Published on June 13, 2023 by Yu SU

Introduction

On 16 February 2023, the International Sustainability Standards Board (ISSB) made a final decision on the timing of the entry into force of the two International Sustainability Disclosure Standards (ISDS) and other related matters. Before this standard was issued, the disclosure rate of ESG reports was high, but most companies lacked a more in-depth and highly substantive ESG strategy system, which affected the sustainable and effective implementation of corporate ESG management. Prior to the ISDS, the Global Reporting Initiative (GRI) standard was the most referenced compilation basis.

The proposed IFRS S1 and S2 guidelines

In March 2022, the ISSB, which was established by the British IFRS Foundation less than six months earlier, released the drafts of two guidelines, aiming to make sustainability reporting as important as financial reporting: IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information, known as IFRS S1, or S1; and IFRS S2 Climate-related Disclosures, known as IFRS S2, or S2.

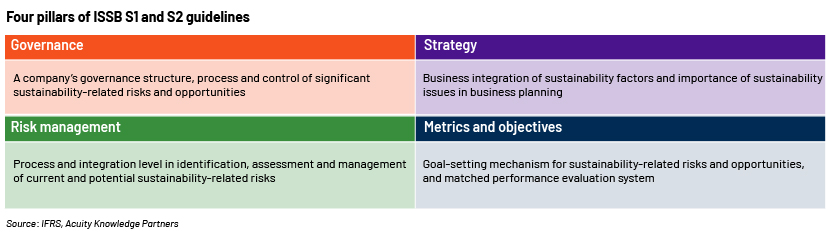

In these two guidelines, the ISSB requires companies to describe how they measure, monitor and manage significant sustainability-related risks and opportunities and disclose financial information related to the risks and opportunities, starting with the four pillars: governance, strategy, risk management, and metrics and objectives. The guidelines aim to improve the quality and comparability of companies’ disclosure of ESG information, and further standardise ESG disclosure responsibilities.

New amendment for business convenience

At the meeting on 16 February 2023, the ISSB set 1 January 2024 as the effective date for S1 and S2 implementation, based on extensive feedback and internal discussions, meaning that companies that choose to follow those guidelines would disclose S1- and S2-compliant financial statements in 2025 at the earliest. However, considering that some companies are already able to apply the two proposed guidelines immediately, the ISSB decided to allow companies to use S1 and S2 earlier, provided they meet two conditions:

-

Companies must adopt both S1 and S2 simultaneously in the event of early compliance

-

They need to mention early adoption of S1 and S2 in their financial statements

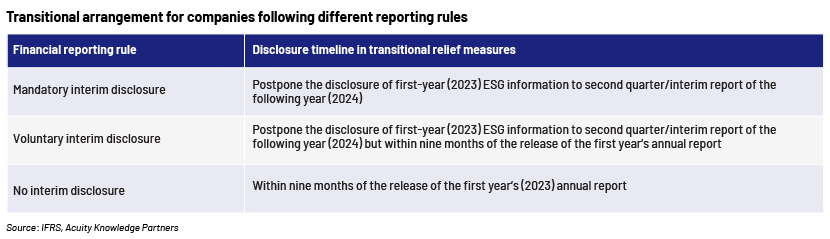

For companies intending to adopt IFRS S1 and S2 earlier, the ISSB will lower the reporting frequency requirement for their first disclosure as "transitional relief". According to the original S1 requirements, sustainability-related financial information should be disclosed at the same time as the annual financial statements, and sustainability-related financial disclosure should cover the same period as the reporting period of the financial statements. However, in the "transitional relief” provided, the ISSB decided to allow companies adopting S1 and S2 to disclose financial statements and ESG reporting separately in their first reporting period.

"Transitional relief" measures were also developed for calculation and disclosure of greenhouse gas (GHG) emissions. This means that if the GHG Protocol[1] was not used previously to calculate GHG emissions, companies could still use the previous standard, and disclosure of Scope 3 GHG emissions[2] is not compulsory.

