Published on April 12, 2022 by Swetha Suresh

The UK’s commercial real estate (CRE) sector is the second largest in Europe, following Germany’s, and was valued at over USD1.5tn in 2020 (USD1.7tn in 2019). Investments in CRE have been decreasing, after reaching a peak in 2015, mainly due to lengthy Brexit negotiations and the pandemic. Nevertheless, turnover and the number of those employed in the sector grew from 2019 to 2020. The sector is closely related to the country’s economic performance, given the large number of businesses it caters to including industry space, warehouses, office and retail.

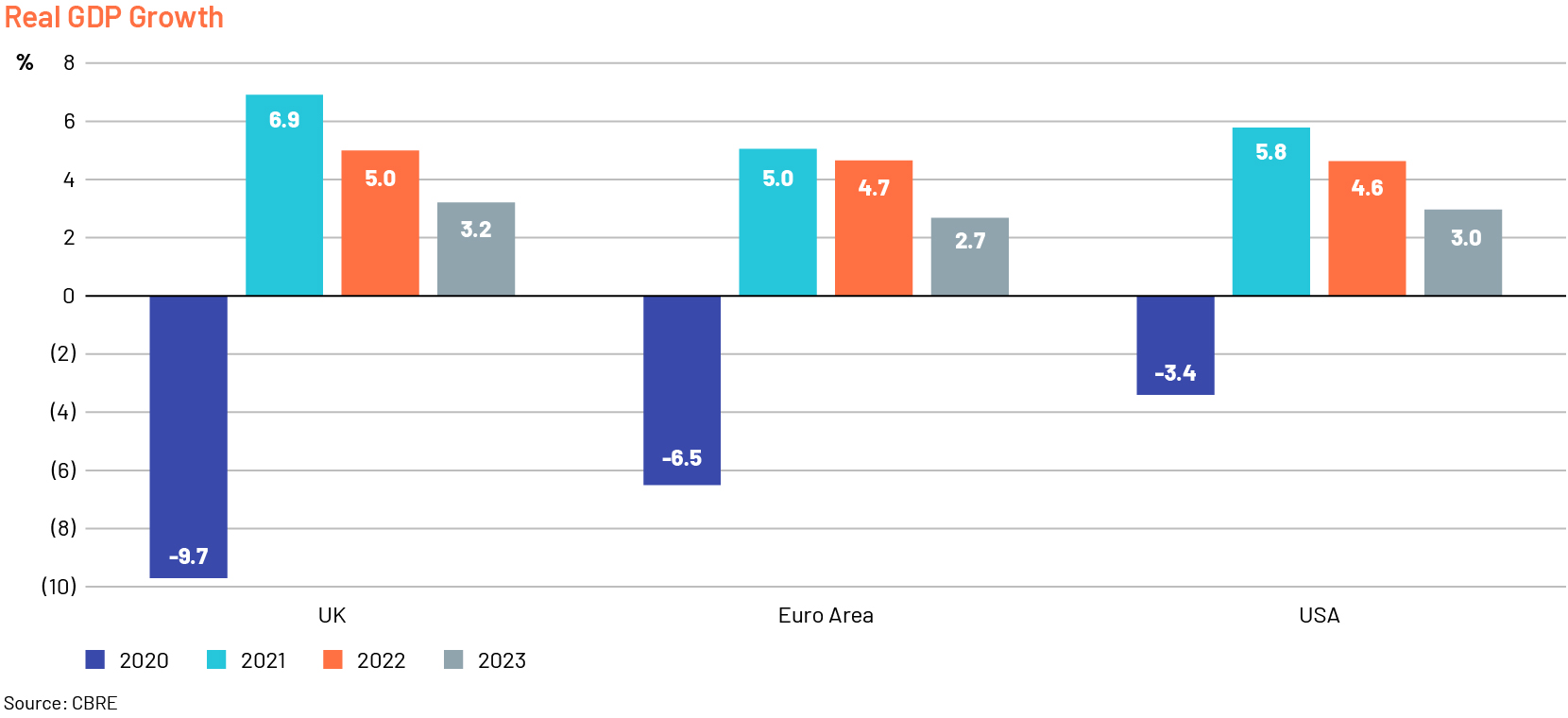

Although the UK’s economy recovered in 2021 on strong policy support, capacity constraints, a tight labour market, rising prices and new virus variants continue to pose downside risk. The IMF expects real GDP to have grown 6.8% in 2021, after having contracted by 9.8% in 2020, due to resilient private consumption and investment, before moderating to 5% in 2022.

