Published on July 28, 2025 by Sonali Jain

In today’s rapidly evolving digital era, the landscape of financial transactions is undergoing a significant transformation. Real-time payment (RTP) has reshaped how consumers and businesses conduct financial transactions.

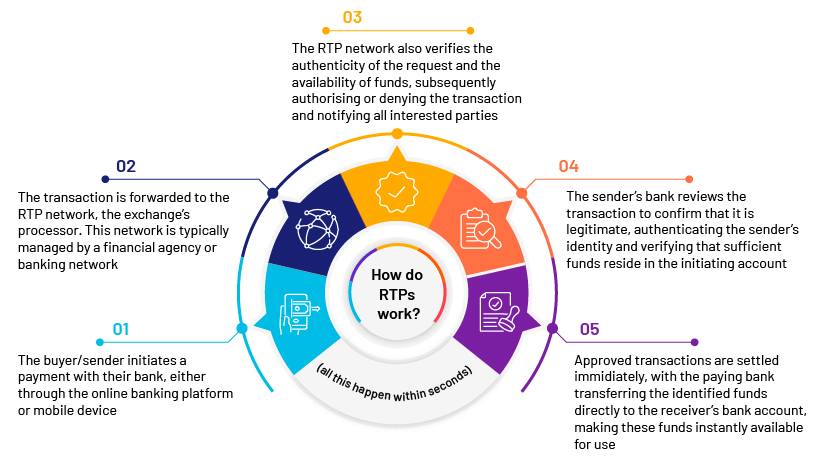

As the term suggests, RTP describes financial transactions that occur in real time between a sender and a receiver. It enables the immediate transfer of funds between bank accounts, typically within seconds.

Since RTPs allow for the immediate transfer of funds 24x7, including at weekends and holidays, traditional banking norms are being redefined, including automated clearing house (ACH) payments, which may take several business days to complete.

With growing demand for faster payment solutions, RTPs are increasingly becoming popular due to their immediacy and convenience.

-

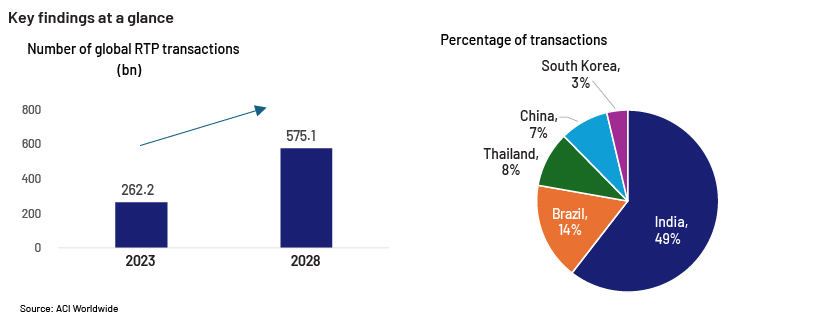

Market size by volume: 2bn RTP transactions in 2023, to reach 575.1bn transactions by 2028

-

Market size by value:92bn in 2024, to reach USD112.32bn by 2028

-

RTP presence: 70+ countries across six continents

-

APAC is recognised as the largest market; it reached 185.8bn transactions in 2023. India remains the leading force in the global RTP market

-

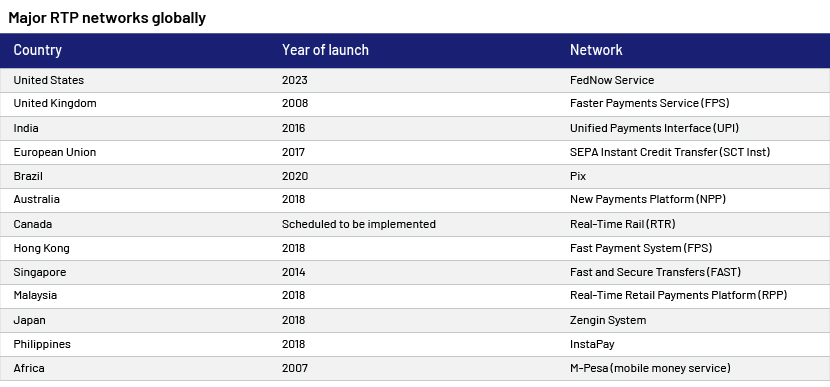

North America is emerging as a significant market for growth, particularly with the introduction of the FedNow service in 2023, which is anticipated to achieve a CAGR of 27.1% from 2023 to 2028

-

EU: The Instant Payments Regulation enacted by the EU in February 2024 is projected to significantly enhance the volume of instant payments

-

The Middle East is experiencing the fastest growth on a global scale

-

Africa: Nigeria stands out as the dominant leader in RTPs in Africa, marking it as another area poised for substantial growth

-

Key drivers of growth

The rapid adoption of RTPs can be attributed to a combination of factors:

-

Infrastructure development: Major central banks are increasingly investing in new instant payment systems to mitigate risks commonly associated with traditional banking transactions.

-

Changing consumer behaviour: RTPs meet growing demand among consumers for instant payment, fostering confidence in financial transactions

-

Business adoption: With new applications (instant payroll, merchant payouts and vendor payments) emerging, RTP is becoming more advantageous. Many global financial institutions, including JP Morgan Chase and BoA, are integrating RTPs into their operations, making it a new norm for businesses

-

Technological advancements: The integration of RTP with advanced technologies including AI, machine learning (ML) and Internet of Things (IoT) has significantly improved payment capabilities. India’s Immediate Payment Service (IMPS) enables instant fund transfer, contributing significantly to the growth of digital transactions

-

Government initiatives: Government initiatives for investing in infrastructure facilities promoting digital transactions and RTP solutions are increasing. For example, Japan aims to double cashless digital transactions by 2025

-

E-commerce growth: RTPs are experiencing significant growth, fuelled by the robust growth of e-commerce and mobile commerce, particularly in person-to-business (P2B) transactions, which accounted for 64% of market share in 2024

RTPs and cross-border transactions

The RTP revolution has extended its reach to cross-border transactions, which have traditionally been slow, expensive and difficult to track. RTP aims to reduce the involvement of intermediaries and regulatory complexity.

Collaborative efforts with SWIFT Global Payments Innovation (GPI) have accelerated the progress and had a strong impact on transactions. SWIFT GPI merges RTP infrastructure with digital tracking, making cross-border payments faster, more apparent and more reliable.

The blockchain-enabled system removes intermediaries, enabling peer-to-peer transactions that are safe, transparent and inexpensive. Ripple and Stellar are two players that use blockchain to enable instant worldwide payments, providing an alternative to imperative banking systems.

Key RTP networks

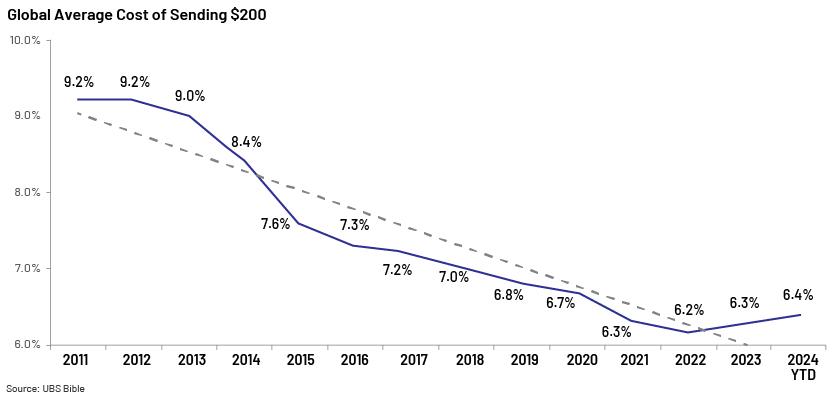

With global advancements in payment infrastructure, costs typically associated with cross-border transactions have seen a significant reduction.

The cross-border payments market has traditionally been dominated by banks and established money transfer operators (MTOs) such as Western Union and MoneyGram. These traditional players facilitated transactions that were slow and expensive. With the emergence of fintech companies and modern payment architecture, cross-border transactions have transformed, with increased speed and reduced cost.

Challenges

Although the future of the RTP market looks promising, there are several challenges that need to be considered:

-

Security concerns: The swift nature of real-time transactions makes them vulnerable to cybercriminals. The industry needs to take robust security measures such as continued monitoring and encryption to prevent fraud and strengthen user trust.

-

Complex regulatory environment: Navigating the varying compliance and regulatory frameworks across regions can be an obstacle for companies looking to operate globally.

The future of RTPs

The future of financial transactions looks promising with the advent and revolution in RTPs. Integration with new technologies such as AI, blockchain and quantum computing would further increase speed, improve security with reduce cost.

Integration of RTP with emerging trends such as IoT sensors and smart devices would enable automatic transactions, giving rise to new use cases such as self-execution of supply-chain payments and in-app purchases. This would enhance operating efficiencies for businesses and lead to new revenue streams for financial institutions and ease of use for consumers.

The global RTP market is estimated to grow at a CAGR of 30% until 2028, indicating the vast potential of this revolution. This disruptive system, with its enhanced speed, efficiency and transparency, would be leveraged across sectors, other than the financial sector, shaping all aspects of the global economy.

RTPs are, thus, positioned for accelerated growth due to technological advancements, increased consumer demand and supportive government frameworks.

How Acuity Knowledge Partners can help

We provide extensive research services centred on market assessment, emerging technologies and insights on consumer behaviour, helping firms uncover growth opportunities. We also offer strategic insights on growth prospects, the competitive landscape and positioning strategies so clients can make informed decisions on investments. We also assist with due diligence and support fundraising efforts through investor presentations, business valuations, due diligence services and providing strategic advice on mergers, acquisitions and partnerships, aimed at promoting scalability and innovation.

Sources:

-

https://www.grandviewresearch.com/industry-analysis/real-time-payments-market

-

Real-Time Payments: Driving Disruptive Innovation | JP Morgan

-

https://www.jpmorgan.com/insights/payments/payables/instant-payments-understanding-rtp-and-fednow

-

https://www.thunes.com/insights/learn/real-time-payments-worldwide/

-

https://www.marketsandmarkets.com/Market-Reports/real-time-payments-market-103502782.html

-

https://www.marketresearchfuture.com/reports/real-time-payment-market-7060

-

https://www.fortunebusinessinsights.com/real-time-payments-market-110424

-

https://www.researchnester.com/reports/real-time-payments-market/5157

-

https://www.jpmorgan.com/insights/payments/real-time-payments/real-time-payments-driving-disruption

What's your view?

About the Author

A seasoned professional with 8+ years of experience in Consulting. Played a pivotal role in driving the success of numerous start-ups and mid-sized companies, assisting them in securing vital funds for their growth initiatives. Have also worked with large tech corporates supporting them in creating corporate strategies including market/opportunity assessment, GTM strategy, benchmarking, due diligence, financial modelling and valuation and others.

Like the way we think?

Next time we post something new, we'll send it to your inbox