Popularity is crucial for the new guidelines

Challenges are inevitable when the ISSB tries to promote its new standards, and the US Securities and Exchange Commission (SEC) is one of the ISSB’s biggest rivals. The International Accounting Standards Committee (IASC) made considerable effort in the past to balance the interests of influential parties, to gain their support on the International Accounting Standard (IAS)[3]. The IASC was also reorganised as the International Accounting Standards Board (IASB), to gain recognition from the SEC. When it comes to rule making for ESG reporting, the SEC is still obsessed with its status as leader. However, US regulators failed to form a unified opinion on ESG disclosure standards, which should have been completed in October 2022. The SEC’s disclosure rule was pushed back further, to fall 2023, after the reset deadline of April 2023, and it covers only topics related to climate change and GHG emissions.

Moreover, the ISSB and the SEC have divergent perspectives when making rules; the SEC focuses more on consistency and adequacy of disclosure, while the ISSB focuses more on the accuracy of disclosure, pointing to a longer grinding-in time for mutual recognition.

Currently, there are different ESG reporting standards in the market, including the most widely applied Global Reporting Initiative (GRI) standard, the most systematic EU Sustainability Reporting Standards (ESRS) and the ISDS, which are committed to becoming a global baseline. To integrate the advantages of the remaining two standards and respond to strong market demand, the ISSB decided to incorporate the GRI standard and ESRS into its guidelines. To this end, the ISSB agreed at the meeting in February 2023 that companies could consider adopting open-ended guidelines to identify and disclose sustainability-related risks and opportunities, suggesting that the ISSB has made substantial compromises and concessions at the standard-setting level to promote its ESG standards by making them easier to adopt for large multinational corporations and industry ESG leaders.

The next roadblock on the ISSB’s path is the interoperability between different standards. The ISSB is currently working with other active ESG standards developers to achieve compatibility across standards for broader adoption. At the same time, the ISSB also intends to launch relevant guidelines, training material and supporting tools, with a specific focus on the needs of emerging economies, developing countries and SMEs.

The future remains bright

Despite facing challenges, the prospects of the two sets of ISDS remain bright. By the end of July 2022, the ISSB’s draft guidelines received more than 1,300 responses from different entities, including positive feedback from Mark Vaessen, a partner at KPMG at the Netherlands headquarters: “There is growing demand among investors for more consistent and comparable information on sustainability-related risks and opportunities. We, therefore, recognise the urgent need for standards that will help preparers report relevant information in a way that is practical and without undue burden. The ISSB’s proposals represent a strong start towards achieving this – a global baseline that can be endorsed and built on by local jurisdictions.” The circumstance indicated that the ISDS have gained significant attention globally. Information users’ high expectations reflect not only the fact that regulation and monitoring of ESG reporting have become a priority in the global ESG ecology, but also the urgent need for a uniform standard at the international level.

[1] The GHG Protocol establishes comprehensive global standardised frameworks to measure and manage GHG emissions from private- and public-sector operations, value chains and mitigation actions.

[2] Released in 2011, the Scope 3 Standard is the only internationally accepted method for companies to account for these types of value-chain emissions. Users of the standard can now account for emissions from 15 categories of Scope 3 activities, both upstream and downstream, of their operations. The Scope 3 framework also supports strategies to partner with suppliers and customers to address climate impacts throughout the value chain.

[3] The IAS is a set of accounting standards developed by the IASC that were in force from 1973 to 2001. In 2001, the IASC was reorganised as the IASB, and any accounting standards published since then have been marked as International Financial Reporting Standards (IFRS). The IASB reports to the IFRS Foundation.

How Acuity Knowledge Partners can help

We have been supporting global financial institutions for over two decades. We work as an extension of a client’s onshore research team, providing end-to-end support across ESG-specific RFPs/DDQs/RFIs, ESG validation, client reporting and content management. To help institutions communicate their ESG themes better, we leverage our extensive marketing experience, built over the years through collaboration with leading organisations.

Sources:

-

https://www.ifrs.org/news-and-events/news/2022/12/issb-describes-the-concept-of-sustainability/

-

https://kpmg.com/au/en/home/insights/2022/04/issb-sustainability-reporting-disclosures-guide.html

-

https://www.miotech.com/zh-CN/article/624a3ff4a7b3340040e4babd

-

https://www.ifrs.org/news-and-events/updates/issb/2023/issb-update-march-2023/

-

https://www.ifrs.org/news-and-events/updates/issb/2023/supplementary-issb-update-april-2023/

-

https://www.hkex.com.hk/News/Regulatory-Announcements/2021/211105news?sc_lang=en

Tags:

What's your view?

About the Author

Like the way we think?

Next time we post something new, we'll send it to your inbox