High inflation could induce monetary tightening and affect the sector in the short to medium term

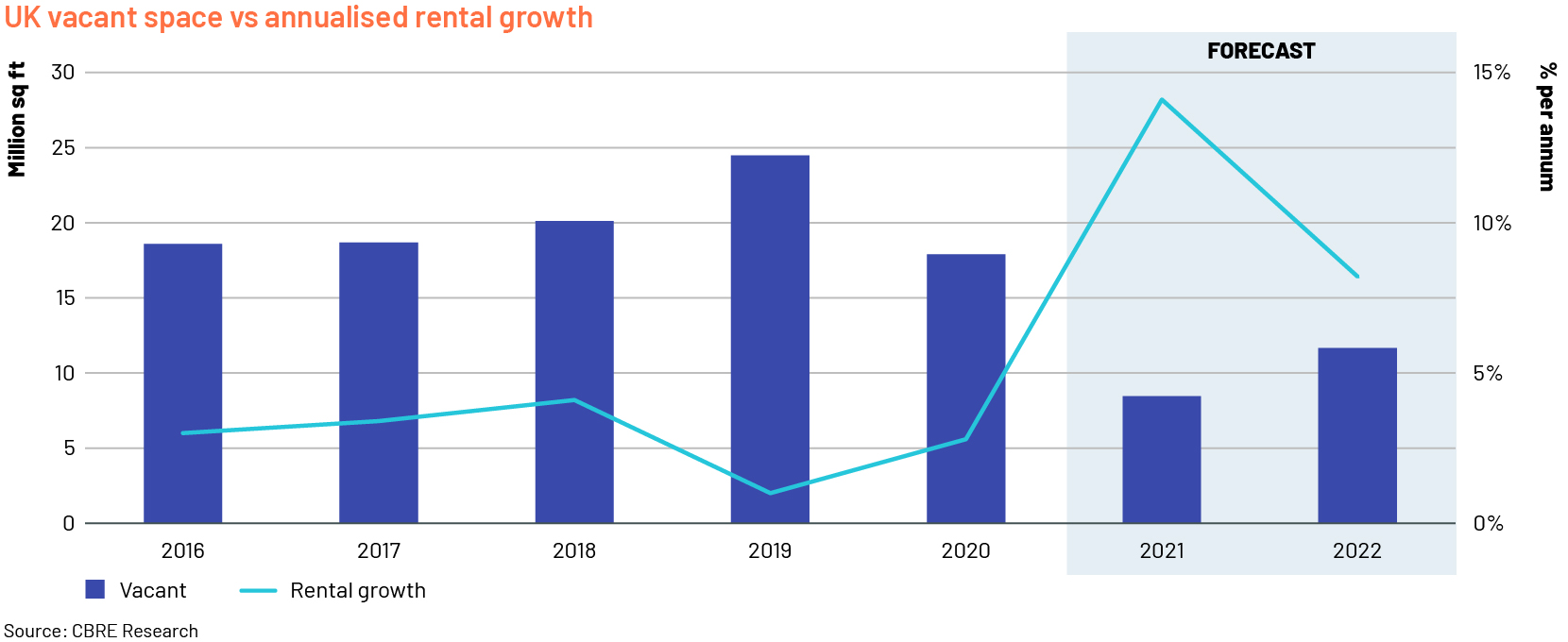

Inflation increased significantly to 4.2% in October 2021 from 0.6% at the start of the year (higher than the average for the decade of 2.1%) on increasing global energy prices as demand recovered while supply remained constrained. These challenges are likely to persist in 2022 and could result in monetary policy tightening, negatively impacting the CRE sector. Real property returns are vulnerable to changes in long-term interest rates due to the impact on the cost of debt and government bond investment yields being risk-free. The detrimental effect of current cost-push inflation on property yields could be offset by strong GDP growth. The impact of inflation and GDP on property returns varies across subsectors, for example, returns on offices and prime properties are more sensitive to inflation, while returns on logistics benefit from GDP growth. Nevertheless, the outlook for the sector remains favourable, with a modest increase in interest rates expected to strengthen yield, according to Coldwell Banker Richard Ellis (CBRE) Group, and rental growth owing to the economic recovery more than offsetting the cost of capital.

CRE demand to bounce back to pre-pandemic levels

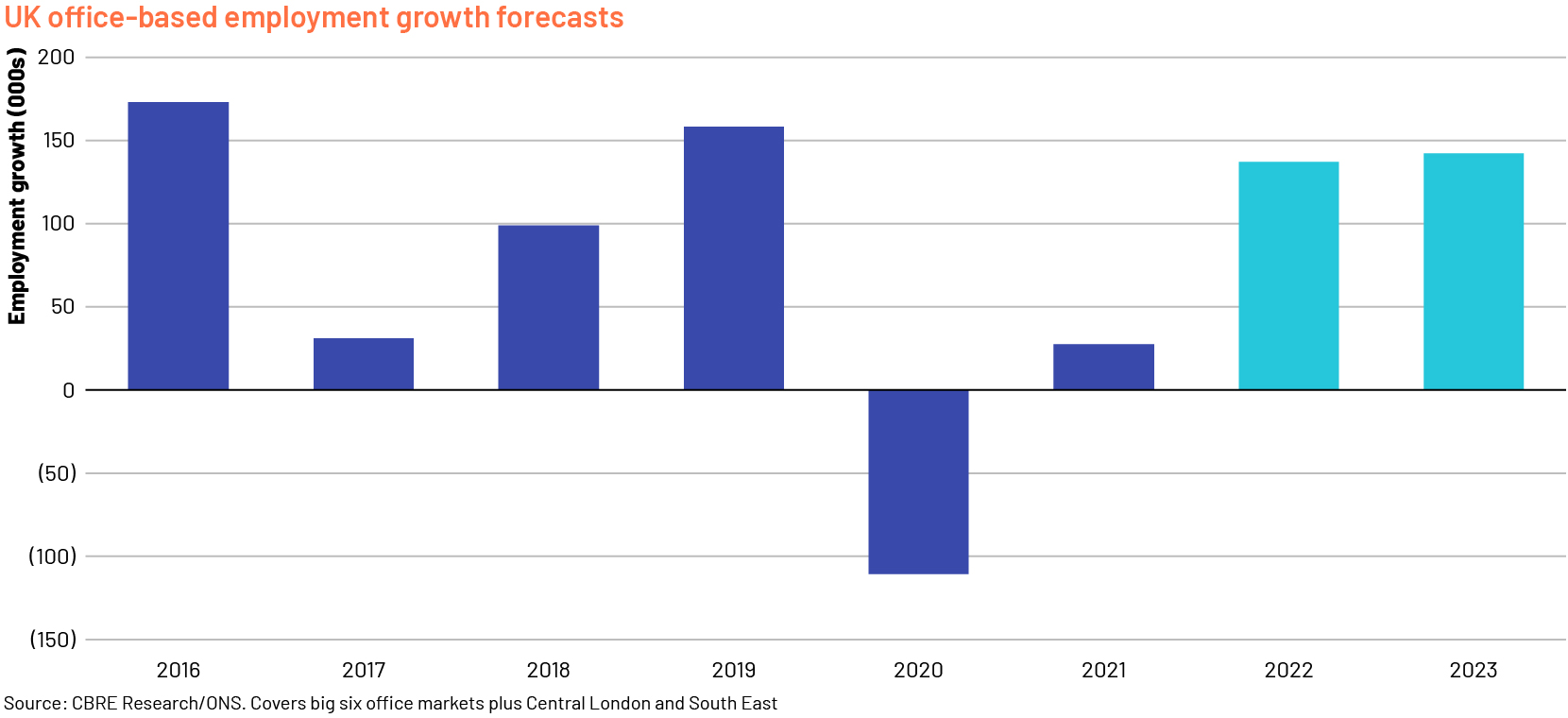

Demand for office space in the UK is expected to expand and return to pre-pandemic levels in 2022, in line with growth in new office-based jobs. However, demand is likely to be polarised towards safe and sustainable buildings and cater to new flexible working practices. To attract employees back to office, companies are focusing on recalibrating office space by focusing on enhanced services, functionality and technology, which would result in higher occupancy costs. This is, however, likely to be offset by the smaller footprint required for hybrid working.

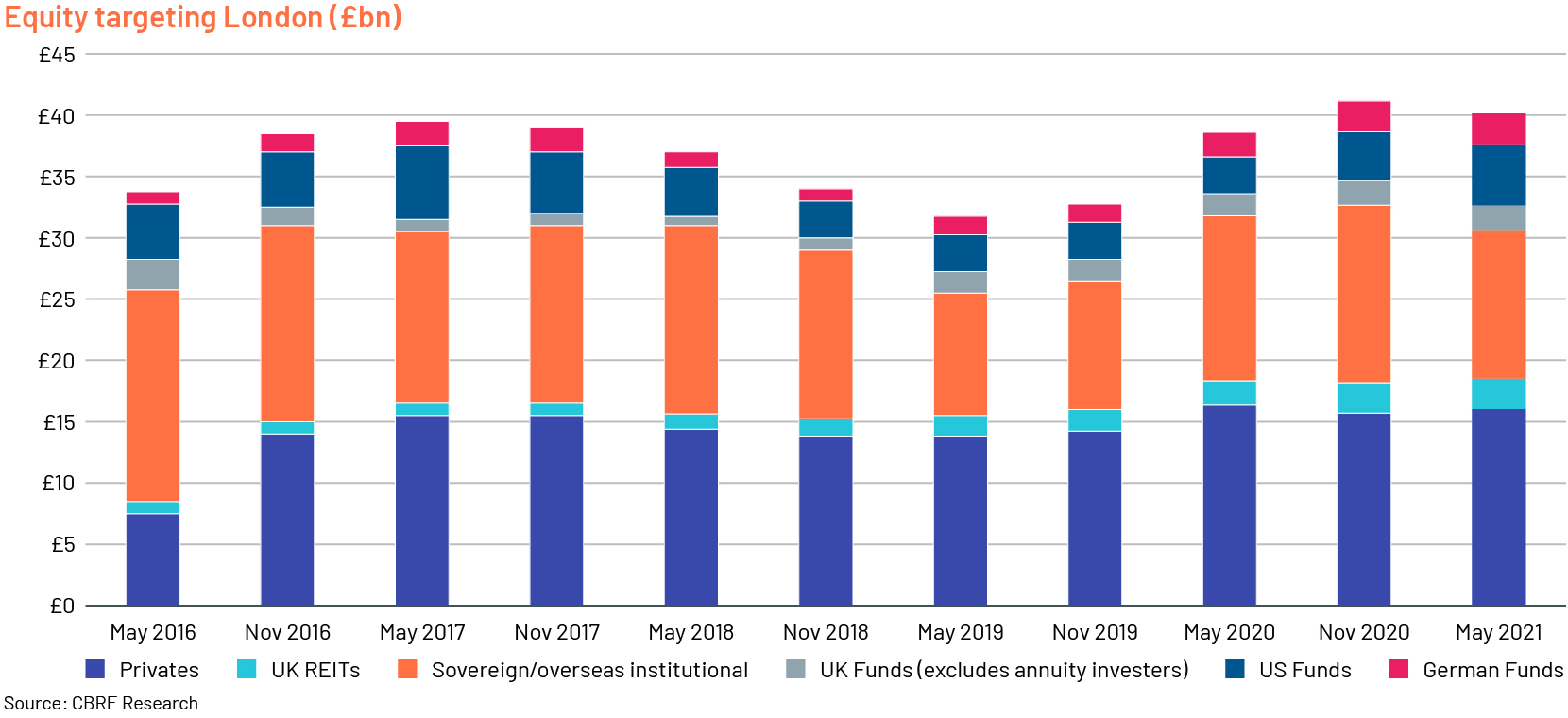

Investment volumes in UK office are projected to grow by c.20% y/y in 2022, supported by overseas investors as travel restrictions are eased. Core assets are expected to remain in high demand, evidenced by private investors accounting for the largest portion.

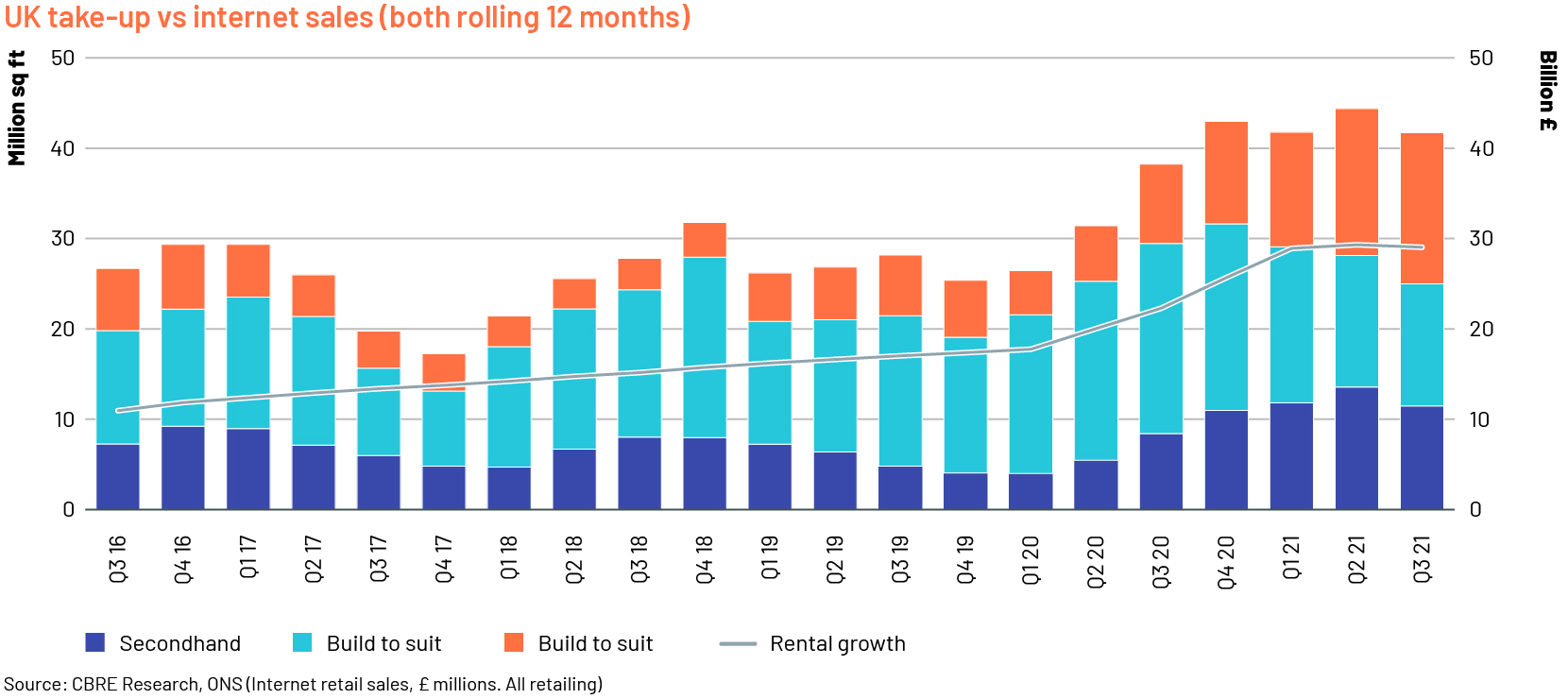

The industrial and logistics market is likely to remain strong in 2022 with continued double-digit growth across the UK, particularly in the South East and the Midlands. Demand rose substantially amid the pandemic, resulting in space requirements. Although speculative developments are expected to increase, the ongoing supply chain disruptions could impact construction costs and timing, increase competition and raise annualised rental growth, while keeping vacancy rates low. The industrial and logistics subsector accounted for 30% of the country’s real estate investment in 9M 2021, breaking previous records, and the share is projected to remain high in 2022. This indicates that investors are adapting their portfolios to changing shopping patterns and ESG requirements.

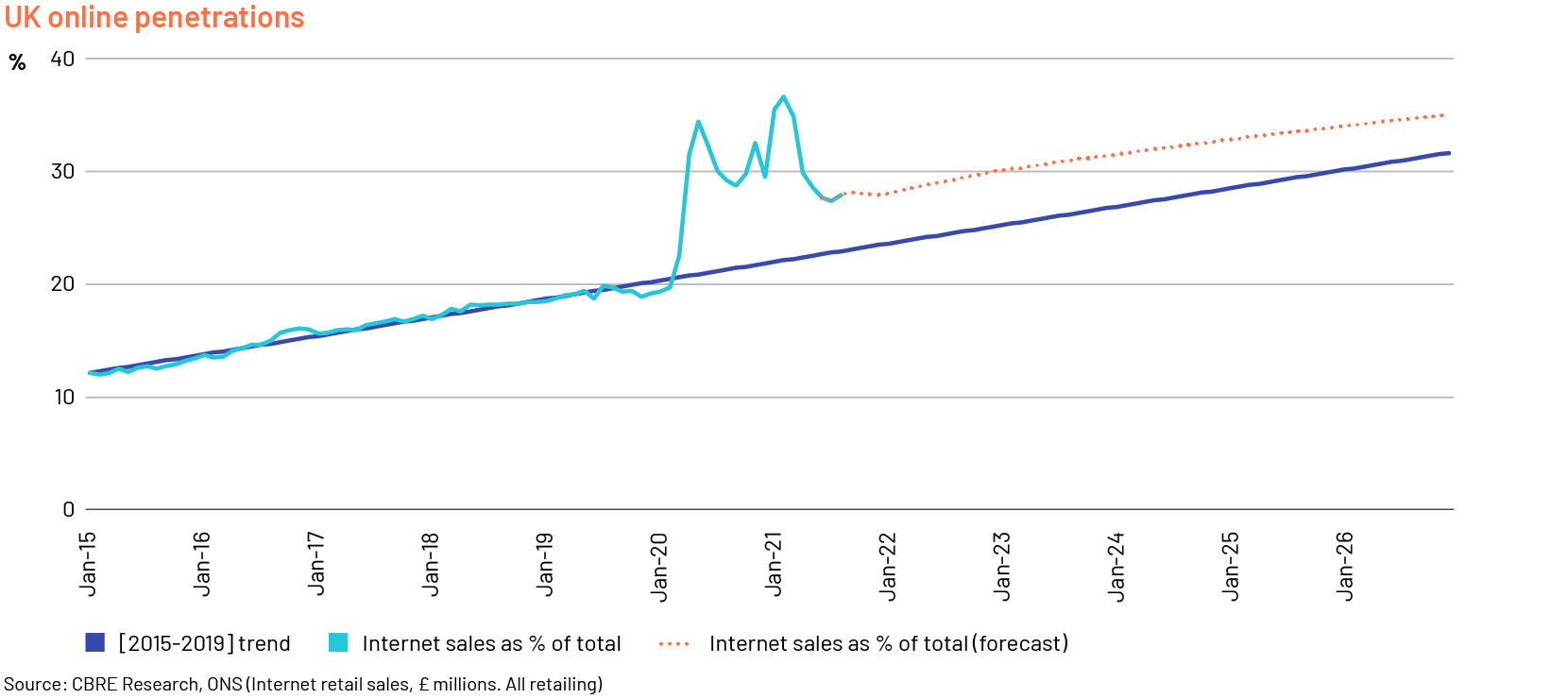

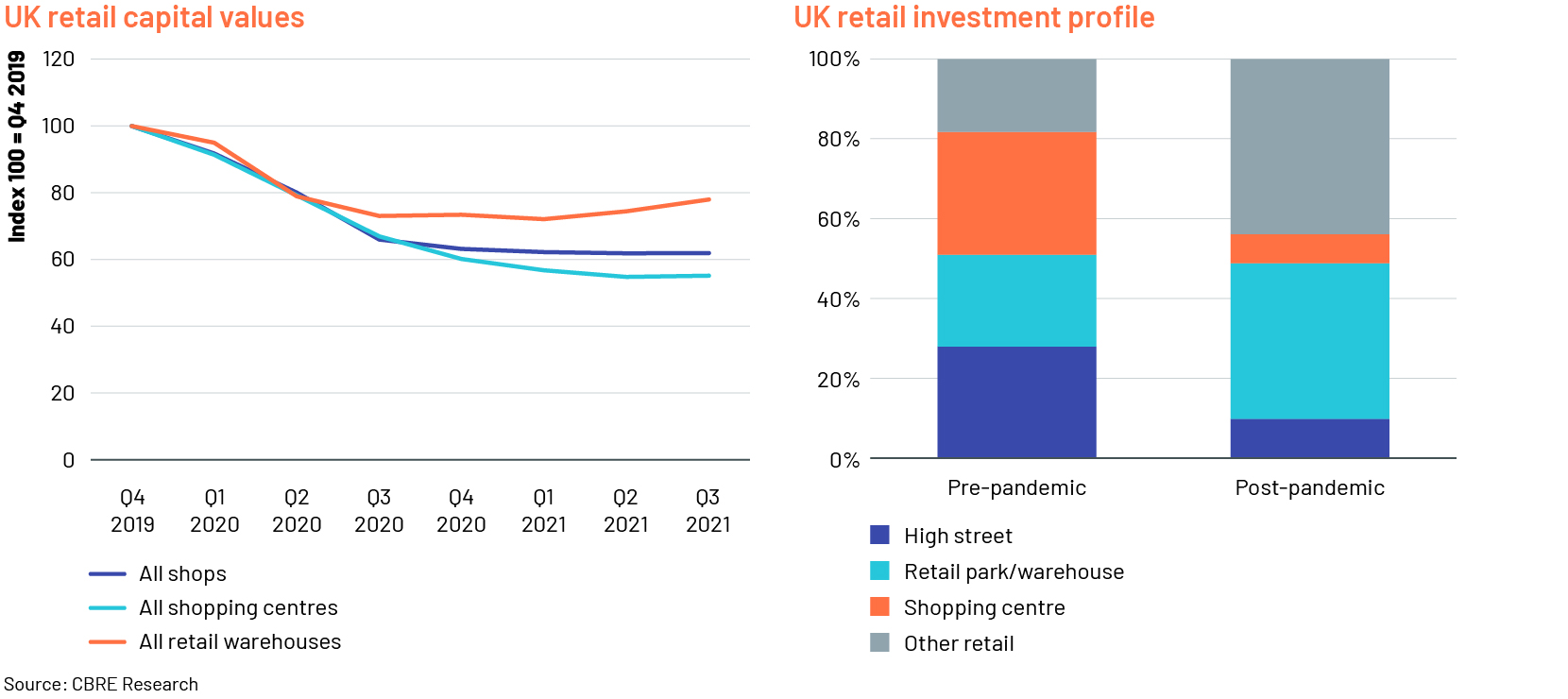

The retail subsector remained resilient, supported by continued growth in online sales. However, online penetration moderated as restrictions eased, and this trend is expected to continue in 2022, indicating that store-based retail will remain relevant post-pandemic. While retail footfall continues to recover, it is inconsistent with that in cities lagging behind and retail parks performing better than shopping centres and high-street outlets. Performance in the cities is expected to improve with a recovery in the tourism and hospitality sectors and as employees return to office. We believe downside risks from supply chain disruptions and new virus strains would be mitigated by the sector’s integration of online and offline channels.

Consumer metrics, however, have improved as occupants restructured their portfolios, a primary focus amid the pandemic. Nevertheless, an oversupply of retail space is projected to keep rents low in 2022.

Capital values of all retail subsectors witnessed a decline amid the pandemic, with shopping centres the worst affected. Investors are expected to prefer retail parks, which have a resilient tenant mix and redevelopment opportunities. We also note growing interest in repurposing retail, which could result in more attractive deals for all stakeholders.

