Published on February 19, 2021 by Dipender Thapa

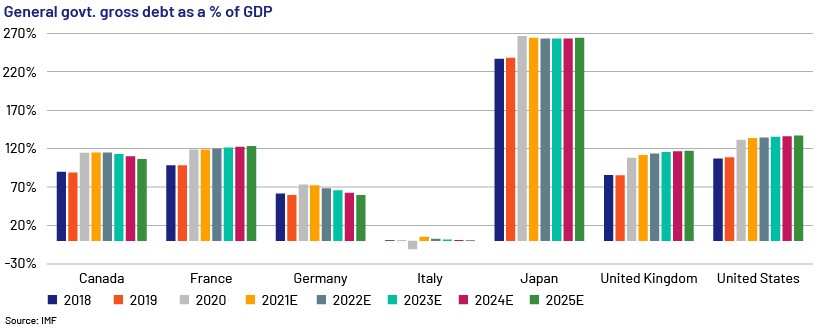

Banks are facing downside risks to asset quality as corporates witness constrained revenue and cash flow in a tepid environment, exacerbated by their high levels of debt. Borrowings by investment-grade US companies in the form of bonds or loans have almost doubled to USD7.2tn in the past decade. Going forward, their sustainability would depend on their ability to refinance during stressed conditions.

Corporates likely to face liquidity challenges in 2021 due to sharp declines in revenue and cash flow

Some investment-grade (IG) firms in the energy sector are likely to face a liquidity crunch owing to operating losses and the need to roll over debt. The sector’s total outstanding debt of USD580bn (or 10% of total IG loans and bonds) accounts for almost 70% of corporate liquidity, according to IMF estimates. Given the current pandemic-induced challenges, if these energy firms are unable to refinance through issuing new debt, more than 80% of the sector’s outstanding debt stock is likely to face liquidity constraints. Other sectors, too, are likely to face liquidity challenges in the first quarter of 2021, although this would depend on the respective corporates’ liquidity reserves in place before the pandemic.

Non-IG companies face solvency risk, particularly those in sectors hit hard by the pandemic

Non-IG (non-energy) firms, with total outstanding debt of USD485bn, are likely to face equity erosion in 2021, according to IMF estimates. The sectors affected the most by the pandemic include entertainment, technology and transportation. Some firms in these sectors could enter bankruptcy proceedings in 2021 due to liquidity disruption and a lack of access to finance.

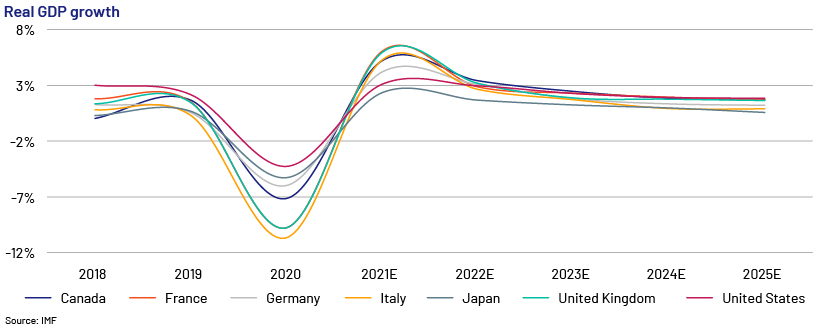

Increasing debt levels undermine vulnerabilities and pose downside risks

The US government plans fiscal stimulus of USD2tn to support the economy. It has also provided for monetary support to individuals and the healthcare system, together with a near-zero Fed rate through to 2022. However, we believe the Fed’s large bond buying programme over an extended period of time could encourage higher risk-taking by corporates, amplifying excessive leverage and increasing risks to financial stability in the long run. The IMF estimates that the fiscal response to the pandemic is likely to increase US gross general government debt to 160% of GDP by 2030 from 132% in 2020. If further stimulus is provided, this could increase further, putting downward pressure on its excellent external ratings. Job losses and higher unemployment could increase household indebtedness, translating into an increase in foreclosures and personal bankruptcy. Corporate debt has spiked from pre-pandemic levels as firms have drawn on bank credit lines to weather the liquidity crisis and build cash reserves. A slow return of corporate earnings and strained cash flow could undermine corporate defaults and failures, weakening US banks’ asset quality.

Higher defaults could weigh on US banks’ asset quality

Increasing corporate debt is a concern, compounded by declining corporate earnings and companies’ inability to refinance. The increase in risky debt markets, like leveraged loans and high-yield bonds, reflects higher vulnerability in the short to medium term. Moreover, US banks’ widespread use of weaker covenants is likely to lead to larger losses in the event of default in 2021-22. Nevertheless, US banks had solid capital buffers at the start of the pandemic; these should absorb some of the short-term shock to asset quality.

How Acuity Knowledge Partners can help

Our Commercial Lending teams provide offshore support to banks by helping in the prudent underwriting of loans to large corporate, mid-corporate and SME customers. Our credit managers provide granular insight at the macro level and help banks’ credit risk teams identify potential risks in lending. Our team of experts has a good understanding of the US banking industry, lending trends and the regulatory framework, and we currently support a number of large global banks in loan appraisal and portfolio monitoring.

Sources:

https://www.fitchratings.com/research/banks/us-banks-2021-sector-outlook-turns-stable-15-12-2020

https://www.imf.org/en/Publications/SPROLLs/world-economic-outlook-databases

Tags:

What's your view?

About the Author

Dipender Thapa has 15 years of experience in investment research and commercial lending. In his 10+ years at Acuity Knowledge Partners, he has managed several credit research and commercial lending teams. He is an expert in the financial institutions group (FIG) sector – covering banks, insurance companies, funds, and sovereigns – and has conducted analyst training sessions at Acuity Knowledge Partners’ Bangalore and Colombo delivery centers.

He has set up three new commercial lending accounts in the past six years, with experience in diverse sectors such as Leverage Lending, Social Housing, FIG, Aviation, and Fund finance. He currently oversees a commercial lending analyst team supporting one of the..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox