Published on by Shivam Garg

The Middle East, one of the world’s top emerging financial markets, is increasing focus on environmental, social and governance (ESG) practices. Concerns over climate change and protection of the environment have enhanced focus of both retail and institutional investors and sovereign wealth funds (SWFs) on sustainable investing. Islamic finance will be the driving force in implementing the social and governance components of ESG considerations while the participation of financial institutions in issuing sukuk and ESG bonds is expected be a major emerging trend in the coming years.

With robust economic growth, job creation and improvement in the general quality of life, the Middle East is undergoing a transition. Consumers in this region are increasingly considering sustainability while making purchases.

60% of the respondents from the region consider sustainability factors when deciding what to buy, according to the PwC Global Consumer Index Survey 2022 – Middle East, and 53% mentioned they always or very frequently buy eco-friendly or sustainable products when they shop in-store, considerably above the global average of 42%.

The involvement of stakeholders such as regulators, investors, customers and employees is also increasing pressure on companies to increase focus on ESG activity. Credit agencies have also been increasing focus on ESG factors, assigning larger weightage in terms of risks to sectors such as oil and gas, iron and steel and mining.

Middle Eastern countries have committed to taking action against climate change. The United Arab Emirates (UAE) is committed to achieving net-zero emissions by 2050, and Bahrain and Saudi Arabia aim for net-zero emissions by 2060. The Dubai Financial Market launched its first ESG index, the S&P/Hawkamah UAE ESG Index, in 2020. The Dubai Investment Fund (DIF), one of the largest independent global investment funds and asset managers, recently announced the creation of an ESG Investment Department with a focus on researching related fields such as "green investment" and "ethical investment" in general and integrating ESG investing principles as part of the fund's long-term strategy. Public-private partnerships for green financing, investment in renewable energy and sustainability-linked sovereign issuance have also increased.

-

Saudi Arabia’s Red Sea tourism project’s green financing. The Red Sea Development Company (TRSDC) received USD3.76bn in investment from four Saudi banks under the first locally denominated green financing credit facility, which included term loans and revolving credit facilities

-

Oman’s green power investment. The country’s utility buyer OPWPC plans to set up MIS Solar IPP 2025, the country’s fourth solar photovoltaic (PV)-based independent power project (IPP), to boost power demand within the Main Interconnected System (MIS) that supplies power to the upper northern half of the country

-

Abu Dhabi’s SWF Mubadala announces the creation of a standalone ESG Unit. The USD284bn wealth fund has been concentrating on assessing ESG-related risks and the potential for current and future investments

ESG issuance in the Middle East

ESG issuance in the region has taken the form of senior unsecured conventional bonds and sukuk. The ESG-compliant nature of underlying assets in sukuk portfolios differentiates them from conventional issuances.

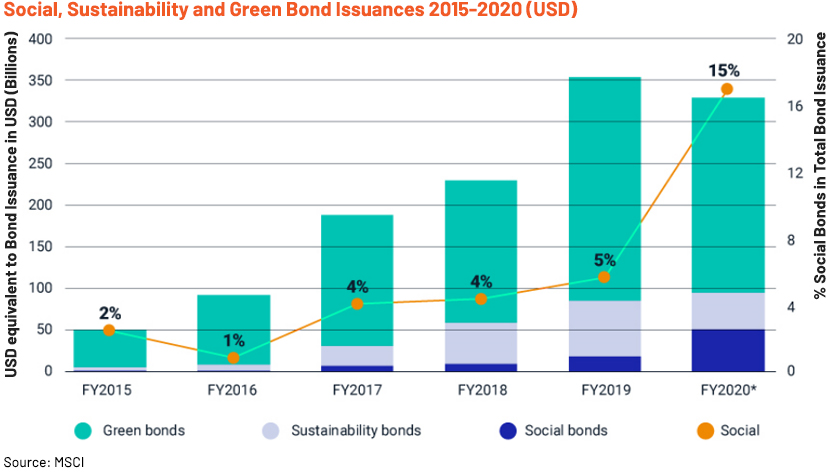

ESG bonds – an emerging instrument

-

The First Abu Dhabi Bank (FAB) was the only bank from the region to issue bonds twice in the Swiss franc (CHF) market in 2021; it issued the region's first green bond in 2017

-

The FAB's first CHF green bond issuance was a CHF260m 5-year bond in January 2021; it priced its second CHF200m 5-year bond at 0.1475%

-

It was the first MENA bank to issue a green bond and has financed over USD10bn in sustainable projects

-

It was recognised by MSCI, with its rating upgraded to AA from A, defining FAB as an “ESG Leader”

-

-

APICORP raised USD750m from its first green bond, and more than 80 institutional and sovereign investors placed orders totalling USD2.2bn

-

Emirates NBD Asset Management signed the United Nations Principles for Responsible Investment (PRI) network, further enhancing its commitment to responsible investment

-

Banks in Qatar have also been focusing on ESG issuance

-

In 2020, QNB Group issued the first green benchmark bonds from Qatar; this was the largest green issuance by a financial institution in the MENA region

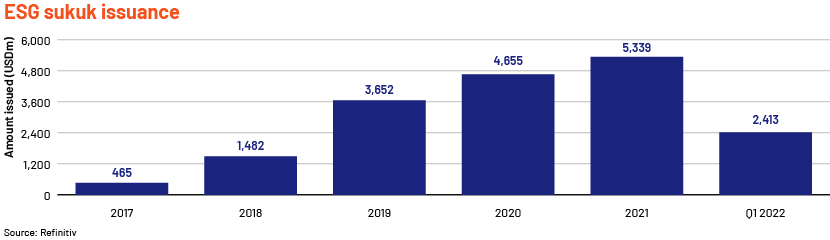

ESG sukuk

-

2% of global sukuk issuance in 2021 was ESG sukuk worth USD5.3bn

-

The Saudi National Bank and Riyad Bank issued sustainability-linked sukuk worth USD750m each

-

Riyad Bank's sukuk was the first sustainability-linked additional tier 1 (AT 1) sukuk in the world. The funds are planned to be used to offer Shariah-compliant funding and refinancing for several sustainable projects

-

The Kingdom of Saudi Arabia is now the largest market for ESG sukuk, worth a total of USD7.9bn

-

-

In March 2021, the Islamic Development Bank of Saudi Arabia issued its USD2.5bn sustainability sukuk

-

ESG sukuk issuance totalled USD2.4bn in 1Q 2022. The largest ESG sukuk issuance during the quarter was USD900m from Bahrain-based Infracorp, the infrastructure investment arm of Gulf Finance House (GFH)

-

Some regulators in the region are also working to include ESG bonds and sukuk in their capital market laws. To further strengthen the local debt market, the Qatar Financial Centre (QFC) created the GCC's first sustainable sukuk and bonds framework

-

Due to the governments' desire to invest heavily in the renewables sector and businesses' incorporation of ESG principles in their operations and finance, ESG investment opportunities are rapidly emerging in GCC markets and changing the region's financial climate

-

ESG sukuk issuance by GCC-based entities, which began in 2018, reached 6bn or 59% of cumulative global issuance up to 1Q 2022

ESG – a new stepping stone for SWFs

With a combined asset pool of over USD3tn, Middle Eastern SWFs have enormous potential for diversification away from fossil fuels and towards ESG. SWF investments in the ESG domain surged by 215.3% from USD7.2bn in 2020 to USD22.7bn in 2021, according to Finbold.com and data from industry tracker Global SWF. SWFs from the region are participating in “One Planet Sovereign Wealth Funds”. The Abu Dhabi Investment Authority (ADIA), Kuwait Investment Authority (KIA), Qatar Investment Authority (QIA) and Saudi Arabia's Public Investment Fund (PIF) are among the participating SWFs. PIF is also formalising its ESG strategy to strengthen its position as it prepares to issue its first green bonds this year, with the goal of diversifying and extending its investor base and aiding the kingdom's transformation to a greener economy.

ESG – a significant consideration in M&A

The ESG strategy underpins higher deal valuations in the Middle East and is thought to be a positive signal of long-term revenue growth. In a recent global poll of 281 M&A professionals, Bain and Company found that 65% of the respondents anticipated an increase in their own company's emphasis on ESG over the next three years. According to the survey, 68% of the executives in the consumer products sector believe ESG will increase share by enhancing their brand image to adapt to shifting customer tastes.

Energy-sector leaders, on the other hand, more frequently credit ESG activities with supporting them in meeting the demands or expectations of investors and bankers to reduce the cost of capital.

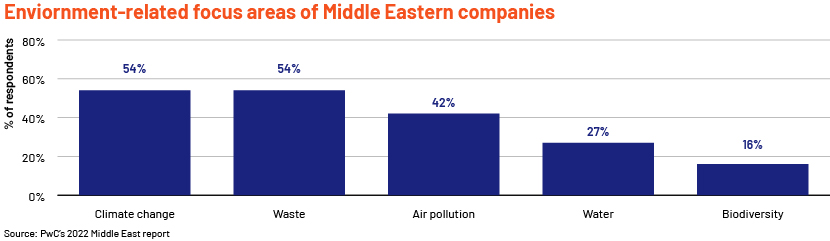

Environment – a major concern for Middle Eastern companies

54% of the respondents claimed that climate change was a top environmental priority for their firms, according to a survey conducted by PwC in early 2022 of top C-suite leaders of companies in the Middle East. Companies in the region are now focusing on sustainability obligations to align with global standards in ESG development.

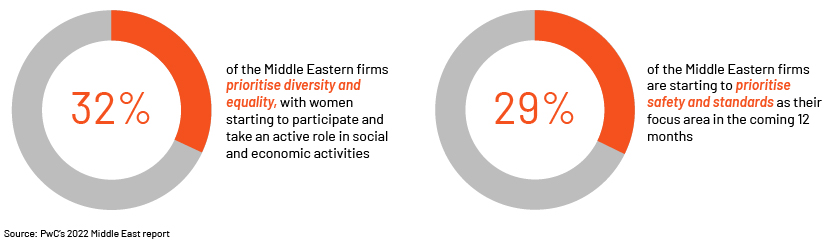

Islamic finance, aid to focus on social factors

Thematic investing, one of the most important forms of ESG investing, has seen extensive application in Middle Eastern nations as investors apply Shariah screens to their portfolios. This excludes companies engaged in business relating to alcohol, tobacco, adult entertainment, gambling and other products and activities deemed unlawful (haram) according to Islamic finance.

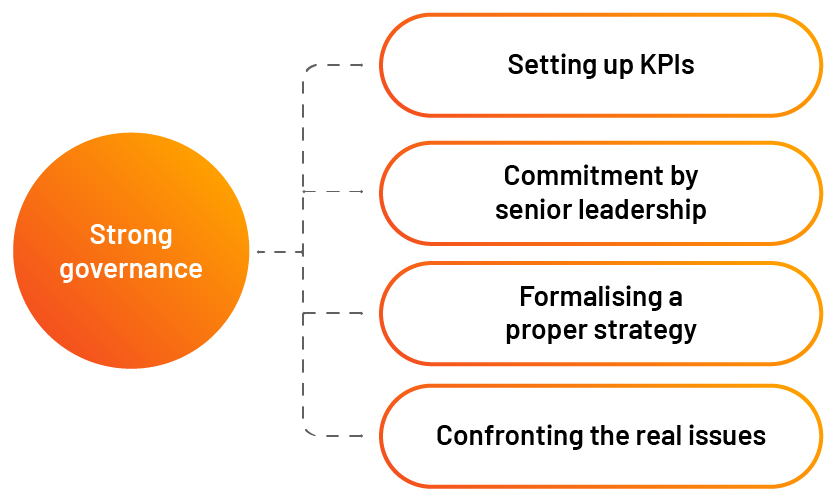

Strong governance – a focus area

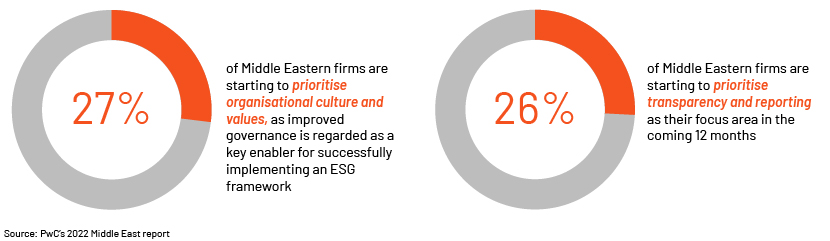

Many experts feel that strong ESG practices in any firm require strong governance. Because of the prevalence of Islam in the region, there has always been a strong focus on the 'G' component of ESG development. Gharar (excessive risk) is forbidden in Islamic finance because it contradicts the concept of certainty and transparency in commercial interactions. The region has already embraced governance principles and codes, and these are becoming increasingly significant. Many nations in the region have adopted governance regulations and recommendations for banks, insurance firms, state-owned enterprises and small and medium-size businesses (SMEs). As the Middle East's ESG agenda progresses, some banks are beginning to examine their investment products and loan portfolios for climate consequences, demonstrating how governance in the region is always changing. This also leads to many high-net-worth individuals (HNWIs) assessing a company’s financial leverage, liquidity ratios and solvency ratios before investing in a security or portfolio of securities.

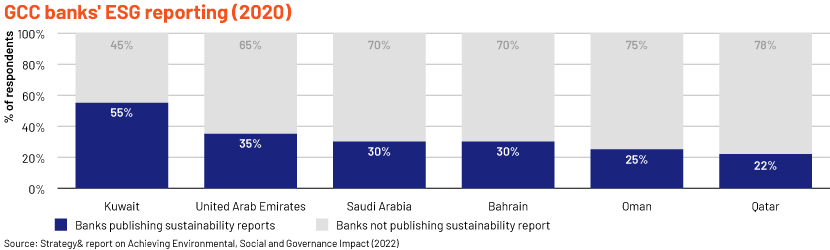

Currently, most GCC banks report their corporate social responsibility (CSR) activities along with significant disclosures on ESG. However, this is still far behind global peers’ disclosures, due to a lack of government incentives such as tax deductions and beneficial regulatory treatment.

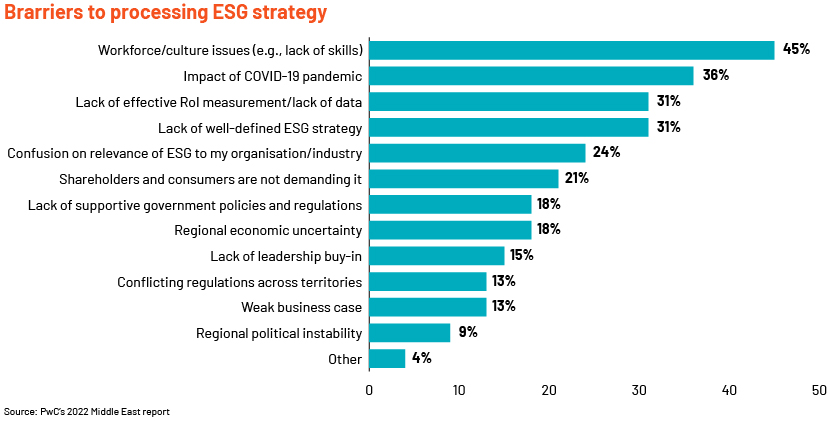

Challenges in ESG implementation

Although economies in the Middle East have been implementing numerous initiatives to promote ESG practices, companies are still in their early phase when it comes to practical application of ESG strategies. Only one-fifth of the companies’ teams and systems are in place to cover the full responsibility of ESG functions in this region, according to the PwC survey.

The road ahead

The Middle East has witnessed a wide scale of change in ESG practices over the past decade, with awareness campaigns, increased pressure from stakeholders, nationwide initiatives and growing mandatory disclosure regulations by governments.

As a result of shareholder activism, political mandates and investor engagement, businesses and SWFs in the region are increasingly adopting sustainable financing activities. This would lead to a bigger pool of ESG-related issuance. Many companies are in the process of establishing ESG frameworks; for instance, DP World, one of the biggest logistics companies in the UAE, has issued a green loan, the price of which is tied to the company’s carbon emission intensity.

Financial institutions in the region will play a key role in the coming years in promoting sustainable finance and ESG benchmarking. This would present many challenges in the investing space but also the opportunity to offer new products and services.

In the current global economic scenario, ESG practices are not simply an option or theme for companies and investors. With widespread awareness, large amounts of data and a number of scoring frameworks related to ESG, the opportunities and risks ESG presents are difficult to side-line. However, the real impact of ESG investing will not be seen if Middle Eastern countries and corporations adopt ESG practices only for the know and show; they would need to work collaboratively to present opportunities to investors and be at the core of global ESG development.

