Published on July 26, 2023 by Rajeev Hota and Bhuwan Joshi

Introduction

Commercial real estate (CRE) sector is trying to deal with “short-term obstacles” – higher interest rates, lower gross domestic product (GDP) and contracting investments. Similar to other sectors, CRE is not immune to headwinds like these. However, it is one of the fastest-growing sectors, providing business opportunities in the multifamily, industrial, office, retail and hospitality segments. It offers the big advantage of attractive leasing rates with longer lease periods/contracts, providing CRE holders decent and consistent cashflow based on occupancy. Investors also benefit from potential capital appreciation. The pandemic slowed the sector down, and the recovery was gradual as CRE investment volume rose by 10% y/y to USD167bn in Q2 2022. However, the CRE investment volume declined 57% y/y to USD78bn in 1Q23 as investment across property types plummeted in Q1 2023 due to higher interest rates.

What impacts CRE?

High inflation

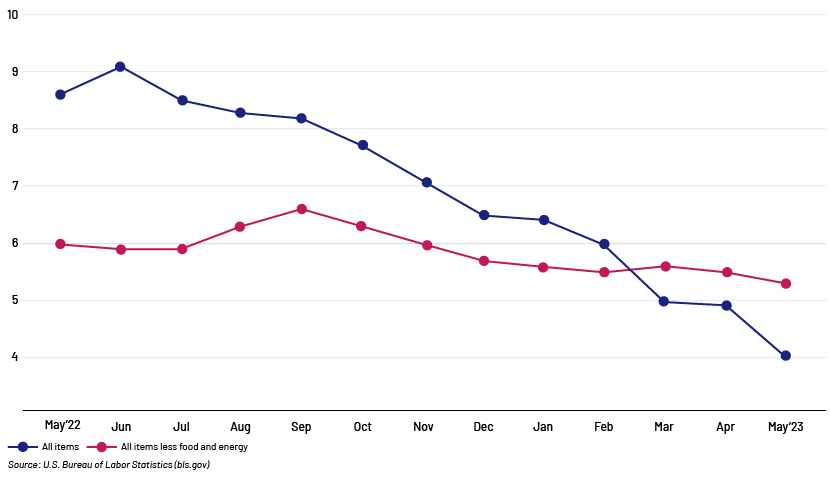

With inflation, the cost of a building increases, while supply and purchase decrease. The Federal Reserve (Fed) continues to raise interest rates to tame inflation. The Fed has so far raised rates by 500bps since March 2022, including the 25bps hike it announced in May 2023. Consequently, prices of all items declined from a peak of 9.2% in June 2022 to 4.0% in May 2023, according to the US Bureau of Labor Statistics. As the current inflation is still higher than the pre-COVID-19 levels, investors will likely continue to delay buying and refinancing CRE projects until interest rates start declining.

Soaring Interest Rates:

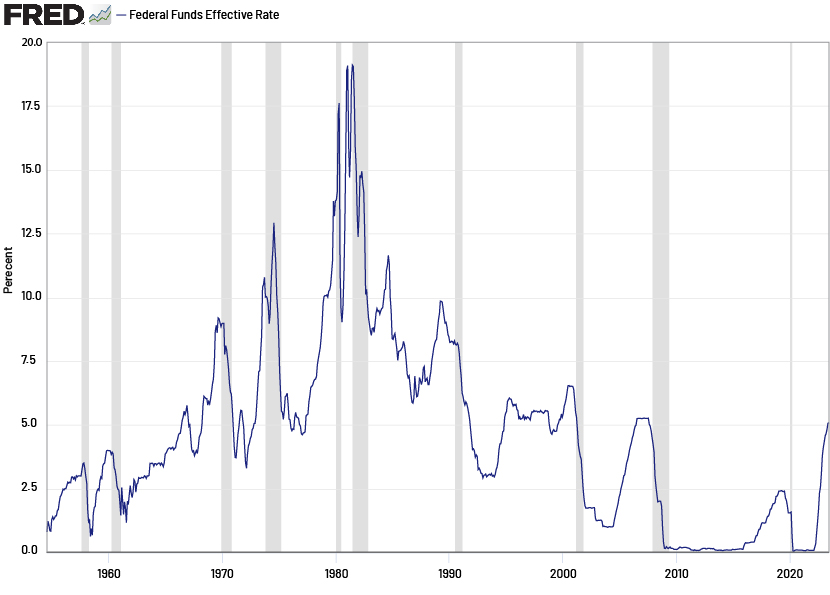

Rising interest rates keep CRE investors away. The May 2023 rate hike was the Fed’s 10th consecutive rate hike. The target Federal funds rate is now 5-5.25%. By raising rates, the Fed tries to mitigate inflation and extract the excess liquidity out of the economy. In June 2023, the Fed kept rates unchanged while hinting at a couple of hikes in the future, which would further reduce the flow of CRE investments as it becomes costlier.

Due to variable financing, short-term loans are more significantly affected by rising interest rates, compared to with long-term loans. The movement of the 10-year Treasury yield is crucial as it facilitates mortgage rates determination. The yield is commonly interpreted as an indication of investor sentiment on the state of the economy. An increase in yields could indicate higher long-term inflation expectations, while a decrease in yields could suggest lower inflation levels and the potential for a slowdown or recession. The 10-year Treasury yield serves as the benchmark for determining mortgage rates throughout the US, while the 10-year Treasury bond stands as the most actively traded and liquid bond globally. The 10-year Treasury yield was 3.81% as of 30 June 2023, which is not an encouraging sign for investors.

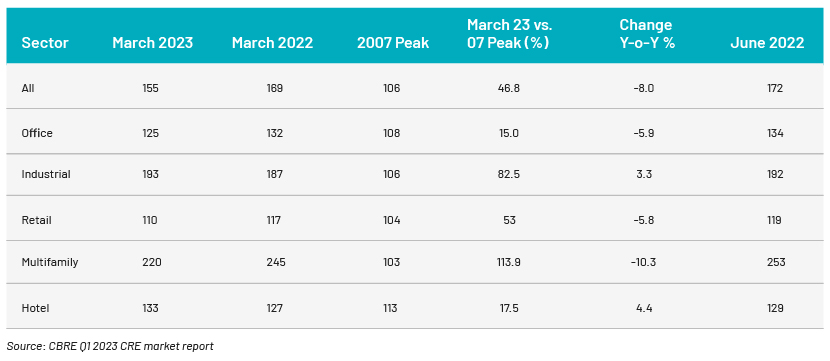

Real estate prices: CRE prices start falling as demand for all types of properties declines. CRE prices decreased by 8.0% y/y, with multifamily property taking the lead with a 10.3% decline, followed by office (5.9%), according to a CBRE report. As expected, hotel prices continue to increase as people resumed spending on leisure after the pandemic.

Rising delinquencies and refinance risk:

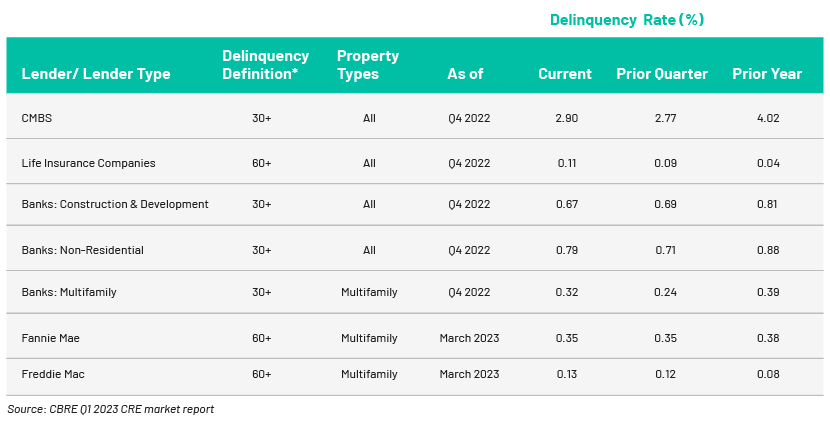

As interest rates move north, property owners/investors find it difficult to make either monthly mortgage payments or refinance mortgages. While CMBS lending has the highest delinquency rate of 2.90%, life insurance companies continue to be the most immune among all lending types owing to their stringent lending policy, as per the CBRE report. As property values take a hit due to lower occupancy and higher concessions, property owners struggle to refinance mortgages due to the tightening loan to value (LTV) parameter. Additionally, equity may be required to reduce loan balance.

