Published on December 20, 2023 by Aditi Sharma

In this blog, we discuss the key challenges two factors pose to the real estate sector and the opportunities available to those who can adapt and strategise effectively. These two factors are higher interest rates and limited credit availability. We examine how these two factors are impacting the buying and selling of property, influencing real estate investments and shaping the aspirations of both seasoned investors and first-time homebuyers in 2023. Understanding these challenges and opportunities is vital for making informed decisions and staying ahead in the ever-evolving real estate market.

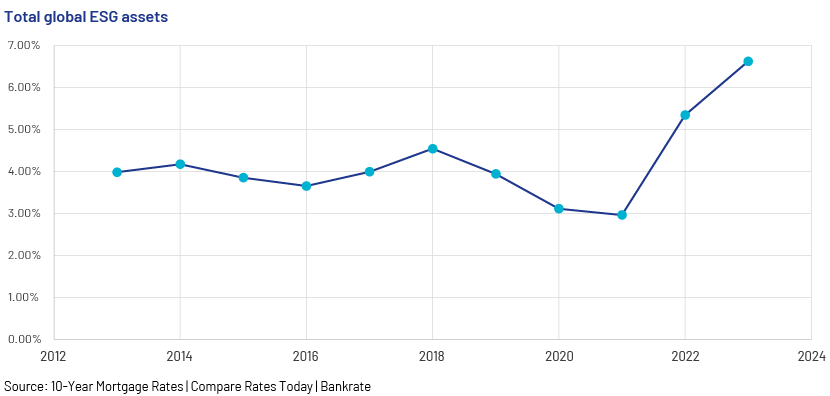

The global financial system has witnessed a gradual shift towards higher interest rates, largely influenced by central banks' efforts to control inflation and stabilise economies. Such tightening of monetary policy and its subsequent impact on interest rates affects all the sectors, especially the real estate sector.

Limited credit availability refers to the fewer loans and mortgages extended by banks and financial institutions. Higher interest rates and limited credit availability are interconnected and exert significant pressure on the real estate sector, affecting property prices, investment decisions and overall demand.

Challenges posed by higher interest rates and limited credit availability

To homebuyers:

-

Reduced affordability and demand: Higher interest rates lead to higher monthly mortgage payments, making it harder for homebuyers to afford their desired properties, and reducing homeownership.

-

Difficulty for first-time buyers: Limited credit availability makes it challenging for first-time buyers to secure mortgages, creating a significant barrier to entering the housing market.

-

Slower economic growth: Limited credit availability indirectly affects job opportunities and economic growth as businesses struggle to access expansion loans, making it harder for homebuyers to find stable employment.

To asset owners (sellers):

-

Slower price growth and struggling sellers: Reduced demand results in slower home price appreciation, affecting sellers who aim to make a profit. The resulting longer listing times can make selling properties more challenging.

To banks and financial institutions:

-

Refinancing difficulties: Banks may see a decrease in homeowners seeking mortgage refinancing due to higher interest rates, impacting their revenue, as refinancing is a common source of banks’ income.

-

Slower economic growth: Limited credit availability can lead to reduced loan demand from businesses seeking expansion loans, potentially affecting banks' profitability.

-

Stricter loan criteria and impact on development: To manage risks related to limited credit availability, financial institutions may tighten their lending criteria. This could limit their customer base and the number of borrowers they serve, impacting real estate, especially development projects reliant on loans.

To borrowers (real estate investors):

-

Difficulty for first-time buyers: Real estate investors may struggle to secure financing due to limited credit availability, potentially slowing property investments.

-

Slower economic growth: Real estate investors may be affected by the slowdown in economic growth, impacting demand for rental properties and property values.

Advantages of higher interest rates and limited credit availability

For homebuyers:

-

Stable real estate market: The combination of higher interest rates and limited credit availability can contribute to a more stable real estate market. This is advantageous for homebuyers, as it reduces the risk of speculative bubbles, providing them with a more reliable and sustainable environment for purchasing homes.

-

Balanced supply and demand: Limited credit availability may lead to a slight reduction in demand, which, in turn, helps to balance supply-demand dynamics. This equilibrium can prevent excessive property price hikes, ultimately making housing more affordable for genuine homebuyers.

-

Long-term investment value: Higher interest rates have the potential to encourage real estate investors to focus on the long-term prospects of properties. This shift can enhance the development and sustainability of the real estate sector, ultimately benefiting homebuyers by ensuring the quality and longevity of their property investments.

For asset owners (sellers):

-

Reduced risk of overleveraging: Limited credit availability deters buyers looking to take on excessive debt, reducing the risk of default on loans. Asset owners could benefit from this scenario, as it ensures the financial stability of buyers, minimising the potential for market downturns.

-

Opportunity for renegotiation: Higher interest rates may lead to more flexible property pricing. Sellers may be open to adjusting their prices to attract serious buyers, creating opportunities for asset owners to make sales in a stable market.

For banks and financial institutions:

-

Balanced supply and demand: Limited credit availability can help maintain balanced supply and demand in the real estate market. This equilibrium mitigates risk of speculative bubbles, ultimately benefiting banks by reducing the likelihood of default on loans.

-

Reduced risk of overleveraging: Limited credit availability discourages borrowers from engaging in excessive borrowing, a positive development for banks, as it lowers the risk of default on loans and minimises financial instability.

For borrowers (real estate investors):

-

Long-term investment value: Higher interest rates have the potential to steer real estate investors towards considering the long-term potential of properties. This shift can benefit borrowers by ensuring that the properties they invest in have sustainable growth and lasting value.

-

Increased rental demand: Limited credit availability for homebuyers may result in increased demand for rental properties. This provides opportunities for real estate investors to generate rental income and capitalise on growing demand for rental properties.

-

Opportunity for renegotiation: Higher interest rates can open doors for borrowers to negotiate property prices, potentially enabling them to find better deals in the market.

Conclusion

The challenges facing the real estate sector in 2023, due to higher interest rates and limited credit availability, have reshaped its landscape. We believe, however, that these also present opportunities for homebuyers, investors and developers to explore innovative strategies. As the market continues to evolve, staying informed and adaptable would be crucial.

How Acuity Knowledge Partners can help

We have multi-sector expertise in the areas of financial analytics, valuation and advisory services. The CRE sector is one of our key focus areas, and we have a large team of CRE analysts and subject-matter experts who support global financial institutions, brokers, investment firms and service providers. We provide support across the CRE deal lifecycle – from loan origination, lease analysis, loan underwriting and valuation, guarantor analysis, covenant monitoring and testing, post-closing and portfolio monitoring to asset management. Our proprietary suite of Business Excellence and Automation Tools (BEAT) gives clients leverage, and we provide them with bespoke products and services customised to their requirements.

References:

-

https://www.linkedin.com/pulse/real-estate-2023-4-challenges-facing-investors-how-overcome

-

https://www.pridepurpleproperties.com/blog/top-9-real-estate-industry-challenges-in-2023/

-

https://www.andydanecarter.com/blog/what-challenges-might-homebuyers-encounter-in-2023/

What's your view?

About the Author

Aditi has two years of experience in the commercial real estate sector and is currently an associate in the Lending services team at Acuity Knowledge Partners. Her expertise spans a broad range of analyses, including loan monitoring, due diligence, portfolio monitoring, market research reports, and cash flow. She is currently supporting one of the global leading insurance organizations, providing support in CRE asset management of portfolios. Aditi holds an MBA (Finance) and a bachelor’s degree in Commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox