Published on January 3, 2024 by Sunil Tammannavar

As themes such as sustainability and social responsibility become integral to corporate governance, Environmental, Social and Governance (ESG) governance has become one of the most-discussed topics in board meetings these days. A few companies see it as a moral responsibility, while others view it as an obligation and compliance requirement.

The past few years saw a significant increase in ESG adoption, mainly due to growing concerns about environmental impacts and social and human rights issues as well as increasing demand for corporate transparency.

With the increasing investment focus on ESG over the last two years, there is no denial of the fact that sustainability holds significant business value.

However, still many leaders prefer to achieve growth and profit over building a sustainable future. They see ESG spending as a capital expenditure. However, we have many examples in front of us that show organisations have benefitted from their ESG investments, whether it is on environment, society or corporate governance.

Environment:

-

HP generated 5-bn of commercial sales in 2021, in which sustainability was a known criteria

-

Sustainability sourcing helped Unilever realise EUR 1.2bn by sustainable sourcing

-

By replacing certain shoe components with sustainable materials, Nike was able to increase its profit margin by USD 50m

-

According to Deloitte, 59% of companies reported positive top-line impact from operational ESG investment in 2020.

(Source: Company documents)

Society:

-

Public companies with better social impact records were likely to become ‘high-quality’ stocks and outperformed the market by 3%-6% per year, according Bank of America Merrill Lynch

-

According to Accenture, companies that are leaders in diversity, employment and inclusion achieved 28% higher revenue, higher net income and c.30% higher profit margins

Corporate Governance:

-

85% of institutional investors incorporate ESG in their investment decisions, according to Gartner

-

61% of investors see ESG and Corporate Social Responsibility (CSR) performance as a sign of ethical corporate behaviour, which reduces investment risk, according to Alfac

-

Diverse management teams deliver 19% higher revenues from innovation compared with less diverse teams, according to Boston Consulting Group

Looking at the above examples, it is evident that investing in ESG has both tangible and intangible benefits. Hence, one can say it is just a matter of time ESG investments become norm in the corporate sector, with investors preferring companies with a strong ESG focus.

ESG progress, AUM and other factors

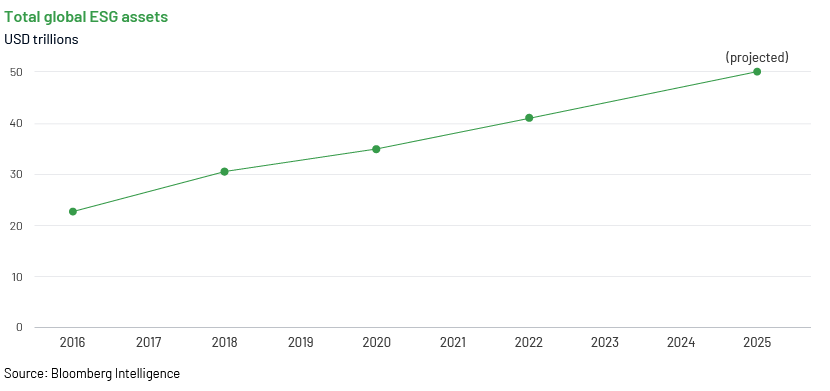

Investors have started prioritising non-financial factors and considering ESG factors seriously while making investment decisions. According to Bloomberg, global ESG assets and investmenta will exceed USD 50trn by 2025 from USD 41trn at the end of 2022.

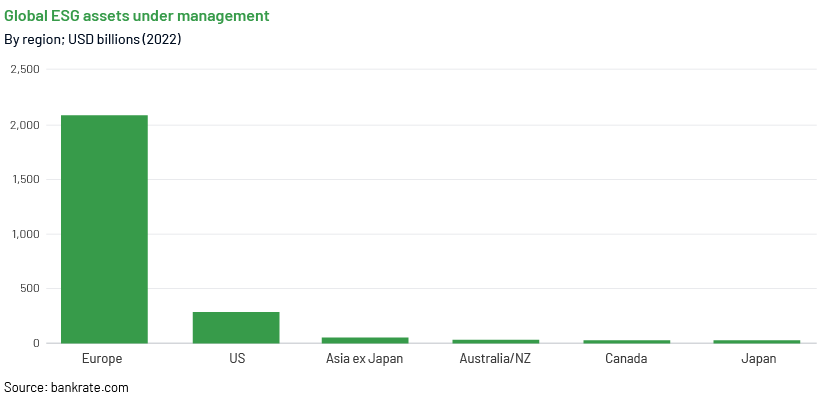

While considering the ESG assets under management geographically, it is very evident that Europe is way ahead of other regions. According to Bankrate, Europe holds c.83% of the global asset under management, which is about USD 2trn.

According to Capital Group report, 31% of European investors consider ESG as important criteria while taking investment decisions, compared with 18% investors in North America.

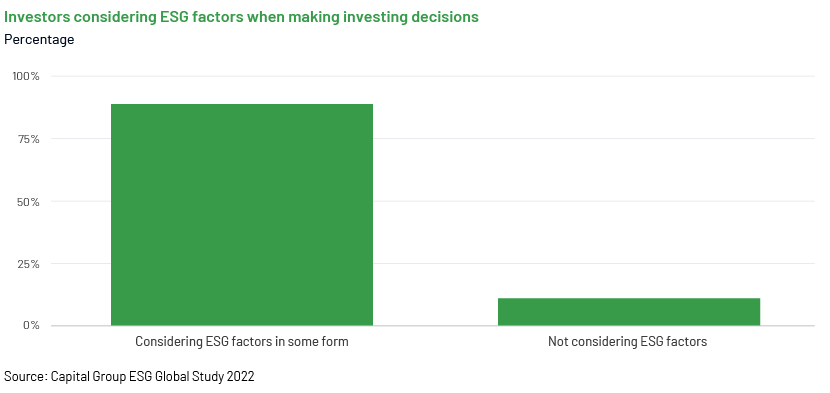

Approximately 89% of investors include ESG issues in their investment decisions, according to Capital Group study. It also found that, the growth is driven by clients and reputation concerns as against 13% of the investors who feel that ESG is a temporary phenomenon and will lose its appeal eventually.

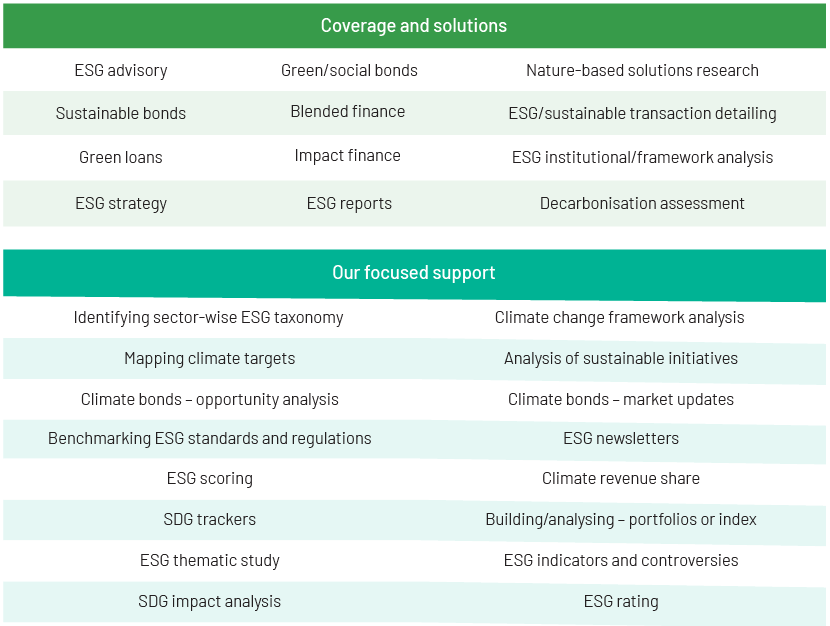

Building an ESG programme for an organization is not an easy task. It is not a one-size-fits-all solution. It is at this point, companies such as Acuity knowledge partners, with their unparalleled ESG expertise, will be helpful for companies and the investors who want to get their ESG tasks done. Acuity helps in conducting pre-investment screening and due diligence and help companies make sound ESG-oriented investment decisions.

Building an ESG programme for an organization is not an easy task. It is not a one-size-fits-all solution. It is at this point, companies such as Acuity knowledge partners, with their unparalleled ESG expertise, will be helpful for companies and the investors who want to get their ESG tasks done. Acuity helps in conducting pre-investment screening and due diligence and help companies make sound ESG-oriented investment decisions.

How Acuity Knowledge Partners can help

We are a leading provider of high-value research, analytics and business intelligence. We help corporate clients from diverse sectors understand strategy; we understand the operational concerns and challenges they face and assist them with decision making.

We offer customised solutions, including market and competitive intelligence, benchmarking and analysis, strategy research, due diligence, and industry analysis. We provide venture capital and private equity firms with comprehensive solutions across the investment cycle and help them stay abreast of industry dynamics and trends in consumer behaviour, economics and demographics in both current and new markets.

Source:

What's your view?

About the Author

Sunil is a Delivery Manager at Acuity Knowledge Partners, having around 15 years of experience working with one of the leading Investment banks in the US. He is skilled in investment research, financial modelling, report writing and ESG. His areas of interest are equity, fixed income and ESG. Has completed his Master's from Karnatak University, Dharwad.

Like the way we think?

Next time we post something new, we'll send it to your inbox