Published on December 18, 2023 by Bikramjeet Singh Sokhi

Introduction – Distress in CRE and the role of special servicers

The special-servicing rate is a barometer of the health of the commercial mortgage-backed securities (CMBS) conduit sector and has been of particular interest after the pandemic. Distress in commercial real estate (CRE) loans and potential defaults involve real estate issues and the performance of the different types of individual real estate property. Distress could be in the form of macroeconomic issues such as rising interest rates or microeconomic issues such as changing demand dynamics. Whatever the form of distress, special servicers are needed to manage loans and resolve the related issues.

Special-servicing strategies for distressed CRE loansThe special servicer is separate from the master servicer; since special servicers are tasked with managing loans that have defaulted on payments, they focus on devising strategies for loan recovery.

The approach taken to resolving loan distress may be affected by a conflict of interest, where the special servicer plays more than one role (e.g., the special servicer and the “B-piece” buyer may be from the same affiliated entity. This may result in actions to protect the B-piece holder at the expense of the borrower.).

Deciding whether to liquidate a distressed loan or property may depend on real estate market conditions. However, a special servicer could work out a repayment plan, providing borrowers time to repay the reworked principal and interest. Other strategic measures include loan modification, loan sales and deeds in lieu of foreclosure.

As such, a loan may not get liquidated at all. However, if it does get liquidated, it may require the investors taking a haircut on their investments.

The CMBS sector sees a notable increase in the office special-servicing rate

A few agencies that have been tracking the performance of the CRE sector have noted increasing stress in the CMBS sector, particularly in the office segment, in the past three quarters.

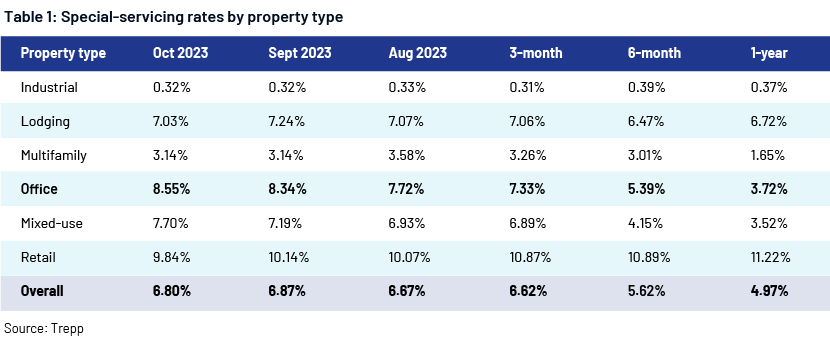

The stress in the sector is captured by the special-servicing rate for the overall CMBS sector, shown in Table 1 below.

The CMBS special-servicing rate for total coverage jumped to 6.80% by the end of October 2023 from 4.97% a year ago, according to Trepp.

Office loan performance

This deterioration in the performance of office property is reflected in the drop in the special-servicing rate. The office segment experienced the largest increase in the special-servicing rate among property types; the rate was at 8.55% by the end of October from 3.72% a year ago (see Table 1).

A further look at the overall property segment indicates that by vintage, the CMBS 2+ (post-2014 issuance) office special-servicing rate has increased by 22bps to 8.31% m/m, driving the overall office rate increase.

From a rating perspective, it is important to note that a loan modification does not automatically trigger a downgrade but may trigger a review, which could result in a downgrade if the rating agency deems the risk profile to have changed. DBRS Morningstar notes that the sector’s delinquency rate has been increasing since the beginning of the year. S&P Global noted an increase in the overall US CMBS delinquency rate.

Distressed rates of office properties

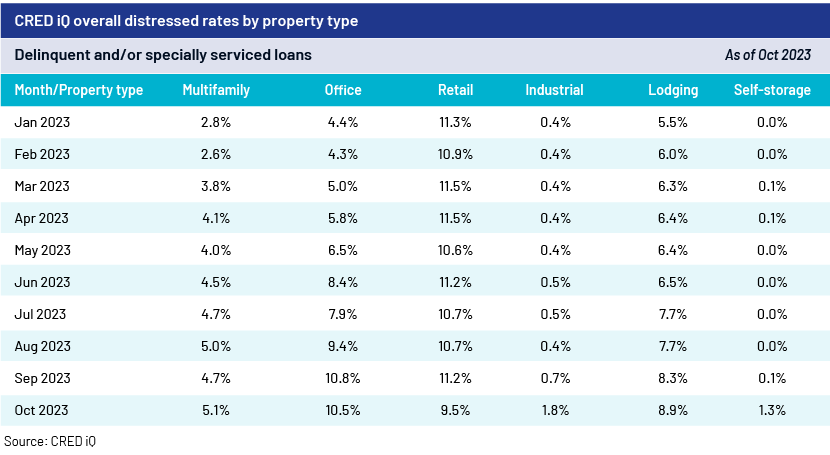

While the special-servicing rate captures distress in loans with a special servicer, several delinquent loans, where the required payments are not made on time, are not with a special servicer. Therefore, a combination of the two would give us a more comprehensive picture of the distress in the sector. The “Overall distressed rate” is calculated as the sum of all the loans that are delinquent, specially serviced or a combination of both, in the conduit and single-asset, single-borrower universe.

The table below captures the general trend in the abovementioned overall distressed rate per month for each property type. The m/m increase in overall distressed rate is the result of a combined increase in delinquency and the special-servicing rate. The retail segment at 9.5% is the second highest; this has been consistently high since the beginning of the calendar year. However, the overall distress rate for the office segment has more than doubled from the beginning of the year.

What could be causing this distress?

CMBS performance was affected by economic conditions, collateral type and transaction peculiarities, as evidenced by the performance of the office segment this year.

At the loan level, industry sources indicate that maturity defaults or refinancing challenges remain a major source of distress in this segment.

At the segment level, according to DBRS Morningstar, demand for office space has reduced on the back of corporate cost-cutting and hybrid working schedules. Demand is expected to continue reducing until such schedules are normalised.

Office properties, particularly in big cities, would see a substantial decline in demand as companies allow their employees to work from home, according to Mansus Clancy, senior director at Trepp.

On the whole, one could conclude that distress in the office segment is a result of the following:

-

Refinancing difficulties at loan maturity

-

The changing nature of leases

-

The current interest rate environment

-

Upcoming loan maturities

Outlook

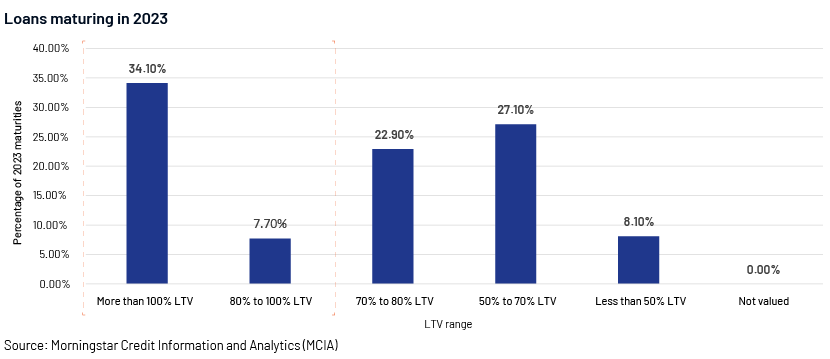

CMBS performance would continue to be affected by economic conditions, collateral type and transaction peculiarities, as indicated by the performance of the office segment so far this year. Nearly 42% of the loans maturing in 2023 have a loan-to-value (LTV) ratio of more than 80%, according to Morningstar’s Maturity Outlook for all the non-defaulted conduit loans set to mature over the remainder of 2023. These will likely face difficulty in securing takeout financing.

This indicates the complications that may well continue to challenge refinancing maturing office and retail (mall) loans.

How Acuity Knowledge Partners can help

We offer structured finance support in private markets across all asset classes, including ABS/CLOs/RMBS/CMBS. Our structured finance expertise spans both the buy side and sell side. We work as a strategic partner and solution provider, offering end-to-end support including origination support, loan-level underwriting to deal surveillance and cashflow modelling.

We have more than two decades of experience in offering support to global clients working in the private market space. We work as pure extensions of their onshore teams, providing end-to-end support across the investment cycle.

References:

-

2023 Special Servicing Rates – Commercial Property Executive (commercialsearch.com)

-

2023 CRE Maturity Outlook: The Year Ahead | CRED iQ Blog (cred-iq.com)

-

2023 Special Servicing Rates – Commercial Property Executive (commercialsearch.com)

-

Special servicer spotlight: Rialto Capital Management (perenews.com)

-

Crisis time for private real estate: Cue the special servicers (perenews.com)

-

Trepp CMBS Research: Oct 2023

-

SF Credit Brief: Overall U.S. CMBS Delinquency Rate Mostly Stable In April 2023;

-

October 2023 Delinquency Report | CRED iQ Blog (cred-iq.com)

What's your view?

About the Author

Bikramjeet is part of private markets team. He has fifteen plus years of work experience in various organizations and in different roles. He has worked in Commercial real estate, structured finance/Securitization and capital markets, including roles in CMBS ratings, real estate valuations and credit analysis. Academic background includes a MBA from the University of Sheffield (U.K), and a Masters in Sociology from Annamalai University.

Like the way we think?

Next time we post something new, we'll send it to your inbox