Despite the challenges of rising inflation and a tight labour market, the economic outlook is expected to remain positive, supported by consumers using up accumulated savings and business investment increasing. In addition to the recovery in the CRE sector, sustainability is expected to gain importance in investor strategies, with a focus on green buildings and incorporating ESG considerations.

How Acuity Knowledge Partners can help

We have a large team of CRE analysts and subject-matter experts who can help CRE lenders, brokers, borrowers and commercial banks achieve efficiency. We deliver end-to-end services – from loan origination, portfolio monitoring, lease analysis, guarantor analysis and covenant monitoring to testing and servicing solutions. Our proprietary suite of Business Excellence and Automation Tools (BEAT) gives leverage and offers bespoke products and services to suit your requirements.

References:

United Kingdom Staff Concluding Statement of the 2021 Article IV Mission (imf.org)

Fitch Affirms the UK at 'AA-'; Outlook Negative (fitchratings.com)

Real estate market in the UK – statistics & facts | Statista

What's your view?

About the Author

Swetha Suresh has over 9 years of experience in Commercial Lending. In her close to 6 years at Acuity Knowledge Partners, she has worked with some of the largest banks in the UK. She is an expert in Financial Institutions Group (FIG) and UK Social Housing sectors, and part of the commercial lending team at Bangalore delivery center.

Like the way we think?

Next time we post something new, we'll send it to your inbox