes.

With our focused set of offerings in the areas of corporate compliance, forensic analysis, compliance testing, monitoring programmes, risk trend analysis, and risk mitigation, we customise and design reviews dedicated to mitigating your firm’s risks, keeping the latest regulatory expectations in mind. We believe a well thought-through approach – from initial analysis to end documentation and recommendation – will provide you with a holistic view of your business’s risks and build its resilience to any threat.

Tags:

What's your view?

About the Author

Manish is the delivery manager and subject matter expert for the forensic testing compliance practice. He has over 8 years of experience in the financial services industry. Prior to joining Acuity Knowledge Partners he worked as an associate with Goldman Sachs – GSAM Compliance. He was part of the global forensics team and was part of the marketing and portfolio management compliance team. Manish was also part of the controls management team for the asset & wealth management team at JP Morgan and was part of the HSBC KYC remediation team for multiple lines of business.

Like the way we think?

Next time we post something new, we'll send it to your inbox