How Acuity Knowledge Partners can help

Through our Investment Banking practice and support on M&A, capital markets, Islamic finance and sustainable finance solutions, we partner with banks and corporate finance advisories across the Middle East to help them achieve their objectives. We have partnered with leading investment banks and boutique advisory firms in the Middle East since 2013, helping them grow their coverage, while reducing overall costs and time to market through access to a large talent pool.

Sources:

-

https://www.pwc.com/m1/en/esg/documents/esg-middle-east-survey-report.pdf

-

https://www.akingump.com/en/news-insights/esg-and-sukuk-in-the-middle-east.html

-

https://www.strategyand.pwc.com/m1/en/strategic-foresight//achieving-esg.pdf

-

https://www.funds-europe.com/news/the-middle-east-is-central-to-global-esg-development

-

https://www.thenationalnews.com/business/economy/esg-forms-the-core-of-uae

-

https://www.tamimi.com/law-update-articles/esg-developments-in-the-mena-and-gcc-region

-

https://www.strategyand.pwc.com/m1/en/strategic-foresight/sector-strategies/financial-sector

-

https://www.refinitiv.com/perspectives/market-insights/how-is-islamic-finance-responding

-

https://www.akingump.com/en/news-insights/esg-and-sukuk-in-the-middle-east.html

-

https://www.zawya.com/en/markets/esg-sukuk-the-role-of-the-sovereign-in-the-evolution-of

-

https://citywiremiddleeast.com/news/esg-how-middle-east-s-net-zero-ambition-is-shifting-the

-

https://www.reuters.com/world/middle-east/saudi-arabia-plans-issue-green-bonds-soon

-

https://oxfordbusinessgroup.com/news/after-landmark-2021-what-does-year-hold-esg-focused

-

https://www.cliffordchance.com/content/dam/cliffordchance/sustainable-capital-markets

-

https://www.zawya.com/en/markets/green-sustainable-debt-issuance-in-mena-hit-18bln

-

https://www.reuters.com/business/sustainable-business/how-sustainable-are-sovereign-wealth

-

https://www.msci.com/documents/10199/a7a02609-aeef-a6a3-1968-4000f1c8d559

-

https://www.sca.gov.ae/en/media-center/news/23/4/2020/scas-support-and-approval-dfm

-

https://www.pwc.com/m1/en/publications/gcis-2022/global-consumer-insights-survey-2022

-

https://www.thenationalnews.com/business/property/saudi-arabia-s-red-sea-tourism-project

-

https://www.zawya.com/en/projects/utilities/omans-green-energy-plans-will-help-diversify

-

https://www.mubadala.com/en/who-we-are/about-the-company#:~:text=Today

-

https://intlbm.com/2021/03/25/mubadala-investment-co-in-abu-dhabi-in-pursuit-of-hiring

-

https://www.mondaq.com/commoditiesderivativesstock-exchanges/1177756/esg-trend-continues

-

https://www.zawya.com/en/islamic-economy/islamic-finance/gcc-takes-lead-in-esg-sukuk

-

https://www.zawya.com/en/press-release/fab-issues-second-green-bond-in-swiss-francs-of

-

https://finbold.com/sovereign-wealth-funds-esg-investments-surge-by-over-200-in-2021/

- https://www.thenationalnews.com/business/markets/2022/01/15/global-sovereign-wealth-fund

-

https://www.khaleejtimes.com/business/gcc-takes-lead-in-esg-sukuk-issuance

-

https://www.thenationalnews.com/business/money/2022/05/10/majority-of-middle-east

-

https://esgnews.com/dubai-investment-fund-dif-announces-the-creation-of-esg-investment

What's your view?

About the Author

Shivam Garg is a part of the Investment Banking division at Acuity Knowledge Partners, currently supporting clients in the Middle East region across areas such as M&A, Capital markets, structured finance and detailed industry researches. He is a gold medalist in his institute for Bachelor of Management Studies (B.M.S.) with finance specailisation from Keshav Mahavidyalaya, Delhi University and has completed CFA Level 1.

Like the way we think?

Next time we post something new, we'll send it to your inbox