Evolution of employment

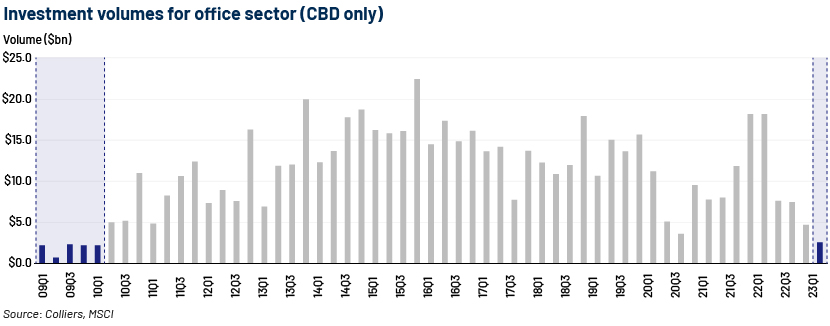

Due to the pandemic and the widespread adoption of work-from-home policies, many organisations have migrated to the hybrid mode or work from home mode of working. Employees are taking advantage of growing pay and more remote work choices. Companies are reorganising workplaces, implementing flexible work hours and providing greater opportunity for career advancement and skill development. Office space makes up a large portion of CRE. Companies that own/rent/lease their office space are rethinking their strategy. Larger spaces no longer seem necessary as companies will never have the same number of employees working from offices. Organisations are choosing smaller offices as employees these days are following a roster system to go to work. Vacancy rates are gradually increasing, and more renters are subletting their offices until their leases expire. Investors and lenders are shying away from office, which is crimping liquidity. As a result, volumes declined the most in the office segment among all asset classes in Q1 2023. Total sales declined to their lowest level in Q1 2023 since the Global Financial Crisis of 2008, while central business district (CBD) sales delivered one of its weakest quarters on record.

CRE trends in 2023

The Fed’s interest rate hikes make borrowing more expensive. Interest rates play a significant role in determining CRE returns; investors worry about the cost of capital, capital availability, property prices, and transaction and leasing activities. CRE investment volumes declined 57% y/y to USD78bn in 1Q23. Multifamily, the most immune investment avenue, emerged as the leading sector in terms of transactions (USD25bn), although down 64% y/y.

Additionally, pandemic has sparked trends such as remote work and ecommerce, which in turn affect CRE prices. The rise in telecommuting, for instance, has diminished the need for office space (vacancy at 17.8% as of 1Q23 vs 11.5% as of 4Q19), while ecommerce has impacted retail real estate as consumers increasingly shop on the internet to reap the benefits of convenience and lower prices. As there exists a significant level of uncertainty surrounding the future, speed and scope of such structural shifts, restrictive financial conditions would exacerbate these effects and further intensify downward pricing pressures on the affected property types.

Based on the current trend and market sentiment, if the Fed does not step in to tap the bond market more aggressively, the economy could enter a recession. We believe the Fed should reverse the course of interest rate hikes and work towards easing the stress in the CRE market. The prevailing level of reduction and investor stress indicate that the economy could take two to three years to return to normalcy. However, after the 2008 subprime crisis, stringent underwriting practices were implemented, making the current distress level acceptable.

Conclusion

The uncertainty in the global economy due to increasing Fed interest rates and higher inflation would continue to reduce real estate transactions and activity in the coming months. The banking industry is experiencing disruptions due to the failure of three major banks, First Republic Bank, Silicon Valley Bank and Signature Bank. Furthermore, in January 2023, the US government reached its debt ceiling of $31.4trn, which was subsequently raised in June 2023 to avoid default. All these events confirm the growing financial distress and liquidity crunch in the economy. Technology that improves efficiency, centralises data and simplifies operations would remain popular among CRE investors. Sadly, most investors believe the sector is not yet ready to adopt such innovations. Many CRE investors and owners would need to concentrate on strategic, investment decision making in both real estate and technology amid this significant uncertainty. The war in Ukraine is just an external factor to observe as the trajectory of interest rates unravels.

Sources

-

REMI: https://www.reminetwork.com/articles/uli-releases-emerging-trends-in-real-estate-2023/

-

Colliers: https://www.cbre.com/insights/briefs/global-investment-declines-sharply-in-q4-2022

Tags:

What's your view?

About the Authors

Rajeev is a Director at Acuity Knowledge Partners, where he has worked for over 11 years. With nearly 20 years of experience in Commercial Real Estate (CRE) lending, monitoring transformation, and solution delivery, he has played a pivotal role in advancing the CRE lending business. His expertise in people management, processes, and CRE has been instrumental in driving success for the company. Currently, Rajeev leads the CRE lending practice at Acuity Knowledge Partners, overseeing service delivery, and ensuring client excellence.

He joined Acuity Knowledge Partners in 2013 as a Senior Associate Vice President and was one of the founding members of the CRE Lending Services business. Before joining..Show More

Bhuwan has over 11 years of experience in working with leading global organizations in commercial real estate lending domains. His expertise spans a broad range of analyses, including CRE loan underwriting, loan servicing, due diligence, portfolio monitoring, escrow disbursement analysis, market research reports, and cash flow modelling. At Acuity Knowledge Partners, he is a part of a leading US based commercial bank, supporting big ticket size CRE loans.

Like the way we think?

Next time we post something new, we'll send it to your inbox