Published on May 12, 2022 by Archana Kanojia

The private sector was not spared from the effects of the pandemic. Although private equity was in a tailspin for the first half of 2020, it recovered during the second half and has been on an upward trajectory since. It was the wave of digitalisation that kept private equity activity alive. With economic activity returning to normal, the private equity space is also on the path to expansion. The results of our recent survey[1] reflect market sentiment towards private equity operations.

“We are the sum of our actions”

– Aristotle

Private equity is also a sum of multiple core activities. From due diligence to exit, each step of the process follows on from the previous one and contributes to the next. Acuity Knowledge Partners’ (Acuity’s) 2022 private equity and venture capital (PE&VC) survey delves deep into the process and the likely post-pandemic scenario.

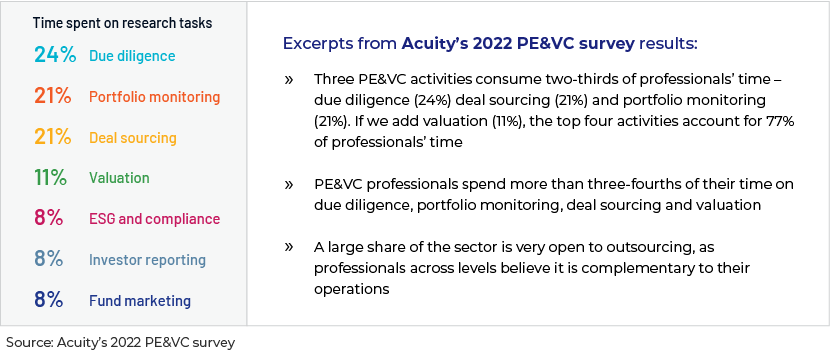

PE professionals spend more than three-fourths of their time on due diligence, portfolio monitoring, deal sourcing and valuation. We consider two of these activities in detail below.

Valuation:

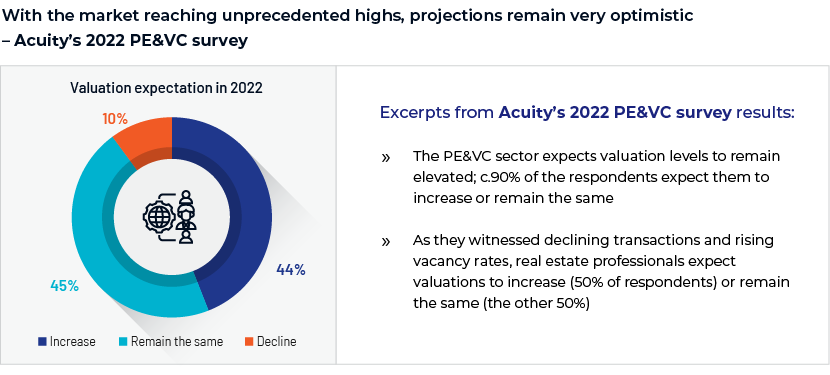

As economic activity slowed due to the lockdowns, valuations of private equity funds declined as businesses suffered losses[2]. While investors were naturally concerned about their investments, private equity fund managers strove to keep the impact on portfolio valuations to a minimum. With markets improving now, valuations are rising.

Deal sourcing:

The quality of a deal (or a prospective target company) is critical in determining the valuation of the entire portfolio of a private equity fund. A good deal earns good returns and boosts the valuation of the fund’s portfolio. Therefore, deal sourcing is critical to the proper functioning of private equity. In a typical scenario, referrals and strong networking are the foundations of deal

The following are excerpts from Acuity’s 2022 PE&VC survey results:

-

Leaders spend most of their time on deal sourcing and, as they are part of various boards as well, portfolio monitoring. They spend twice the time as associates on fund marketing

-

Due to their deal-sourcing methods, funds of funds and private debt firms spend less time on deal sourcing than VC firms

-

In terms of size of funds, the time spent on deal sourcing and portfolio monitoring increases as the size of fund decreases. Larger funds generally spend more time on deal evaluation

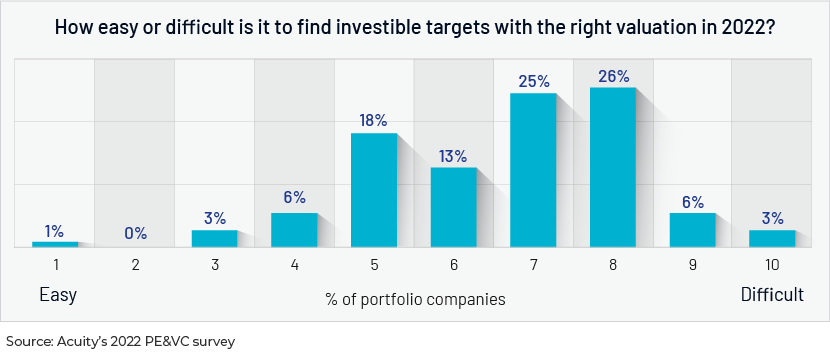

Sourcing deals with the proper valuation:

With company valuations soaring, it becomes imperative for private equity firms to source deals at the correct valuations.

Survey results show that 81% of the respondents rated the difficulty between 5 and 8 or more on a scale of 1 to 10.

A source of help:

Seeking correctly priced deals while handling other important tasks can be stressful. Outsourcing some functions is an option that could be explored.

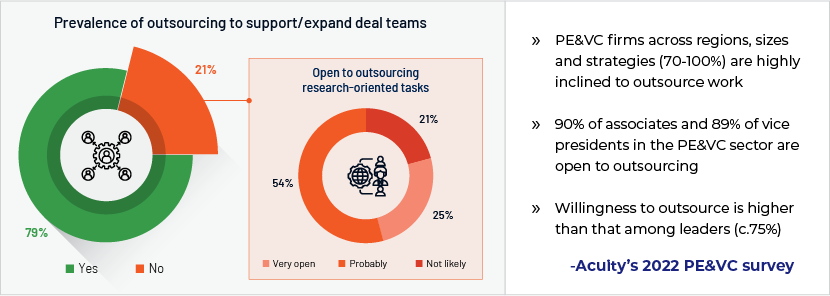

Our survey results reflect market sentiment towards outsourcing:

-

PE&VC firms are actively augmenting their teams with outside support (including for accounting, administration, human resources, operations and technology infrastructure)

-

79% of the respondents stated that they are currently outsourcing work

-

Of the remaining 21%, 46% are likely to outsource or are open to outsourcing

Additionally, the PE&VC sector finds outsourcing complementary to their operations and not a threat. In fact, acceptance of outsourcing is very high across designations, driven by the support and value associated with outsourcing.

How Acuity Knowledge Partners can help:

We support 400+ clients, including PE&VC firms, and our subject-matter experts work as an extension of a client team, providing flexibility in managing volatile work flow, including portfolio management, opportunity screening, business development, due diligence and periodic reporting. We ensure all critical functions are taken care of, irrespective of the workload.

Sources:

https://www.acuitykp.com/global-private-equity-report-2022/

https://www.wsj.com/articles/coronavirus-pandemic-scrambles-private-equity-valuations-11589494824

What's your view?

About the Author

Archana Kanojia started her career with Acuity Knowledge Partners in 2010. She currently provides oversight to various teams assisting client business development teams’ in proposals drafting, managing proposal content, lead generation and consultant databases. Previously, she provided oversight to teams that assisted clients to set up fund databases for private equity funds of funds, analyzing private equity (PE) firms and their funds from an investment standpoint, and also extended investment support to PE firms through industry studies, information memoranda and similar activities.

Archana holds a Post Graduate in Business Management with a specialization in Finance and Marketing from New Delhi Institute of Management, Delhi. She..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox