Published on July 26, 2018 by Archana Kanojia

Long considered a cornerstone in alternative investments, private equity (PE) is now emerging as a preferred choice for investors. In 2017, PE firms raised USD701bn globally and delivered better returns compared with other traditional instruments. For the 10-year period ending June 2017, US buyout funds in aggregate returned 9.7% returns vs. 7.9% for the S&P 500, funds in developed Europe returned 8.7% vs. 3.6% for the MSCI Europe, and Asia-Pacific buyout and growth funds posted 10.5% vs. 4.5% for the MSCI AC Asia Pacific.

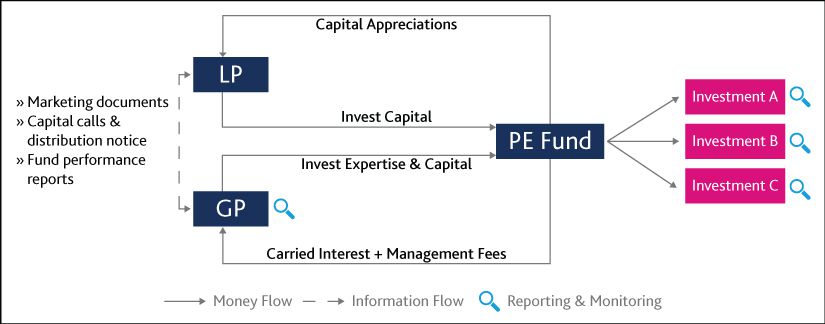

During the fund’s investment lifecycle, a PE fund administrator coordinates with various nodes for money and information flow, as depicted below.

Source: MA Knowledge Services analysis

As PE firms lure more equity capital market solutions, they become vulnerable to a plethora of challenges of administrative operations. Most of the fund administration relies on traditional methods (i.e., emails and spreadsheets) for coordinating and storing vast amount of data, which are time consuming and non-value adding activities. Let us also not overlook the heavily regulated financial environment and the increasing Limited Partners (“LP”) interest into the workings of the fund. As such, it becomes challenging for a PE firm to focus its time and resources on its key value-addition activity – Investing Decisions.

As such, PE firms are investing in CRM tools like Salesforce, a data analysis software, to enable General Partners (“GP”) to improve the quality and timeliness of their decision making and minimize the chances of missing an investment.

Focus on the Core

However, in view of the above scenario, fund administrators should get pragmatic and apply the Pareto principle. With little effort, they can achieve 80% of the outcome by focusing on 20% of the highest priority items initially. However, the ever-increasing volume and velocity of data restricts this – diverting 80% of the effort towards data management and the remaining 20% on investing decisions.

The demands of regulators and LPs make it inefficient and impractical for a fund administrator to continue administering funds in-house. Working with credible partners allows fund administrators to focus on their core competency – investing and generating returns for investors. The fund administrators are, thus, gradually shifting focus on back and middle office operations, thus saving time and resources for efficiently deploying its investment strategy. In short, the more time and resources a PE firm invests on its core competencies, the better IRR it produces, adding more LPs to its portfolio of investors.

Build vs. Buy

In the present financial environment, GPs are required to make a well-informed decision regarding capital management by carefully extracting meaningful information from volumes of data. They also need to develop complex IT programs to extract and analyze strategic information from this voluminous data.

Notably, with the perennial flow of information, CRM tools have to be constantly updated with data about past, current, and potential portfolio investments to help GPs make well-informed decisions.

Identifying activities where a PE fund can leverage skills and resources from outside its firm is the key. The first challenge is to identify activities where outside partners can add value – this is especially true for PE firms seeking knowledge partner support for the first time. Acuity Knowledge Partners, based on its experience in making PE processes more efficient, has developed a framework to identify such activities.

The foremost crucial task of creating a repository of internal knowledge/experience begins with identifying a partner that can handle the tasks. Selecting the right partner for PE data management is half the job done, as it frees up operational bandwidth. Prior to hiring an offshore partner, it is important to assess the capability of the potential partner in handling specific requirements. This assessment should evaluate the three pillars of the potential partner: the people, process, and technology.

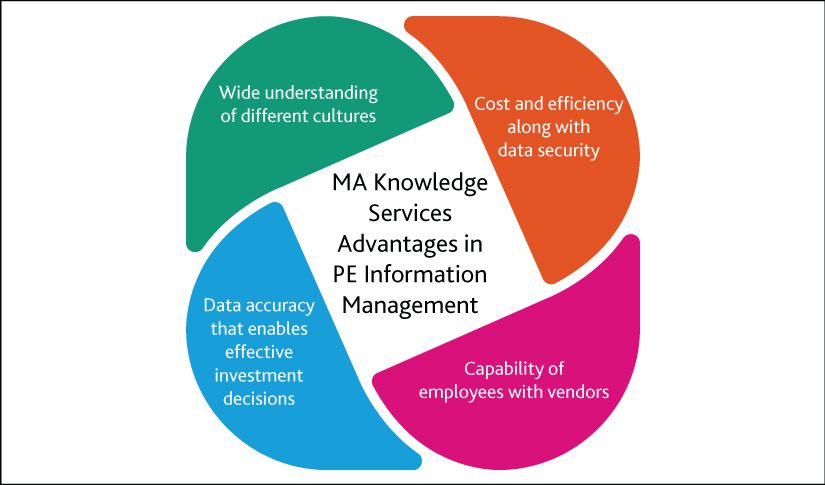

MA Knowledge Services is uniquely positioned for clients’ benefit

Source: MA Knowledge Services analysis

MA Knowledge Services offers PE firms the much needed flexibility in managing high volatile workflow. With its experienced resources, MA Knowledge Services ensures that all critical functions of its client – opportunity screening, due diligence, periodic reporting, and portfolio monitoring – are taken care of opportunely.

Source: Bain & Company Global Private Equity Report 2018

What's your view?

About the Author

Archana Kanojia started her career with Acuity Knowledge Partners in 2010. She currently provides oversight to various teams assisting client business development teams’ in proposals drafting, managing proposal content, lead generation and consultant databases. Previously, she provided oversight to teams that assisted clients to set up fund databases for private equity funds of funds, analyzing private equity (PE) firms and their funds from an investment standpoint, and also extended investment support to PE firms through industry studies, information memoranda and similar activities.

Archana holds a Post Graduate in Business Management with a specialization in Finance and Marketing from New Delhi Institute of Management, Delhi. She..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox