Published on November 19, 2018 by Rangana Hettiarachchi

A decade ago, regulatory pressure disrupting digital marketers did not seem as distinctly evident as they did for financial service providers. Post the financial crisis, financial regulators tightened every possible loophole in order to minimize risks of future financial catastrophes. Several reforms were introduced consecutively over the span of a few years. Out of these, Markets in Financial Instruments Directive (MIFID II), Revised Payment Service Directive (PSD2), and General Data Protection Regulation (GDPR) have impacted the marketing functions of the global financial services industry the most.

The surging adoption of digital marketing in the financial industry over the past three to four years has implied that being compliant is now a “must” for this function as well. What remains to be seen is whether these regulatory challenges prove to be a headwind or a tailwind to the future of digital marketing, especially to Asset Management Digital Marketing.

Do fund marketers have their task cut out?

Despite measures to cut costs in order to increase the profitability of financial services institutions, compliance-related costs have soared, thereby offsetting these measures. Some key outcomes are as follows:

1. Cost reductions in order to increase profitability, including overall reduction of headcount in operations.

2. Forced discontinuation of operations in some markets

In the same period, regulators stepped in with various compliance updates, which, in turn, have led to an increase in compliance-related hiring for subject matter experts in these organizations. Based on a Thompson Reuters survey, in 2017 alone, the regulatory compliance spend in the financial services industry was c.USD100bn.

Not worried yet?

If this wave of regulatory reforms is not taken seriously enough, it could cost an organization significant amounts in penalties. Fines for non-compliance have increased significantly over the past couple of years; for example, under GDPR, the maximum fine that the Information Commissioner’s Office can impose currently, which is GBP500,000, could increase drastically. The administrative GDPR fine consists of two tiers; the lower-tier penalty is capped at EUR10m, or 2% of annual global turnover (whichever figure is higher), while in the upper tier, it can go up to EUR20m, or 4% of annual global turnover (whichever is higher).

How are digital assets impacted?

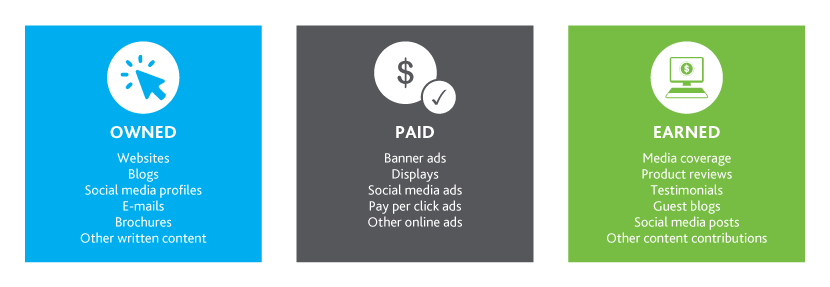

When looking at which digital assets should be given emphasis, according to the Digital Marketing Institute, there are three main categories of digital marketing assets – owned, paid, and earned, as depicted below.

Recent regulatory reforms have had an impact on all of the above digital marketing assets.

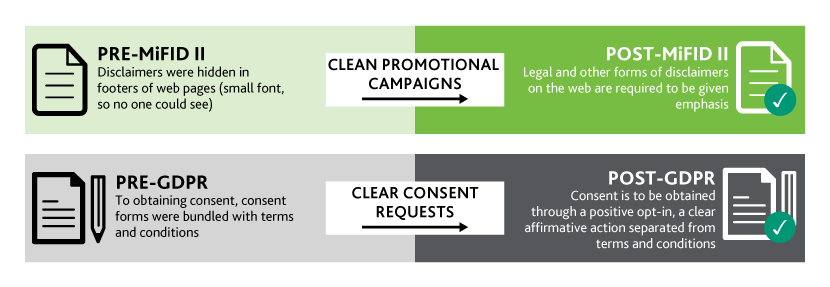

The recent regulatory reforms, especially MIFID II and GDPR, have had impacts in some way on corporate websites, social media profiles, and every other piece of content created and published. Let’s see how existing processes in aspects such as data display and processing and customer consent in communications have been impacted by recent regulatory changes.

How to make it work?

Treating compliance in silos is not going to be the long-term solution, unfortunately. Every day-to-day process is impacted by these regulatory changes; hence, ‘compliance change’ needs to be treated as another organizational change by integrating all the regulatory-related functions with regular activities. In enabling this transformation, technology needs to be given the lead and the compliance function automated.

An effective strategy would be to use a high-quality external service provider to manage digital assets, which would also reduce the cost of information technology architecture used in the compliance function. Furthermore, this would improve the efficiency of the function, while the easily-available external expertise of regulatory reforms would allow asset managers to adapt and embrace compliance challenges in a timelier manner.

Here’s how you can champion digital compliance:

Making it a win-win

The ultimate objective of these regulations is to make the digital marketing space more equitable, which, in turn, would positively impact the financial services industry as a whole. Hence, asset managers who understand and embody the ever-growing list of regulations as cost-effectively and efficiently as possible while managing their digital assets in an integrative manner will stand out and reap rich benefits.

What's your view?

About the Author

Rangana Hettiarachchi is a Delivery Lead at Acuity Knowledge Partners Digital Marketing function with over seven years of experience in digital strategy, customer experience management, lead scoring and content management. Prior to joining Acuity Knowledge Partners, he worked as Manager, Content Development, at Smart Media (PVT) Ltd. In this role, he had worked with local and international clients on sustainability and corporate communications strategy development. Rangana holds a Master’s degree in Business Administration from Postgraduate Institute of Management, University of Sri Jayewardenepura, Sri Lanka.

Like the way we think?

Next time we post something new, we'll send it to your inbox